Saudi Arabia Higher Education Market Size, Share, Trends and Forecast by Component, Deployment Mode, Course Type, Learning Type, End User, and Region, 2026-2034

Saudi Arabia Higher Education Market Summary:

The Saudi Arabia higher education market size was valued at USD 316.53 Million in 2025 and is projected to reach USD 1,567.05 Million by 2034, growing at a compound annual growth rate of 19.45% from 2026-2034.

The market experiences robust growth driven by Vision 2030's emphasis on human capital development, substantial government investments in educational infrastructure, and the Kingdom's strategic pivot toward becoming a global innovation hub. Digital transformation initiatives, including artificial intelligence (AI) integration and cloud-based learning platforms, are reshaping academic delivery models while fostering greater accessibility and engagement across diverse student demographics, thereby expanding the Saudi Arabia higher education market share.

Key Takeaways and Insights:

-

By Component: Solutions dominate the market with a share of 58% in 2025, encompassing comprehensive digital infrastructure including student information management systems, content collaboration platforms, and campus management solutions that facilitate seamless administrative operations and enhance institutional efficiency.

-

By Deployment Mode: On-premises leads the market with a share of 56% in 2025, reflecting institutional preferences for data sovereignty, customized integration with existing systems, and alignment with stringent regulatory frameworks governing sensitive student information.

-

By Course Type: Engineering represents the largest segment with a market share of 35% in 2025, driven by strong demand for technical expertise in petroleum, renewable energy, AI, and advanced manufacturing sectors aligned with national economic diversification objectives.

-

By Learning Type: Offline learning leads the market with a share of 63% in 2025, sustained by traditional pedagogical preferences, robust campus infrastructure investments, and the emphasis on face-to-face interactions that support holistic student development and community building.

-

By End User: State universities represent the largest segment with a market share of 62% in 2025, benefiting from substantial government funding, extensive geographic coverage across regions, and the capacity to serve large student populations through comprehensive program offerings.

