Saudi Arabia Home Aroma Diffusers Market Size, Share, Trends and Forecast by Product Type, Power Source, Price Range, Distribution Channel, End User, and Region, 2026-2034

Saudi Arabia Home Aroma Diffusers Market Overview:

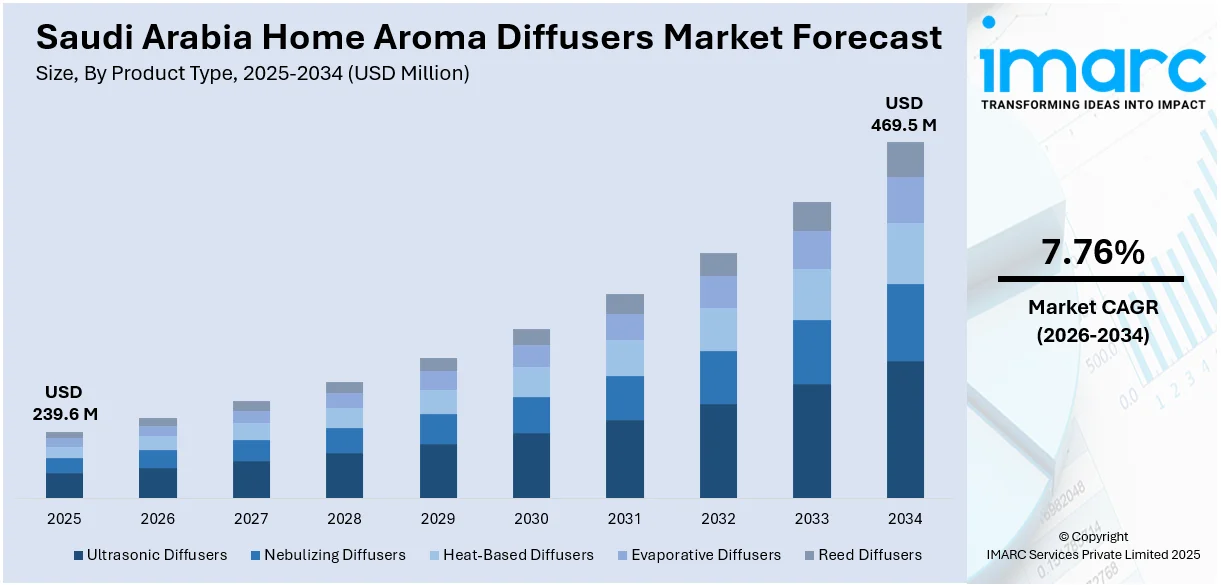

The Saudi Arabia home aroma diffusers market size reached USD 239.6 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 469.5 Million by 2034, exhibiting a growth rate (CAGR) of 7.76% during 2026-2034. The market is witnessing steady growth, driven by increasing consumer interest in wellness, aromatherapy, and home aesthetics. Rapid urbanization, rising disposable incomes, and growing preference for natural fragrances are also fueling product demand. Product innovation, premium offerings and expanding retail and e-commerce channels are further contributing to the Saudi Arabia home aroma diffusers market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 239.6 Million |

| Market Forecast in 2034 | USD 469.5 Million |

| Market Growth Rate 2026-2034 | 7.76% |

Saudi Arabia Home Aroma Diffusers Market Trends:

Growing Wellness Awareness

In Saudi Arabia, the growing focus on emotional wellbeing and overall well-being is strongly impacting consumer trends, particularly in the home aroma diffusers sector. With individuals increasingly aware of stress reduction and emotional equilibrium, aromatherapy is increasingly popular as a natural and efficient remedy. Essential oils such as lavender, eucalyptus, and chamomile are being employed in diffusers to produce soothing home atmospheres. This shift is also underpinned by the growing use of wellness practices that include mindfulness, meditation, and relaxation techniques. Consumers are now perceiving aroma diffusers not only as a decorative piece of furniture, but rather as a necessary accessory for maximizing daily living quality. This change in attitude is fuelling consistent demand and informing product development in the Saudi Arabia home aroma diffusers market.

To get more information on this market Request Sample

Growing Preference for Natural Products

There is a discernible trend towards organic and natural products in the Saudi Arabia home fragrance diffusers market. Customers are becoming more health-oriented in their selection, and hence the demand for diffusers that employ pure essential oils and botanically based ingredients is increasing. It is inspired by fear of artificial chemicals and their impact on health. Natural diffusers are viewed as cleaner, more therapeutic, and eco-friendly. Brands are meeting this challenge by producing products that are free from artificial fragrances, parabens, and toxins. Furthermore, the popularity of traditional Middle Eastern fragrances such as oud and frankincense, when combined with natural oils, is increasing product attractiveness. This has been driven by a general lifestyle trend toward sustainability and wellness, impacting both product formulation and marketing across the region.

Smart Diffuser Adoption

The incorporation of smart technology into household aroma diffusers is quickly revolutionizing Saudi consumer experiences. As IoT technology gains popularity, users can now activate and manage diffusers remotely through smartphone apps, voice assistants, or control systems. Such smart diffusers come with scheduling, intensity levels, and scent personalization options, fitting the technologically enabled lifestyle of today's households. This innovation increases convenience and also reinforces wellness rituals by enabling users to customize their environment with ease. As smart home penetration continues to increase throughout the region, these cutting-edge diffusers are picking up popularity, particularly among the younger generation. This technological evolution is a key factor driving the Saudi Arabia home aroma diffusers market growth, reflecting a broader trend toward connected and intelligent living spaces.

