Saudi Arabia Hot Melt Adhesive Market Size, Share, Trends and Forecast by Product, Application, and Region, 2026-2034

Saudi Arabia Hot Melt Adhesive Market Summary:

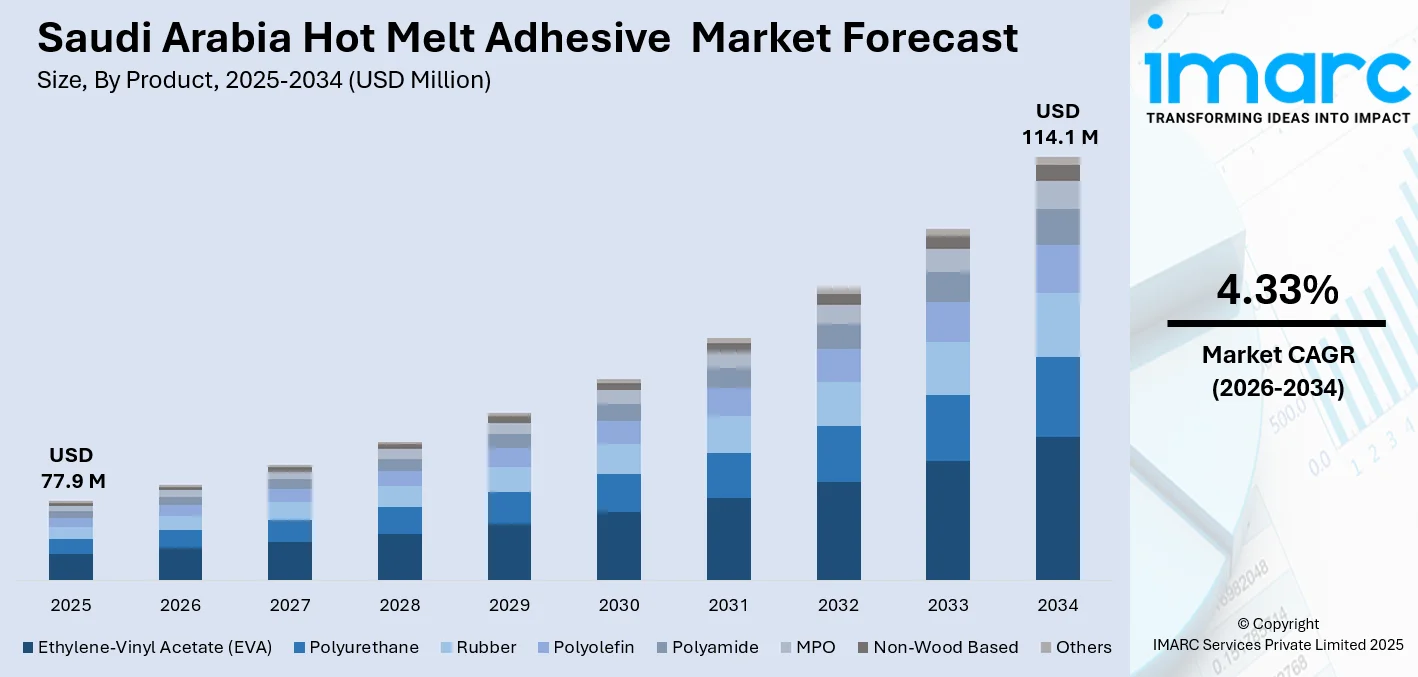

The Saudi Arabia hot melt adhesive market size was valued at USD 77.9 Million in 2025 and is projected to reach USD 114.1 Million by 2034, growing at a compound annual growth rate of 4.33% from 2026-2034.

The Saudi Arabia hot melt adhesive market is experiencing robust expansion, driven by accelerating industrial diversification initiatives and rapid growth across the packaging and construction sectors. Rising demand for efficient bonding solutions in manufacturing applications, coupled with the expansion of e-commerce logistics infrastructure, is propelling market development. The transition towards sustainable and high-performance adhesive formulations continues to shape industry dynamics throughout the Kingdom.