-

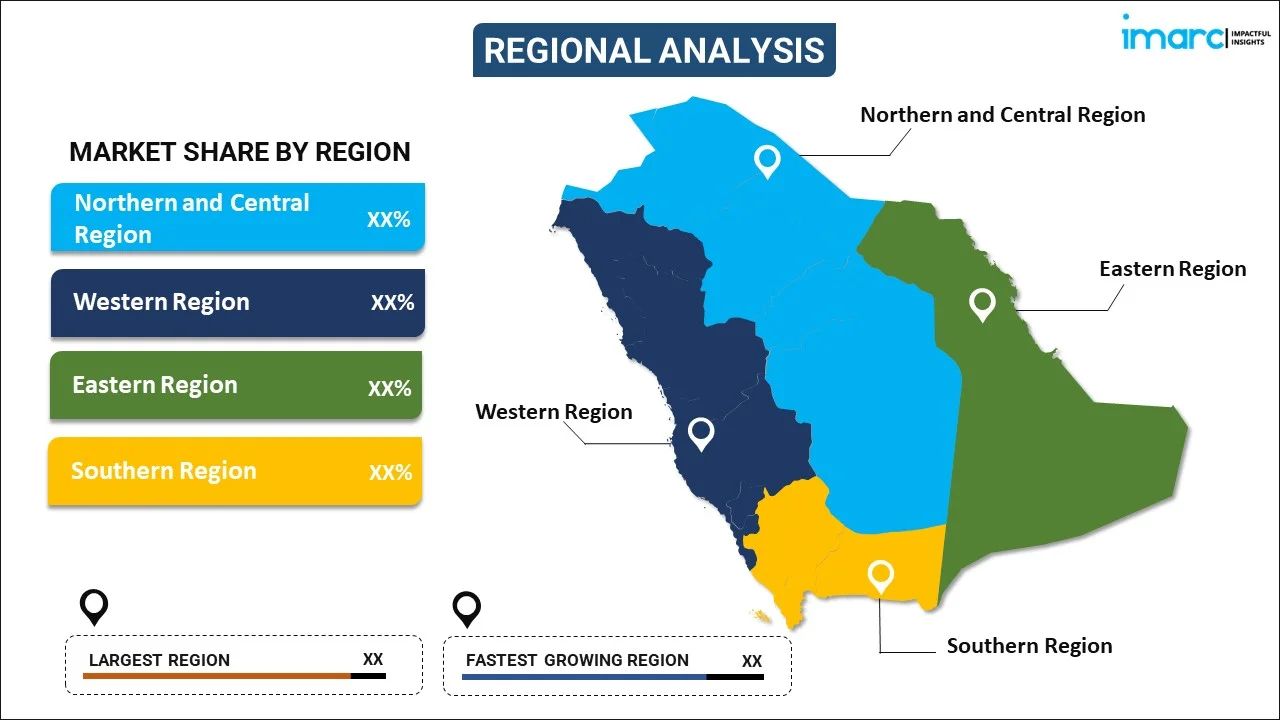

By Region: Northern and Central Region leads the market with a share of 41% in 2025, anchored by Riyadh's concentration of premier institutions, government facilities, and growing technology ecosystem that attracts both domestic and international academic talent.

-

Key Players: The Saudi Arabia higher education market demonstrates moderate competitive intensity, with established public universities commanding dominant positions alongside emerging private institutions and international branch campuses seeking market entry through strategic partnerships.

The market benefits from unprecedented government commitment to educational excellence, with massive infrastructure investments transforming institutional capabilities and expanding access to quality programs. Vision 2030's emphasis on knowledge economy development has catalyzed curriculum modernization, international collaborations, and technology adoption that position Saudi institutions as regional leaders in innovation and research. Growing female participation, supported by dedicated universities and inclusive policies, has broadened talent pools while strengthening workforce diversity. The Kingdom's strategic focus on technical and vocational training addresses critical skills gaps, ensuring graduates possess industry-relevant competencies that drive economic progress. Furthermore, the establishment of specialized research centers, joint degree programs with leading global universities, and generous scholarship initiatives have elevated the Kingdom's standing as an attractive destination for both regional and international students seeking world-class education within a rapidly developing economy. In 2025, Heriot-Watt University in Edinburgh has finalized an agreement to establish a campus in Riyadh, subject to regulatory approval, while the University of New Haven in the U.S.

Saudi Arabia Higher Education Market Trends:

Nationwide Artificial Intelligence Curriculum Integration

Educational institutions across Saudi Arabia are systematically embedding artificial intelligence literacy into their academic frameworks, transforming traditional teaching methodologies through intelligent tutoring systems, adaptive learning platforms, and data-driven pedagogical approaches. In 2025, the Saudi Data and Artificial Intelligence Authority's collaboration with the Ministry of Education to develop comprehensive AI modules to support classrooms reflects the Kingdom's commitment to preparing students for technology-driven careers. Universities are establishing specialized AI research centers, offering degree programs focused on machine learning, neural networks, and computational intelligence while partnering with industry leaders to provide practical exposure to real-world applications. This trend extends beyond computer science faculties, with AI tools being integrated into diverse disciplines including healthcare, engineering, business administration, and humanities to enhance analytical capabilities and critical thinking skills across the academic spectrum.

Expansion of International University Branch Campuses

Saudi Arabia's regulatory reforms permitting foreign universities to establish local operations have catalyzed a wave of international academic partnerships, bringing globally recognized educational brands and pedagogical methodologies directly to the Kingdom. The approval process for branch campuses emphasizes institutional reputation, program quality, and alignment with national workforce development priorities, ensuring that international presence contributes meaningfully to Vision 2030 objectives. In 2024, Arizona State University, University of Wollongong, University of Strathclyde, Royal College of Surgeons in Ireland, and IE University are expected to open their branches in Saudi Arabia. Among the universities, preparations for a Strathclyde campus were planned for completion, pending formal government approval of its business plan. These partnerships facilitate cross-cultural knowledge exchange, enable Saudi students to access world-class education without relocating abroad, and attract international faculty who bring diverse perspectives and research expertise.

