Saudi Arabia Heat Exchanger Market Size, Share, Trends and Forecast by Product, Material, End User Industry, and Region, 2026-2034

Saudi Arabia Heat Exchanger Market Summary:

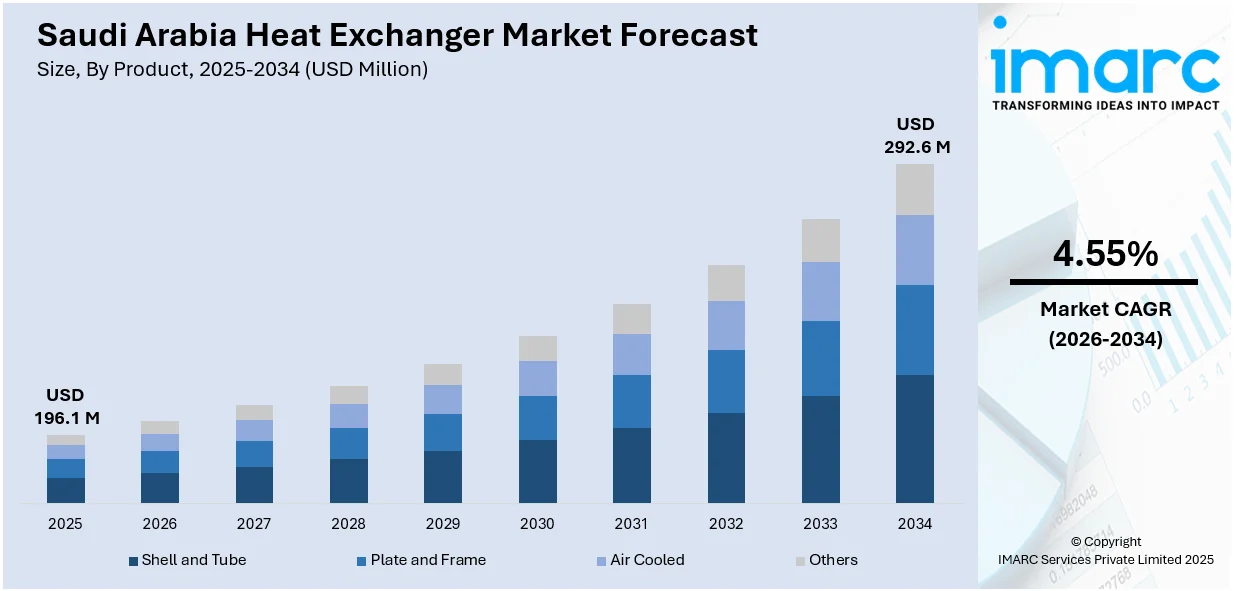

The Saudi Arabia heat exchanger market size was valued at USD 196.1 Million in 2025 and is projected to reach USD 292.6 Million by 2034, growing at a compound annual growth rate of 4.55% from 2026-2034.

The Saudi Arabia heat exchanger market is advancing rapidly as the nation accelerates industrial development and infrastructure modernization under Vision 2030. Expanding oil and gas operations, rising petrochemical investments, and growing desalination capacity are strengthening thermal management requirements across multiple sectors. Enhanced energy efficiency regulations, localized manufacturing initiatives, and increasing integration with renewable energy systems are reshaping industrial practices, positioning the country as a strategic hub for advanced thermal solutions and expanding the Saudi Arabia heat exchanger market share.

Key Takeaways and Insights:

- By Product: Shell and tube lead the market with 44% share in 2025, establishing themselves as the dominant solution for high-pressure and high-temperature applications across Saudi Arabia's industrial landscape.

- By Material: Carbon steel holds the largest market share at 35% in 2025, serving as the preferred material choice for cost-effective and durable heat exchanger construction in diverse industrial applications.

