Saudi Arabia Grinding Wheels Market Size, Share, Trends and Forecast by Type, Material, and Region, 2026-2034

Saudi Arabia Grinding Wheels Market Summary:

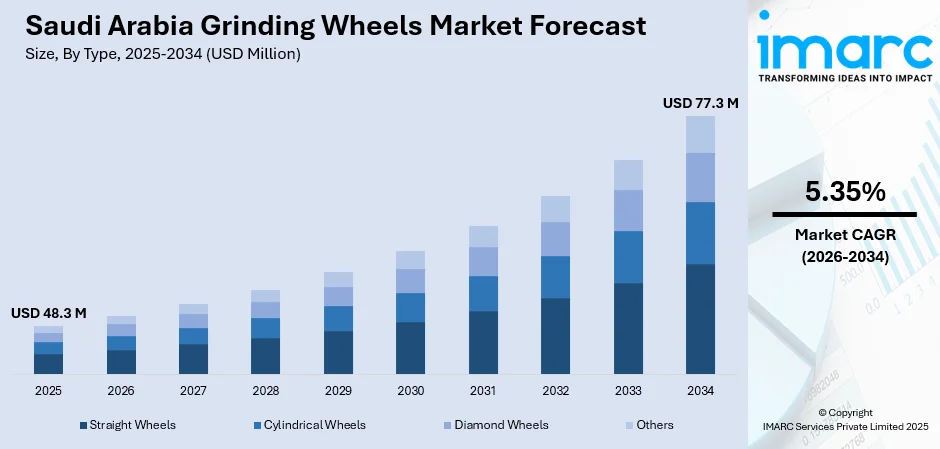

The Saudi Arabia grinding wheels market size was valued at USD 48.3 Million in 2025 and is projected to reach USD 77.3 Million by 2034, growing at a compound annual growth rate of 5.35% from 2026-2034.

The Kingdom's grinding wheels market is experiencing robust growth driven by accelerating industrial diversification initiatives under Vision 2030 and expanding manufacturing capabilities across automotive, construction, and energy sectors. Rising investments in precision metalworking technologies, infrastructure mega-projects, and oil and gas exploration activities are generating sustained demand for high-performance abrasive tools, strengthening the Saudi Arabia grinding wheels market share.

Key Takeaways and Insights:

-

By Type: Straight wheels dominate the market with a share of 42.03% in 2025, owing to their widespread applications in surface grinding operations and versatile compatibility with various metalworking processes across construction and manufacturing sectors.

-

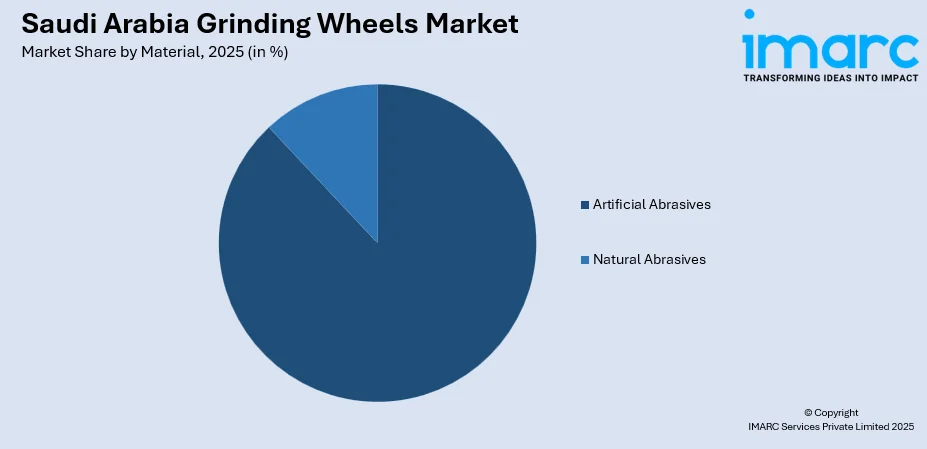

By Material: Artificial abrasives lead the market with a share of 88.05% in 2025, driven by superior hardness properties, consistent quality standards, and cost-effective production capabilities meeting industrial scale grinding requirements.

