Saudi Arabia Healthcare Cold Chain Logistics Market Size, Share, Trends and Forecast by Product, Segment, and Region, 2026-2034

Saudi Arabia Healthcare Cold Chain Logistics Market Overview:

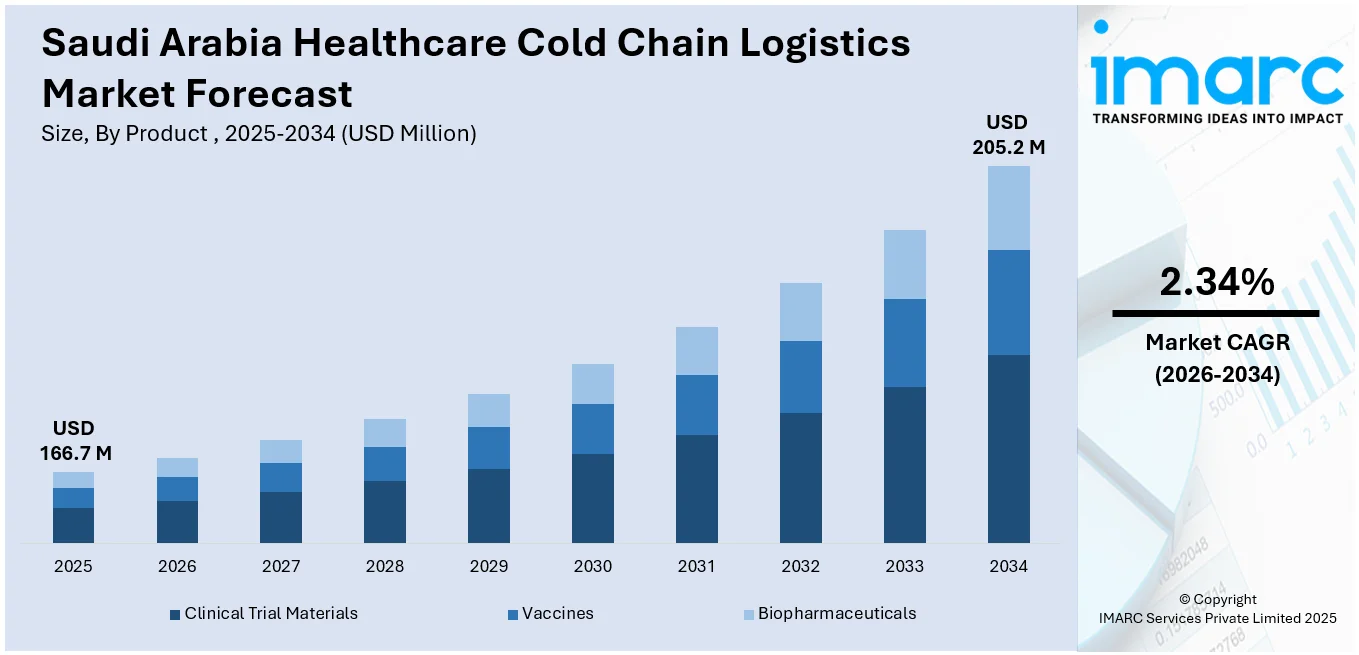

The Saudi Arabia healthcare cold chain logistics market size reached USD 166.7 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 205.2 Million by 2034, exhibiting a growth rate (CAGR) of 2.34% during 2026-2034. The rising demand for temperature-sensitive pharmaceutical products, ongoing improvements in healthcare infrastructure, and enhanced regulatory frameworks are fueling the market growth. Additionally, growing awareness around vaccine distribution and the continued expansion of the pharmaceutical and biotechnology industries are also acting as growth-inducing factors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 166.7 Million |

| Market Forecast in 2034 | USD 205.2 Million |

| Market Growth Rate 2026-2034 | 2.34% |

Saudi Arabia Healthcare Cold Chain Logistics Market Trends:

Government Initiatives and Healthcare Reforms

Saudi Arabia's Vision 2030 and its ongoing healthcare reforms are major drivers for the healthcare sector. The government is implementing policies to boost the efficiency of healthcare services and improve the quality of care. As part of these efforts, the demand for pharmaceutical and healthcare products is increasing, leading to a rise in the need for cold chain logistics. The government is also focusing on establishing specialized infrastructure, such as warehouses and distribution centers, to facilitate the growth of cold chain logistics networks. These initiatives are improving accessibility, efficiency, and security in the healthcare cold chain logistics market. On January 25, 2024, His Royal Highness Prince Mohammed bin Salman bin Abdulaziz Al Saud, the Crown Prince and Prime Minister, unveiled the National Biotechnology Strategy, a detailed plan aimed at establishing the Kingdom as a worldwide biotechnology center by 2040. In line with this vision, Saudi Arabia participated in the BIO International Convention 2025, which took place in Boston, USA, the largest biotechnology event globally. The delegation from Saudi Arabia, headed by the Ministry of Health and made up of 25 organizations, presented a cohesive national framework for biotechnology, highlighting the Kingdom’s rise as an important global contributor in line with Vision 2030 and the National Biotechnology Strategy.