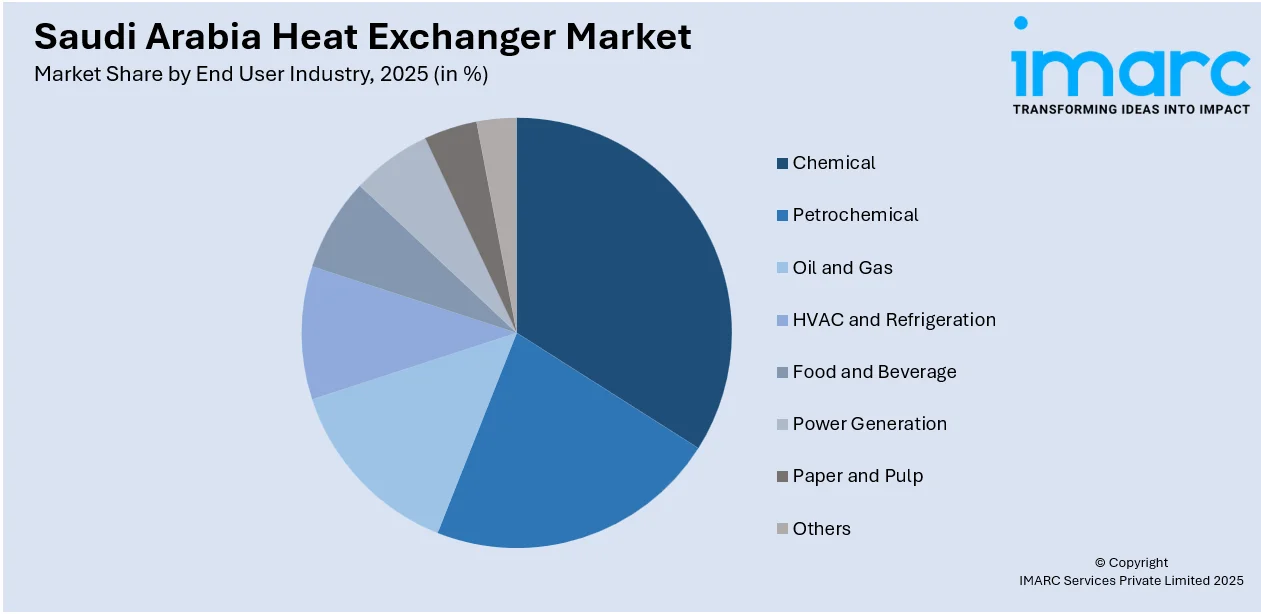

- By End User Industry: Oil and gas represents the largest segment with a market share of 20% in 2025, reflecting the sector's critical role in driving demand for heat exchangers in refining, processing, and energy recovery operations.

- By Region: Northern and central region hold the largest share at 28% in 2025, benefiting from concentrated industrial activity, major petrochemical complexes, and strategic infrastructure investments.

- Key Players: The Saudi Arabia heat exchanger market is characterized by increasing competition as manufacturers expand localized production, enhance thermal efficiency solutions, invest in advanced materials, and forge strategic partnerships to strengthen market positioning and support the Kingdom's industrial transformation.

To get more information on this market Request Sample

The Saudi Arabia heat exchanger sector is experiencing robust momentum as multiple sectors recognize the strategic value of advanced thermal management systems. Rapid industrialization, particularly in petrochemical processing and refinery operations, is generating sustained demand for high-capacity heat exchangers capable of withstanding extreme operational conditions. The Kingdom's ambitious desalination program, producing over 7 million cubic meters of water daily, relies heavily on efficient heat transfer equipment to maintain cost-effective operations. In November 2024, Alfa Laval Arabia assembled its first locally manufactured plate heat exchanger units, including four AHRI-certified AQ10T-BFM units for an HVAC client working on a district cooling project, demonstrating the growing localization of thermal equipment manufacturing. Additionally, the expanding district cooling infrastructure, requires sophisticated heat exchangers to serve major urban developments. Government regulations through the Saudi Standards, Metrology and Quality Organization continue to push industries toward energy-efficient technologies, creating favorable conditions for advanced heat exchanger adoption across commercial, industrial, and infrastructure applications.

