Saudi Arabia Heavy-Duty Automotive Aftermarket Market Size, Share, Trends and Forecast by Replacement Parts, Vehicle Type, Service Channel, and Region, 2026-2034

Saudi Arabia Heavy-Duty Automotive Aftermarket Market Size and Share:

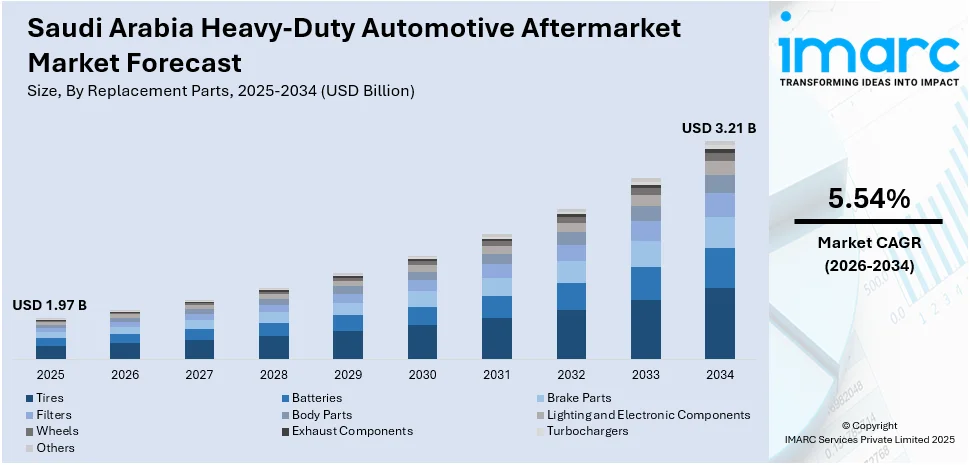

The Saudi Arabia heavy-duty automotive aftermarket market size reached USD 1.97 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 3.21 Billion by 2034, exhibiting a growth rate (CAGR) of 5.54% during 2026-2034. Advancements in digital technologies, including telematics and predictive maintenance, are reshaping Saudi Arabia heavy-duty automotive aftermarket, driving the demand for smart components, while the expansion of vehicle fleets across key sectors increases the need for specialized aftermarket services, parts, and efficient supply chain management.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1.97 Billion |

| Market Forecast in 2034 | USD 3.21 Billion |

| Market Growth Rate 2026-2034 | 5.54% |

Saudi Arabia Heavy-Duty Automotive Aftermarket Market Trends:

Advancements in Technology and Digitalization

The rapid incorporation of digital technologies is transforming the heavy-duty automotive aftermarket in Saudi Arabia, as fleet operators are more frequently utilizing telematics, predictive maintenance solutions, and fleet management software to improve vehicle efficiency and lower operational expenses. These technologies enable immediate vehicle diagnostics, assist in predicting component failures, and simplifying maintenance scheduling, all of which enhances efficiency and reduces downtime. This transition is catalyzing the demand for sophisticated aftermarket solutions, such as smart sensors, diagnostic tools, and performance monitoring devices that correspond with digital infrastructure. Insights based on data are enabling more precise forecasts for parts replacement, enhancing inventory management and service planning. For instance, in 2024 telematics project introduced by Najm for Insurance Services, in partnership with Cambridge Mobile Telematics and AiGeNiX. This program leveraged mobility analytics to study driving behavior and promote safer roads, demonstrating how digital innovation is not only reshaping fleet efficiency but also influencing broader road safety policies. Such initiatives highlight the expanding role of connected technologies in the aftermarket ecosystem, encouraging service providers to align their offerings with evolving digital standards. As Saudi fleets modernize, the aftermarket is being reshaped by a tech-forward shift, creating new opportunities for digital-enabled service models and products tailored to connected vehicle environments.

To get more information on this market, Request Sample

Increasing Vehicle Fleet Expansion

The rise in heavy-duty vehicle fleets in Saudi Arabia, driven by the continuous growth of essential sectors like construction, transportation, and agriculture, is bolstering the market growth. As companies expand their operations to satisfy the growing domestic demand, they are putting money into larger fleets to guarantee prompt delivery of products and services nationwide. This increase in fleet size drives a corresponding demand for aftermarket services, such as routine maintenance, parts replacement, and specialized repairs, to ensure vehicles function reliably and efficiently. The need to reduce downtime and ensure steady performance is making the aftermarket an essential support system for industries reliant on fleets. Moreover, effective supply chains for aftermarket parts are increasingly vital to prevent operational interruptions. Besides this, the introduction of advanced vehicles is further catalyzing the demand for specialized aftermarket services and components. In 2024, Tata Motors launched its first Automated Manual Transmission (AMT) truck, the Tata Prima 4440.S AMT, in Saudi Arabia at the HEAT show in Dammam. The truck offered high fuel efficiency, enhanced driver comfort, and is suited for heavy-duty applications like container and car carrier transportation. As new, advanced vehicles like the Tata Prima are introduced to the market, they create further demand for specialized aftermarket services and parts, reinforcing the ongoing need for efficient and responsive aftermarket solutions.