Key Takeaways and Insights:

- By Product: Ethylene-vinyl acetate (EVA) dominates the market with a share of 40% in 2025, owing to its cost-effectiveness, versatility across multiple substrates, and excellent bonding performance. The polymer's compatibility with high-speed packaging lines and favorable thermal stability characteristics continue to drive widespread adoption across industrial applications.

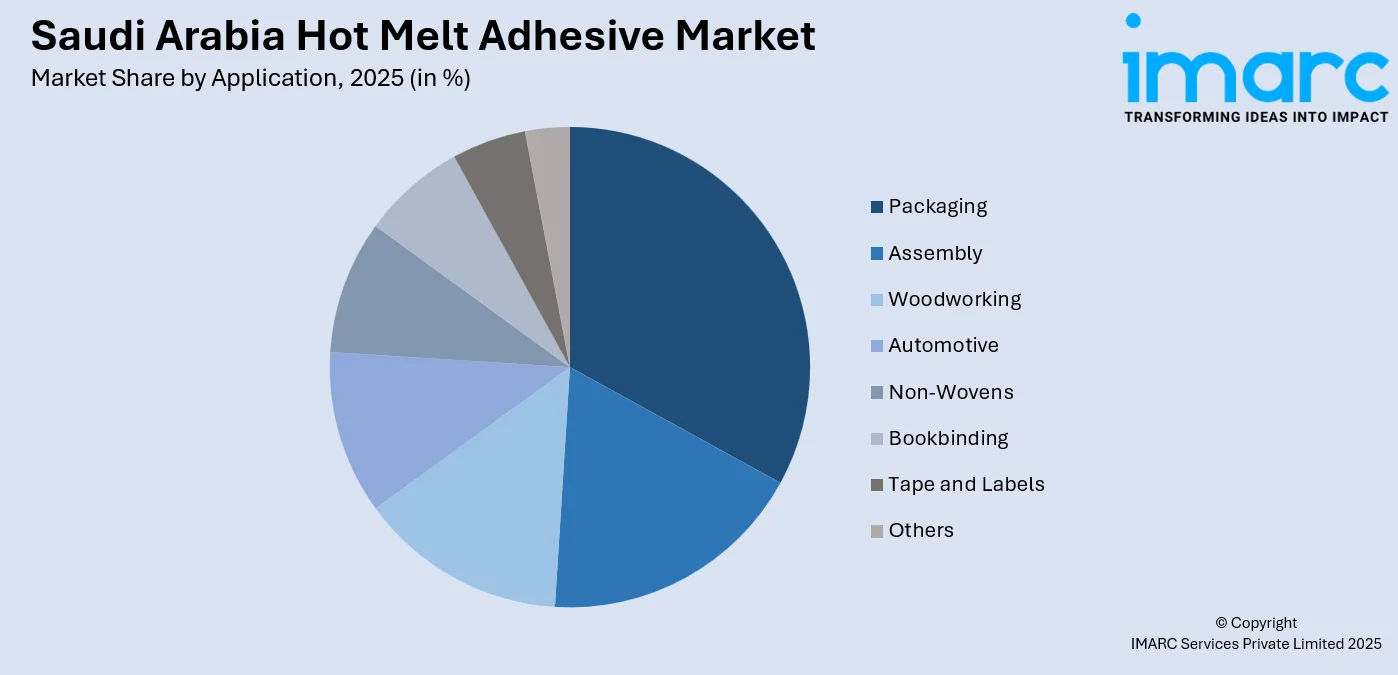

- By Application: Packaging leads the market with a share of 34% in 2025. This dominance is driven by exponential e-commerce growth requiring efficient carton sealing solutions, expanding food and beverage (F&B) processing facilities, and increasing demand for reliable flexible packaging adhesives across consumer goods manufacturing operations.

- By Region: Northern and Central Region represents the largest region with 36% share in 2025, propelled by the concentration of manufacturing plants in Riyadh industrial zones, presence of key packaging converters, and proximity to logistics hubs serving national distribution networks and export channels.

- Key Players: Key players drive the Saudi Arabia hot melt adhesive market by expanding local manufacturing capabilities, introducing sustainable formulations, and strengthening distribution networks. Their investments in technical support services, application engineering, and partnerships with end-user industries enhance product adoption and ensure consistent supply across diverse industrial segments.