Saudi Arabia Home Aroma Diffusers Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product type, power source, price range, distribution channel, and end user.

Product Type Insights:

- Ultrasonic Diffusers

- Nebulizing Diffusers

- Heat-Based Diffusers

- Evaporative Diffusers

- Reed Diffusers

The report has provided a detailed breakup and analysis of the market based on the product type. This includes ultrasonic diffusers, nebulizing diffusers, heat-based diffusers, evaporative diffusers, and reed diffusers.

Power Source Insights:

- Electric Diffusers

- Battery-Operated Diffusers

- Manual/Non-Electric Diffusers

A detailed breakup and analysis of the market based on the power source have also been provided in the report. This includes electric diffusers, battery-operated diffusers, and manual/non-electric diffusers.

Price Range Insights:

- Premium

- Mid-Range

- Economy

A detailed breakup and analysis of the market based on the price range have also been provided in the report. This includes premium, mid-range, and economy.

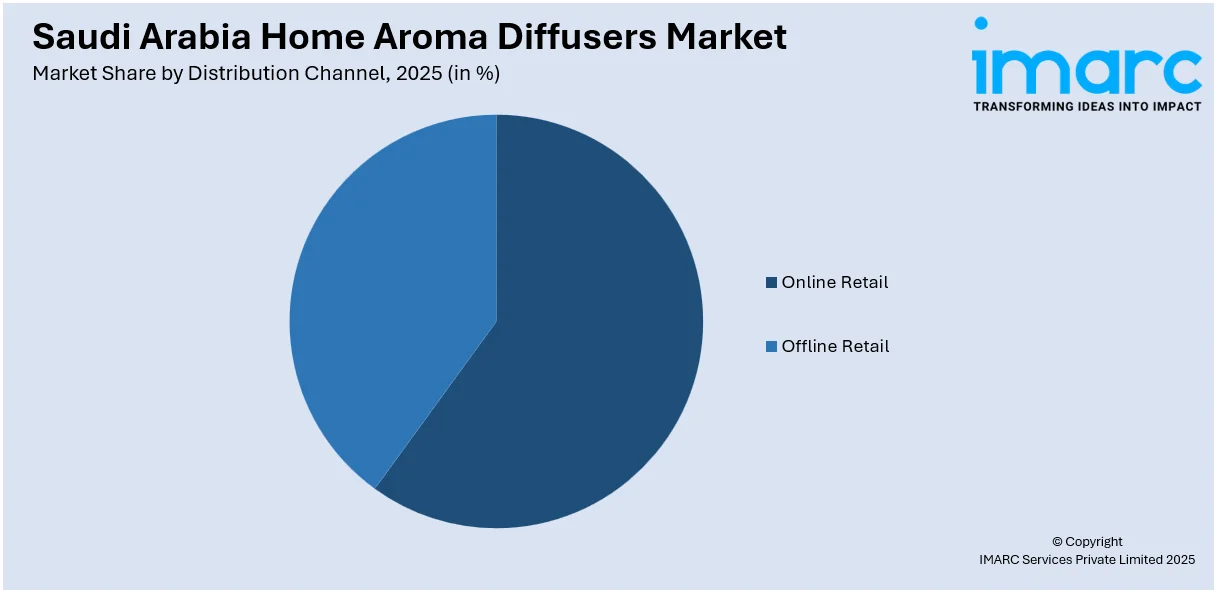

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Online Retail

- Offline Retail

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online retail and offline retail.

End User Insights:

- Residential

- Commercial

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes residential and commercial.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern & Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Home Aroma Diffusers Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Ultrasonic Diffusers, Nebulizing Diffusers, Heat-Based Diffusers, Evaporative Diffusers, Reed Diffusers |

| Power Sources Covered | Electric Diffusers, Battery-Operated Diffusers, Manual/Non-Electric Diffusers |

| Price Ranges Covered | Premium, Mid-Range, Economy |

| Distribution Channels Covered | Online Retail, Offline Retail |

| End Users Covered | Residential, Commercial |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia home aroma diffusers market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia home aroma diffusers market on the basis of product type?

- What is the breakup of the Saudi Arabia home aroma diffusers market on the basis of power source?

- What is the breakup of the Saudi Arabia home aroma diffusers market on the basis of price range?

- What is the breakup of the Saudi Arabia home aroma diffusers market on the basis of distribution channel?

- What is the breakup of the Saudi Arabia home aroma diffusers market on the basis of end user?

- What is the breakup of the Saudi Arabia home aroma diffusers market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia home aroma diffusers market?

- What are the key driving factors and challenges in the Saudi Arabia home aroma diffusers market?

- What is the structure of the Saudi Arabia home aroma diffusers market and who are the key players?

- What is the degree of competition in the Saudi Arabia home aroma diffusers market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia home aroma diffusers market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia home aroma diffusers market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia home aroma diffusers industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)