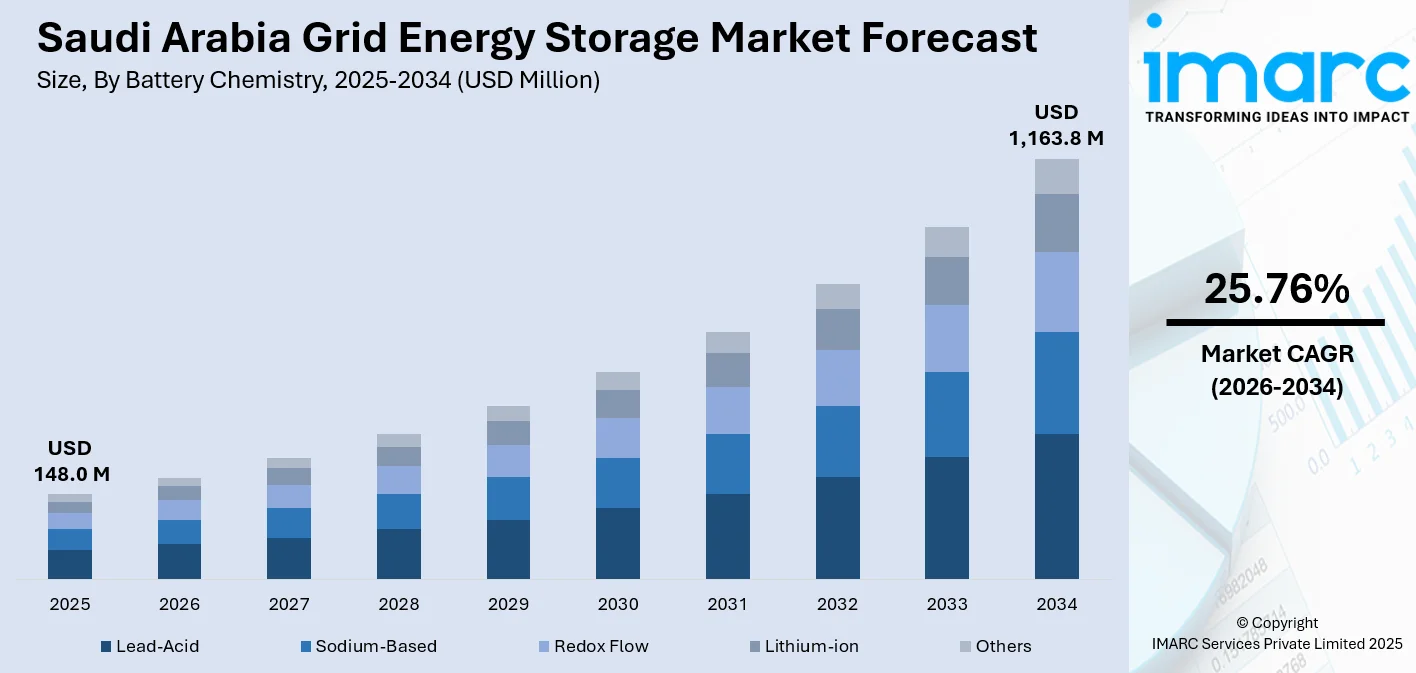

Saudi Arabia Grid Energy Storage Market Size, Share, Trends and Forecast by Battery Chemistry, Ownership, Application, and Region, 2026-2034

Saudi Arabia Grid Energy Storage Market Summary:

The Saudi Arabia grid energy storage market size was valued at USD 148.0 Million in 2025 and is projected to reach USD 1,163.8 Million by 2034, growing at a compound annual growth rate of 25.76% from 2026-2034.

The Saudi Arabia grid energy storage market is experiencing substantial momentum, as the Kingdom accelerates its energy transition under Vision 2030. Rising investments in utility-scale battery storage systems, coupled with expanding solar and wind capacity, are driving robust demand for energy storage solutions. Strategic government initiatives, declining lithium-ion battery costs, and the integration of smart grid technologies are reshaping the energy landscape. Advanced storage deployments are enabling grid stability, peak load management, and enhanced renewable energy utilization.