Saudi Arabia Heat Exchanger Market Trends:

Integration with Renewable Energy and District Cooling Systems

A prominent trend reshaping Saudi Arabia's heat exchanger market is the accelerating integration of thermal management systems within renewable energy infrastructure and expanding district cooling networks. With the Kingdom's commitment to diversify its energy mix under Vision 2030, investments in solar and wind power projects have surged significantly. Saudi Arabia targets generating 50 percent of its electricity from renewable sources by 2030. These clean energy systems require efficient thermal management where heat exchangers maintain operational stability and optimize energy conversion. Additionally, large-scale urban developments like NEOM and the Red Sea Project are driving district cooling expansion, which necessitates advanced thermal transfer solutions to manage energy consumption, reduce environmental impact, and maintain optimal temperatures across massive residential and commercial zones.

Localized Manufacturing Boosting Thermal System Efficiency

Saudi Arabia is reinforcing its industrial self-reliance by establishing domestic assembly centers for thermal management equipment. In November 2023, Alfa Laval inaugurated a plate heat exchanger assembly facility in Jubail, aligning with Saudi Vision 2030 objectives to enhance local manufacturing capabilities. This facility reduces product lead times, lowers logistics-related emissions by minimizing airfreight, and ensures timely availability of critical components for industrial applications. In March 2025, the DESOLINATION heat exchanger was effectively installed at the site, an innovative device that efficiently enables heat transfer between the sCO₂ power cycle and the thermal storage and desalination systems. To address this essential element, the current towers at King Saud University were altered, guaranteeing seamless integration with the total system design and facilitating maximum heat transfer effectiveness across the facility. This localization trend shortens supply chains, enables customized designs suited to regional climatic and operational conditions, supports development of a skilled industrial workforce, and encourages technology transfer, enhancing Saudi Arabia's long-term autonomy in thermal management equipment production.

Digital Transformation and Advanced Thermal Technologies

The Saudi Arabia heat exchanger market is witnessing significant technological advancement as industries adopt digital monitoring systems, predictive maintenance capabilities, and high-performance thermal solutions. Modern heat exchangers are increasingly integrated with sensors that communicate real-time operational data to building management systems, enabling proactive maintenance and optimized efficiency. In 2024, a consortium comprising TAQA, JERA, and AlBawani signed agreements to develop two 1.8 gigawatt combined cycle gas turbine power plants in Saudi Arabia. These projects rely heavily on advanced heat exchange systems for thermal energy recovery and efficiency optimization, reflecting the growing sophistication of industrial applications. Additionally, specialized thermal solutions designed for extreme temperatures and corrosive environments are gaining traction in petrochemical and refinery operations, where reliability and performance under demanding conditions remain paramount.

How Vision 2030 is Transforming the Saudi Arabia Heat Exchanger Market:

Saudi Arabia’s Vision 2030 is significantly transforming the heat exchanger market by accelerating industrial growth, infrastructure development, and energy diversification. Large-scale giga-projects are driving strong demand for advanced HVAC and district cooling systems, where heat exchangers play a critical role in improving energy efficiency under extreme climatic conditions. At the same time, Vision 2030’s focus on renewable energy and sustainability is expanding the use of high-efficiency heat exchangers in solar power, desalination, and power generation applications. The strategy also promotes economic diversification beyond oil and gas, increasing demand from petrochemicals, food processing, and manufacturing sectors. Additionally, government support for local manufacturing and technology localization is encouraging global and regional players to invest in domestic production, digital monitoring, and advanced designs. Together, these initiatives are creating a more diversified, technology-driven, and resilient heat exchanger market aligned with Saudi Arabia’s long-term economic and environmental goals.

Market Outlook 2026-2034:

The Saudi Arabia heat exchanger market is positioned for sustained expansion as industrial diversification accelerates and infrastructure investments intensify. The market generated a revenue of USD 196.1 Million in 2025 and is projected to reach a revenue of USD 292.6 Million by 2034, growing at a compound annual growth rate of 4.55% from 2026-2034. This is primarily supported by expanding petrochemical capacity, increasing desalination requirements, and rising adoption of energy-efficient thermal systems. Government initiatives promoting localized manufacturing, stringent energy efficiency regulations, and continued investment in power generation and HVAC applications will collectively drive consistent demand. The integration of heat exchangers into renewable energy projects, district cooling networks, and modernized industrial facilities reinforces long-term market prospects.