To get more information on this market Request Sample

Increasing Health Consciousness

As the Saudi population becomes more health-conscious, there is an increasing demand for high-quality and safe healthcare products. People are seeking products that are not only effective but also maintained under optimal conditions to preserve their quality. This shift in behavior is encouraging manufacturers and distributors to adopt more advanced cold chain logistics solutions. The rise in demand for organic and natural healthcare products, many of which require refrigerated transportation, is further fueling the growth of the cold chain logistics market. Healthcare companies are responding by strengthening their cold chain capabilities to meet the expectations of a more discerning consumer base. Moreover, the increase in occurrence of chronic diseases is driving the need for advanced solutions in the country. The regulatory structure established under Vision 2030 seeks to tackle chronic diseases issues by promoting increased participation from the private sector. The government has emphasized public-private partnerships (PPPs) as a system to enhance effectiveness and increase capacity. The National Center for Private Sector Participation (NCPP) manages these projects, which involve privatizing hospitals, outsourcing diagnostic and radiology services, and involving private providers to manage primary healthcare centers. By the year 2030, the administration seeks to raise the private sector's contribution to healthcare delivery to 65 percent of overall services, a notable change from the existing environment, where public providers are prevalent.

Growth in Pharmaceutical and Biotech Industries

The pharmaceutical and biotechnology industries in Saudi Arabia are experiencing significant growth, driving the demand for temperature-sensitive healthcare products. With the increasing number of biopharmaceuticals, vaccines, and biologics being developed and produced, the need for cold chain logistics is intensifying. These products require precise temperature control to maintain efficacy and safety during transportation and storage. Companies are investing heavily in state-of-the-art refrigerated storage and transportation systems to ensure the integrity of these sensitive products. This growing demand for high-quality, temperature-controlled logistics services is propelling the cold chain logistics market forward. IMARC Group predicts that the Saudi Arabia pharmaceuticals market is projected to attain USD 11.7 Billion by 2033.

Saudi Arabia Healthcare Cold Chain Logistics Market Growth Drivers:

Technological Advancements in Cold Chain Solutions

Advancements in cold chain technologies, such as real-time temperature monitoring, GPS tracking, and smart packaging, are contributing to the growth of the healthcare cold chain logistics market in Saudi Arabia. These innovations enhance the efficiency and reliability of the logistics process, allowing companies to maintain optimal conditions for sensitive products. The integration of IoT-based solutions in monitoring and controlling temperature in real-time is improving the visibility and accuracy of the entire supply chain, reducing the risk of product degradation. As these technologies continue to evolve, they are playing a crucial role in driving the expansion of the cold chain logistics sector.

Increase in Vaccine Distribution and Demand

The global health crisis is catalyzing the need for efficient vaccine distribution, including the importance of cold chain logistics. Saudi Arabia, like many other countries, is ramping up its vaccination efforts to ensure public health. Vaccines, particularly those that are temperature-sensitive, require a robust cold chain system for distribution. The growing focus on immunization and the need for maintaining the integrity of vaccines during transportation and storage is driving the demand for specialized cold chain logistics solutions. This is becoming a critical factor for the healthcare cold chain logistics market in Saudi Arabia.

Rising Demand for Perishable Healthcare Products

The increasing demand for perishable healthcare products, such as blood, tissue, and organ transplants, is another significant factor driving the healthcare cold chain logistics market in Saudi Arabia. These products are extremely sensitive to temperature fluctuations, and their safe transportation is essential for maintaining their viability. The growing prevalence of organ transplants and the need for timely delivery of blood products are pushing the healthcare sector to invest more in specialized cold chain logistics infrastructure. This includes temperature-controlled vehicles, monitoring systems, and refrigeration units that ensure products maintain their required temperature throughout the entire supply chain.

Saudi Arabia Healthcare Cold Chain Logistics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on product and segment.

Product Insights:

- Clinical Trial Materials

- Vaccines

- Biopharmaceuticals

The report has provided a detailed breakup and analysis of the market based on the product. This includes clinical trial materials, vaccines, and biopharmaceuticals.

