Saudi Arabia Home Storage Market Size, Share, Trends and Forecast by Product Type, Material, Installation, Distribution Channel, and Region, 2026-2034

Saudi Arabia Home Storage Market Overview:

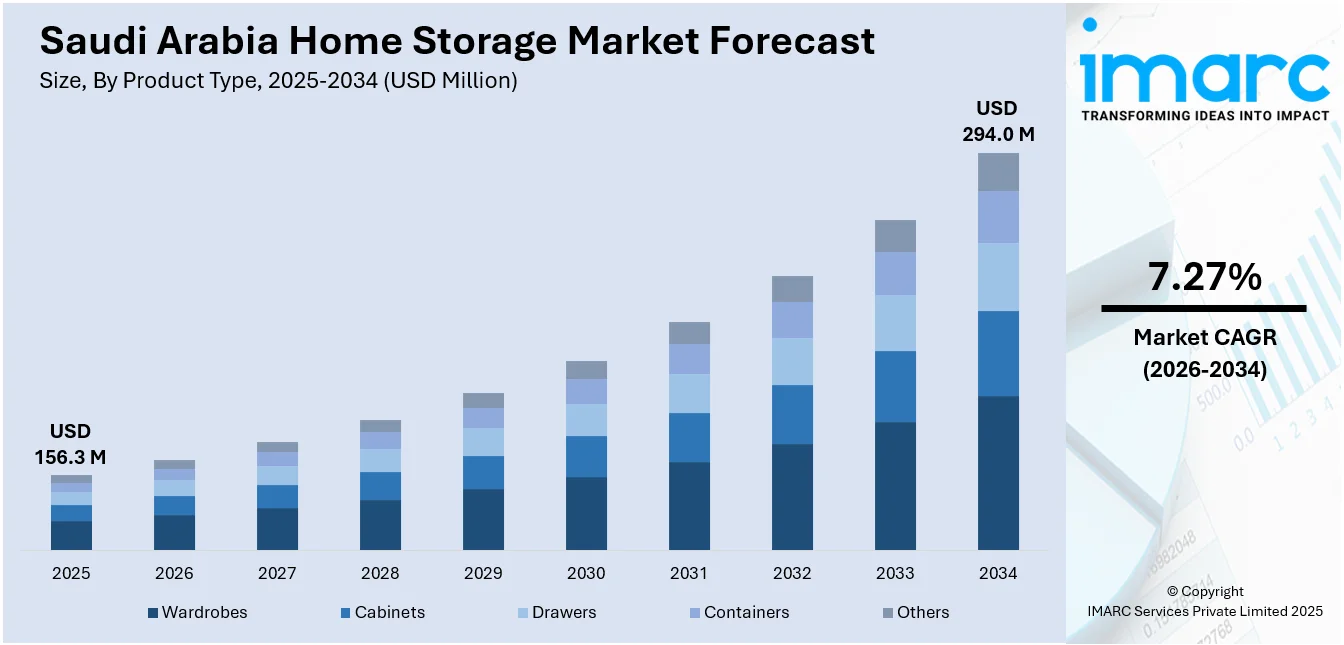

The Saudi Arabia home storage market size reached USD 156.3 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 294.0 Million by 2034, exhibiting a growth rate (CAGR) of 7.27% during 2026-2034. The market is driven by the growing trend of compact urban housing that necessitates smart, space-saving storage solutions. Modern lifestyle shifts and social media influence are increasing the desire for aesthetically organized and efficiently designed interiors, thereby fueling the market. Expanding e-commerce platforms that offer customizable, convenient storage products are streamlining consumer access, which further augments the Saudi Arabia home storage market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 156.3 Million |

| Market Forecast in 2034 | USD 294.0 Million |

| Market Growth Rate 2026-2034 | 7.27% |

Saudi Arabia Home Storage Market Trends:

Rise in Urbanization and Compact Residential Living Spaces

With Saudi Arabia undergoing accelerated urbanization and housing development, particularly in cities such as Riyadh, Jeddah, and Dammam, the demand for functional home organization solutions is gaining momentum. As per industry reports, the GCC region is expected to see a significant rise in urban populations, with projections indicating a 30% increase between 2020 and 2030. The Kingdom is at the forefront of this urban growth, with plans to construct 500,000 new housing units to accommodate the expanding demand for living spaces. As more people move into these new homes, the need for efficient home storage solutions is also rising. This growing demand presents opportunities for businesses in Saudi Arabia to offer smart and space-saving storage solutions, enabling residents to maximize the use of their living spaces. Moreover, the government's Vision 2030 plan is contributing to the construction of compact residential units, apartments, and smart homes. Apart from this, younger families and working professionals are especially seeking affordable, multifunctional storage items that optimize available space without compromising interior aesthetics. Retailers are responding with localized product ranges that align with spatial layouts commonly found in Saudi homes. Furniture and homeware brands are also customizing products to cater to Islamic design preferences, offering closed cabinetry, under-bed compartments, and ottomans with storage. These developments reflect a broader shift in residential living patterns that necessitate practical, accessible storage innovations. As population densities rise and apartment living becomes more prevalent, these factors will remain critical to Saudi Arabia home storage market growth, encouraging consistent demand for scalable and smart organization solutions across the country.