Cloud-Based Learning Management System Proliferation

Higher education institutions are rapidly transitioning to cloud computing infrastructure that enables flexible content delivery, remote collaboration, and scalable digital resources accessible across devices and locations. Government-backed platforms have achieved remarkable penetration, supporting millions of students through integrated ecosystems that combine learning materials, assessment tools, communication channels, and administrative functions within unified digital environments. Cloud adoption facilitates real-time data analytics that inform instructional improvements, personalized learning pathways that accommodate individual student needs, and cost efficiencies through reduced hardware investments and streamlined maintenance. This technological shift aligns with Digital Government Authority initiatives promoting interoperability across educational institutions while ensuring data security, privacy compliance, and business continuity capabilities that protect critical academic operations from disruptions. IMARC Group predicts that the Saudi Arabia cloud services market is projected to attain USD 13.1 Billion by 2033.

How Vision 2030 is Transforming the Saudi Arabia Higher Education Market:

Vision 2030 is reshaping Saudi Arabia’s higher education market by pushing universities to align more closely with labor market needs and national priorities. Public funding is being redirected toward outcomes, which has nudged institutions to revise curricula, invest in applied research, and strengthen links with industry. Programs in engineering, health sciences, data, and renewable energy have expanded as the country looks to reduce reliance on oil and build new sectors. International collaboration has grown, with foreign universities opening branch campuses and joint programs, supported by regulatory reforms and incentives. Private universities are gaining space as demand rises for flexible degrees, executive education, and short-term certifications. Digital learning has also picked up pace, driven by national platforms and blended teaching models that extend access beyond major cities. Additionally, these shifts are changing how higher education is delivered, funded, and evaluated, positioning it as a practical engine for workforce development and economic diversification.

Market Outlook 2026-2034:

The Saudi Arabia higher education market is projected to experience sustained expansion throughout the forecast period, driven by demographic tailwinds including a predominantly young population with escalating aspirations for tertiary education. The market generated a revenue of USD 316.53 Million in 2025 and is projected to reach a revenue of USD 1,567.05 Million by 2034, growing at a compound annual growth rate of 19.45% from 2026-2034. The market will witness increasing private sector participation through establishment of specialized academies, executive education centers, and industry-focused training programs that complement traditional university offerings.

Saudi Arabia Higher Education Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Component | Solutions | 58% |

| Deployment Mode | On-premises | 56% |

| Course Type | Engineering | 35% |

| Learning Type | Offline | 63% |

| End User | State Universities | 62% |

| Region | Northern and Central Region | 41% |

Component Insights:

To get detailed segment analysis of this market Request Sample

- Solutions

- Student Information Management System

- Content Collaboration

- Data Security and Compliance

- Campus Management

- Others

- Services

- Managed Services

- Professional Services

Solutions dominate with a market share of 58% of the total Saudi Arabia higher education market in 2025.

The solutions segment dominates due to institutions' increasing recognition that comprehensive technology infrastructure forms the foundation for delivering modern education experiences aligned with student expectations and administrative efficiency requirements. Student information management systems enable seamless tracking of enrollment, academic progress, attendance patterns, and performance metrics while facilitating communication between students, faculty, and administrative staff through centralized portals accessible across devices. Content collaboration platforms empower educators to create, share, and update instructional materials dynamically while supporting multimedia integration, interactive assessments, and peer-to-peer learning activities that enhance engagement and knowledge retention. Campus management solutions optimize resource allocation, facility scheduling, maintenance operations, and security protocols while providing analytics that inform strategic decisions regarding infrastructure investments and service improvements.

