Saudi Arabia Green Energy Market Size, Share, Trends and Forecast by Type, End-Users, and Region, 2026-2034

Saudi Arabia Green Energy Market Summary:

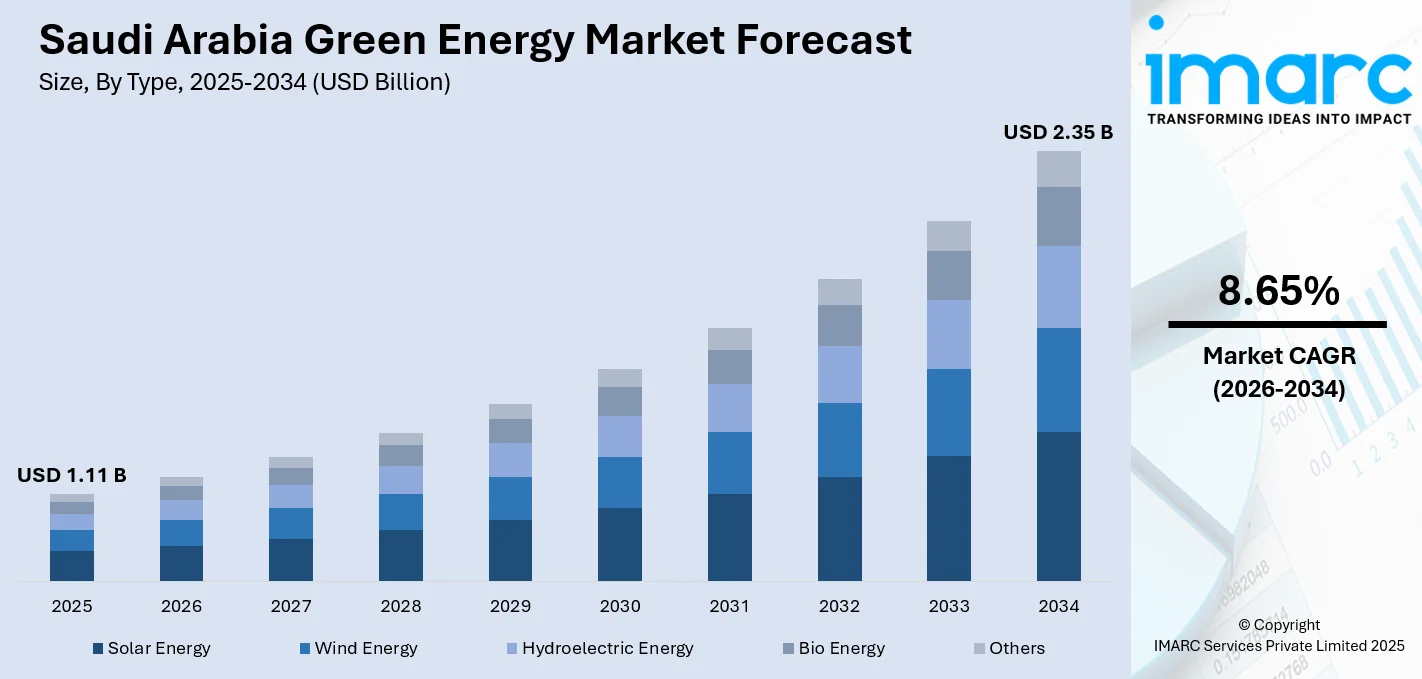

The Saudi Arabia green energy market size was valued at USD 1.11 Billion in 2025 and is projected to reach USD 2.35 Billion by 2034, growing at a compound annual growth rate of 8.65% from 2026-2034.

The Saudi Arabia green energy market is experiencing accelerated growth, as the Kingdom advances its Vision 2030 economic diversification agenda through strategic investments in renewable infrastructure. Government-led initiatives, favorable regulatory frameworks, and increasing private sector participation are strengthening the sector's expansion. The abundant solar resources across the Arabian Peninsula, combined with ambitious national targets to achieve carbon neutrality, are positioning the Kingdom as a regional leader in sustainable energy transformation and influencing the market share.

Key Takeaways and Insights:

- By Type: Solar energy dominates the market with a share of 51% in 2025, driven by the Kingdom's exceptional solar irradiation levels. Government-backed procurement programs under the National Renewable Energy Program are accelerating utility-scale solar deployment.

