Saudi Arabia Homeopathic Medicine Market Size, Share, Trends and Forecast by Type, Application, End-User, and Region, 2026-2034

Saudi Arabia Homeopathic Medicine Market Overview:

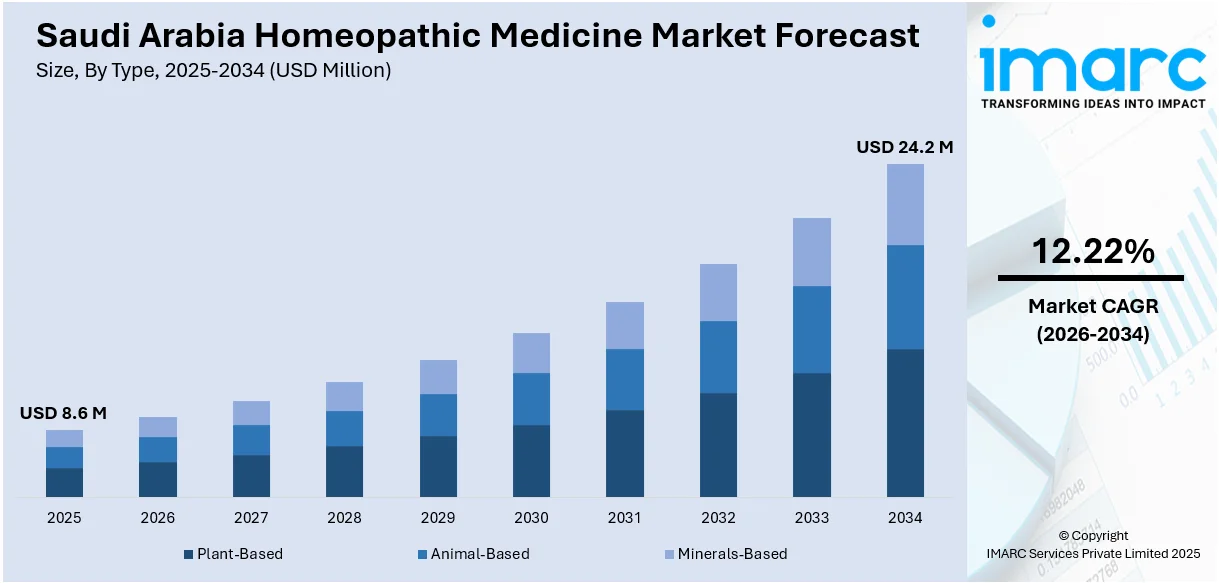

The Saudi Arabia homeopathic medicine market size reached USD 8.6 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 24.2 Million by 2034, exhibiting a growth rate (CAGR) of 12.22% during 2026-2034. The market is driven by the demand for natural and holistic forms of treatment, with an increase in people turning towards alternatives to traditional medicine. Furthermore, increased knowledge regarding the advantages of homeopathic treatments, combined with rising healthcare concerns, is driving business growth. Additionally, favorable government policies encouraging traditional medical practices and a transformation towards preventive healthcare are also expanding the Saudi Arabia homeopathic medicine market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 8.6 Million |

| Market Forecast in 2034 | USD 24.2 Million |

| Market Growth Rate 2026-2034 | 12.22% |

Saudi Arabia Homeopathic Medicine Market Trends:

Rising Consumer Preference for Natural Remedies

The increasing demand for natural remedies over artificial drugs is a leading trend in the marketplace. This trend is fueled by growing concerns about the potential side effects and long-term risks associated with pharmaceutical products. Homeopathic remedies, characterized by natural ingredients and a holistic treatment strategy, have become popular due to their safety profile and fewer side effects. Individuals are increasingly turning to therapies that align with a natural way of life, particularly in a health-conscious society, which is positively impacting the market. Furthermore, the growth in the trend towards wellness, including the consumption of organic food and the practice of alternative therapies, has led individuals to look towards homeopathy to manage chronic conditions, stress, and overall wellness. This market is also propelled by the strong cultural emphasis on conventional healing practices, which resonate well with the values of many Saudi consumers who prefer natural, environmentally friendly treatments.

To get more information on this market Request Sample

Government Support for Traditional Medicine

Another prominent trend is the increasing patronage from the Saudi government for incorporating traditional medicine practices, such as homeopathy, into the healthcare industry. With Saudi Vision 2030 focusing on diversifying the health sector and promoting holistic well-being, the government has made efforts to promote the use of alternative and complementary medicine. Regulating bodies are formulating guidelines to standardize and legitimize homeopathic treatment, thereby maintaining the quality and safety of such practices for consumers. Moreover, homeopathic educational and research programs are further fortifying the market by promoting professional skills and knowledge acquisition. Government approval is instrumental in creating customer confidence and ensuring that homeopathy is included in public health agendas. These actions are part of a larger mission to improve preventive healthcare options, minimize reliance on chemical-based medications, and sustain culturally based health solutions in the kingdom.