To get more information on this market Request Sample

The Saudi Arabia hot melt adhesive market is witnessing transformative growth, underpinned by the Kingdom's ambitious Vision 2030 economic diversification program and substantial infrastructure investments. The packaging sector remains the primary consumption driver, with corrugated box manufacturers and flexible packaging converters increasingly adopting hot melt technologies for their rapid setting characteristics and superior bond strength. The construction industry's expansion, valued at USD 101.4 Billion in 2025, creates sustained demand for assembly and woodworking adhesive applications. Industrial manufacturers are transitioning from traditional solvent-based systems toward hot melt formulations due to their environmental advantages and operational efficiency benefits. The e-commerce logistics sector's exponential growth necessitates reliable carton sealing solutions capable of withstanding temperature variations during transit across the Kingdom's diverse climate zones. Sustainability considerations are gaining prominence, with manufacturers introducing bio-based formulations aligned with national environmental objectives.

Saudi Arabia Hot Melt Adhesive Market Trends:

Rising Adoption of Bio-Based and Sustainable Adhesive Formulations

The Saudi Arabia hot melt adhesive market is experiencing a notable shift towards bio-based formulations, as manufacturers align with Vision 2030 sustainability mandates. Companies are increasingly integrating renewable raw materials into their product portfolios to reduce carbon footprints while maintaining performance standards. This transition is supported by growing end user demand from the packaging, hygiene, and construction sectors seeking environmentally responsible solutions. Additionally, regulatory encouragement and corporate sustainability commitments are accelerating investments in research and development (R&D) for high-performance bio-based hot melt adhesives.

Growing Integration of Automation in Adhesive Application Systems

Manufacturing facilities across Saudi Arabia are increasingly adopting automated adhesive dispensing systems to enhance operational efficiency and product consistency. The integration of precision application equipment reduces material waste while improving throughput on high-speed production lines. This automation trend aligns with the Kingdom's broader industrial modernization objectives, particularly within packaging and assembly operations where consistent bond quality and reduced cycle times deliver competitive advantages for manufacturers serving domestic and export markets.

Expansion of Local Manufacturing Capabilities and Supply Chain Localization

The Saudi Arabia hot melt adhesive market is witnessing increased investment in domestic production infrastructure as companies respond to localization incentives. Manufacturers are expanding local manufacturing capacities to reduce import reliance, shorten supply chains, and improve responsiveness to regional demand. Government-led industrial programs encourage technology transfer and local value creation, making domestic production economically attractive. These investments also support job creation and strengthen the Kingdom’s position as a regional hub for adhesive manufacturing and distribution.

How Vision 2030 is Transforming the Saudi Arabia Hot Melt Adhesive Market:

Vision 2030 is reshaping the Saudi Arabia hot melt adhesive market by accelerating industrial diversification, infrastructure development, and domestic manufacturing growth. Large-scale construction, smart city projects, and housing developments are increasing demand for hot melt adhesives in insulation, flooring, and interior applications. The expansion of the packaging and e-commerce sectors is further boosting usage in carton sealing, labeling, and flexible packaging. Vision 2030’s focus on localizing manufacturing encourages investments in advanced adhesive production facilities, reducing import dependence. Sustainability objectives are also influencing product innovations, with manufacturers developing low volatile organic compound (VOC), energy-efficient, and recyclable-compatible hot melt formulations.

Market Outlook 2026-2034:

The Saudi Arabia hot melt adhesive market demonstrates promising growth prospects, driven by sustained industrial expansion and infrastructure development initiatives throughout the forecast period. Increasing investments in manufacturing localization, coupled with the Kingdom's strategic focus on economic diversification, create favorable conditions for adhesive consumption across multiple end-use sectors. The packaging industry's continued modernization, supported by e-commerce expansion, ensures consistent demand for high-performance bonding solutions. The market generated a revenue of USD 77.9 Million in 2025 and is projected to reach a revenue of USD 114.1 Million by 2034, growing at a compound annual growth rate of 4.33% from 2026-2034. Construction sector growth, automotive assembly expansion, and non-woven hygiene product manufacturing contribute additional demand streams, supporting market development.