Data security and compliance modules have become essential components as institutions manage sensitive student information, financial records, and research data subject to stringent regulatory requirements governing privacy protection and access controls. The integration of AI capabilities within solutions platforms enables predictive analytics that identify at-risk students requiring intervention, personalized recommendations that guide course selection based on individual learning patterns and career aspirations, and automation of routine administrative tasks that free staff to focus on higher-value activities requiring human judgment and creativity. Cloud-based deployment models are increasingly preferred for implementation of solutions, offering scalability to accommodate enrollment fluctuations, automatic software updates that maintain security and functionality, and cost structures that align expenses with actual usage rather than requiring substantial upfront capital investments. In 2024, CNTXT launched the CNTXT Academy Headquarters in Saudi Arabia. This initiative seeks to provide local talent with vital cloud and digital skills while enhancing the overall digital ecosystem in the Kingdom. CNTXT Academy will provide extensive training initiatives in new cloud technologies, such as artificial intelligence (AI), machine learning (ML), and modernization of applications and infrastructure. These programs aim to enhance the skills of Saudi professionals driving digital transformation in their companies or those looking to enter the technology sector.

Deployment Mode Insights:

- On-premises

- Cloud-based

On-premises leads with a share of 56% of the total Saudi Arabia higher education market in 2025.

On-premises deployment maintains strong market presence because universities prioritize data sovereignty concerns, particularly regarding student records, research intellectual property, and confidential administrative information that institutions prefer to maintain within their direct physical and operational control. Owing to the high frequency of cyber security breaches, universities are taking security prospects seriously. This approach enables customized integration with existing campus systems, legacy databases, and specialized research equipment that may require local processing power and low-latency connectivity unavailable through cloud architectures.

Regulatory frameworks governing educational institutions often mandate specific data handling protocols, backup procedures, and access controls that universities find easier to implement and audit when infrastructure resides on campus under institutional management. In 2025, the Enterprise Architecture Office at Prince Sattam bin Abdulaziz University initiated its Enterprise Architecture Tool project following the completion of the contract with the implementing firm and the start of the project's technical activities. The office stated that the tool is designed to help the university oversee its enterprise architecture elements via a unified platform that encompasses models, documents, maps, and project updates, facilitating alignment activities and enhancing the quality of organizational data. The office stated that the project is a move towards supporting the university's strategic goals and digital transformation, and it improves the use of innovative methods in monitoring and decision-making.

Course Type Insights:

- Arts

- Economics

- Engineering

- Law

- Science

- Others

Engineering exhibits a clear dominance with a 35% share of the total Saudi Arabia higher education market in 2025.

Engineering education commands substantial market share due to alignment with Vision 2030's focus on expanding petroleum, petrochemicals, mining, renewable energy, water management, construction, and advanced manufacturing sectors requiring highly skilled technical professionals capable of designing, implementing, and managing complex systems. King Fahd University of Petroleum and Minerals' global recognition, ranking fourth worldwide in petroleum engineering programs, exemplifies the Kingdom's commitment to excellence in technical education that attracts both domestic and international students seeking specialized expertise in energy-related disciplines. The integration of emerging technologies including robotics, automation, additive manufacturing, and smart materials into curricula ensures graduates possess cutting-edge knowledge applicable to modernizing industries and establishing new technology-driven enterprises.

Universities have established strong partnerships with leading industrial corporations, government agencies, and research institutions that provide students with internship opportunities, collaborative research projects, and employment pathways facilitating seamless transition from academic environments to professional roles. Female enrollment in engineering disciplines continues expanding, supported by dedicated programs, scholarships, and mentorship initiatives that challenge traditional gender stereotypes and broaden talent pools available to technology sectors. The establishment of specialized engineering colleges focused on specific domains such as artificial intelligence, cybersecurity, sustainable infrastructure, and biomedical engineering reflects the evolving nature of technical disciplines and institutions' responsiveness to emerging market demands. In 2025, SDAIA from Saudi Arabia has partnered with the University of Oxford to launch a rigorous AI application engineering boot camp. This eight-week program is designed to educate Saudi and international graduates in cutting-edge AI technologies, addressing topics such as computer vision, deep learning, and generative models. Attendees will acquire hands-on experience with instruments such as Python, TensorFlow, and PyTorch.

