Saudi Arabia Home Automation Market Size, Share, Trends and Forecast by Type, Technology, End User, and Region, 2026-2034

Saudi Arabia Home Automation Market Overview:

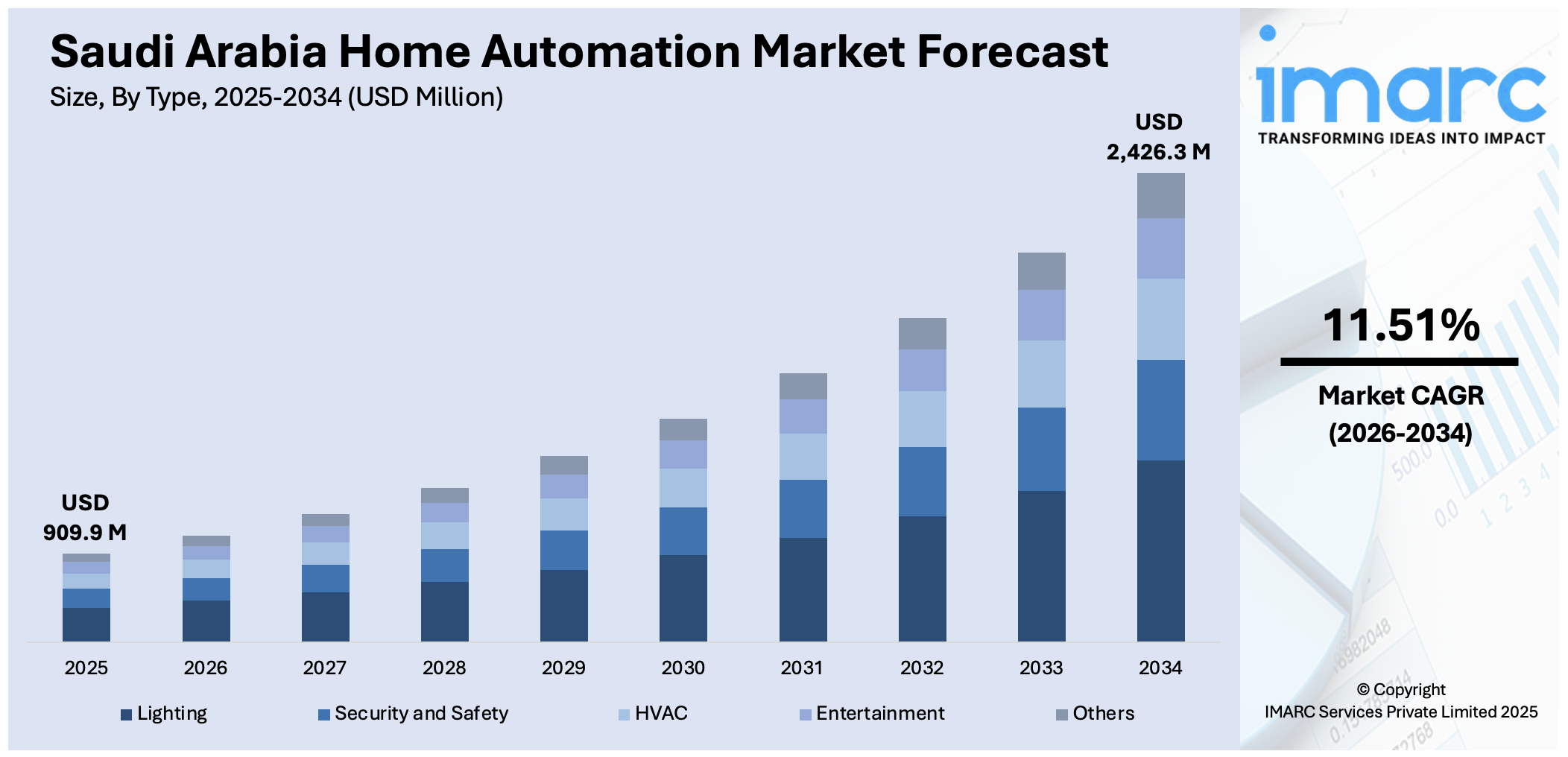

The Saudi Arabia home automation market size reached USD 909.9 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 2,426.3 Million by 2034, exhibiting a growth rate (CAGR) of 11.51% during 2026-2034. The market is driven by the integration of smart systems into Vision 2030 housing projects. Also, rising energy costs and efficiency goals are fueling the product adoption. Additionally, growing demand for security and remote surveillance is increasing system installations. Government-backed development, energy-conscious living, and privacy-driven technology adoption are some of the other factors positively impacting the Saudi Arabia home automation market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 909.9 Million |

| Market Forecast in 2034 | USD 2,426.3 Million |

| Market Growth Rate 2026-2034 | 11.51% |

Saudi Arabia Home Automation Market Trends:

Integration of Smart Technologies into Vision 2030 Housing Projects

Saudi Arabia’s Vision 2030 is transforming urban development, with large-scale housing projects incorporating smart infrastructure as a core feature. Developments such as NEOM, Qiddiya, and the Red Sea Project are designed to include connected home technologies by default, positioning home automation as a foundational element rather than an upgrade. The Ministry of Municipal, Rural Affairs and Housing is actively promoting the use of smart systems for lighting, HVAC, energy metering, and security in new residential communities. These systems are aligned with broader goals around sustainability, digital transformation, and energy efficiency. With high electricity consumption driven by air conditioning and lighting needs, automation is being used to reduce waste and manage load during peak periods. As per an industry report published on May 26, 2024, smart home adoption in Saudi Arabia rose in 2023, with over six million devices connected to Amazon Alexa—marking a 90% year-on-year increase. Users in the Kingdom are increasingly automating lighting, climate control, entertainment systems, and security through voice-activated commands, with smart lighting and air conditioning being the most engaged categories. Homebuyers in middle- and upper-income segments are increasingly expecting automation-ready homes as standard offerings, especially in Riyadh and Jeddah. This shift is a key factor driving Saudi Arabia home automation market growth, particularly as smart infrastructure becomes embedded in real estate financing, construction guidelines, and municipal development strategies. Automation is no longer seen as optional, it is becoming a core utility in modern Saudi housing design.

To get more information on this market Request Sample

Security Concerns and the Rise of Smart Surveillance

Personal security is a high priority for residential buyers in Saudi Arabia, particularly in urban and high-income communities. As concerns around property safety, privacy, and intrusion prevention rise, smart security systems are becoming standard in new home installations. This includes automated locks, motion sensors, video doorbells, and cloud-connected surveillance cameras accessible through mobile apps. Homeowners value the ability to monitor their property remotely, especially during periods of travel or when managing multiple residences. Developers in high-end residential compounds and vertical housing projects are offering pre-installed security automation packages to meet growing expectations among buyers. Additionally, cultural preferences for privacy and discreet surveillance further support the adoption of smart systems that can be managed internally without third-party involvement. As per a 2024 industry report, AI-driven home automation is gaining traction in Saudi Arabia, with firms like Smart Citizens entering the market to deliver integrated security and energy solutions aligned with Vision 2030 goals. Their systems use AI and IoT to enable real-time threat detection, behavioral analytics, and voice-activated controls, achieving up to a 40% reduction in false alarms. These developments reflect the Kingdom’s push to elevate living standards through smart technologies while supporting its broader ambitions in sustainability, safety, and digital infrastructure. With increased availability of secure, cloud-based storage and more user-friendly interfaces in Arabic, adoption is accelerating across demographics. The focus on safety, convenience, and technological integration is positioning smart surveillance not only as a lifestyle enhancement but as a default feature in modern home environments.

Saudi Arabia Home Automation Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type, technology, and end user.

Type Insights:

- Lighting

- Relay

- Dimmers

- Switches

- Others

- Security and Safety

- Bells

- Locks

- Security Cameras

- Others

- HVAC

- Thermostats

- Sensors

- Control Valves

- Others

- Entertainment

- Home Theater System

- Audio, Volume, and Multimedia Controls

- Others

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes lighting (relay, dimmers, switches, and others), security and safety (bells, locks, security cameras, and others), HVAC (thermostats, sensors, control valves, and others), entertainment (home theater system, audio, volume, and multimedia controls, and others), and others.

Technology Insights:

- Wired

- Wireless

The report has provided a detailed breakup and analysis of the market based on the technology. This includes wired and wireless.