Key Takeaways and Insights:

- By Battery Chemistry: Lithium-ion dominates the market with a share of 65% in 2025, driven by its high energy density, established effectiveness in extreme temperatures, and decreasing costs. Technological advancements in thermal management have enhanced reliability for desert deployment, while modular configurations support scalable renewable integration.

- By Ownership: Third-party owned leads the market with a share of 51% in 2025, reflecting growing investor confidence and the proliferation of independent power producer models. Build-own-operate frameworks are attracting global developers, enabling utilities to procure flexible storage services without capital-intensive infrastructure investments.

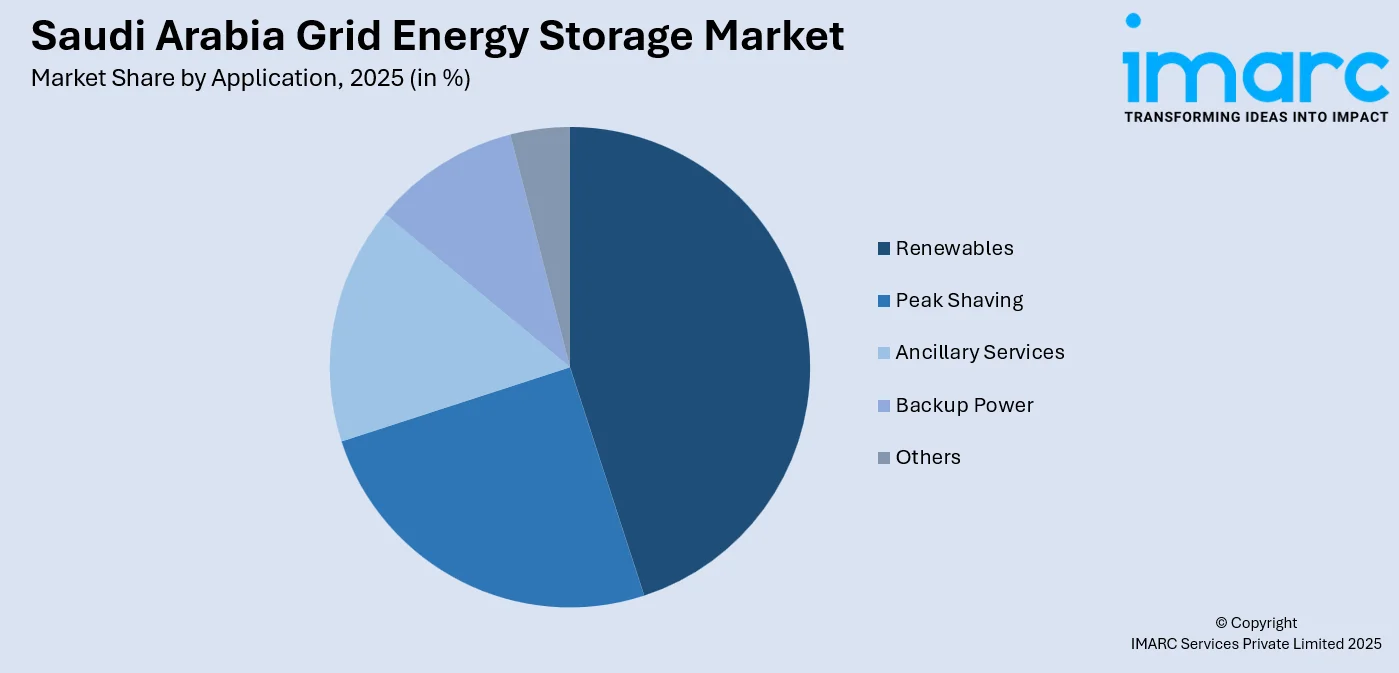

- By Application: Renewables comprise the largest segment with a market share of 40% in 2025, underpinned by the urgent need to manage intermittency from expanding solar and wind installations. Storage systems facilitate firm capacity commitments, enabling renewable generators to participate fully in energy markets.

- By Region: Northern and Central Region represents the largest region with 35% share in 2025, driven by Riyadh's strategic importance as the political and economic hub, substantial industrial electricity demand, and concentrated renewable energy projects across the capital and surrounding provinces.

