Saudi Arabia Hosiery Market Size, Share, Trends and Forecast by Type, End Use, and Region, 2026-2034

Saudi Arabia Hosiery Market Overview:

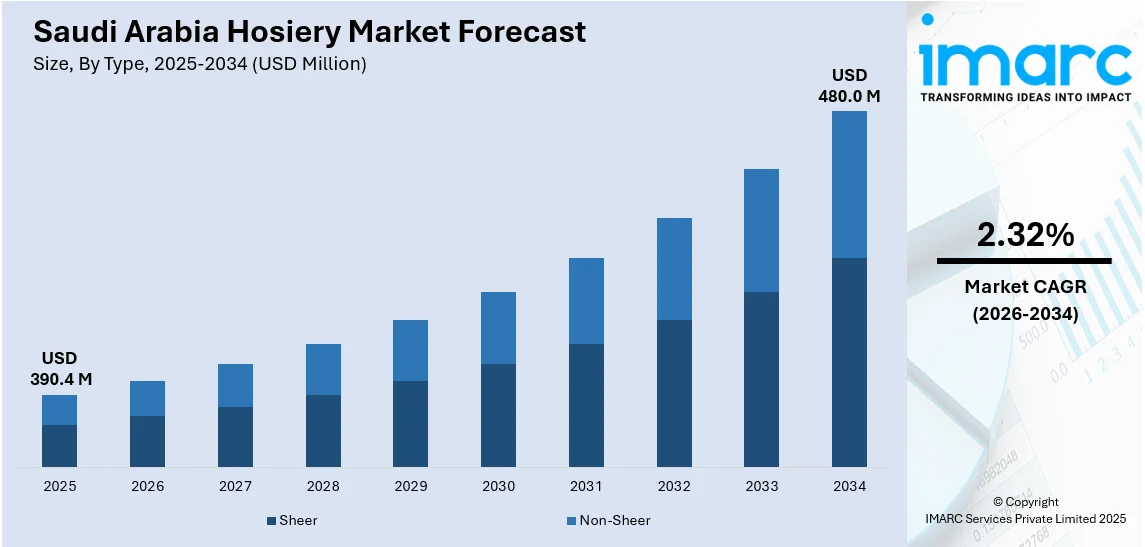

The Saudi Arabia hosiery market size reached USD 390.4 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 480.0 Million by 2034, exhibiting a growth rate (CAGR) of 2.32% during 2026-2034. The market is driven by growing female workforce participation and liberalization of dress codes supporting increased hosiery adoption. Fabric innovation tailored to the kingdom’s climate is enabling comfort-focused, culturally compliant designs across segments, thereby fueling the market. The growing demand for medical-grade and daily wellness hosiery reinforces usage across age groups, thus further augmenting the Saudi Arabia hosiery market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 390.4 Million |

| Market Forecast in 2034 | USD 480.0 Million |

| Market Growth Rate 2026-2034 | 2.32% |

Saudi Arabia Hosiery Market Trends:

Shifting Female Fashion Norms and Workplace Inclusion

Increased participation of women in the Saudi workforce and gradual shifts in public dress codes are creating new avenues for hosiery adoption. While traditional attire still defines daily wear for many, modern clothing choices are gaining visibility across urban centers such as Riyadh, Jeddah, and Dammam. Hosiery, particularly skin-toned tights and compression stockings are increasingly integrated into women’s wardrobes as part of professional, formal, and semi-formal ensembles. The alignment of hosiery with modest fashion, allowing coverage without sacrificing comfort or style, makes it a fitting accessory in both conservative and contemporary outfits. Global and regional brands are adjusting their product lines to suit local preferences, offering lightweight, breathable fabrics suited to the hot climate and designed for layering. Moreover, the availability in department stores, malls, and e-commerce platforms supports access across demographics. Influencer culture and digital campaigns also promote hosiery as a practical, everyday fashion choice, improving social acceptance. These intersecting developments, rising economic engagement of women, social liberalization, and increasing style experimentation are generating sustained demand. As these cultural shifts take root and diversify fashion choices, they are collectively contributing to Saudi Arabia hosiery market growth by expanding the consumer base for both functional and fashion-led products.

To get more information on this market Request Sample

Climate-Specific Hosiery Innovation and Material Adaptation

Saudi Arabia’s extreme climate conditions are compelling hosiery manufacturers to rethink conventional fabric offerings. Standard thermal or dense hosiery is ill-suited to the country’s high temperatures, particularly during extended outdoor activity or long work hours. As a result, market players are introducing lightweight, moisture-wicking, and UV-protective materials that cater to comfort without compromising modesty. Open-knit styles, sheer finishes, and odor-resistant fabrics are gaining popularity in both urban and semi-urban markets. These material innovations also address the needs of working women in indoor environments with strong air conditioning, where comfort layering becomes essential. Retailers are focusing on seamless finishes, reinforced toes, and adaptive waistband designs for better fit and breathability. Premium offerings include high-denier yet skin-cooling fabrics that maintain opacity and structure under abayas or long skirts. Additionally, the expansion of sports and fitness culture among women is encouraging the use of performance socks and compression hosiery in activewear routines. The material-led evolution, supported by Saudi consumers’ increasing comfort with foreign brands and quality standards, is shaping product portfolios that are both seasonally relevant and culturally appropriate.

