Saudi Arabia Green Packaging Market Size, Share, Trends and Forecast by Packaging Type, End Use Industry, and Region, 2026-2034

Saudi Arabia Green Packaging Market Overview:

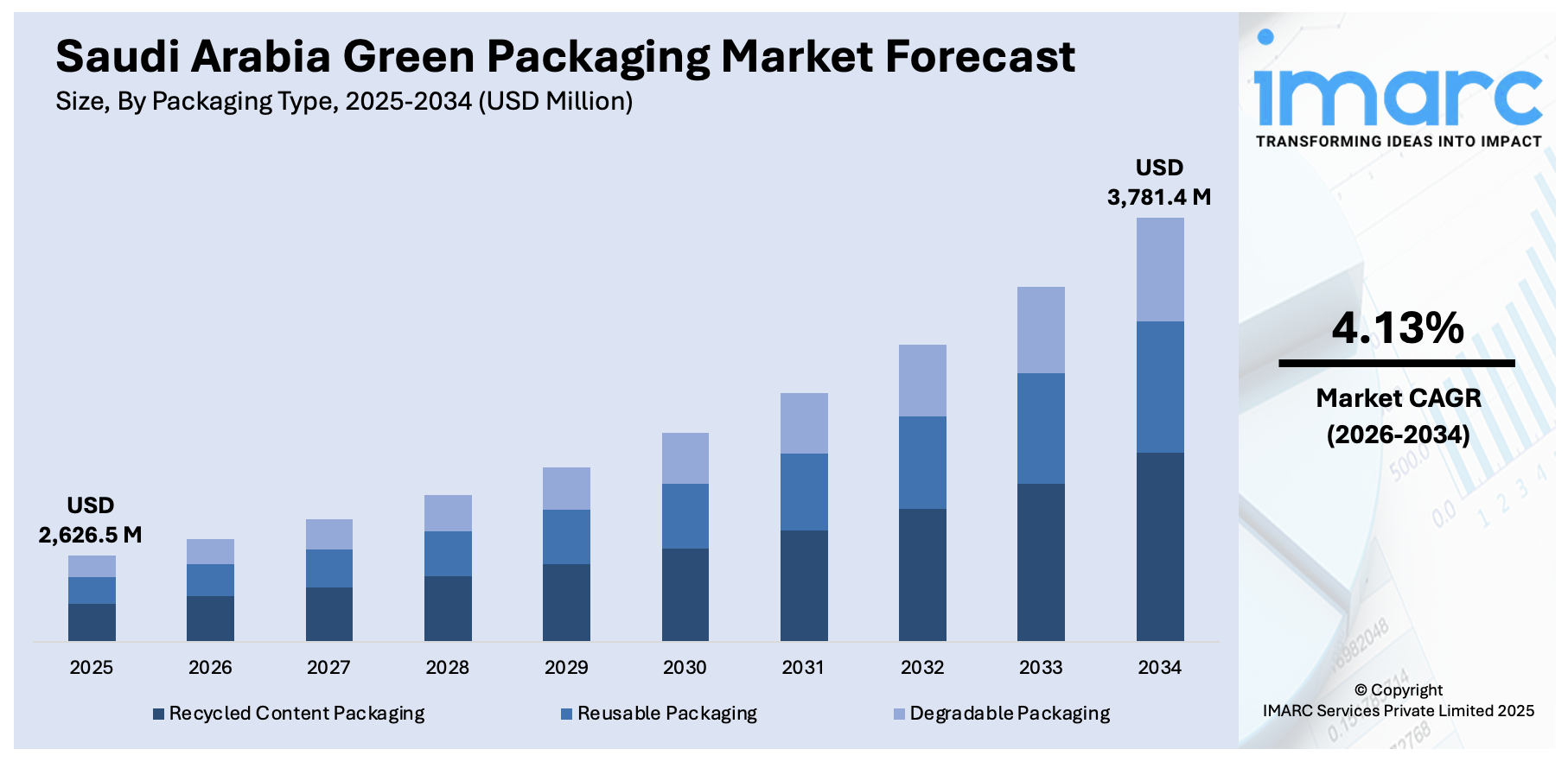

The Saudi Arabia green packaging market size reached USD 2,626.5 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 3,781.4 Million by 2034, exhibiting a growth rate (CAGR) of 4.13% during 2026-2034. The market is driven by Vision 2030 sustainability goals, government restrictions on single-use plastics, and increasing consumer environmental awareness. Advances in biodegradable materials, intelligent packaging, and recycling technologies further drive growth. E-commerce growth and business sustainability initiatives also drive demand, making sustainable packaging a top industry focus.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 2,626.5 Million |

| Market Forecast in 2034 | USD 3,781.4 Million |

| Market Growth Rate 2026-2034 | 4.13% |

Saudi Arabia Green Packaging Market Trends:

