Saudi Arabia Home Textile Market Size, Share, Trends and Forecast by Product, Distribution Channel, and Region, 2026-2034

Saudi Arabia Home Textile Market Summary:

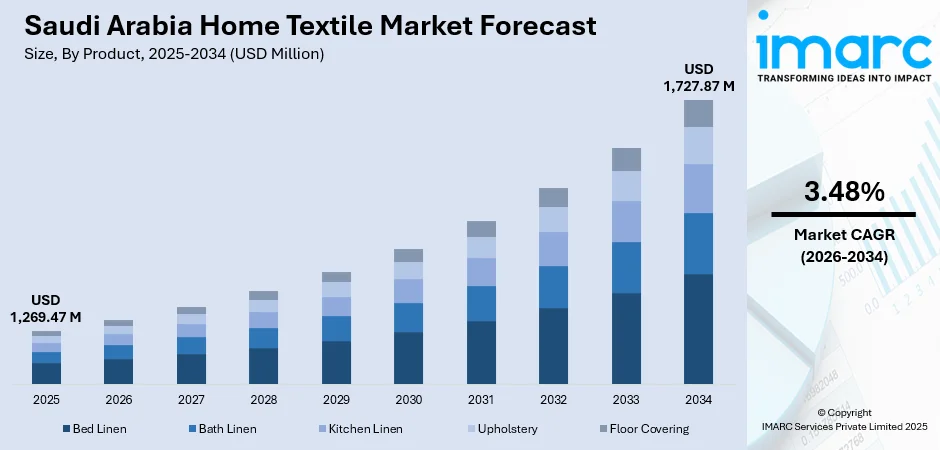

The Saudi Arabia home textile market size was valued at USD 1,269.47 Million in 2025 and is projected to reach USD 1,727.87 Million by 2034, growing at a compound annual growth rate of 3.48% from 2026-2034.

The Saudi Arabia home textile market is experiencing robust expansion driven by the Kingdom's Vision 2030 initiative, which has catalyzed unprecedented investments in residential and hospitality infrastructure. Rising disposable incomes among the growing middle class, coupled with evolving consumer preferences for premium and aesthetically pleasing home décor, are reshaping purchasing patterns. The proliferation of e-commerce platforms and increasing urbanization are further strengthening market accessibility, while a notable shift towards sustainable and eco-friendly textiles reflects growing environmental consciousness among Saudi consumers, collectively enhancing Saudi Arabia home textile market share.

Key Takeaways and Insights:

-

By Product: Bed linen dominates the market with a share of 41% in 2025, driven by rising demand for premium, comfortable bedding products and the influence of global minimalistic design trends.

-

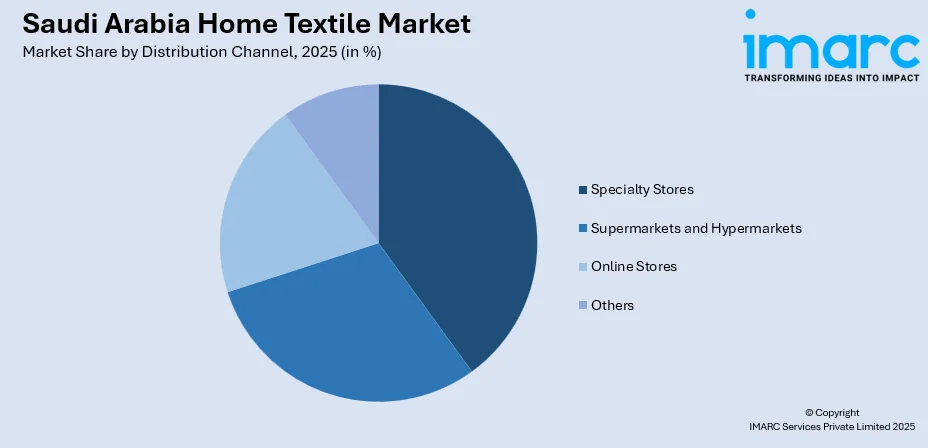

By Distribution Channel: Specialty stores lead the market with a share of 37% in 2025, offering curated selections, personalized shopping experiences, and professional advice for premium home textile purchases.

-

By Region: Northern and Central region represents the largest segment with a market share of 48% in 2025, fueled by Riyadh's rapid urbanization and significant residential development projects under Vision 2030.