-

Key Players: The Saudi Arabia grinding wheels market exhibits a moderately fragmented competitive structure characterized by the presence of established international abrasives manufacturers alongside regional suppliers serving diverse industrial applications across construction, automotive, and oil and gas sectors.

To get more information on this market Request Sample

The grinding wheels market in Saudi Arabia is evolving significantly amid the Kingdom's unprecedented industrial transformation driven by Vision 2030 economic diversification objectives. With over 12,000 factories operational across 40 industrial cities by end of 2024 and ambitious targets to reach 36,000 factories by 2035, demand for precision grinding solutions continues to accelerate. In May 2024, Saudi Arabia launched the Advanced Manufacturing and Production Center aimed at accelerating industrial transformation through Fourth Industrial Revolution technologies, creating substantial opportunities for advanced grinding wheel applications. The oil and gas sector remains a critical demand driver, with the King Salman Energy Park investment and ongoing maintenance requirements for pipelines and refinery equipment generating consistent demand for durable grinding solutions throughout the forecast period.

Saudi Arabia Grinding Wheels Market Trends:

Growing Adoption of Advanced Abrasive Materials

The Saudi Arabia grinding wheels market is witnessing increasing preference for technologically advanced abrasive materials including diamond and cubic boron nitride compositions. These premium materials deliver enhanced performance characteristics in precision grinding applications involving hard and brittle materials such as ceramics and specialized alloys. Industries working with high-strength metals and composites are increasingly adopting these superior abrasives to achieve tighter tolerances and improved surface finishes in demanding manufacturing environments.

Integration of Automation and Industry 4.0 Technologies

Automation integration represents a defining trend transforming grinding wheel applications across Saudi industrial facilities. Manufacturers are increasingly deploying automated grinding systems that optimize operational efficiency while reducing production cycles and operational costs. Smart manufacturing initiatives are driving adoption of CNC-controlled grinding equipment featuring real-time monitoring capabilities, predictive maintenance functions, and data-driven process optimization that enhance precision, minimize material waste, and improve overall productivity in metalworking operations throughout the Kingdom.

Expanding Repair, Maintenance, and Overhaul Applications

The growing scale of repair, maintenance, and overhaul services across oil and gas, aviation, and power generation sectors is driving substantial grinding wheel consumption. CNC grinding machines enable precise material removal and surface finishing essential for extending equipment life and minimizing operational downtime. As the CNC grinding machines market size in Saudi Arabia is expected to reach USD 66.36 Million by 2033, exhibiting a growth rate (CAGR) of 3.71% during 2025-2033, associated consumable grinding wheel demand continues strengthening throughout the Kingdom's industrial maintenance infrastructure (Source: IMARC Group).

How Vision 2030 is Transforming the Saudi Arabia Grinding Wheels Market:

Saudi Arabia's Vision 2030 is reshaping the grinding wheels market by prioritizing industrial diversification and positioning the Kingdom as a regional manufacturing powerhouse. Mega-projects such as NEOM, the Red Sea Global developments, Qiddiya, and Diriyah are driving unprecedented demand for precision metalworking tools including grinding wheels for construction equipment manufacturing and infrastructure component fabrication. Regulatory reforms, including the National Industrial Strategy and substantial investments in industrial development have accelerated adoption of advanced grinding solutions. Riyadh's rapid urbanization and the establishment of specialized industrial clusters including the King Salman Automotive Complex producing 300,000 vehicles annually are creating substantial demand for high-performance grinding wheels supporting automotive component manufacturing, metalworking operations, and precision engineering applications across the Kingdom.

Market Outlook 2026-2034:

The Saudi Arabia grinding wheels market outlook remains highly positive through the forecast period, supported by sustained infrastructure investments in active construction developments and expanding manufacturing localization initiatives. Growing automotive production capabilities, continued oil and gas sector modernization, and increasing adoption of precision manufacturing technologies across industrial clusters will drive consistent demand. The Kingdom's strategic focus on economic diversification under Vision 2030 ensures robust long-term growth prospects for grinding wheel consumption throughout the forecast period. The market generated a revenue of USD 48.3 Million in 2025 and is projected to reach a revenue of USD 77.3 Million by 2034, growing at a compound annual growth rate of 5.35% from 2026-2034.

