Saudi Arabia Hearing Aids Market Size, Share, Trends and Forecast by Product Type, Hearing Loss, Patient Type, Technology Type, End-User, and Region, 2026-2034

Saudi Arabia Hearing Aids Market Overview:

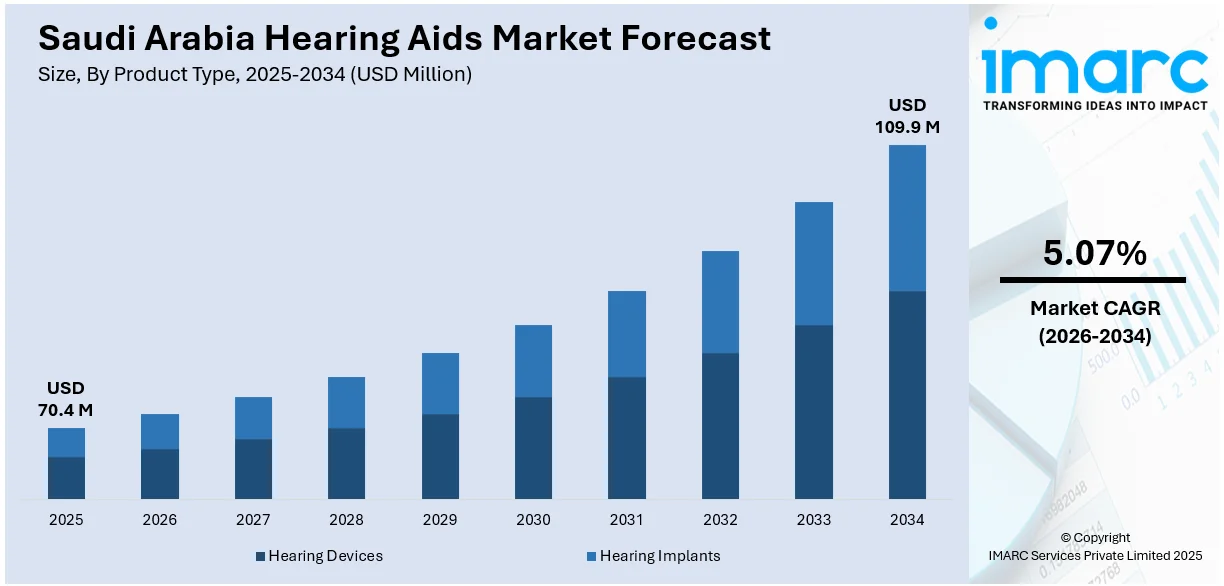

The Saudi Arabia hearing aids market size reached USD 70.4 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 109.9 Million by 2034, exhibiting a growth rate (CAGR) of 5.07% during 2026-2034. The market is driven by the rising adoption of smart hearing aids, fueled by technological advancements, Bluetooth connectivity, and AI-powered customization, meeting the demand for seamless audio integration. Government healthcare initiatives and expanding audiology clinics are increasing accessibility, while the aging population amplifies the need for advanced hearing solutions. Additionally, the shift toward rechargeable, eco-friendly devices aligns with Vision 2030 sustainability goals, further augmenting the Saudi Arabia hearing aids market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 70.4 Million |

| Market Forecast in 2034 | USD 109.9 Million |

| Market Growth Rate 2026-2034 | 5.07% |

Saudi Arabia Hearing Aids Market Trends:

Growing Prevalence of Hearing Loss Among Aging Population

Rising elderly population in Saudi Arabia is a major driver of the market growth. Information from the General Authority for Statistics (GASTAT) indicated that the senior demographic, individuals aged 65 and over, made up 2.8% of the population of Saudi Arabia, equating to 988,000 individuals in 2024. With longer life expectancy and improvements in healthcare, more individuals are reaching ages where hearing loss affects quality of life, communication, and social interaction. Hearing aids offer essential solutions, helping seniors remain active and engaged within their families and communities. Government healthcare programs and insurance coverage for seniors are also making hearing devices more accessible, addressing affordability challenges. Additionally, campaigns by medical associations are creating awareness about the benefits of early adoption of hearing aids.

To get more information on this market Request Sample

Rising Awareness and Early Diagnosis of Hearing Disorders

Awareness campaigns and improved access to audiology services in Saudi Arabia are driving early diagnosis of hearing impairments, strengthening the market. Hospitals, clinics, and specialized ear, nose, and throat (ENT) centers are investing in advanced diagnostic technologies to identify hearing loss at earlier stages, making timely interventions possible. Public health campaigns also encourage routine hearing checks, especially for at-risk groups, such as children, elderly citizens, and individuals exposed to occupational noise. As more people are recognizing the impact of untreated hearing loss on education, employment, and overall well-being, the adoption of hearing devices is increasing. Schools and workplaces are also becoming proactive in screening programs, ensuring early corrective action. With rising incidence of hearing loss and heightened emphasis on awareness and prevention, more individuals are turning towards hearing aids as a practical solution. A cross-sectional, descriptive study was carried out on Saudi adults in Jazan in 2024. The research involved 428 participants, comprising 53.3% males and 45.6% aged 18–25. It indicated that 14.3% of participants experienced hearing impairment.