-

Key Players: The Saudi Arabia home textile market exhibits moderate competitive intensity, with established local manufacturers and international brands competing across price segments. Companies are focusing on product innovation, sustainability initiatives, and digital engagement to capture market share in this evolving landscape. Some of the key players operating in the market include Bed Quarter (Al Mazro Group), Omar Kassem Alesayi Group, Satex, Tawreed, Watheer International, etc.

To get more information on this market Request Sample

The Saudi Arabia home textile market is advancing rapidly as the Kingdom transforms its economic landscape through Vision 2030. Government investments in infrastructure have reached unprecedented levels, with real estate transactions surging significantly in 2024. In November 2024, Saudi banks issued SR10.06 billion in residential mortgages, marking a substantial annual increase of over fifty percent. This housing boom has created sustained demand for quality home textiles across residential and hospitality sectors. The market is supported by a young, brand-aware consumer base with growing interest in contemporary designs and sustainable products. At the same time, expanding e-commerce platforms are improving access to a wide range of home textile options from both local and international brands, strengthening market growth.

Saudi Arabia Home Textile Market Trends:

Digital Transformation and E-Commerce Expansion

The rapid growth of e-commerce platforms is revolutionizing the Saudi Arabia home textile market by enhancing product accessibility and consumer convenience. With internet penetration reaching 99% and social media users exceeding 35 million in early 2024, digital retail channels are becoming essential for home textile brands. Online platforms enable consumers to explore diverse product options with customization features, virtual design tools, and competitive pricing, supporting the Saudi Arabia home textile market growth through enhanced shopping experiences and expanded brand reach.

Sustainable and Eco-Friendly Textile Adoption

Environmental consciousness is increasingly influencing consumer purchasing decisions in the Saudi home textile market. Demand for products made from organic, biodegradable, and recycled materials is rising as consumers seek sustainable living solutions. In March 2024, Sedar Global expanded its presence by opening stores in Tabuk, Saudi Arabia, focusing on sustainable designs and innovative products for home interiors. Manufacturers are responding by developing eco-friendly textiles that combine environmental responsibility with premium quality and aesthetic appeal.

Premiumization and Luxury Home Décor Preferences

Rising affluence among Saudi consumers is driving demand for luxury and premium home textile products. The young, brand-conscious population shows a strong preference for high-end international brands and sophisticated designs, particularly in bed linens and upholstery fabrics. Digital printing technologies and innovative textile designs, including combinations of embroidery and jacquard patterns, are gaining substantial traction. This premiumization trend is encouraging manufacturers to introduce exclusive collections featuring superior materials and contemporary aesthetics.

How Vision 2030 is Transforming the Saudi Arabia Home Textile Market:

Vision 2030 is significantly reshaping the Saudi Arabia home textile market by driving economic diversification, local manufacturing, and higher consumer standards. Government initiatives encouraging domestic production and investment are supporting the expansion of textile manufacturing and reducing reliance on imports. Rising disposable incomes, urbanization, and large-scale housing and hospitality projects linked to tourism development are boosting demand for home textiles such as bedding, curtains, and towels. Sustainability goals under Vision 2030 are also encouraging the adoption of eco-friendly fabrics and efficient production practices. Together, these reforms are modernizing the home textile sector, improving product quality, and creating opportunities for both local and international brands.

Market Outlook 2026-2034:

The Saudi Arabia home textile market is set for steady growth from 2025 to 2033, fueled by ongoing Vision 2030 initiatives and strong expansion in residential and hospitality construction. Major giga-projects such as NEOM, Qiddiya, and the Red Sea developments are driving significant demand for premium textiles, particularly in luxury hotels and upscale residential complexes, creating opportunities for both local manufacturers and international brands to supply high-quality, innovative, and sustainable home textile products. The market generated a revenue of USD 1,269.47 Million in 2025 and is projected to reach a revenue of USD 1,727.87 Million by 2034, growing at a compound annual growth rate of 3.48% from 2026-2034.

Saudi Arabia Home Textile Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product |

Bed Linen |

41% |

|

Distribution Channel |

Specialty Stores |

37% |

|

Region |

Northern and Central Region |

48% |

Product Insights:

- Bed Linen

- Bath Linen

- Kitchen Linen

- Upholstery

- Floor Covering

Bed linen dominates the Saudi Arabia home textile market with a 41% share in 2025.