Learning Type Insights:

- Online

- Offline

Offline leads with a share of 63% of the total Saudi Arabia higher education market in 2025.

Offline learning maintains market dominance because traditional campus-based education provides comprehensive student experiences including laboratory work, hands-on technical training, collaborative projects, extracurricular activities, and social interactions that foster personal development, professional networks, and institutional belonging difficult to replicate in virtual environments. The substantial investments in physical infrastructure including state-of-the-art classrooms, specialized laboratories, libraries, sports facilities, and student housing create compelling value propositions that justify campus attendance and support premium positioning. Cultural preferences within Saudi society emphasize the importance of structured educational environments, direct faculty-student relationships, and community engagement that offline settings naturally facilitate.

Offline learning in Saudi Arabia has seen a steady rise as students and institutions place renewed value on campus-based education. Universities and training centers report stronger demand for in-person classes that offer structured schedules and direct interaction with faculty. This shift is especially visible in medical, engineering, and vocational programs, where practical training matters. Investment in new campuses, research facilities, and student housing supports this trend, alongside government funding tied to quality outcomes. Parents and employers also show greater confidence in offline formats, viewing them as better suited for skill development, peer learning, and professional discipline.

End User Insights:

- State Universities

- Community Colleges

- Private Colleges

State universities exhibit a clear dominance with a 62% share of the total Saudi Arabia higher education market in 2025.

State universities dominate the higher education landscape because they receive substantial government funding enabling them to maintain lower tuition fees, offer generous scholarships, employ prestigious faculty, and develop comprehensive research infrastructure unavailable to smaller private institutions operating on tuition revenue and limited endowments. Public institutions serve approximately 95% of higher education students, reflecting their capacity to accommodate large enrollments through extensive campus networks spanning multiple regions and their long-established reputations as the preferred pathways to professional careers and social advancement. The concentration of enrollment at public universities creates powerful network effects where alumni associations, corporate recruitment programs, and government employment preferences reinforce the status and attractiveness of these institutions.

Government policy actively supports public university development through record budget allocations dedicated to higher education and technical training, enabling continuous infrastructure improvements, technology adoption, faculty development, and research funding that strengthen institutional capabilities. State universities benefit from streamlined coordination with government ministries, access to policymakers shaping national development strategies, and preferential treatment in securing research grants, international partnerships, and regulatory approvals for program launches. The emergence of specialized public universities focused on technology, medicine, Islamic studies, and other domains demonstrates the government's commitment to creating centers of excellence that can compete globally while serving specific national needs.

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and Central Region leads with a share of 41% of the total Saudi Arabia higher education market in 2025.

The Northern and Central Region leads the market due to Riyadh's status as the national capital and primary center for government operations, corporate headquarters, diplomatic missions, and cultural institutions that create dense networks of opportunities attracting ambitious students and accomplished faculty. The region hosts many of the Kingdom's most prestigious universities including King Saud University, Princess Nourah bint Abdulrahman University, Imam Mohammad Ibn Saud Islamic University, and several emerging private institutions that collectively serve hundreds of thousands of students across undergraduate, graduate, and professional programs.

Substantial government investments in regional infrastructure including transportation networks, residential developments, healthcare facilities, and entertainment venues enhance quality of life and make the capital increasingly attractive for both domestic and international academic talent. UK independent school Malvern College plans to broaden its international presence with the establishment of its inaugural Saudi campus in Riyadh, scheduled to open in 2027. It will be created in collaboration with KSA Education Investment Partners (KEIP) as part of a broader strategy to build a network of Malvern-branded schools and nurseries throughout the Kingdom and the region.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Higher Education Market Growing?