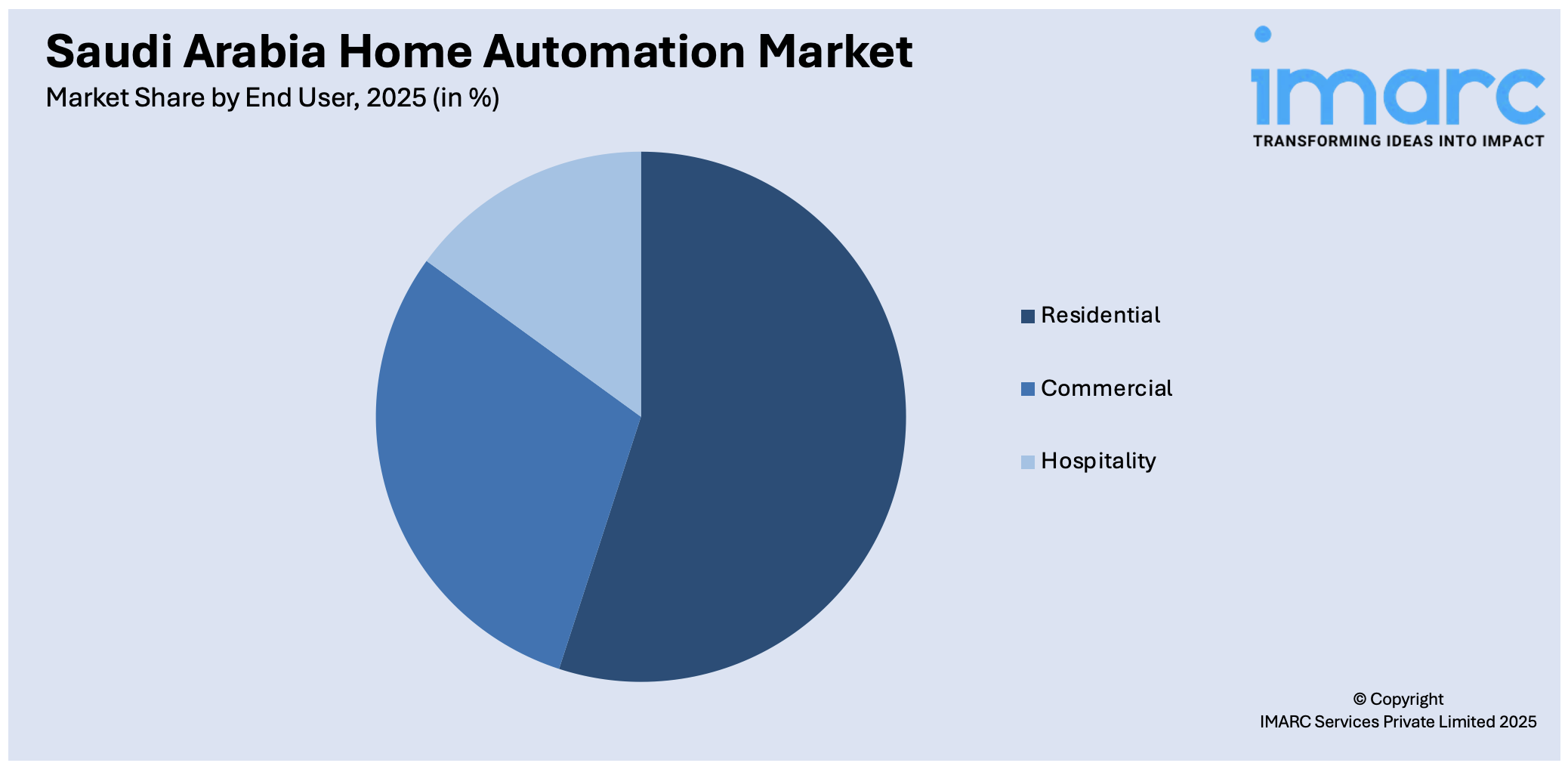

End User Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial

- Hospitality

The report has provided a detailed breakup and analysis of the market based on the end user. This includes residential, commercial, and hospitality.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has provided a comprehensive analysis of all major regional markets. This includes Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Home Automation Market News:

- January 15, 2025: Nokia and Zain KSA have launched the region’s first 4G/5G femtocell Smart Node solution in Saudi Arabia to enhance indoor connectivity for enterprise clients, laying groundwork for smarter, more secure building environments. The plug-and-play system ensures robust network coverage while minimizing infrastructure demands, key for integrating home and office automation systems. This move supports Vision 2030’s digital transformation goals and positions Zain KSA to lead in offering next-gen IoT-enabled automation and security technologies across Saudi homes and enterprises.

- June 4, 2024: Honeywell has launched its first local assembly line for fire alarm and building management systems in Dhahran, marking a major step in advancing home and building automation in Saudi Arabia. The facility supports Vision 2030 by boosting localization, enabling faster product delivery, and meeting growing demand for smart, efficient infrastructure solutions. Honeywell’s move reinforces Saudi Arabia’s position as a regional hub for safety and automation technologies, particularly as urbanization and smart city initiatives accelerate across the Kingdom.

Saudi Arabia Home Automation Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Technologies Covered | Wired, Wireless |

| End Users Covered | Residential, Commercial, Hospitality |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia home automation market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia home automation market on the basis of type?

- What is the breakup of the Saudi Arabia home automation market on the basis of technology?

- What is the breakup of the Saudi Arabia home automation market on the basis of end user?

- What is the breakup of the Saudi Arabia home automation market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia home automation market?

- What are the key driving factors and challenges in the Saudi Arabia home automation market?

- What is the structure of the Saudi Arabia home automation market and who are the key players?

- What is the degree of competition in the Saudi Arabia home automation market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia home automation market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia home automation market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia home automation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)