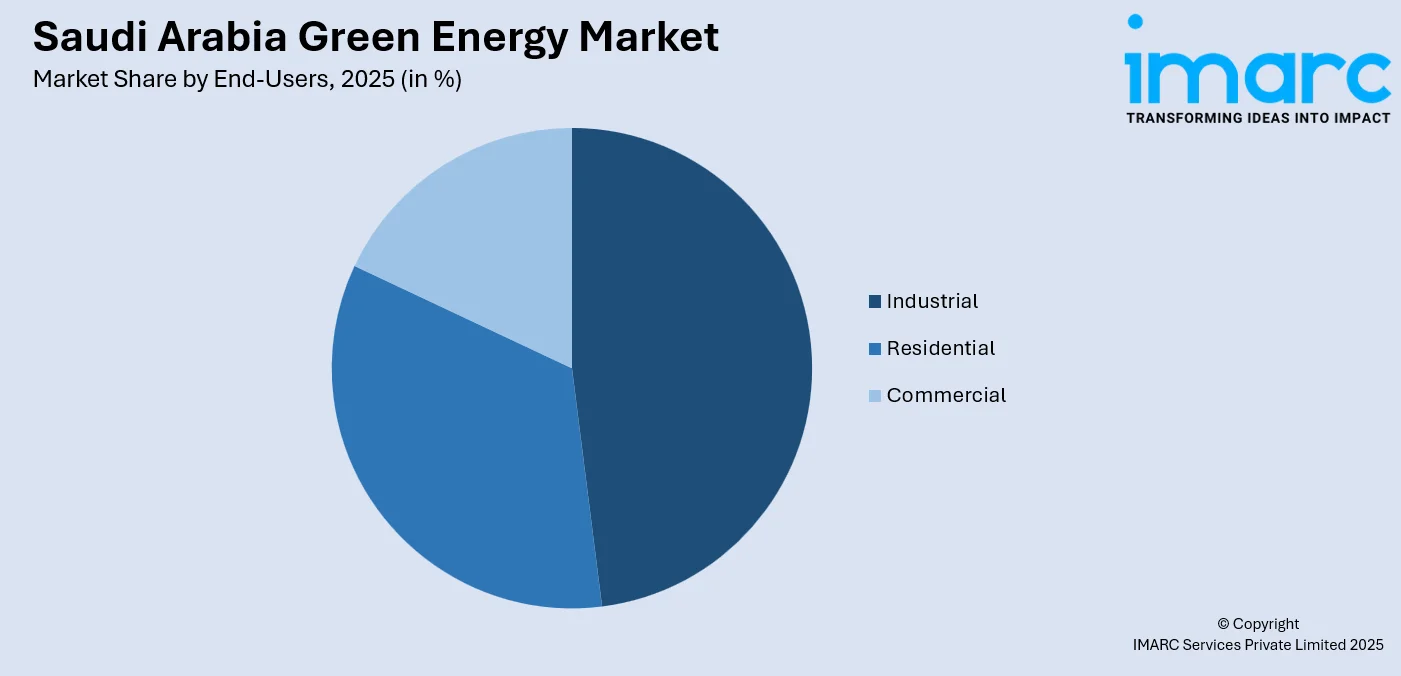

- By End-Users: Industrial leads the market with a share of 48% in 2025, reflecting the Kingdom's strategic focus on decarbonizing energy-intensive manufacturing, petrochemicals, and mining operations. Corporate sustainability mandates and competitive renewable power purchase agreements are accelerating industrial adoption.

- By Region: Northern and Central Region comprises the largest region with 30% share in 2025, supported by Riyadh's concentration of industrial facilities, government institutions, and flagship renewable energy projects.

- Key Players: Key players drive the Saudi Arabia green energy market by expanding renewable portfolios, forming strategic international partnerships, investing in local manufacturing capabilities, and securing long-term power purchase agreements to strengthen their market positioning and support national sustainability objectives.

To get more information on this market Request Sample

The Saudi Arabia green energy market is undergoing a transformational phase, as the Kingdom implements comprehensive strategies to diversify its energy mix and reduce dependence on hydrocarbon-based power generation. The National Renewable Energy Program has established a robust framework for project development, with competitive auctions attracting significant international investment and achieving record-low power purchase costs. According to the General Authority for Statistics, Saudi Arabia's operational renewable energy capacity reached 6,551 megawatts by the end of 2024, representing SAR 19.839 Billion in cumulative investments across nine solar projects and one wind farm. Strategic partnerships with leading technology providers from China, Europe, and the United States are facilitating knowledge transfer and localization of manufacturing capabilities. The integration of battery energy storage systems and smart grid technologies is further enhancing grid stability and enabling higher renewable energy penetration rates across the national electricity network.