- Key Players: The Saudi Arabia grid energy storage market features intense competition among global technology providers expanding their regional presence. Companies are focusing on advanced battery solutions, localized manufacturing, strategic partnerships with state utilities, and customized desert-ready systems to secure large-scale procurement contracts and strengthen their market positioning.

To get more information on this market Request Sample

The Saudi Arabia grid energy storage market is advancing rapidly, as the Kingdom prioritizes energy diversification and sustainability under its Vision 2030 framework. Government bodies, including Saudi Electricity Company and Saudi Power Procurement Company, are actively deploying pilot projects and launching large-scale tenders to integrate storage systems into core grid operations. The transition from a centralized fossil-fuel-dependent grid towards a flexible, digitally managed network necessitates substantial energy storage capacity for load balancing, frequency regulation, and renewable integration. In April 2025, Saudi Arabia launched construction of a landmark 2.5 GW/10 GWh grid-scale battery storage project across five regions, backed by an investment exceeding SAR 6.73 Billion, reinforcing the nation's commitment to becoming a global energy storage leader. Strategic investments in smart grid platforms, real-time performance monitoring, and predictive maintenance capabilities are enhancing operational efficiency and grid resilience.

Saudi Arabia Grid Energy Storage Market Trends:

Surge in Utility-Scale Battery Energy Storage Deployments

Saudi Arabia is witnessing unprecedented growth in utility-scale battery energy storage projects, as the Kingdom targets substantial renewable energy integration by 2030. Transmission and distribution operators are increasingly adopting large-capacity storage systems for peak load management, grid congestion relief, and enhanced energy resilience in remote areas. In December 2025, the Kingdom of Saudi Arabia finalized the grid connection of its significant battery energy storage project boasting a nameplate capacity of 7.8 GWh. The initiative covered three locations situated in the southwestern areas of the Kingdom: Najran, Khamis Mushait, and Madaya. These deployments are enabling the Kingdom to balance intermittent solar and wind generation while reducing reliance on fossil-fuel peaker plants.

Integration with Smart Grid and Digital Monitoring Platforms

Energy storage installations across Saudi Arabia are increasingly being integrated with advanced smart grid platforms for real-time performance monitoring and predictive maintenance. Grid-forming battery systems are providing critical services, including black-start capability, virtual inertia, fast frequency response, and voltage support, thereby strengthening system stability. The deployment of intelligent monitoring technologies enables operators to optimize charging and discharging cycles, maximize asset utilization, and extend equipment lifespan. These digital advancements are significantly contributing to the market growth while enhancing overall grid reliability and operational efficiency.

Development of Localized Manufacturing and Desert-Adapted Solutions

The emergence of localized battery manufacturing is reshaping the competitive landscape, as international technology providers establish regional production facilities. In October 2024, Hithium and Saudi firm MANAT announced a joint venture to set up battery energy storage system (BESS) production plants in Saudi Arabia, aiming for an annual output capacity of 5GWh, featuring desert-tailored solutions with advanced sandstorm protection and robust high-temperature designs. These locally manufactured systems support ultra-long discharge cycles exceeding 12 hours, addressing the unique environmental challenges of the Arabian Peninsula while reducing supply chain dependencies and accelerating project delivery timelines.

How Vision 2030 is Transforming the Saudi Arabia Grid Energy Storage Market:

Vision 2030 is reshaping the Saudi Arabia grid energy storage market by accelerating the Kingdom’s transition towards a more resilient, flexible, and sustainable power system. As renewable energy capacity expands, grid-scale energy storage is becoming essential to manage intermittency, stabilize frequency, and ensure reliable power supply. Government-led reforms encourage utilities to integrate BESS alongside solar and wind projects, improving grid efficiency and reducing reliance on conventional peaking power plants. Investments in smart grids, digital monitoring, and advanced energy management systems further support large-scale storage deployment. Vision 2030 also promotes private sector participation and technology partnerships, fostering innovation in lithium-ion, flow batteries, and hybrid storage solutions.