Unprecedented Government Investment and Vision 2030 Alignment

The Saudi Arabian government has demonstrated unparalleled commitment to educational transformation through record budget allocations that position education as the largest single component of national expenditure, reflecting leadership's conviction that human capital development forms the cornerstone of successful economic diversification away from petroleum dependence toward knowledge-based industries. The allocation of SAR 191 billion to education in 2024, with 42% specifically directed toward higher education and technical vocational training, enables comprehensive infrastructure modernization including construction of new campuses, renovation of existing facilities, procurement of advanced laboratory equipment and digital learning technologies, and expansion of residential capacity to accommodate growing enrollments. Vision 2030's explicit goal of cultivating globally competitive graduates capable of driving innovation across priority sectors including renewable energy, advanced manufacturing, healthcare, tourism, entertainment, and technology services directly shapes curriculum development, research priorities, and international partnership strategies adopted by institutions seeking government support and recognition.

Female Workforce Participation and Educational Inclusivity

The dramatic expansion of female participation in higher education and subsequent entry into professional careers represents one of the most transformative social changes within Saudi society, creating unprecedented demand for educational services while simultaneously expanding the pool of qualified instructors, researchers, and administrators available to institutions. Saudi Vision 2030 seeks to raise women’s participation in the workforce to 30%, enhance vocational training, and stimulate women’s involvement in leadership initiatives. During its G20 presidency, Saudi Arabia's W20 agenda highlighted the importance of women's inclusion for economic growth and diversification. Princess Nourah bint Abdulrahman University, the world's largest women's university, exemplifies institutional innovations specifically designed to provide high-quality educational experiences within frameworks accommodating cultural sensitivities while preparing graduates for leadership roles across public and private sectors.

Skills Gap and Workforce Development Imperatives

The persistent mismatch between competencies possessed by university graduates and capabilities required by employers in both public and private sectors drives continuous institutional innovation aimed at enhancing program relevance, strengthening industry connections, and preparing students for successful career transitions. Youth unemployment rate decreased 7.6% in Q1 2024, owing to the urgency of aligning educational outputs with labor market demands, motivating curriculum reforms emphasizing practical skills, experiential learning, and professional competencies alongside theoretical knowledge. The dramatic growth in executive education enrollments reflects widespread recognition among working professionals that rapidly evolving technologies, business models, and competitive dynamics require continuous skill updating to maintain career relevance and advancement trajectories.

Market Restraints:

What Challenges the Saudi Arabia Higher Education Market is Facing?

Faculty Training and Technology Integration Gaps

The rapid adoption of advanced educational technologies including artificial intelligence platforms, virtual reality simulations, learning analytics systems, and digital content creation tools has exposed significant capability gaps among faculty members trained in traditional pedagogical methods who lack both technical proficiency and theoretical frameworks necessary to effectively leverage these innovations. The scale of training required is substantial, with over 500,000 teachers undergoing mandatory pre-service and ongoing professional development programs designed to build competencies in technology-enhanced instruction, but the pace of technological change often outstrips training program capacity, creating persistent misalignment between available tools and instructor capabilities to utilize them effectively. Resistance to pedagogical innovation among some faculty members accustomed to lecture-based delivery models creates implementation challenges when institutions attempt to transition toward more interactive, student-centered approaches that require fundamentally different teaching skills, classroom management strategies, and assessment methodologies.

Infrastructure and Resource Distribution Disparities

Significant variations exist in infrastructure quality, technology availability, and resource adequacy across institutions based on factors including geographic location, historical funding patterns, institutional size, and government prioritization, creating unequal educational experiences and outcomes that challenge national objectives for system-wide quality improvement. Universities in major urban centers benefit from proximity to government ministries, corporate partners, research facilities, and international connections that provide advantages unavailable to institutions serving smaller cities or rural regions where resources are scarcer and opportunities more limited. Some institutions lack adequate smart devices, high-speed internet connectivity, specialized laboratory equipment, and modern learning spaces necessary to implement technology-enhanced instruction and provide students with hands-on experiences developing practical competencies demanded by employers.