Bed linen represents the largest product segment in the Saudi Arabia home textile market, driven by growing consumer demand for premium, comfortable, and aesthetically pleasing bedding products. The increasing preference for high-quality fabrics such as Egyptian cotton, linen, and luxury blends reflects evolving consumer lifestyles and rising disposable incomes. In June 2024, Bedding Industries of America partnered with Saudi-based Bed Quarter Co. to produce and distribute Eclipse mattresses across the region, highlighting the strategic focus on premium bedding solutions. Global design influences, particularly minimalist and contemporary styles, are shaping purchasing patterns as consumers invest in bedroom aesthetics.

The bed linen segment benefits from the rapid expansion of residential construction and the hospitality sector under Vision 2030. Luxury hotels and residential complexes require high-thread-count sheets, duvet covers, and pillowcases that combine functionality with modern design sensibilities. Retailers are responding by offering customized bed linen options in diverse designs, colors, and sizes, while e-commerce platforms have expanded consumer access to international brands and specialty products, further strengthening segment growth.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Stores

- Others

Specialty stores lead the Saudi Arabia home textile market with a 37% share in 2025.

Specialty stores maintain their leadership position by offering curated selections of premium and branded home textile products that appeal to quality-conscious consumers. These outlets provide personalized shopping experiences with professional design consultation, helping customers make informed purchasing decisions. Specialty retailers focus on exclusive product ranges, superior customer service, and in-store displays that showcase product quality and design possibilities, differentiating themselves from mass-market channels.

The specialty store segment continues to evolve with leading retailers expanding their presence across Saudi Arabia. Wall covering and interior specialist Sedar Global has grown to operate eight stores in Saudi Arabia, offering products ranging from curtains and blinds to upholstery fabrics and home automation systems. These stores cater to consumers seeking unique, designer, and luxury home textile items not commonly available in supermarkets, with many specialty retailers now integrating digital tools and virtual consultation services to enhance customer engagement.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The Northern and Central region holds the largest share at 48% of the Saudi Arabia home textile market in 2025.

The Northern and Central region, centered around the capital Riyadh, leads the Saudi Arabia home textile market due to rapid urban development and major investments in residential projects under Vision 2030. The expanding middle class is increasingly spending on interior décor and home furnishings, boosting demand for premium bedding, upholstery, and bath textiles. Strong housing activity in the region continues to support robust consumption of home textile products across both new and existing residential developments.

Riyadh serves as the commercial and administrative hub of Saudi Arabia, concentrating significant retail infrastructure and consumer purchasing power. The development of residential complexes in cities, including Riyadh, Qassim, and Hail, is boosting demand across all home textile categories. Retailers are expanding their footprints in the region to capture the emerging market opportunity, with specialty stores and e-commerce platforms establishing a strong presence to serve the growing consumer base seeking quality and stylish home textile products.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Home Textile Market Growing?

Vision 2030 and Real Estate Sector Expansion

Saudi Arabia's Vision 2030 initiative has significantly transformed the real estate sector, driving unprecedented investments in residential, commercial, and hospitality construction. The Saudi Arabia real estate market size was valued at USD 77.2 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 137.8 Billion by 2034, exhibiting a CAGR of 6.70% during 2026-2034. The Kingdom invested substantially in infrastructure during 2024, with real estate transactions reaching significant values. Giga-projects including NEOM, Qiddiya, and Red Sea developments are creating massive demand for high-quality home textiles. Luxury hotels, residential complexes, and entertainment hubs require premium textiles such as curtains, bed linens, and upholstery to meet modern aesthetic and functional standards. This construction boom directly supports sustained market expansion as newly completed properties require comprehensive furnishing.

Rising Disposable Income and Lifestyle Changes

The increasing affluence of Saudi Arabia's population, particularly among dual-income households and the expanding middle class, is driving demand for premium home textiles. Consumers are prioritizing home comfort and interior aesthetics, investing in quality bedding, bath linens, and decorative textiles. The relatively young population shows a strong preference for high-end brands and modern design influences, particularly Western and minimalist styles. Globalization and increased digital connectivity have exposed consumers to international design trends, encouraging investment in sophisticated home décor that enhances living spaces and reflects personal style preferences.