Saudi Arabia Green Energy Market Trends:

Mega-Scale Renewable Infrastructure Development

The Kingdom is increasingly prioritizing large-scale renewable energy projects to accelerate the expansion of clean power generation capacity. Major power developers and state-backed entities are collaborating on solar and wind projects distributed across multiple regions, reflecting strong execution capabilities and coordinated planning. In October 2025, Abu Dhabi Future Energy Company PJSC – Masdar, a leader in global clean energy, declared that it secured two solar photovoltaic (PV) projects, totaling a capacity of 2 Gigawatts (GW), during the sixth bidding round of the Kingdom of Saudi Arabia's National Renewable Energy Program (NREP). These utility-scale developments highlight growing confidence among private investors in the Kingdom’s renewable energy framework and long-term power offtake security.

Industrial Decarbonization and Green Manufacturing

Saudi Arabia is integrating renewable energy solutions into industrial operations to reduce carbon emissions and enhance operational sustainability. Major manufacturing facilities and industrial cities are adopting corporate power purchase agreements with renewable energy developers. In November 2024, ENGIE, a worldwide leader in low-carbon energy and services, entered into a power purchase agreement with Al Jouf Cement Company (AJCC) to construct a 22 MWp solar PV plant at AJCC’s cement facility situated south of Turaif Governorate in the Northern Borders Province region of Saudi Arabia. This exemplifies the growing trend of industrial enterprises securing dedicated renewable energy supply to meet sustainability commitments and reduce operational costs.

Technology Localization and Supply Chain Development

Technology localization and supply chain development are fueling the Saudi Arabia green energy market expansion by reducing dependence on imports and strengthening domestic capabilities. Local manufacturing of solar panels, wind components, and energy storage systems lowers project costs, shortens delivery timelines, and improves supply security. Knowledge transfer through joint ventures enhances technical expertise and supports innovation. Developing local supplier networks also creates jobs and aligns renewable expansion with industrial diversification goals, accelerating project execution and supporting long-term sustainability.

How Vision 2030 is Transforming the Saudi Arabia Green Energy Market:

Vision 2030 is fundamentally transforming the Saudi Arabia green energy market by shifting the economy away from oil dependence toward sustainable power generation. The program promotes large-scale investments in solar, wind, and hydrogen projects, creating a clear policy roadmap that attracts private and foreign investors. Government-backed initiatives encourage public-private partnerships (PPPs), local manufacturing of renewable components, and technology transfer, strengthening domestic capabilities. Regulatory reforms, competitive auctions, and long-term power purchase agreements reduce project risks and improve bankability. Vision 2030 also emphasizes energy efficiency, smart grids, and carbon reduction targets, increasing demand for clean technologies across industries. Workforce development programs are building skilled talent to support renewable deployment and operations. Together, these measures are accelerating capacity additions, lowering renewable energy costs, and positioning Saudi Arabia as a hub for green energy innovation.

Market Outlook 2026-2034:

The Saudi Arabia green energy market is positioned for sustained expansion, as the Kingdom accelerates its renewable energy deployment to meet ambitious Vision 2030 targets. Government-led procurement programs, competitive auction mechanisms, and favorable regulatory frameworks are creating an attractive investment environment for domestic and international developers. The market generated a revenue of USD 1.11 Billion in 2025 and is projected to reach a revenue of USD 2.35 Billion by 2034, growing at a compound annual growth rate of 8.65% from 2026-2034. The continued development of large-scale solar and wind projects, combined with investments in energy storage infrastructure and grid modernization, will strengthen market fundamentals. Strategic initiatives to localize manufacturing capabilities and establish green hydrogen production facilities are expected to diversify revenue streams and position the Kingdom as a regional hub for clean energy technology exports.

Saudi Arabia Green Energy Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Solar Energy |

51% |

|

End-Users |

Industrial |

48% |

|

Region |

Northern and Central Region |

30% |

Type Insights:

- Solar Energy

- Wind Energy

- Hydroelectric Energy

- Bio Energy

- Others

Solar energy dominates with a market share of 51% of the total Saudi Arabia green energy market in 2025.

The solar energy segment maintains its dominant position in the Saudi Arabia green energy market, driven by the Kingdom's exceptional solar irradiation conditions and aggressive deployment of utility-scale PV facilities. As per IMARC Group, the Saudi Arabia solar energy market size reached USD 8.3 Billion in 2025. Saudi Arabia's geographical location provides abundant sunlight throughout the year. The National Renewable Energy Program has successfully contracted numerous solar projects through competitive auctions, achieving record-low levelized costs of electricity.