To get more information on this market Request Sample

Lifestyle Modernization and Consumer Preference for Organized Living

Modern Saudi households are placing increasing importance on aesthetic organization and space efficiency, largely influenced by global home improvement trends and the pervasive reach of lifestyle content on social media. With consumer mindsets shifting toward decluttered living, there is a growing preference for visually cohesive interiors and well-structured storage systems. Influencers, interior designers, and local online platforms are driving awareness of solutions such as pantry organization racks, closet organizers, stackable storage bins, and label-based systems. As dual-income households rise, people are investing more time and resources into functional home upgrades, including storage optimization. A recent study highlights that this growing demand for practical and aesthetic home organization is also shaped by cultural influences. Notably, about 43.3% of Saudi millennials are significantly influenced by nostalgic design when making furniture purchasing decisions, with a strong preference for seating styles that evoke memories of traditional Hijazi culture. The study also reveals that while nostalgia plays a major role, a considerable proportion (33%) prefers modern furniture due to its simplicity and unique features. This preference for a mix of traditional and modern styles is also positively impacting the market. As people seek to create living spaces that reflect both heritage and contemporary trends, there is an increasing demand for storage solutions that are both functional and aesthetically pleasing. Local and international brands are expanding retail footprints and e-commerce capabilities, providing extensive options in terms of color schemes, materials, and modular configurations. Retailers are leveraging localized logistics, Arabic-language interfaces, and easy return policies to improve customer trust and satisfaction. Seasonal marketing campaigns, influencer endorsements, and virtual interior design tools are further supporting online demand. Seasonal sales and organized living campaigns have become common, promoting home storage not as an accessory but as a lifestyle necessity.

Saudi Arabia Home Storage Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product type, material, installation, and distribution channel.

Product Type Insights:

- Wardrobes

- Cabinets

- Drawers

- Containers

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes wardrobes, cabinets, drawers, containers, and others.

Material Insights:

- Plastic

- Wood

- Metal

- Others

The report has provided a detailed breakup and analysis of the market based on the material. This includes plastic, wood, metal, and others.

Installation Insights:

- Wall Mounted

- Floor Standing

The report has provided a detailed breakup and analysis of the market based on the installation. This includes wall mounted and floor standing.

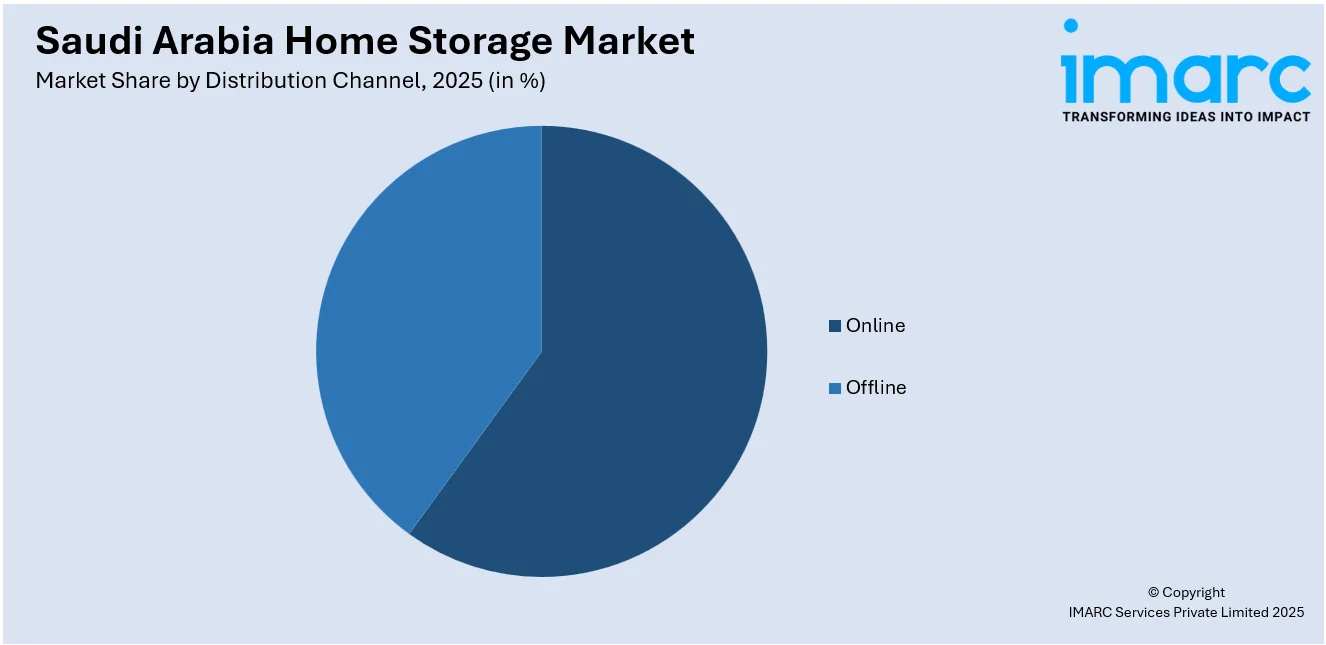

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Online

- E-Commerce Websites

- Company-Owned Websites

- Offline

- Supermarket/Hypermarket

- Specialty Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes online (e-commerce websites and company-owned websites) and offline (supermarket/hypermarket, specialty stores, and others).

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all major regional markets. This includes Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Home Storage Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Wardrobes, Cabinets, Drawers, Containers, Others |

| Materials Covered | Plastic, Wood, Metal, Others |

| Installations Covered | Wall Mounted, Floor Standing |

| Distribution Channels Covered |

|

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia home storage market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia home storage market on the basis of product type?

- What is the breakup of the Saudi Arabia home storage market on the basis of material?

- What is the breakup of the Saudi Arabia home storage market on the basis of installation?

- What is the breakup of the Saudi Arabia home storage market on the basis of distribution channel?

- What is the breakup of the Saudi Arabia home storage market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia home storage market?

- What are the key driving factors and challenges in the Saudi Arabia home storage market?

- What is the structure of the Saudi Arabia home storage market and who are the key players?

- What is the degree of competition in the Saudi Arabia home storage market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia home storage market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia home storage market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia home storage industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)