Rise in Health-Conscious Consumers and Therapeutic Hosiery Demand

The growing awareness of circulation-related health issues and lifestyle-induced discomfort is driving demand for medical and support hosiery in Saudi Arabia. With prolonged sitting, sedentary office environments, and an aging population, consumers are increasingly turning to compression stockings and support tights for both preventive and therapeutic purposes. Medical professionals are prescribing hosiery for varicose veins, swelling, and post-operative recovery, increasing adoption among older adults and middle-aged users. Pharmacies, healthcare retailers, and e-commerce platforms are stocking certified products with graduated compression ratings, anti-microbial properties, and ergonomic designs. These products are being marketed not only as post-surgical aids but also as daily wellness accessories. Male consumers, traditionally less engaged with hosiery, are also entering the market through athletic socks, diabetic footcare options, and travel compression gear. Brands are ensuring compliance with regional sensitivities by providing educational materials in Arabic, discreet packaging, and unisex formats. As health and wellness continue to rise as national priorities, therapeutic hosiery is moving from a niche offering to a mainstream personal care solution.

Saudi Arabia Hosiery Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type and end use.

Type Insights:

- Sheer

- Non-Sheer

The report has provided a detailed breakup and analysis of the market based on the type. This includes sheer and non-sheer.

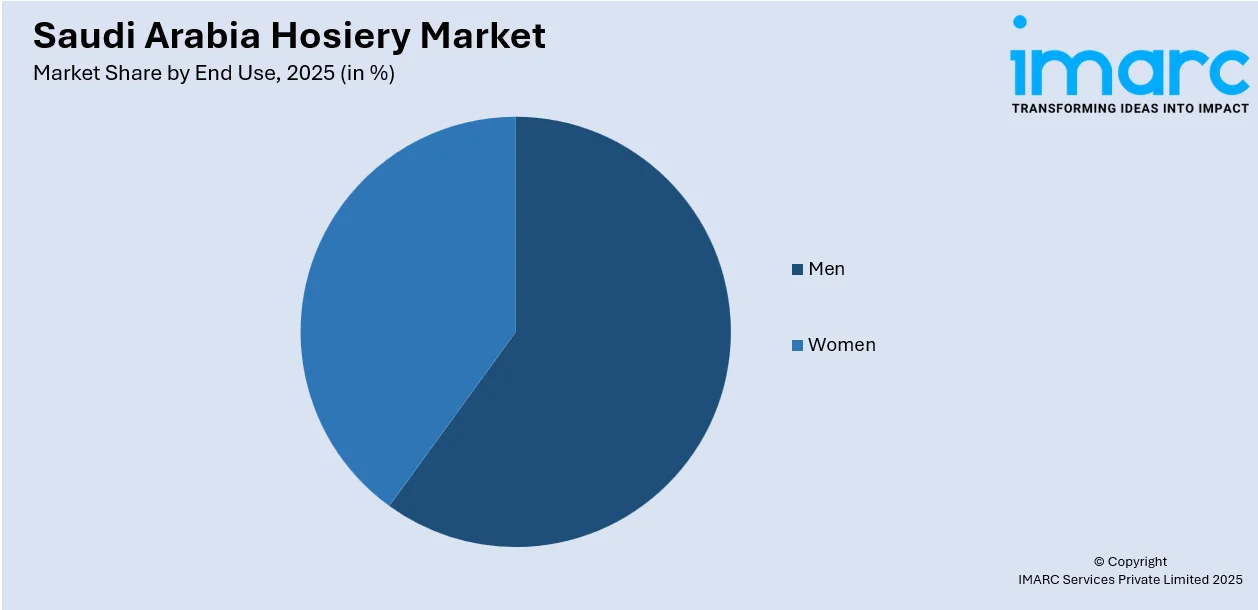

End Use Insights:

Access the comprehensive market breakdown Request Sample

- Men

- Women

The report has provided a detailed breakup and analysis of the market based on the end use. This includes hosiery products for men and women.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all major regional markets. This includes Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Hosiery Market News:

- On January 8, 2025, Mölnlycke Health Care announced a strategic investment of USD 8 Million in Siren, a healthcare tech company specializing in diabetic foot ulcer management through temperature-sensing textile technology. Siren's innovative socks have been clinically tested and proven to reduce the risk of amputations by 83% and diabetic foot ulcers by up to 68%, offering significant cost savings of approximately USD 10,000 per patient annually.

Saudi Arabia Hosiery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Sheer, Non-Sheer |

| End Uses Covered | Men, Women |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia hosiery market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia hosiery market on the basis of type?

- What is the breakup of the Saudi Arabia hosiery market on the basis of end use?

- What is the breakup of the Saudi Arabia hosiery market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia hosiery market?

- What are the key driving factors and challenges in the Saudi Arabia hosiery market?

- What is the structure of the Saudi Arabia hosiery market and who are the key players?

- What is the degree of competition in the Saudi Arabia hosiery market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia hosiery market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia hosiery market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia hosiery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)