Curriculum Alignment with Evolving Industry Demands

The traditional academic model emphasizing theoretical knowledge, disciplinary depth, and research methodologies often produces graduates lacking practical skills, cross-functional competencies, and adaptability required for success in dynamic professional environments characterized by rapid technological change, evolving business models, and shifting competitive landscapes. Employers consistently report that university graduates require substantial additional training before becoming productive employees, indicating gaps between academic curricula and workplace requirements that impose costs on hiring organizations while delaying graduate career progression. The lag time inherent in curriculum development, approval processes, and implementation cycles means that academic programs often teach outdated technologies, superseded methodologies, and obsolete industry practices by the time students graduate, reducing the immediate value of their credentials and necessitating expensive continuing education investments.

Competitive Landscape:

The Saudi Arabia higher education market demonstrates moderate competitive intensity shaped by the dominant presence of well-established public universities commanding substantial market share through government funding, brand recognition, and extensive infrastructure, alongside emerging private institutions and international branch campuses seeking to differentiate through specialized programs, innovative delivery models, and industry partnerships. Public universities benefit from substantial advantages including government subsidies enabling lower tuition fees, preferential access to scholarship funding for students, established alumni networks spanning decades of graduates occupying influential positions across government and private sectors, and comprehensive program portfolios serving diverse student needs from undergraduate education through doctoral research. Competition centers primarily on institutional reputation, academic quality, research productivity, international rankings, and graduate outcomes rather than pricing, as public institution fees remain negligible and private alternatives target distinct market segments willing to pay premiums for specialized offerings, English-language instruction, or international credentials.

Recent Developments:

-

In October 2025, DataVolt, a developer, investor, and operator of sustainable digital infrastructure, has partnered with the Energy & Water Academy (EWA), a non-profit vocational training institute, and Innovatics, a prominent educator in Data Science and Artificial Intelligence (AI), to announce the launch of a nationally recognized Diploma in Data Science and AI that is fully integrated with industry. This unprecedented program is specifically crafted to merge academic excellence with practical AI problem solving and seeks to prepare Saudi Arabia’s workforce for the digital era.

-

In September 2025, In a strategic effort to enhance its creative economy, Saudi Arabia has revealed the establishment of the Riyadh University of Arts (RUA), a significant cultural education organization aimed at promoting artistic talent, generating employment, and aligning with the Kingdom’s Vision 2030 objectives. Through a detailed academic structure and international partnerships, the university strives to be instrumental in shaping Saudi Arabia’s changing cultural environment.

Saudi Arabia Higher Education Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Components Covered |

|

| Deployment Modes Covered | On-premises, Cloud-based |

| Course Types Covered | Arts, Economics, Engineering, Law, Science, Others |

| Learning Types Covered | Online, Offline |

| End Users Covered | State Universities, Community Colleges, Private Colleges |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia higher education market size was valued at USD 316.53 Million in 2025.

The Saudi Arabia higher education market is expected to grow at a compound annual growth rate of 19.45% from 2026-2034 to reach USD 1,567.05 Million by 2034.

Solutions segment commanded the largest market share at 58%, driven by institutions' adoption of comprehensive digital platforms including student information management systems, content collaboration tools, and campus management solutions that enhance operational efficiency and educational delivery.

Key factors driving the Saudi Arabia higher education market include unprecedented government investment through Vision 2030 with education budget allocations, significant expansion of female workforce participation creating broader demand for educational services, persistent skills gaps between graduate competencies and labor market requirements driving curriculum innovation and industry partnerships, rapid technology adoption including AI integration and cloud-based learning platforms.

Major challenges include faculty training gaps requiring massive professional development programs for teachers to effectively utilize advanced educational technologies, infrastructure and resource distribution disparities creating unequal experiences across institutions based on location and funding patterns, curriculum alignment difficulties matching academic programs with rapidly evolving industry demands and emerging career pathways, technology integration complexity involving substantial investments in hardware, software, and support systems, regulatory adaptation to accommodate international partnerships.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)