Saudi Arabia Heavy-Duty Automotive Aftermarket Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on replacement parts, vehicle type, and service channel.

Replacement Parts Insights:

- Tires

- Batteries

- Brake Parts

- Filters

- Body Parts

- Lighting and Electronic Components

- Wheels

- Exhaust Components

- Turbochargers

- Others

A detailed breakup and analysis of the market based on the replacement parts have also been provided in the report. This includes tires, batteries, brake parts, filters, body parts, lighting and electronic components, wheels, exhaust components, turbochargers, and others.

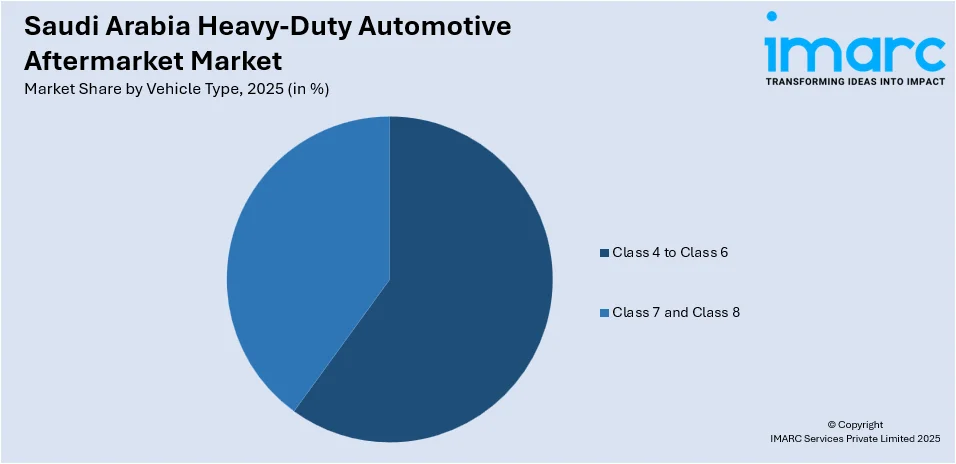

Vehicle Type Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Class 4 to Class 6

- Class 7 and Class 8

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes class 4 to class 6 and class 7 and class 8.

Service Channel Insights:

- DIY

- OE Seller

- DIFM

A detailed breakup and analysis of the market based on the service channel have also been provided in the report. This includes DIY, OE seller, and DIFM.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Heavy-Duty Automotive Aftermarket Market News:

- In February 2025, Automechanika Riyadh, Saudi Arabia's leading trade show for the automotive aftermarket sector, returns for its 7th edition from April 28-30, 2025, at the Riyadh International Convention and Exhibition Center (RICEC). The event will feature over 450 exhibitors from 32 countries and is expected to attract 19,000 visitors.

Saudi Arabia Heavy-Duty Automotive Aftermarket Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Replacement Parts Covered | Tires, Batteries, Brake Parts, Filters, Body Parts, Lighting and Electronic Components, Wheels, Exhaust Components, Turbochargers, Others |

| Vehicle Types Covered | Class 4 to Class 6, Class 7 and Class 8 |

| Service Channels Covered | DIY, OE Seller, DIFM |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia heavy-duty automotive aftermarket market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia heavy-duty automotive aftermarket market on the basis of replacement parts?

- What is the breakup of the Saudi Arabia heavy-duty automotive aftermarket market on the basis of vehicle type?

- What is the breakup of the Saudi Arabia heavy-duty automotive aftermarket market on the basis of service channel?

- What is the breakup of the Saudi Arabia heavy-duty automotive aftermarket market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia heavy-duty automotive aftermarket market?

- What are the key driving factors and challenges in the Saudi Arabia heavy-duty automotive aftermarket market?

- What is the structure of the Saudi Arabia heavy-duty automotive aftermarket market and who are the key players?

- What is the degree of competition in the Saudi Arabia heavy-duty automotive aftermarket market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia heavy-duty automotive aftermarket market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia heavy-duty automotive aftermarket market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia heavy-duty automotive aftermarket industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)