In addition, declining technology costs, availability of vast land parcels, and strong grid integration plans continue to support rapid solar capacity expansion. Government-backed power purchase agreements provide long-term revenue visibility, encouraging private and foreign investment. Solar energy also aligns well with peak daytime electricity demand from cooling, commercial activity, and industrial operations. Localization of solar component manufacturing and growing expertise among local developers further strengthen the segment’s growth outlook, ensuring solar power remains the cornerstone of Saudi Arabia’s clean energy transition and long-term energy diversification strategy.

End-Users Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial

- Industrial

Industrial leads with a share of 48% of the total Saudi Arabia green energy market in 2025.

Industrial represents the largest segment in the Saudi Arabia green energy market, reflecting the Kingdom's strategic focus on decarbonizing energy-intensive manufacturing and processing operations. Large-scale industrial facilities, including petrochemical plants, cement factories, mining operations, and desalination complexes, are increasingly adopting renewable energy solutions to reduce operational costs and meet corporate sustainability objectives. Industrial electricity tariff increases have further enhanced the economic attractiveness of solar installations for manufacturing enterprises.

In addition, long-term power purchase agreements allow industrial users to secure stable and predictable energy costs while reducing exposure to fuel price volatility. Integration of on-site solar, captive power plants, and hybrid renewable systems supports operational reliability and energy independence. Multinational corporations operating in the Kingdom are also aligning with global environmental, social, and governance (ESG) commitments, accelerating renewable adoption across industrial assets. Government incentives, regulatory support, and expanding grid connectivity further enable large consumers to transition towards clean energy, reinforcing the industrial sector’s leadership in driving green energy demand in Saudi Arabia.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and Central Region exhibits a clear dominance with a 30% share of the total Saudi Arabia green energy market in 2025.

Northern and Central Region leads the Saudi Arabia green energy market due to the concentration of large-scale renewable projects, strong grid infrastructure, and proximity to major demand centers. Vast land availability around central provinces supports development of utility-scale solar and wind projects with minimal land-use constraints. The region benefits from high solar irradiation levels and favorable wind conditions, enabling efficient power generation. Close alignment with national planning authorities also accelerates project approvals and grid integration, strengthening regional leadership in renewable energy deployment.

The region’s dominance is further supported by strong industrial and urban electricity demand centered around Riyadh, which creates immediate offtake for renewable power. Presence of government institutions, major developers, and financial entities improves coordination and funding access for clean energy projects. Large industrial zones, data centers, and mega urban developments increasingly prioritize renewable power sourcing, reinforcing sustained demand. Together, infrastructure readiness, policy alignment, and demand concentration position the Northern and Central Region as the primary growth engine of Saudi Arabia’s green energy market.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Green Energy Market Growing?

Vision 2030 Policy Framework and Government Commitment

The Saudi Arabian government’s Vision 2030 strategy has firmly positioned renewable energy as a national priority, creating a stable and investor-friendly policy framework. Strong institutional support, clear regulations, and transparent procurement mechanisms have encouraged sustained participation from domestic and international developers. Competitive auction-based tenders have improved price discovery and strengthened confidence in long-term project viability. The government’s clear renewable energy ambitions provide market certainty, enabling developers to plan large-scale projects with confidence. In July 2024, the Ministry of Energy announced plans to tender 20 gigawatts of new renewable energy projects annually, potentially expanding total capacity to 130 gigawatts by 2030. Strategic involvement of state-backed investment entities and leading power developers is accelerating execution while aligning projects with national goals. Together, these coordinated measures have significantly enhanced Saudi Arabia’s attractiveness as a global destination for renewable energy investment.

Exceptional Solar Resources and Favorable Geography

The Saudi geography offers very favorable conditions for green energy development, primarily solar power production. The strong solar irradiance in most of the regions of the country makes solar power generation a very efficient and effective activity, complementing the solar power output potential of the projects positively. The Saudi geography, particularly the fact that the country covers an enormous area of land that consists of huge deserts, offers huge tracts of land required for the development of large green energy projects in the country without the need to deal with land disputes. Many suitable sites are located close to major demand centers, helping reduce transmission requirements and associated costs. Favorable natural conditions have enabled renewable projects to achieve highly competitive electricity generation costs, strengthening investor interest and accelerating deployment. In addition to solar, coastal and northern regions present suitable conditions for wind energy development, supporting diversification of the renewable energy mix. Together, abundant solar radiation, available land, and favorable wind corridors position Saudi Arabia as a highly attractive market for utility-scale renewable energy projects and long-term clean power generation.