Technological Advancements in Hearing Aid Devices

The market is benefiting from rapid technological advancements, making devices smaller, smarter, and more efficient. Modern hearing aids integrate features like Bluetooth connectivity, rechargeable batteries, noise cancellation, and artificial intelligence (AI)-based sound processing, offering enhanced user comfort and functionality. As per the IMARC Group, the Saudi Arabia AI market size was valued at USD 1,073 Million in 2024. These innovations appeal to younger and tech-savvy consumers who previously hesitated to adopt traditional devices due to stigma or inconvenience. Mobile apps also allow users to customize sound settings in real time, improving satisfaction and usability. Additionally, miniaturization ensures that hearing aids are discreet, encouraging adoption among individuals concerned about aesthetics. With Saudi Arabia being a digitally connected society, the demand for tech-enhanced medical devices is strong.

Key Growth Drivers of Saudi Arabia Hearing Aids Market:

Expanding Healthcare Infrastructure and Audiology Services

The Kingdom’s heavy investments in healthcare infrastructure under Vision 2030 are fueling the market growth. The expansion of hospitals, specialized ENT clinics, and audiology centers ensures greater accessibility to diagnosis and treatment for patients with hearing impairments. Modern healthcare facilities are equipped with advanced diagnostic tools and skilled professionals who can recommend personalized hearing solutions. Government funding and private-sector participation are also improving the distribution of medical devices across urban and rural areas, making hearing aids more available to previously underserved populations. Additionally, healthcare digitization, including tele-audiology services, is helping reach patients in remote areas, facilitating consultations and device adjustments without travel. The broadening of infrastructure and specialized services is a key factor enabling market growth, as it is creating a stronger ecosystem for diagnosis, treatment, and adoption of hearing aids in Saudi Arabia.

Increasing Pediatric Hearing Loss Cases and Early Intervention Programs

Rising cases of congenital and pediatric hearing loss in Saudi Arabia are catalyzing the demand for specialized hearing aids designed for children. Early intervention is critical for speech development, education, and social integration, leading parents and healthcare providers to prioritize timely solutions. Government health initiatives and newborn hearing screening programs are playing a major role in identifying impairments at an early stage. Pediatric-focused devices, such as behind-the-ear (BTE) hearing aids with customizable features, are gaining traction as they support child-friendly designs and adaptability as the child grows. Schools and educational institutions are also adopting supportive technologies to help students with hearing challenges. With the growing focus on children’s health and education, the market is set to expand.

Government Support and Insurance Coverage for Hearing Devices

Saudi Arabia’s government support through subsidies, healthcare funding, and insurance coverage is making hearing aids more affordable and accessible to patients. Public health institutions often provide subsidized or free hearing aids for citizens in need, reducing barriers to adoption. Private insurance providers are also expanding their coverage to include hearing aids, reflecting a growing recognition of their importance in improving quality of life. This support is encouraging more people to seek treatment for hearing impairments rather than avoiding it due to cost concerns. Additionally, government investments in healthcare awareness programs are further highlighting the availability of assistance, motivating patients to act early. By lowering financial hurdles, government initiatives are a significant driver for the widespread adoption of hearing aids in Saudi Arabia’s healthcare landscape.

Saudi Arabia Hearing Aids Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product type, hearing loss, patient type, technology type, and end-user.

Product Type Insights:

- Hearing Devices

- Behind-the-Ear (BTE)

- Receiver-in-the Ear (RITE)

- In-the-Ear (ITE)

- Canal Hearing Aids (CHA)

- Others

- Hearing Implants

- Cochlear Implants

- BAHA Implants

The report has provided a detailed breakup and analysis of the market based on the product type. This includes hearing devices (behind-the-ear (BTE), receiver-in-the ear (RITE), in-the-ear (ITE), canal hearing aids (CHA), and others) and hearing implants (cochlear implants and BAHA implants).

Hearing Loss Insights:

- Sensorineural Hearing Loss

- Conductive Hearing Loss

A detailed breakup and analysis of the market based on the hearing loss have also been provided in the report. This includes sensorineural hearing loss and conductive hearing loss.