Saudi Arabia Grinding Wheels Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Straight Wheels |

42.03% |

|

Material |

Artificial Abrasives |

88.05% |

Type Insights:

- Straight Wheels

- Cylindrical Wheels

- Diamond Wheels

- Others

The straight wheels dominate with a market share of 42.03% of the total Saudi Arabia grinding wheels market in 2025.

Straight grinding wheels maintain dominant market position owing to their fundamental versatility and widespread applicability across diverse industrial operations including surface grinding, cylindrical grinding, and general-purpose metal removal tasks. These wheels deliver consistent performance in grinding metal, concrete, and other hard materials particularly essential for construction and metalworking operations throughout the Kingdom. The ongoing emphasis on manufacturing modernization and infrastructure development creates sustained demand for reliable straight wheel solutions meeting broad industrial specifications.

The segment benefits significantly from Saudi Arabia's construction sector expansion driven by mega-projects and urban development initiatives across the Kingdom. Manufacturing facilities producing structural steel components, automotive parts, and precision machinery consistently utilize straight grinding wheels for finishing operations. The growing network of industrial cities and specialized manufacturing clusters further strengthens demand, as fabrication workshops and metalworking enterprises rely on straight wheels for versatile material removal and surface preparation applications.

Material Insights:

Access the comprehensive market breakdown Request Sample

- Artificial Abrasives

- Natural Abrasives

The artificial abrasives lead with a share of 88.05% of the total Saudi Arabia grinding wheels market in 2025.

Artificial abrasives including aluminum oxide and silicon carbide compositions command overwhelming market share due to superior performance consistency, controlled grain sizes, and enhanced hardness properties essential for industrial-scale applications. These manufactured abrasives enable precise material removal rates and predictable grinding performance critical for quality-sensitive manufacturing operations across automotive, aerospace, and precision engineering sectors driving industrial growth under Vision 2030 initiatives.

The segment's dominance is reinforced by expanding steel production capacity and metalworking activities. In December 2023, Saudi Arabia announced intentions to invest approximately USD 12 billion in steel projects, creating substantial downstream demand for artificial abrasive grinding wheels in fabrication, finishing, and maintenance operations. The Kingdom's strategic focus on industrial localization and manufacturing self-sufficiency further strengthens artificial abrasives consumption across diverse metalworking applications supporting economic diversification objectives.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The Northern and Central Region is driven by Riyadh's position as the Kingdom's industrial and economic hub hosting numerous factories. Major infrastructure projects including New Murabba, Diriyah Gate, and King Salman Park generate substantial grinding wheel demand for construction equipment manufacturing and precision metalworking operations.

The Western Region including Makkah demonstrates strong market presence supported by Jeddah's strategic port infrastructure and expanding food manufacturing cluster. King Abdullah Economic City hosts automotive manufacturing facilities including electric vehicle production plants, creating automotive grade grinding wheel demand.

The Eastern Region serves as the Kingdom's petrochemical and heavy industry heartland with critical oil and gas infrastructure. Jubail Industrial City, Ras Al-Khair mining complex, and King Salman Energy Park generate intensive grinding wheel consumption for equipment maintenance, pipeline fabrication, and precision manufacturing operations.

The Southern Region presents growing market opportunities driven by Jazan Industrial City's focus on heavy industries, energy-intensive manufacturing, and food processing applications. Regional agricultural equipment manufacturing and construction material production activities contribute to grinding wheel demand, supported by government initiatives to distribute industrial development across the Kingdom's geographic regions.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Grinding Wheels Market Growing?

Accelerating Infrastructure Development and Mega-Project Construction

Saudi Arabia's unprecedented infrastructure development program represents the primary growth catalyst for grinding wheel demand. Massive construction developments across the Kingdom and numerous urban expansion initiatives are driving substantial requirements for structural steel fabrication, metalworking, and precision component manufacturing. These mega-projects generate sustained abrasive consumption as construction equipment maintenance, material processing, and infrastructure component fabrication activities continue expanding throughout the forecast period.