Rising Demand for Sustainable Packaging in Saudi Arabia

The increasing consumer awareness and government initiatives promoting sustainability is majorly driving the Saudi Arabia green packaging market growth. With Vision 2030 emphasizing environmental responsibility, businesses are shifting toward biodegradable, recyclable, and compostable packaging solutions. The food and beverage sector, in particular, is adopting eco-friendly materials to meet regulatory standards and consumer preferences. Additionally, e-commerce growth has accelerated the demand for sustainable packaging as companies seek to reduce plastic waste. Multinational corporations and local brands are investing in plant-based plastics, recycled paper, and reusable packaging to align with global sustainability trends. Saudi Arabia has a dominating share of 67% of the plastic resin production in the GCC, and it also takes the lead in terms of polymer consumption with a 61% market share. Recycling activities in the region are minimal, with only 5-7% of plastic being recycled, but Saudi Arabia's progress in converting plastic waste into certified circular polymers shows a positive sign. Thus, this is complementing the region's move towards sustainable green packaging. The Saudi government’s ban on single-use plastics in certain regions further drives this shift, encouraging innovation in green packaging. As environmental concerns rise among consumers, businesses that adopt eco-friendly packaging gain a competitive edge, expanding the Saudi Arabia green packaging market share.

To get more information on this market Request Sample

Technological Advancements in Green Packaging Solutions

The industry is experiencing a revolution fueled by technological innovations as businesses adopt new materials and production methods to foster sustainability. Bioplastics innovations, such as polylactic acid (PLA) and algae-based packaging, offer efficient substitutes for traditional plastics. Smart packaging, which incorporates IoT and biodegradable sensors, is improving shelf life and reducing waste. In addition, 3D printing enables the development of personalized packaging designs that cause minimal waste, hence maximizing resource efficiency. Regional manufacturers are joining hands with foreign companies to incorporate cutting-edge recycling technologies in line with circular economy. The Saudi government is supporting such efforts through investments and policies, including the Saudi Green Initiative, which promotes research and development into sustainable packaging. An industry report shows that 64% of Saudi Arabian consumers are concerned about environmental issues, with 63% sorting plastic packaging for recycling and 58% sorting cartons for recycling. Together with its local recycling partners, Tetra Pak has invested over SAR 12 Million (approximately USD 3.2 Million) in Saudi Arabia to establish a recycling center that helps achieve sustainable packaging. The business has established a target to use 100% certified raw materials in 2025 and eliminate all production waste that goes into landfills by 2030. With increased investments in green technology, the Kingdom is positioning itself as a regional leader in eco-friendly packaging solutions. These innovations reduce environmental impact and enhance brand reputation, creating a positive Saudi Arabia green packaging market outlook.

Saudi Arabia Green Packaging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the county and regional levels for 2026-2034. Our report has categorized the market based on packaging type, and end use industry.

Packaging Type Insights:

- Recycled Content Packaging

- Paper

- Plastic

- Metal

- Glass

- Others

- Reusable Packaging

- Drum

- Plastic Container

- Others

- Degradable Packaging

The report has provided a detailed breakup and analysis of the market based on the packaging type. This includes recycled content packaging (paper, plastic, metal, glass, and others), reusable packaging (drum, plastic container, and others), and degradable packaging.