Patient Type Insights:

- Adults

- Pediatrics

The report has provided a detailed breakup and analysis of the market based on the patient type. This includes adults and pediatrics.

Technology Type Insights:

- Analog

- Digital

A detailed breakup and analysis of the market based on the technology type have also been provided in the report. This includes analog and digital.

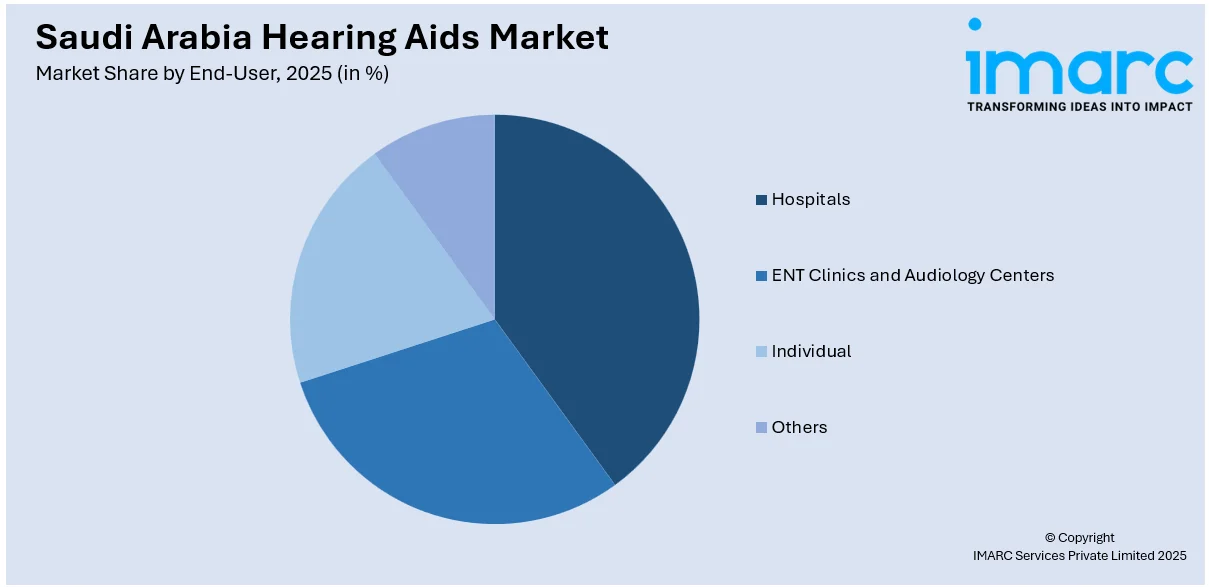

End-User Insights:

Access the comprehensive market breakdown Request Sample

- Hospitals

- ENT Clinics and Audiology Centers

- Individual

- Others

The report has provided a detailed breakup and analysis of the market based on the end-user. This includes hospitals, ENT clinics and audiology centers, individual, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Hearing Aids Market News:

- March 2025: Apple introduced its Hearing Aid and Hearing Test functionalities in Saudi Arabia after receiving authorization from the Saudi Food and Drug Authority. The Hearing Aid feature, accessible via a free software update for AirPods Pro 2, was designed to assist users experiencing mild to moderate hearing loss. This launch highlighted Apple's wider initiatives to enhance its technological offerings throughout the Middle East, particularly in Saudi Arabia.

- September 2024: KSrelief initiated the Saudi Sama'a Program in Hatay, Turkey, distributing 83 cochlear implants and 250 hearing aids. The program featured auditory rehabilitation sessions aimed at instructing families on how to utilize hearing aids and offer support for children with cochlear implants. The voluntary initiative highlighted Saudi Arabia's persistent dedication to enhancing global hearing health.

Saudi Arabia Hearing Aids Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Hearing Losses Covered | Sensorineural Hearing Loss, Conductive Hearing Loss |

| Patient Types Covered | Adults, Pediatrics |

| Technology Types Covered | Analog, Digital |

| End-Users Covered | Hospitals, ENT Clinics and Audiology Centers, Individual, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia hearing aids market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia hearing aids market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia hearing aids industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The hearing aids market in Saudi Arabia was valued at USD 70.4 Million in 2025.

The Saudi Arabia hearing aids market is projected to exhibit a CAGR of 5.07% during 2026-2034, reaching a value of USD 109.9 Million by 2034.

Advancements in digital hearing technologies, such as Bluetooth-enabled and nearly invisible devices, are making products more appealing and accessible. Government efforts aimed at enhancing healthcare facilities and ensuring improved access to medical services are also supporting the market expansion. Moreover, increasing affordability and availability of hearing aids through retail outlets are contributing to rising adoption rates.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)