Saudi Arabia Heat Exchanger Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product |

Shell and Tube |

44% |

|

Material |

Carbon Steel |

35% |

|

End User Industry |

Oil and Gas |

20% |

|

Region |

Northern and Central Region |

28% |

Product Insights:

- Shell and Tube

- Plate and Frame

- Air Cooled

- Others

Shell and tube dominate with a market share of 44% of the total Saudi Arabia heat exchanger market in 2025.

Shell and tube heat exchangers command substantial market presence by offering proven reliability in demanding industrial environments. Their design accommodates extreme operational conditions, making them indispensable for refinery processes, petrochemical operations, and power plant applications where thermal efficiency and durability are critical. The configuration allows for easy maintenance, scalability for large-capacity requirements, and compatibility with various fluids and temperatures. Saudi Arabia's extensive oil and gas infrastructure relies heavily on shell and tube designs for heat recovery, crude oil processing, and gas treatment applications.

The versatility of shell and tube heat exchangers extends across multiple industrial segments, from chemical processing to power generation. Their ability to handle fouling fluids, corrosive environments, and high thermal loads ensures continued preference among industrial 123o0.perators. Recent technological improvements in tube materials, baffle designs, and thermal performance have enhanced efficiency while maintaining the fundamental robustness that defines this product category. As Saudi Arabia expands refining capacity and petrochemical production, shell and tube heat exchangers remain the cornerstone technology for thermal management across critical industrial processes.

Material Insights:

- Carbon Steel

- Stainless Steel

- Nickel

- Others

Carbon steel leads with a share of 35% of the total Saudi Arabia heat exchanger market in 2025.

Carbon steel material dominates the Saudi Arabia heat exchanger market by delivering an optimal balance of affordability, mechanical properties, and performance characteristics. Industrial operators favor carbon steel for applications where moderate corrosion resistance suffices and cost considerations influence procurement decisions. The material's widespread availability, ease of fabrication, and compatibility with standard welding and manufacturing processes enable efficient production and maintenance. Saudi Arabia's established supply chains and local steel processing capabilities further support carbon steel adoption across industrial heat exchanger applications.

The material's versatility accommodates various heat exchanger designs, from shell and tube to plate configurations, making it suitable for petroleum refining, power generation, and general industrial processes. While stainless steel and specialized alloys address specific corrosive environments, carbon steel remains the foundational material for the majority of standard industrial applications. Protective coatings and surface treatments extend carbon steel heat exchangers' operational lifespans, enhancing value proposition while maintaining cost advantages. As industrial expansion continues, carbon steel heat exchangers provide accessible thermal management solutions that support Saudi Arabia's diverse manufacturing and processing sectors.

End User Industry Insights:

Access the comprehensive market breakdown Request Sample

- Chemical

- Petrochemical

- Oil and Gas

- HVAC and Refrigeration

- Food and Beverage

- Power Generation

- Paper and Pulp

- Others

Oil and gas exhibit a clear dominance with a 20% share of the total Saudi Arabia heat exchanger market in 2025.

The oil and gas sector generates significant demand for heat exchangers as Saudi Arabia maintains its position among the world's leading petroleum producers, with daily production capacity approaching 10.5 million barrels. Refining operations require sophisticated thermal management for crude distillation, catalytic cracking, hydroprocessing, and various separation processes. Heat exchangers serve critical functions in cooling, heating, and energy recovery throughout refineries and gas processing plants. The government's investment to enhance refining capabilities underscores the sustained importance of thermal equipment in maintaining operational efficiency and meeting environmental standards.

The petrochemical segment contributes substantial heat exchanger demand as Saudi Arabia expands its downstream capabilities. Large-scale petrochemical projects including Petro Rabigh, Ras Tanura, and Jizan Export refineries continue driving demand for heat exchangers in chemical processing applications. Power generation applications are increasingly important as the Kingdom develops new electricity capacity through combined cycle gas turbines, requiring heat recovery steam generators and related thermal equipment. HVAC and refrigeration applications, particularly district cooling systems serving major urban developments, represent growing market segments as cities expand and commercial infrastructure develops.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and central region lead with a share of 28% of the total Saudi Arabia heat exchanger market in 2025.