Expanding Automotive and Manufacturing Ecosystem

The Kingdom's emerging automotive manufacturing ecosystem is creating significant grinding wheel demand. Multiple electric vehicle production facilities are now operational or under development, establishing Saudi Arabia's first domestic automotive manufacturing base. Strategic partnerships between the Public Investment Fund and global automotive manufacturers are accelerating production capabilities, substantially increasing precision grinding requirements for engine components, transmission parts, and chassis manufacturing operations supporting the Kingdom's mobility sector ambitions. In June 2024, Ceer signed a SAR 8.2 Billion (USD 2.18 Billion) contract with Hyundai Transys for integrated electric vehicle drive systems.

Sustained Oil and Gas Sector Maintenance Requirements

The oil and gas sector continues driving grinding wheel demand through extensive maintenance, repair, and component fabrication requirements. As a leading global oil exporter, Saudi Arabia maintains substantial pipeline networks, refinery infrastructure, and drilling platforms requiring specialized grinding solutions for corrosion-resistant surface preparation and precision machining. The sector's intensive metalworking activities support consistent grinding wheel consumption throughout exploration, production, and downstream processing operations across the Kingdom's energy infrastructure.

Market Restraints:

What Challenges the Saudi Arabia Grinding Wheels Market is Facing?

Raw Material Price Volatility and Supply Chain Dependencies

Fluctuating prices for abrasive raw materials including aluminum oxide, silicon carbide, and bonding agents create cost uncertainties affecting grinding wheel manufacturing economics. Import dependencies for specialized abrasive minerals and supply chain disruptions impact production costs and inventory management for distributors serving Saudi industrial markets.

Skilled Labor Shortages in Precision Manufacturing

The Kingdom faces workforce challenges in precision manufacturing and advanced machining operations requiring trained technicians proficient in grinding wheel selection and application optimization. Despite Saudization initiatives promoting national workforce development, specialized industrial skills remain constrained, potentially limiting optimal grinding solution implementation across manufacturing facilities.

Competition from Alternative Material Removal Technologies

Advancing laser cutting, waterjet machining, and electrical discharge machining technologies present competitive alternatives for certain material removal applications traditionally served by grinding operations. Adoption of non-contact processing methods in precision manufacturing may partially constrain grinding wheel demand growth in specific industrial segments.

Competitive Landscape:

The Saudi Arabia grinding wheels market exhibits a moderately fragmented competitive structure characterized by the presence of established multinational abrasives manufacturers competing alongside regional suppliers and specialized distributors. Market participants focus on product differentiation through technical specifications, application-specific formulations, and service capabilities including technical support and customization options. The competitive environment is influenced by localization requirements under Vision 2030 initiatives encouraging domestic manufacturing development. Strategic partnerships between international abrasives companies and local distributors enhance market coverage across the Kingdom's diverse industrial regions.

Saudi Arabia Grinding Wheels Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Straight Wheels, Cylindrical Wheels, Diamond Wheels, Others |

| Materials Covered | Artificial Abrasives, Natural Abrasives |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia grinding wheels market size was valued at USD 48.3 Million in 2025.

The Saudi Arabia grinding wheels market is expected to grow at a compound annual growth rate of 5.35% from 2026-2034 to reach USD 77.3 Million by 2034.

Straight wheels dominated the market with 42.03% share in 2025, driven by their widespread applications in surface grinding operations and versatile compatibility across construction and manufacturing sectors requiring reliable general-purpose grinding solutions.

Key factors driving the Saudi Arabia grinding wheels market include accelerating infrastructure development under Vision 2030, expanding automotive manufacturing ecosystem, sustained oil and gas sector maintenance requirements, and growing adoption of precision manufacturing technologies across industrial sectors.

Major challenges include raw material price volatility affecting production economics, skilled labor shortages in precision manufacturing operations, supply chain dependencies for specialized abrasive materials, and competition from alternative material removal technologies in specific industrial applications.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)