Tourism and Hospitality Sector Growth

The expansion of Saudi Arabia's tourism and hospitality sectors is creating substantial demand for commercial-grade home textiles. The Saudi Arabia hospitality market size was valued at USD 53.2 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 115.8 Billion by 2034, exhibiting a CAGR of 9.03% from 2026-2034. The Kingdom is developing world-class tourism destinations and significantly increasing hotel room capacity to accommodate growing visitor numbers. Hospitality establishments demand premium textiles such as antibacterial fitted sheets, high-quality cotton towels, and designer bed linens that seamlessly blend practicality with visual sophistication. These specialized products are essential for delivering both comfort and elegance, meeting the expectations of discerning guests while enhancing the overall aesthetic of hotel interiors. The Hajj and Umrah seasons continue to drive significant seasonal demand for hospitality textiles, while new entertainment destinations require comprehensive furnishing solutions across multiple property categories.

Market Restraints:

What Challenges the Saudi Arabia Home Textile Market is Facing?

Price Sensitivity Among Consumer Segments

Price sensitivity in certain consumer segments poses challenges for market growth. While high-end products appeal to affluent buyers, cost-conscious consumers prioritize affordable alternatives, creating pressure on pricing strategies. Manufacturers and retailers must carefully balance quality, innovation, and value propositions to attract both premium and budget-conscious buyers, ensuring broader market penetration without compromising brand positioning or profitability.

Competition from Low-Cost Imports

Domestic home textile manufacturers encounter significant competition from low-cost imported products, which impacts both market share and premium product positioning. The industry depends largely on imported raw materials, making local production susceptible to global price fluctuations and supply chain disruptions. These challenges increase competitive pressure and create obstacles for sustaining and expanding domestic manufacturing operations.

Fluctuating Raw Material Costs

Volatility in raw material prices, particularly cotton and specialty fibers, impacts production costs and profitability across the home textile sector. Global market fluctuations affect procurement, pricing, and manufacturing planning, potentially limiting consistent product availability and challenging competitive pricing. Manufacturers must adopt strategies to mitigate cost risks while maintaining quality and ensuring a stable supply to meet market demand.

Competitive Landscape:

The Saudi Arabia home textile market shows moderate competition, with well-established local producers and international brands competing across multiple price categories. Market rivalry is increasingly shaped by product quality, design innovation, and sustainability credentials, as consumers place greater emphasis on environmentally responsible choices. Digital channels, particularly e-commerce platforms, are becoming critical for enhancing brand visibility and expanding customer reach. To strengthen their market positions, companies are investing in online engagement, physical retail growth, and strategic collaborations. At the same time, rising demand for customized and distinctive designs is driving product innovation, while sustainability-focused initiatives are helping progressive brands stand out in a competitive and evolving market.

Some of the key players include:

- Bed Quarter (Al Mazro Group)

- Omar Kassem Alesayi Group

- Satex

- Tawreed

- Watheer International

Recent Developments:

-

September 2025: Bed Quarter, a leading Saudi mattress retailer, opened its first exclusive Eclipse store in Riyadh, introducing the Royal Collection featuring premium mattresses with advanced spring technology and natural comfort materials, marking a significant milestone for luxury bedding in the Middle East market.

Saudi Arabia Home Textile Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Bed Linen, Bath Linen, Kitchen Linen, Upholstery, Floor Covering |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Online Stores, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Companies Covered | Bed Quarter (Al Mazro Group), Omar Kassem Alesayi Group, Satex, Tawreed, Watheer International, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia home textile market size was valued at USD 1,269.47 Million in 2025.

The Saudi Arabia home textile market is expected to grow at a compound annual growth rate of 3.48% from 2026-2034 to reach USD 1,727.87 Million by 2034.

Bed linen, representing the largest revenue share of 41% in 2025, dominates the Saudi Arabia home textile market, driven by rising demand for premium, comfortable bedding products and the influence of global design trends among brand-conscious consumers.

Key factors driving the Saudi Arabia home textile market include Vision 2030 infrastructure investments, rising disposable incomes, expanding e-commerce platforms, growing tourism and hospitality sectors, and increasing consumer preference for premium and sustainable home décor products.

Major challenges include price sensitivity among certain consumer segments, competition from low-cost imports, fluctuating raw material costs, dependence on imported materials, and the need for continuous product differentiation in a competitive marketplace.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)