Northern and Central Region dominates the Saudi Arabia heat exchanger market through its concentration of industrial facilities, petrochemical complexes, and manufacturing operations centered around Riyadh and surrounding industrial cities. The region hosts significant refining capacity, chemical processing plants, and power generation facilities that collectively generate substantial demand for thermal management equipment. Government initiatives under Vision 2030 have channeled investment into industrial zones, special economic areas, and infrastructure projects throughout this region. The presence of established supply chains, technical expertise, and supporting industries facilitates heat exchanger procurement, installation, and maintenance services across diverse applications.

The Eastern Region maintains strong market presence driven by its extensive oil and gas infrastructure along the Arabian Gulf coast. Jubail Industrial City, one of the world's largest industrial complexes, houses numerous petrochemical plants, refineries, and manufacturing facilities requiring continuous heat exchanger installations and replacements. Major desalination facilities depend heavily on heat exchangers for efficient thermal management. The Southern Region is experiencing gradual growth as infrastructure development expands, while the Western Region benefits from Red Sea coastal projects and tourism developments requiring district cooling and HVAC applications.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Heat Exchanger Market Growing?

Expansion in Oil and Gas and Petrochemical Projects

The Saudi Arabia heat exchanger market experiences robust growth driven by continuous expansion in the nation's core oil and gas sector, which contributes nearly 90 percent of government revenue. Saudi Arabia ranks among the world's top oil producers, producing 10,872,023 barrels per day of oil (as of 2024), generating sustained demand for heat exchangers across refining, processing, and distribution operations. The government's commitment to investing to enhance refining capabilities creates substantial opportunities for thermal equipment suppliers. In February 2024, Lummus Technology secured a contract from Hyundai Engineering & Construction to supply eight Short Residence Time ethylene cracking heaters featuring proprietary heat transfer technologies for SATORP's Amiral petrochemical complex in Saudi Arabia. These large-scale projects require extensive heat exchanger installations for process heating, cooling, condensing, and heat recovery applications.

Investment in Desalination Infrastructure

Saudi Arabia's position as the world's leading desalinated water producer generates significant heat exchanger demand across expanding water treatment facilities. By 2025, Saudi Arabia fulfills more than 60% of its water requirements via desalination, with intentions to expand this up to 90%. The nation runs nearly 30 desalination plants, featuring significant installations like Ras Al Khair and Shuaiba 3, which rank among the largest globally. This investment increases production capacity, reduces energy consumption, and extends operational lifespans. Desalination processes rely heavily on heat exchangers for thermal energy recovery, preheating feed water, condensing vapors, and managing brine concentrations. The Saudi Water Authority's ongoing initiatives to rebuild end-of-life facilities with improved technologies ensure continuous procurement cycles for thermal management components across the Kingdom's desalination network.

Regulatory Support for Energy Efficiency Standards

Government regulations promoting energy efficiency and environmental responsibility are accelerating heat exchanger adoption across industrial and commercial applications. The Saudi Standards, Metrology and Quality Organization has developed comprehensive standards providing guidance for energy efficiency and environmental impact of industrial operations. SASO's technical regulations mandate minimum energy performance requirements for various equipment categories, driving industries toward high-efficiency thermal systems. The Kingdom released updated air conditioner efficiency standards SASO 2663:2025, establishing stricter minimum energy performance, labeling, and testing requirements for low capacity units. These evolving standards compel manufacturers and facility operators to upgrade thermal equipment to meet regulatory thresholds, directly benefiting energy-efficient heat exchanger technologies. As Vision 2030 continues emphasizing industrial transformation, environmental responsibility, and technology adoption, regulatory frameworks ensure that heat exchangers meeting modern efficiency standards become essential components across manufacturing, petrochemical, power generation, and commercial building applications, creating favorable market conditions for thermal equipment suppliers focused on performance optimization.

Market Restraints:

What Challenges the Saudi Arabia Heat Exchanger Market is Facing?