Market Outlook 2026-2034:

The Saudi Arabia grid energy storage market outlook remains exceptionally positive, as the Kingdom positions itself among the world's leading energy storage markets. Strategic government initiatives under the National Renewable Energy Program are driving substantial capacity additions. The market generated a revenue of USD 148.0 Million in 2025 and is projected to reach a revenue of USD 1,163.8 Million by 2034, growing at a compound annual growth rate of 25.76% from 2026-2034. Continued investments in large-scale renewable energy projects, declining battery technology costs, and expanding grid modernization efforts are expected to sustain robust growth throughout the forecast period, creating substantial opportunities for technology providers, developers, and investors across the energy storage value chain.

Saudi Arabia Grid Energy Storage Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Battery Chemistry | Lithium-ion | 65% |

| Ownership | Third-party Owned | 51% |

| Application | Renewables | 40% |

| Region | Northern and Central Region | 35% |

Battery Chemistry Insights:

- Lead-Acid

- Sodium-Based

- Redox Flow

- Lithium-ion

- Others

Lithium-ion dominates with a market share of 65% of the total Saudi Arabia grid energy storage market in 2025.

Lithium-ion leads the Saudi Arabia grid energy storage market due to its high energy density, fast response times, and proven reliability for large-scale power applications. Lithium-ion batteries efficiently support grid stabilization, frequency regulation, and peak load management, which are critical for integrating renewable energy sources into the national grid. Their modular design allows flexible deployment across utility-scale projects, substations, and renewable plants, making them suitable for Saudi Arabia’s rapidly evolving energy infrastructure. Additionally, declining technology costs have improved their economic attractiveness for long-term grid investments.

Lithium-ion’s strong compatibility with solar and wind power further reinforces its dominance in the market. Lithium-ion systems enable effective storage of excess renewable energy and deliver quick discharge during demand surges, ensuring grid reliability. Advanced battery management systems enhance safety, performance monitoring, and lifecycle efficiency under harsh climatic conditions. Government-backed renewable energy targets and utility modernization initiatives favor lithium-ion adoption, as utilities prioritize mature, scalable, and bankable storage solutions that can be deployed rapidly to support Vision 2030 energy transition goals.

Ownership Insights:

- Third-party Owned

- Utility Owned

Third-party owned leads with a share of 51% of the total Saudi Arabia grid energy storage market in 2025.

Third-party owned is gaining substantial traction in the Saudi Arabia grid energy storage market, as independent power producers and private developers increasingly participate in large-scale storage procurements. The build-own-operate framework enables utilities to access flexible energy storage services without committing substantial capital expenditure, while transferring technology and operational risks to experienced developers. The growing adoption of third-party ownership reflects evolving market structures and regulatory frameworks that encourage private sector participation in strategic energy infrastructure.

Saudi Power Procurement Company's structured tender processes under long-term storage services agreements have attracted significant international investor interest and fostered competitive pricing dynamics across the market. In November 2024, the Saudi Power Procurement Company initiated the qualification process for bidders for a massive initiative involving four grid-scale battery projects with a combined storage capacity of 8 GWh throughout the Kingdom, under a build-own-operate model, with contracts offering 15-year storage services agreements that provide revenue stability for investors. This ownership structure is accelerating deployment timelines, introducing advanced technologies, and establishing clear compensation mechanisms for grid services, such as frequency regulation and peak shaving, thereby enhancing overall market efficiency and competitiveness.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Renewables

- Peak Shaving

- Ancillary Services

- Backup Power

- Others

Renewables comprise the leading segment with a 40% share of the total Saudi Arabia grid energy storage market in 2025.

Renewables dominate the market in Saudi Arabia, reflecting the Kingdom's ambitious target of generating 50% of electricity from renewable sources by 2030. Energy storage systems are essential for managing the intermittency of solar and wind generation, enabling these variable resources to provide reliable baseload power. Storage integration allows renewable generators to offer firm capacity commitments and participate fully in electricity markets, dramatically improving project economics and accelerating deployment rates.