Industrial Demand Growth and Economic Diversification

The Kingdom's accelerating economic diversification strategy is creating substantial new electricity demand from the industrial, commercial, and residential sectors that renewable energy is increasingly positioned to serve. Energy-intensive industries, including data centers, electric vehicle (EV) manufacturing, and advanced electronics production are establishing operations in the Kingdom, driving incremental electricity demand. The launch of Alat in 2024 to develop clean energy-powered electronics manufacturing in Saudi Arabia exemplifies industrial developments requiring substantial renewable energy supply. Corporate sustainability commitments and ESG reporting requirements are motivating industrial consumers to secure green energy through power purchase agreements, creating stable long-term demand. In parallel, large-scale urban development projects and smart cities are prioritizing renewable integration, further reinforcing long-term electricity demand growth aligned with clean energy objectives.

Market Restraints:

What Challenges the Saudi Arabia Green Energy Market is Facing?

Grid Infrastructure Limitations and Integration Challenges

The existing electricity transmission and distribution infrastructure requires substantial upgrades to accommodate the rapid expansion of variable renewable energy generation. Grid congestion in high-solar regions can limit the ability to connect new projects and transmit power to demand centers efficiently. The intermittent nature of solar and wind generation creates technical challenges for grid operators in maintaining system stability and balancing supply with demand.

Supply Chain Dependencies and Import Reliance

The Saudi Arabia green energy market currently relies heavily on imported equipment and components, particularly from China, which supplies the majority of solar panels, inverters, and battery storage systems. This dependency creates exposure to international supply chain disruptions, geopolitical tensions, and currency fluctuations that can affect project costs and timelines. While localization initiatives are progressing, establishing domestic manufacturing capacity for advanced renewable energy components requires significant time and investment. Wind turbine components present particular challenges due to the technical complexity and specialized manufacturing requirements.

Competition from Subsidized Conventional Energy Sources

Historically low domestic natural gas prices create competitive pressure for renewable energy projects. The abundant availability of low-cost hydrocarbon resources that have powered the Kingdom's development for decades presents an established alternative to renewable energy investments. While electricity tariff reforms have improved renewable energy economics, the transition requires continued policy support to overcome the inherent cost advantage of subsidized conventional generation. Consumer awareness and acceptance of renewable energy technologies also remain areas requiring development.

Competitive Landscape:

The Saudi Arabia green energy market features a dynamic competitive landscape, characterized by collaborations between government-linked entities and international renewable energy developers. State-owned enterprises maintain significant market positions through strategic project development and long-term power purchase agreements. International developers from the UAE, France, China, and other countries actively participate in competitive auctions, bringing global expertise and technology partnerships. Competition is intensifying as project pipelines expand, driving innovations in project development approaches, financing structures, and technology deployment. Strategic alliances between Saudi and international partners are facilitating knowledge transfer and supporting government objectives to localize manufacturing capabilities and develop domestic expertise.

Recent Developments:

- In July 2025, ACWA Power, Badeel, and Saudi Aramco Power Company (SAPCO) signed power purchase agreements valued at approximately USD 8.3 Billion with the Saudi Power Procurement Company to develop seven renewable energy plants with a combined capacity of 15,000 megawatts. The portfolio included five solar PV projects (Bisha, Humaij, Khulis, Afif1, and Afif2) and two wind projects (Starah and Shaqra), with operations expected to commence in 2027-2028.

Saudi Arabia Green Energy Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Solar Energy, Wind Energy, Hydroelectric Energy, Bio Energy, Others |

| End-Users Covered | Residential, Commercial, Industrial |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia green energy market size was valued at USD 1.11 Billion in 2025.

The Saudi Arabia green energy market is expected to grow at a compound annual growth rate of 8.65% from 2026-2034 to reach USD 2.35 Billion by 2034.

Solar energy dominated the market with a share of 51%, driven by exceptional solar irradiation conditions, government-backed procurement programs, and record-low power purchase costs achieved through competitive auctions.

Key factors driving the Saudi Arabia green energy market include Vision 2030 policy support, abundant solar resources, competitive project economics, industrial decarbonization initiatives, and government targets to achieve significant renewable electricity generation.

Major challenges include grid infrastructure limitations requiring substantial upgrades, supply chain dependencies on imported components, integration challenges from variable renewable generation, and competition from subsidized conventional energy sources.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)