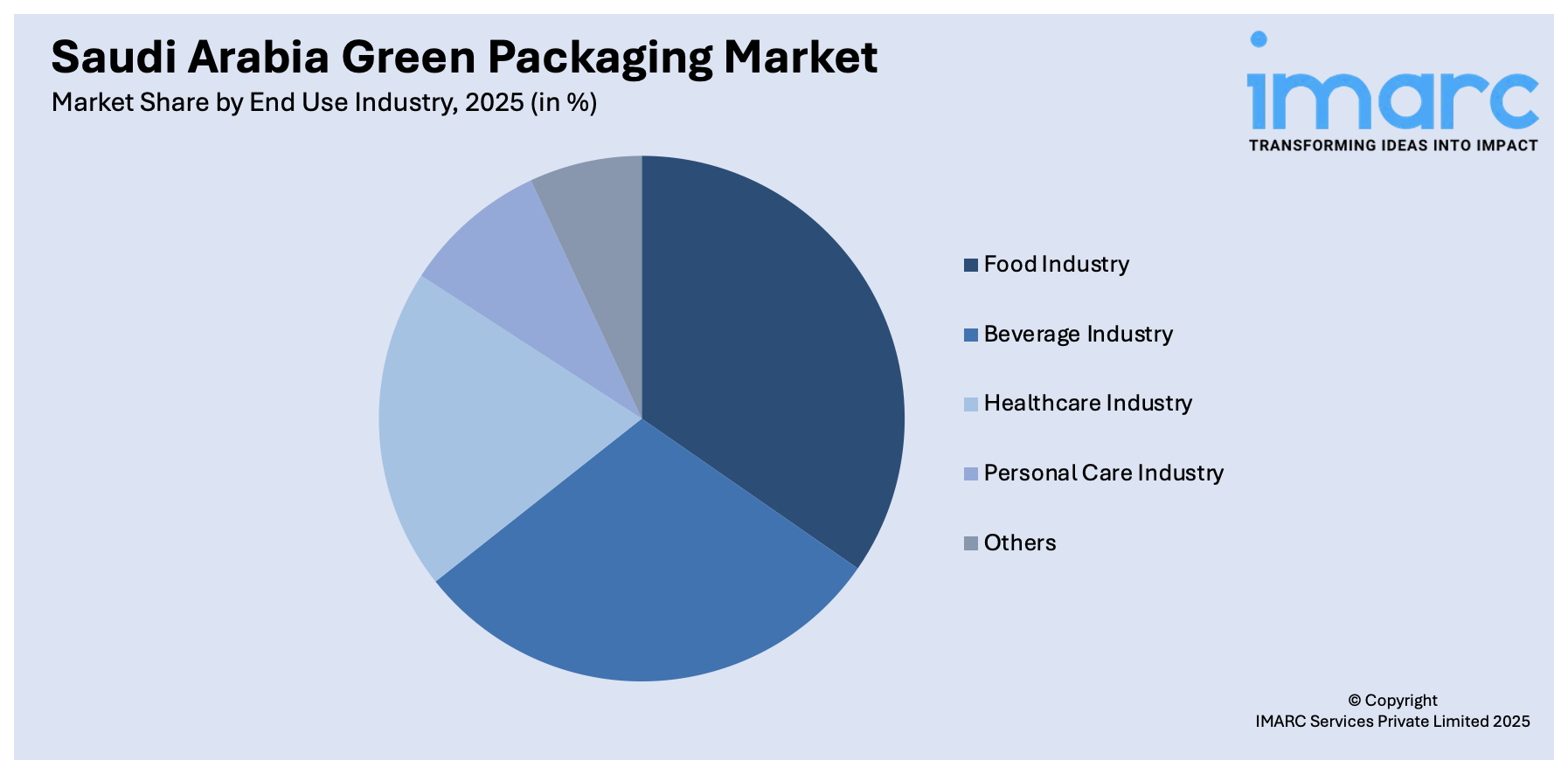

End Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- Food Industry

- Beverage Industry

- Healthcare Industry

- Personal Care Industry

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes food industry, beverage industry, healthcare industry, personal care industry, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Green Packaging Market News:

- August 06, 2024: Alesayi Beverage Corporation, which holds a 60% market share in Saudi Arabia's energy drinks sector, partnered with SIG to introduce sustainable bag-in-box (BIB) packaging using the SIG SureFill 42 Aseptic filling system. The state-of-the-art system is housed in a newly built facility in Jeddah, spanning over 98,000 square meters, and consists of 10L SIG bags made of eco-friendly SIG 2Pure Film. This move underlines Alesayi's commitment to encouraging eco-friendly packaging solutions and expanding its product range for the HoReCa market.

- April 30, 2024: SABIC, Napco, and FONTE unveiled Saudi Arabia's first circular bread packaging, employing 100% recycled polyethylene from pyrolysis oil as part of the TRUCIRCLE™ vision. Napco's Oat Arabic Bread bags are manufactured with food-contact qualified polyethylene grades, ensuring the same level of purity as virgin plastics. The accomplishment represents another milestone in the development of sustainable green packaging and a circular plastic economy in Saudi Arabia.

Saudi Arabia Green Packaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Packaging Types Covered |

|

| End Use Industries Covered | Food Industry, Beverage Industry, Healthcare Industry, Personal Care Industry, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia green packaging market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia green packaging market on the basis of packaging type?

- What is the breakup of the Saudi Arabia green packaging market on the basis of end use industry?

- What is the breakup of the Saudi Arabia green packaging market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia green packaging market?

- What are the key driving factors and challenges in the Saudi Arabia green packaging market?

- What is the structure of the Saudi Arabia green packaging market and who are the key players?

- What is the degree of competition in the Saudi Arabia green packaging market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia green packaging market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia green packaging market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia green packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)