The critical role of storage in renewable integration is evident across Saudi Arabia's major clean energy initiatives, where battery systems are increasingly mandated for utility-scale solar and wind projects. Storage systems support load shifting by storing excess renewable generation during off-peak periods and supplying power during peak demand hours. They also enhance grid stability by providing frequency regulation, voltage support, and reserve capacity. As renewable penetration rises, utilities increasingly rely on energy storage to reduce curtailment, optimize transmission infrastructure utilization, and ensure consistent power availability across urban and industrial demand centers.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and Central Region represents the leading region with a 35% share of the total Saudi Arabia grid energy storage market in 2025.

Northern and Central Region dominates the Saudi Arabia grid energy storage market, owing to Riyadh's strategic importance as the nation's political and economic center, coupled with substantial industrial electricity demand and concentrated renewable energy developments. The capital region serves as the primary hub for policy formulation, investment coordination, and major infrastructure projects that drive storage deployment. Key cities, including Riyadh, Qaisumah, Jouf, Rabigh, and Dawadmi, were selected as deployment sites for large-scale BESS projects in 2025. The region's extensive solar radiation resources and planned wind energy capacity are creating substantial demand for complementary storage solutions.

In addition, the Northern and Central Region benefits from strong grid connectivity and proximity to major transmission corridors, enabling efficient integration of large-scale storage systems into the national power network. The presence of industrial zones, data centers, and expanding urban developments drives the need for reliable, uninterrupted power supply supported by energy storage. Government-backed pilot projects and utility-led tenders in this region further accelerate technology adoption, positioning it as a testing ground for advanced battery systems and grid-scale energy management solutions.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Grid Energy Storage Market Growing?

Government Vision 2030 Initiatives and Regulatory Framework Development

The Saudi government's Vision 2030 framework has positioned energy storage as a strategic priority within the national energy transition agenda, establishing clear targets and policy mechanisms that are driving substantial market growth. The National Renewable Energy Program mandates the integration of advanced storage technologies to support solar and wind deployments, enhance grid reliability, and improve overall energy efficiency. Government bodies are implementing structured procurement processes that provide revenue certainty and attract significant international investment. In parallel, regulatory reforms are encouraging private sector participation and public–private partnerships in large-scale storage projects, reducing entry barriers for technology providers. Incentives for local manufacturing and knowledge transfer are supporting the development of domestic capabilities across battery assembly, system integration, and maintenance services. These initiatives not only accelerate deployment timelines but also strengthen supply chain resilience and support long-term energy security objectives under Vision 2030.

Rapid Expansion of Renewable Energy Capacity and Integration Requirements

Saudi Arabia's ambitious renewable energy expansion program is creating unprecedented demand for grid energy storage systems capable of managing intermittent solar and wind generation. As per IMARC Group, the Saudi Arabia renewable energy market reached a volume of 2.09 Gigawatt in 2025. Large-scale BESS solutions are increasingly being deployed to stabilize grid operations, balance peak and off-peak demand, and ensure uninterrupted power supply as renewable capacity scales up. Storage solutions enable excess solar energy generated during daytime to be stored and dispatched during evening peak hours, improving grid flexibility and reducing reliance on conventional fossil-fuel-based backup power. Additionally, the integration of storage enhances frequency regulation, voltage control, and overall grid resilience, which are critical for accommodating higher renewable penetration. Growing investments in utility-scale solar parks and wind farms across multiple regions are further accelerating the adoption of advanced energy storage technologies as a core component of Saudi Arabia’s evolving power infrastructure.

Declining Battery Technology Costs and Performance Improvements

Continuous technological advancements and manufacturing scale efficiencies have significantly reduced the cost of BESS, strengthening their economic attractiveness and accelerating adoption across Saudi Arabia. Declining battery prices, improved production processes, and standardized system designs have enhanced the commercial feasibility of large-scale storage projects. Advanced thermal management solutions now enable reliable performance under extreme temperature conditions, addressing the Kingdom’s harsh climate while extending battery lifespan and lowering maintenance needs. Ongoing innovations in lithium-ion chemistries, particularly lithium iron phosphate, are improving safety, durability, and cycle life, making these systems well suited for grid-scale applications. Enhanced energy density, faster response times, and flexible operating capabilities allow battery storage to effectively support peak demand management and grid stabilization. Collectively, these technological and cost advancements are positioning energy storage as a competitive alternative to conventional peaking power solutions, encouraging sustained investment and broader deployment across the national power infrastructure.

