Saudi Arabia Heat Exchanger Tubes Market Size, Share, Trends and Forecast by Material Type, Product Type, Tube Configuration, Distribution Channel, End Use Industry, and Region, 2026-2034

Saudi Arabia Heat Exchanger Tubes Market Overview:

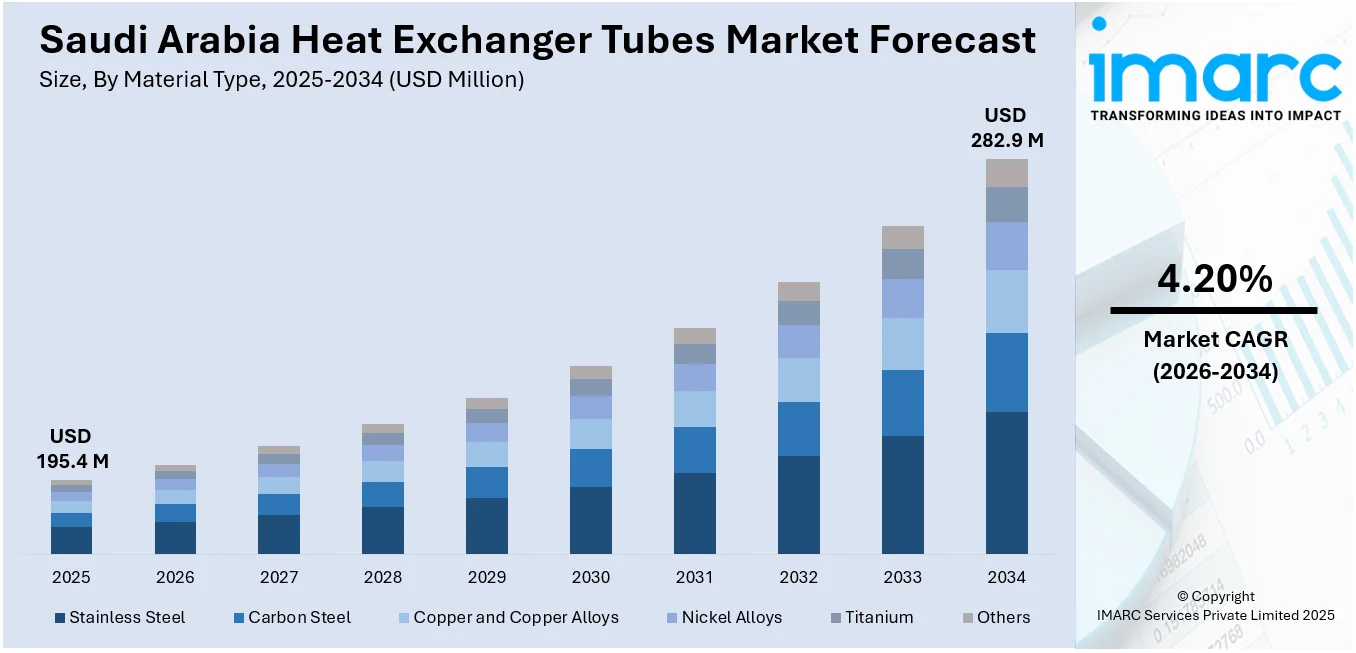

The Saudi Arabia heat exchanger tubes market size reached USD 195.4 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 282.9 Million by 2034, exhibiting a growth rate (CAGR) of 4.20% during 2026-2034. The growing demand for industrial applications across the oil and gas, power generation, and HVAC sectors drives the market. The increasing need for energy-efficient solutions and advancements in tube material technology continues to support Saudi Arabia heat exchanger tubes market share, fostering demand in various industries.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 195.4 Million |

| Market Forecast in 2034 | USD 282.9 Million |

| Market Growth Rate 2026-2034 | 4.20% |

Saudi Arabia Heat Exchanger Tubes Market Trends:

Increase in Regional Manufacturing Capacity

The Saudi Arabia heat exchanger tubes market is on the growth path as the country develops more local manufacturing capacity to meet growing industrial needs. As the nation advances toward its Vision 2030, domestic production is targeted to increase and be less dependent on imports. The creation of domestic manufacturing facilities is crucial to enhancing the nation's industrial growth and sustainability. For example, in May 2025, TEMA India and Petron Saudia announced a joint venture in Saudi Arabia for producing heat exchangers, such as shell-and-tube heat exchangers. This joint venture is intended to increase production capacity and cater to the growing industrial demand in the region. Similarly, in April 2025, Ratnamani Metals & Tubes Ltd. and SESCO announced a joint venture to establish a world-class tubing plant in Dammam, Saudi Arabia. The new plant will be designed to manufacture high-performance nickel alloy steel, stainless steel, and specialty tubing for heat exchangers. The expansion will further enhance regional manufacturing capacity, positioning the heat exchanger tubes market to meet future demand while complementing the country's economic diversification efforts. As these joint ventures progress, they are expected to contribute significantly to the Saudi Arabia heat exchanger tubes market growth.

To get more information on this market Request Sample

Strategic Partnerships for Technological Progress

Increasing demand for technologically sophisticated and high-performance heat exchanger tubes in Saudi Arabia is fueling strategic alliances aimed at driving innovation and building industrial capacity. These alliances are centered around introducing advanced manufacturing solutions to the market. Consistent with this, Ratnamani Metals & Tubes Ltd. and SESCO opened a joint venture in April 2025 to establish a tubing plant in Dammam, Saudi Arabia, for manufacturing high-performance heat exchanger tubing. The venture aligns with the country's vision of enhancing production facilities for advanced materials and reducing import dependency. Additionally, in May 2025, Petron Saudia and TEMA India established a joint venture for the production of shell-and-tube heat exchangers, which will be a pivotal component in meeting the industrial demand of the region. This partnership is not only intended to increase production capacity but also to enhance the efficiency and performance of heat exchanger systems used by numerous sectors, including oil and gas, petrochemicals, and power generation. As these business opportunities introduce innovative manufacturing technologies, they will drive the technological development of the Saudi Arabia heat exchanger tubes market, making the area a hub for high-quality, locally manufactured heat exchange solutions.

Saudi Arabia Heat Exchanger Tubes Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2026-2034. Our report has categorized the market based on material type, product type, tube configuration, distribution channel, and end use industry.

Material Type Insights:

- Stainless Steel

- Carbon Steel

- Copper and Copper Alloys

- Nickel Alloys

- Titanium

- Others

The report has provided a detailed breakup and analysis of the market based on the material type. This includes stainless steel, carbon steel, copper and copper alloys, nickel alloys, titanium, and others.

Product Type Insights:

- Seamless Heat Exchanger Tubes

- Welded Heat Exchanger Tubes

The report has provided a detailed breakup and analysis of the market based on the product type. This includes seamless heat exchanger tubes and welded heat exchanger tubes.

Tube Configuration Insights:

- U-Tubes

- Straight Tubes

- Finned Tubes

The report has provided a detailed breakup and analysis of the market based on the tube configuration. This includes u-tubes, straight tubes, and finned tubes.