Growing E-commerce and Retail Channels for Homeopathic Products

The expansion of e-commerce platforms and retail outlets dedicated to homeopathic products is another factor propelling Saudi Arabia homeopathic medicine market growth. In early 2024, Saudi Arabia reported an internet penetration rate of 99.0%, with 36.84 million internet users, facilitating access to online pharmacy services primarily through mobile phones. As digitalization is on the rise in the region, online drugstores and e-commerce websites dealing in natural and homeopathic drugs have witnessed considerable expansion. Consumers are increasingly likely to purchase homeopathic treatments on online platforms due to convenience, privacy, and the options provided. Additionally, retail store chains are increasingly stocking homeopathic products due to rising consumer demand. These channels are providing homeopathic remedies to a wider segment of the population, including those in rural areas where traditional healthcare services may be scarce. This trend reflects a shift towards more contemporary, digital-first purchasing habits, which is enhancing the availability and market reach.

Saudi Arabia Homeopathic Medicine Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type, application, and end-user.

Type Insights:

- Plant-Based

- Animal-Based

- Minerals-Based

The report has provided a detailed breakup and analysis of the market based on the type. This includes plant-based, animal-based, and minerals-based.

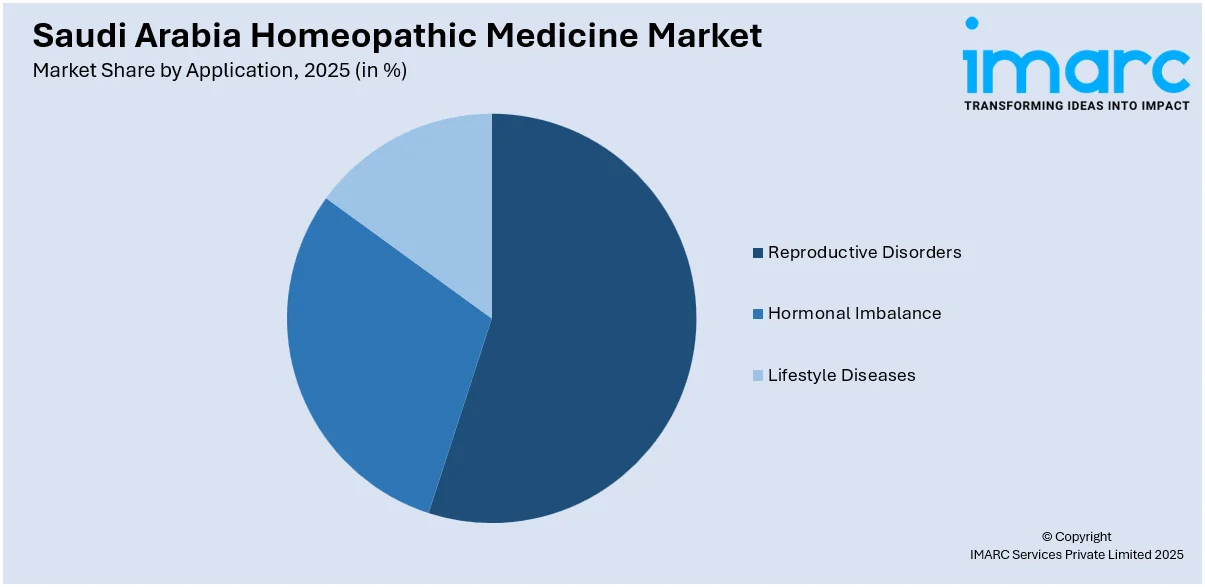

Application Insights:

Access the comprehensive market breakdown Request Sample

- Reproductive Disorders

- Hormonal Imbalance

- Lifestyle Diseases

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes reproductive disorders, hormonal imbalance, and lifestyle diseases.

End-User Insights:

- Hospitals

- Homeopathic Clinics

The report has provided a detailed breakup and analysis of the market based on the end-user. This includes hospitals and homeopathic clinics.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Homeopathic Medicine Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Plant-Based, Animal-Based, Minerals-Based |

| Applications Covered | Reproductive Disorders, Hormonal Imbalance, Lifestyle Diseases |

| End-Users Covered | Hospitals, Homeopathic Clinics |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia homeopathic medicine market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia homeopathic medicine market on the basis of type?

- What is the breakup of the Saudi Arabia homeopathic medicine market on the basis of application?

- What is the breakup of the Saudi Arabia homeopathic medicine market on the basis of end-user?

- What is the breakup of the Saudi Arabia homeopathic medicine market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia homeopathic medicine market?

- What are the key driving factors and challenges in the Saudi Arabia homeopathic medicine market?

- What is the structure of the Saudi Arabia homeopathic medicine market and who are the key players?

- What is the degree of competition in the Saudi Arabia homeopathic medicine market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia homeopathic medicine market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia homeopathic medicine market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia homeopathic medicine industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)