Market Restraints:

What Challenges the Saudi Arabia Grid Energy Storage Market is Facing?

Supply Chain Dependencies and Import Reliance

The Saudi Arabia energy storage market faces notable supply chain challenges due to heavy reliance on imported battery components and systems sourced mainly from overseas manufacturers. This dependence exposes projects to geopolitical uncertainties, logistics disruptions, and exchange rate volatility, which can affect costs and delivery timelines. At the same time, rising local content requirements add complexity for developers, while domestic supplier ecosystems and skilled labor capabilities are still evolving, contributing to deployment delays and cost uncertainty.

Extreme Climate and Environmental Operating Challenges

Saudi Arabia's harsh desert environment presents substantial operational challenges for BESS, including extreme temperature variations, frequent sandstorms, and demanding maintenance conditions. High ambient temperatures require sophisticated cooling systems that increase capital and operating costs while reducing overall system efficiency. Sandstorm protection and specialized enclosures add complexity to system design and installation. These environmental factors necessitate customized solutions with enhanced durability specifications, potentially limiting the pool of qualified technology providers and increasing procurement costs compared to deployments in more temperate climates.

High Initial Investment Costs for Battery Systems

One of the primary challenges facing the Saudi Arabia grid energy storage market is the substantial upfront capital expenditure required for large-scale battery installations. Despite declining technology costs, the financial barrier associated with deploying multi-gigawatt-hour storage systems remains significant for both utilities and independent developers. These investment requirements can strain project financing capabilities, extend development timelines, and limit participation from smaller market players. The absence of established local financing mechanisms specifically tailored for energy storage assets further constrains market accessibility and growth potential.

Competitive Landscape:

The Saudi Arabia grid energy storage market is characterized by intensifying competition among global technology providers and system integrators seeking to establish leadership positions in one of the world's fastest-growing storage markets. Companies are differentiating through advanced battery technologies, localized manufacturing capabilities, strategic utility partnerships, and specialized solutions adapted for desert operating conditions. Competition is driven by large-scale government tenders that attract international developers, equipment manufacturers, and engineering contractors pursuing long-term service agreements. Strategic collaborations between global technology leaders and local partners are accelerating market entry while addressing domestic content requirements. The emergence of build-own-operate procurement models is fostering innovations in project financing, risk allocation, and operational optimization as market participants compete to deliver cost-effective, reliable storage solutions that support the Kingdom's renewable energy integration objectives.

Recent Developments:

- In February 2025, BYD Energy Storage and Saudi Electricity Company successfully finalized contracts for the largest grid-scale energy storage projects globally, boasting a capacity of 12.5GWh at that time. This signing represented a significant and vital advance in their partnership within the renewable energy field, providing strong impetus for the growth of the Saudi Arabia renewable energy sector and aiding in achieving the objectives of Saudi Arabia's Vision 2030.

Saudi Arabia Grid Energy Storage Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Battery Chemistries Covered | Lead-Acid, Sodium-Based, Redox Flow, Lithium-Ion, Others |

| Ownerships Covered | Third-Party Owned, Utility Owned |

| Applications Covered | Renewables, Peak Shifting, Ancillary Services, Backup Power, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia grid energy storage market size was valued at USD 148.0 Million in 2025.

The Saudi Arabia grid energy storage market is expected to grow at a compound annual growth rate of 25.76% from 2026-2034 to reach USD 1,163.8 Million by 2034.

Lithium-ion dominated the market with a share of 65%, driven by its superior energy density, proven reliability in extreme temperatures, declining costs, and modular architecture that supports scalable deployments aligned with the Kingdom's renewable energy integration requirements.

Key factors driving the Saudi Arabia grid energy storage market include government Vision 2030 initiatives and regulatory support, rapid renewable energy expansion requiring storage integration, declining battery technology costs, grid modernization programs, and increasing investments in smart grid infrastructure.

Major challenges include high initial investment costs for large-scale battery systems, extreme climate operating conditions requiring specialized equipment, local content compliance requirements, and the underdeveloped local supplier and workforce ecosystem.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)