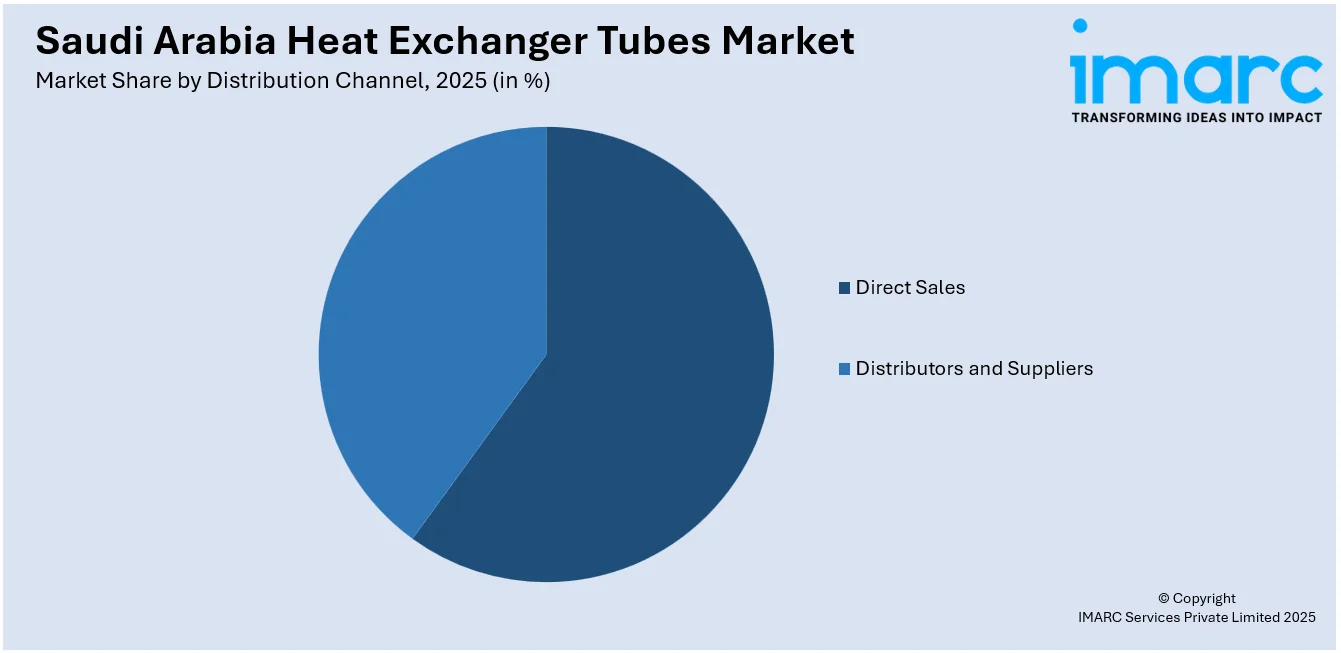

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Direct Sales

- Distributors and Suppliers

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes direct sales and distributors and suppliers.

End Use Industry Insights:

- Power Generation

- Oil and Gas

- Chemical and Petrochemical

- HVAC and Refrigeration

- Food and Beverage Processing

- Automotive and Aerospace

- Marine and Shipbuilding

- Pharmaceuticals

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes power generation, oil and gas, chemical and petrochemical, HVAC and refrigeration, food and beverage processing, automotive and aerospace, marine and shipbuilding, pharmaceuticals, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central region, Western region, Eastern region, and Southern region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Heat Exchanger Tubes Market News:

- May 2025: TEMA India and Petron Saudia formed a joint venture in Saudi Arabia, focusing on manufacturing heat exchangers, including shell & tube heat exchangers, for the region. This collaboration is expected to boost the Saudi Arabia heat exchanger tubes market by enhancing production capacity and meeting rising industrial demand.

- April 2025: Ratnamani Metals & Tubes Ltd. and SESCO launched a joint venture to establish a state-of-the-art tubing plant in Dammam, Saudi Arabia. The facility will produce high-performance nickel alloy steel, stainless steel, and specialty tubing for heat exchangers, strengthening regional manufacturing capacity and supporting Saudi Arabia's Vision 2030.

Saudi Arabia Heat Exchanger Tubes Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Material Types Covered | Stainless Steel, Carbon Steel, Copper and Copper Alloys, Nickel Alloys, Titanium, Others |

| Product Types Covered | Seamless Heat Exchanger Tubes, Welded Heat Exchanger Tubes |

| Tube Configurations Covered | U-Tubes, Straight Tubes, Finned Tubes |

| Distribution Channels Covered | Direct Sales, Distributors and Suppliers |

| End Use Industries Covered | Power Generation, Oil and Gas, Chemical and Petrochemical, HVAC and Refrigeration, Food and Beverage Processing, Automotive and Aerospace, Marine and Shipbuilding, Pharmaceuticals, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia heat exchanger tubes market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia heat exchanger tubes market on the basis of material type?

- What is the breakup of the Saudi Arabia heat exchanger tubes market on the basis of product type?

- What is the breakup of the Saudi Arabia heat exchanger tubes market on the basis of tube configuration?

- What is the breakup of the Saudi Arabia heat exchanger tubes market on the basis of distribution channel?

- What is the breakup of the Saudi Arabia heat exchanger tubes market on the basis of end use Industry?

- What is the breakup of the Saudi Arabia heat exchanger tubes market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia heat exchanger tubes market?

- What are the key driving factors and challenges in the Saudi Arabia heat exchanger tubes market?

- What is the structure of the Saudi Arabia heat exchanger tubes market and who are the key players?

- What is the degree of competition in the Saudi Arabia heat exchanger tubes market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia heat exchanger tubes market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia heat exchanger tubes market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia heat exchanger tubes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)