Saudi Arabia Gypsum Board Market Size, Share, Trends and Forecast by Product Type, End Use, and Region, 2026-2034

Saudi Arabia Gypsum Board Market Overview:

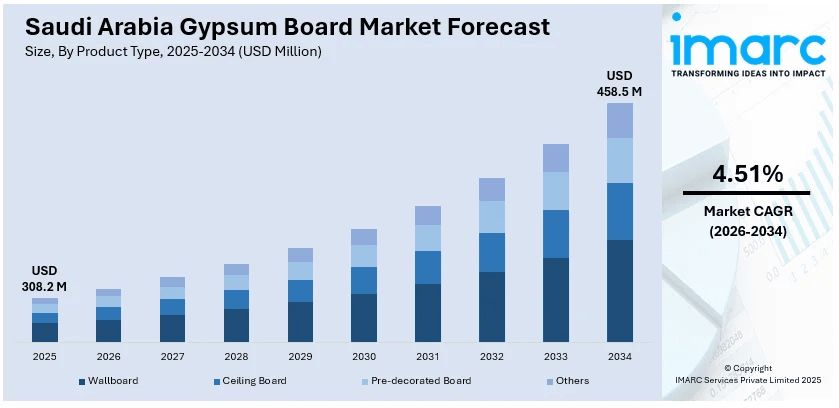

The Saudi Arabia gypsum board market size reached USD 308.2 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 458.5 Million by 2034, exhibiting a growth rate (CAGR) of 4.51% during 2026-2034. The market is being driven by rapid urbanization, increasing construction activities, the government's push for sustainable building practices, rising demand for energy-efficient and fire-resistant materials, and significant investments in infrastructure projects and residential developments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 308.2 Million |

| Market Forecast in 2034 | USD 458.5 Million |

| Market Growth Rate 2026-2034 | 4.51% |

Saudi Arabia Gypsum Board Market Trends:

Surge in Infrastructure Development and Urbanization

The rapid urban growth and large-scale infrastructure projects across the country are among the key market drivers. As part of its Vision 2030 drive to diversify the economy and reduce dependency on oil, Saudi Arabia is undertaking substantial urban development, with a concentration on the construction of new cities, residential complexes, and commercial structures. This surge in construction activity has spiked the demand for building materials like gypsum boards. The Saudi construction industry, which was valued at USD 97.8 billion in 2024, is predicted to expand to USD 135.6 billion by 2033, with a 3.7% CAGR between 2025 and 2033. Major projects such as NEOM City, Qiddiya Entertainment City, and the Red Sea Project are driving this expansion, resulting in a significant demand for low-cost, fire-resistant, and energy-efficient materials like gypsum boards. Their lightweight, insulating, and adaptable qualities make them excellent for walls, ceilings, and partitions in both residential and commercial buildings. As urbanization accelerates, with an annual need for 200,000 new units, the Saudi gypsum board industry is expected to grow substantially.

To get more information on this market Request Sample

Growing Demand for Sustainable and Fire-Resistant Materials

Another key trend propelling the growth of the gypsum board market in Saudi Arabia is the rising demand for sustainable, fire-resistant, and energy-efficient building materials. In line with national efforts to elevate construction standards and reduce energy consumption, there has been a marked shift towards environmentally friendly and fireproof solutions like gypsum boards. Known for their non-combustibility, sound insulation, and thermal efficiency, gypsum boards are increasingly preferred in both residential and commercial construction. In 2023, Saudi Arabia implemented stricter building codes focused on enhancing safety, particularly fire prevention. This regulatory shift has significantly boosted demand for fire-resistant materials. Furthermore, increased environmental consciousness has fueled interest in sustainable construction approaches. Organizations like the Saudi Green Building Council, in addition to enforcing the Saudi Building Code, advocate for materials that reduce carbon footprints and increase building efficiency. In Saudi Arabia's hot environment, gypsum boards provide great thermal insulation, coinciding with national sustainability goals and solidifying their place in the country's changing building scene.

Saudi Arabia Gypsum Board Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on product type, and end use.

Product Type Insights:

- Wallboard

- Ceiling Board

- Pre-decorated Board

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes wallboard, ceiling board, pre-decorated board, and others.

End Use Insights:

.jpeg)

Access the comprehensive market breakdown Request Sample

- Residential

- Corporate

- Commercial

- Institutional

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes residential, corporate, commercial, and institutional.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Gypsum Board Market News:

- April 2025: United Mining Industries (UMI), a producer of gypsum board, gypsum powder, and cement boards in Saudi Arabia, announced its transition from the parallel market (Nomu) to the main market of the Saudi Stock Exchange (Tadawul). This was done to enhance the company's visibility and attract greater investment opportunities.

- January 2024: Saudi Arabia’s Public Investment Fund (PIF) increased its stake in the Middle East Paper Company (MEPCO) to 23.08% through a capital increase and subscription of new shares. This strategic investment aims to support MEPCO's expansion, particularly in packaging and specialized building materials, such as gypsum boards.

- December 2023: The National Gypsum Co. signed an SAR 30 million contract to develop and modernize a gypsum board production line at its Riyadh factory. The project aimed to enhance production capacity to up to 15 million square meters of gypsum board annually.

- November 2023: United Mining Industries (UMI) awarded an EUR 12.3 million contract to Canada-based Gyptech for the expansion of its gypsum wallboard plant in Saudi Arabia. The project aimed to enhance the plant's production capacity and efficiency.

Saudi Arabia Gypsum Board Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Wallboard, Ceiling Board, Pre-decorated Board, Others |

| End Uses Covered | Residential, Corporate, Commercial, Institutional |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia gypsum board market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia gypsum board market on the basis of product type?

- What is the breakup of the Saudi Arabia gypsum board market on the basis of end use?

- What are the various stages in the value chain of the Saudi Arabia gypsum board market?

- What are the key driving factors and challenges in the Saudi Arabia gypsum board market?

- What is the structure of the Saudi Arabia gypsum board market and who are the key players?

- What is the degree of competition in the Saudi Arabia gypsum board market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia gypsum board market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia gypsum board market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia gypsum board industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)