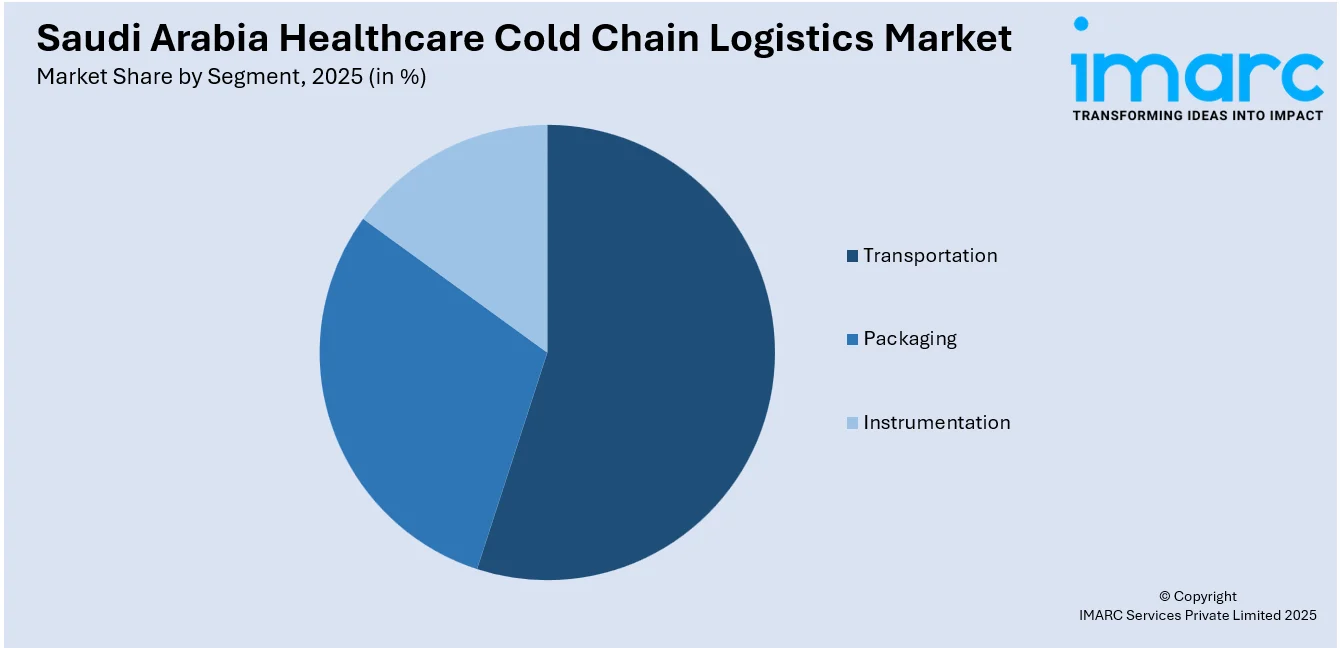

Segment Insights:

Access the comprehensive market breakdown Request Sample

- Transportation

- Packaging

- Instrumentation

A detailed breakup and analysis of the market based on the segment have also been provided in the report. This includes transportation, packaging, and instrumentation.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Healthcare Cold Chain Logistics Market News:

- July 2025: Four Winds Saudi Arabia Limited, a frontrunner in full-service moving and logistics solutions since 1979, has officially been granted a license by the Saudi Food and Drug Authority (SFDA) for the storage of medical devices and supplies in its newly established cold chain logistics facility. The newly constructed warehouse is a component of the company’s latest logistics center, designed specifically for Four Winds Saudi Arabia Limited on a 10,000-square-meter plot. This achievement signifies the company's dedication to enhancing the efficiency of pharmaceutical supply chains, utilizing top-tier logistics standards, and conforming to healthcare regulations at national, regional, and international levels.

- June 2025: DHL Group intends to allocate €500 million ($575 million) towards healthcare infrastructure in Africa and the Middle East in the coming five years. The investment accounts for 25% of the company’s €2 billion global healthcare budget aimed at enhancing warehousing, packaging, and logistics capabilities due to increasing pharmaceutical demand in the area. Major centers consist of South Africa, Egypt, Kenya, Dubai, and Saudi Arabia. The emphasis is on valuable, urgent shipments like vaccines, stem cells, insulin treatments, and cryogenic substances, prioritizing traceability and the integrity of the cold chain.

- February 2025: NUPCO secured USD 667 million to enhance the healthcare supply chain Saudi Arabia. The funding supports advanced storage and transport systems critical for temperature-sensitive medicines and vaccines.

Saudi Arabia Healthcare Cold Chain Logistics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Clinical Trial Materials, Vaccines, Biopharmaceuticals |

| Segments Covered | Transportation, Packaging, Instrumentation |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia healthcare cold chain logistics market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia healthcare cold chain logistics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia healthcare cold chain logistics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The healthcare cold chain logistics market in Saudi Arabia was valued at USD 166.7 Million in 2025.

The Saudi Arabia healthcare cold chain logistics market is projected to exhibit a CAGR of 2.34% during 2026-2034, reaching a value of USD 205.2 Million by 2034.

Key factors driving the Saudi Arabia healthcare cold chain logistics market include the growing demand for temperature-sensitive pharmaceuticals, increasing healthcare investments, advancements in vaccine distribution, government initiatives to improve healthcare infrastructure, and the expansion of the pharmaceutical and biotechnology industries in the region.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)