Saudi Arabia Hot Melt Adhesive Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product |

Ethylene-Vinyl Acetate (EVA) |

40% |

|

Application |

Packaging |

34% |

|

Region |

Northern and Central Region |

36% |

Product Insights:

- Ethylene-Vinyl Acetate (EVA)

- Polyurethane

- Rubber

- Polyolefin

- Polyamide

- MPO

- Non-Wood Based

- Others

Ethylene-vinyl acetate (EVA) dominates with a market share of 40% of the total Saudi Arabia hot melt adhesive market in 2025.

Ethylene-vinyl acetate (EVA) leads the market, due to its exceptional balance of performance characteristics and cost efficiency. The copolymer's versatility enables reliable bonding across diverse substrates, including paper, cardboard, wood, and various plastics, making it indispensable for packaging manufacturers operating high-speed production lines. EVA-based hot melt adhesives offer fast setting times, consistent viscosity, and strong adhesion, which are critical for maintaining productivity and minimizing downtime in automated packaging operations. Their thermal stability allows effective performance across varying processing temperatures, supporting both flexible and rigid packaging applications.

Additionally, EVA formulations can be easily modified with tackifiers and additives to meet specific bonding and durability requirements. The widespread availability of EVA raw materials across the country further enhances supply reliability and price stability. These advantages make EVA a preferred choice not only in packaging but also in woodworking, bookbinding, and hygiene applications, reinforcing its dominant position within the thriving Saudi Arabia hot melt adhesive market.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Packaging

- Assembly

- Woodworking

- Automotive

- Non-Wovens

- Bookbinding

- Tape and Labels

- Others

Packaging leads with a share of 34% of the total Saudi Arabia hot melt adhesive market in 2025.

Packaging commands the largest share of the Saudi Arabia hot melt adhesive market due to the country’s expanding manufacturing and logistics ecosystem. Growth in food, beverage, consumer goods, and pharmaceutical production is driving high demand for efficient sealing and bonding solutions. As per IMARC Group, the Saudi Arabia pharmaceuticals market size reached USD 9.4 Billion in 2024. Hot melt adhesives support high-speed packaging lines by offering fast setting times, strong adhesion, and compatibility with diverse substrates such as paperboard, films, and corrugated boxes. Their reliability helps manufacturers improve productivity while maintaining packaging integrity.

Another key factor is the rapid growth of e-commerce and organized retail in Saudi Arabia, which requires durable and tamper-resistant packaging for transportation and storage. Hot melt adhesives provide clean application, reduced waste, and energy-efficient processing, aligning with operational efficiency goals. Additionally, increasing focus on sustainable and lightweight packaging solutions favors hot melts, as they enable material reduction and support recyclable packaging formats, reinforcing the packaging segment’s market dominance.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and Central Region exhibits a clear dominance with a 36% share of the total Saudi Arabia hot melt adhesive market in 2025.

Northern and Central Region's market leadership stems from Riyadh's position as Saudi Arabia's industrial and commercial hub, hosting numerous packaging converters, manufacturing facilities, and logistics centers driving adhesive consumption. The capital's construction sector experiences unprecedented demand, with Riyadh delivering around 16,200 residential units in the first half of 2024 alone, creating additional requirements for assembly and woodworking adhesive applications throughout building projects. Additionally, Riyadh’s growing industrial diversification and concentration of commercial activities attract new manufacturing ventures, further boosting hot melt adhesive demand.

Strategic infrastructure investments concentrate within this region, including mega-projects like New Murabba and King Salman Park generating sustained demand for construction-related adhesive solutions. The region benefits from established distribution networks ensuring efficient product availability, proximity to major transportation corridors facilitating raw material supply, and the presence of technical support resources enabling manufacturers to optimize adhesive application processes across diverse industrial operations. The presence of research centers and training programs in the region also helps manufacturers implement advanced adhesive technologies efficiently, enhancing overall productivity and application quality.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Hot Melt Adhesive Market Growing?