High Initial Capital Investment

The substantial upfront costs associated with purchasing and installing industrial-grade heat exchangers present significant barriers, particularly for smaller enterprises and industries operating with constrained capital budgets. Advanced heat exchanger systems, especially those designed for high-capacity applications or specialized materials like stainless steel and nickel alloys, require considerable financial commitments that can strain project budgets and affect return-on-investment timelines. While long-term operational savings through improved energy efficiency and reduced maintenance eventually offset these initial expenses, the immediate financial burden often delays procurement decisions or leads organizations to select lower-cost alternatives that may not deliver optimal performance.

Energy-Intensive Traditional Technologies

Conventional heat exchanger designs, particularly older multi-stage flash and multi-effect distillation systems widely deployed in desalination applications, consume substantial amounts of energy during operation. These energy-intensive technologies increase operational costs, contribute to higher carbon emissions, and conflict with Saudi Arabia's sustainability objectives under Vision 2030. Although modern heat exchanger technologies offer improved efficiency, the existing installed base of traditional equipment requires significant capital investment and operational downtime to replace or retrofit. The transition from energy-intensive legacy systems to advanced thermal solutions progresses gradually, as organizations balance immediate operational needs against long-term efficiency improvements.

Supply Chain Dependencies and Material Availability

Saudi Arabia's heat exchanger market faces challenges related to imported specialized materials, components, and manufacturing equipment required for producing high-performance thermal systems. While localization initiatives are advancing, certain critical materials such as specialized alloys, high-grade stainless steel, and precision-engineered components remain dependent on international suppliers. Global supply chain disruptions, fluctuating material costs, and lead time uncertainties can delay project timelines and increase procurement expenses. The Kingdom's efforts to establish domestic manufacturing capabilities, exemplified by Alfa Laval's Jubail facility, represent positive developments, yet comprehensive supply chain independence for all heat exchanger components requires continued investment in local production infrastructure and technical expertise.

Competitive Landscape:

The Saudi Arabia heat exchanger market is experiencing intensifying competition as both international manufacturers and emerging local producers expand their presence throughout the Kingdom. Established global players leverage their technological expertise, extensive product portfolios, and proven track records to secure contracts in major industrial projects, while local manufacturers benefit from proximity to end users, faster delivery times, and alignment with government localization initiatives. Companies are focusing on diversifying product offerings across shell and tube, plate and frame, and air-cooled configurations to serve multiple industrial segments. Competition is driven by investments in localized manufacturing facilities, advanced material technologies, and energy-efficient designs that meet evolving regulatory standards. Strategic partnerships between international technology providers and local engineering firms are becoming common as organizations seek to combine global expertise with regional market knowledge. As industrial expansion continues and Vision 2030 drives infrastructure development, market participants are refining their strategies through enhanced after-sales support, technical training programs, and customized solutions tailored to Saudi Arabia's demanding operational environments, positioning themselves to capture growing opportunities across oil and gas, petrochemical, power generation, desalination, and district cooling applications.

Saudi Arabia Heat Exchanger Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Shell and Tube, Plate and Frame, Air Cooled, Others |

| Materials Covered | Carbon Steel, Stainless Steel, Nickel, Others |

| End User Industries Covered | Chemical, Petrochemical, Oil and Gas, HVAC and Refrigeration, Food and Beverage, Power Generation, Paper and Pulp, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia heat exchanger market size was valued at USD 196.1 Million in 2025.

The Saudi Arabia heat exchanger market is expected to grow at a compound annual growth rate of 4.55% from 2026-2034 to reach USD 292.6 Million by 2034.

Shell and tube, holding the largest revenue share of 44% in 2025, remain the dominant solution for Saudi Arabia's heat exchanger applications, providing robust construction, versatility in handling high-pressure and high-temperature conditions, and proven reliability across oil and gas, petrochemical, and power generation sectors.

Key factors driving the Saudi Arabia heat exchanger market include expansion in oil and gas and petrochemical projects, investment in desalination infrastructure, regulatory support for energy efficiency standards, integration with renewable energy systems, localized manufacturing initiatives, and growing district cooling requirements across urban developments.

Major challenges include high initial capital investment requirements for advanced systems, energy-intensive traditional technologies requiring replacement, supply chain dependencies on imported specialized materials, and the need for continuous technology upgrades to meet evolving regulatory standards while maintaining operational continuity across critical industrial applications.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)