Accelerating Packaging Industry Expansion Driven by E-Commerce Growth

The Saudi Arabia hot melt adhesive market benefits substantially from the packaging sector's rapid expansion fueled by e-commerce proliferation and changing consumer purchasing behaviors. Online retail growth creates unprecedented demand for reliable carton sealing solutions capable of protecting products during transit across the Kingdom's extensive distribution networks. The Saudi Arabia e-commerce logistics market reached USD 4,578.30 Million in 2024, directly correlating with increased adhesive consumption for primary and secondary packaging applications. F&B manufacturers increasingly adopt hot melt technologies for their operational efficiency advantages, including rapid set times reducing production bottlenecks and clean application characteristics minimizing equipment maintenance requirements. The trend of employing flexible packaging formats for consumer convenience products further amplifies adhesive demand as converters require high-performance bonding solutions maintaining seal integrity throughout product lifecycles.

Robust Construction Sector Growth Under Vision 2030 Infrastructure Programs

Saudi Arabia's ambitious infrastructure development agenda creates substantial opportunities for hot melt adhesive applications in construction and woodworking segments. The Kingdom's construction industry is thriving, with projects spanning residential developments, commercial complexes, and mega-infrastructure initiatives generating sustained adhesive demand. Saudi Arabia intended to invest approximately 4.8 Billion Saudi riyals (USD 1.28 Billion) into new housing initiatives in 2025. Hot melt formulations serve essential functions in furniture manufacturing, cabinetry production, edge-banding operations, and assembly applications throughout the building materials value chain. Government-backed projects, including NEOM, Qiddiya, and Red Sea developments, require extensive finishing materials where adhesive performance directly impacts project quality and timeline adherence. The residential construction sector's expansion to meet homeownership targets specified under Vision 2030 translates into consistent demand for woodworking and assembly adhesives supporting interior finishing operations across thousands of housing units annually.

Industrial Diversification and Manufacturing Localization Initiatives

Industrial diversification and manufacturing localization initiatives are key drivers of the Saudi Arabia hot melt adhesive market, as the Kingdom seeks to reduce import dependency and strengthen domestic production under Vision 2030. Expansion of local manufacturing across the packaging, construction, automotive, and consumer goods sectors is increasing demand for reliable adhesive solutions that support high-volume and high-speed operations. Localization programs encourage companies to set up production facilities within the country, improving supply chain efficiency, shortening lead times, and reducing logistics costs. These initiatives also promote technology transfer and workforce skill development, enabling the adoption of advanced hot melt adhesive formulations tailored to local industrial needs. Furthermore, incentives for domestic production attract both global and regional players to invest in Saudi Arabia, fostering innovations, enhancing product availability, and creating a robust market ecosystem that supports sustained growth across multiple end-use industries.

Market Restraints:

What Challenges the Saudi Arabia Hot Melt Adhesive Market is Facing?

Raw Material Price Volatility Affecting Production Economics

The Saudi Arabia hot melt adhesive market faces challenges from fluctuating raw material costs, particularly for petroleum-derived resins, including EVA and styrenic block copolymers. Global crude oil price variations directly impact polymer feedstock costs, creating uncertainty in production economics and complicating pricing strategies for manufacturers serving price-sensitive industrial customers. Supply chain disruptions and demand-supply imbalances periodically affect resin availability, requiring inventory management adjustments throughout the value chain.

Performance Limitations in Extreme Temperature Applications

Standard hot melt adhesive formulations demonstrate reduced performance under extreme temperature conditions prevalent in certain Saudi Arabian environments and cold storage applications. Summer temperatures exceeding forty degrees Celsius can soften adhesive bonds during transportation and warehousing, while refrigerated storage requirements demand specialized formulations with enhanced thermal resistance. These performance constraints necessitate careful formulation selection and may limit market penetration in temperature-sensitive applications requiring premium adhesive solutions.

Competition from Alternative Bonding Technologies and Adhesive Systems

The market encounters competitive pressure from alternative adhesive technologies, including water-based systems, reactive adhesives, and mechanical fastening solutions, offering distinct advantages for specific applications. Environmental considerations increasingly favor water-based formulations eliminating VOC concerns, while reactive polyurethane adhesives provide superior performance for demanding structural bonding requirements. Manufacturers must continuously innovate to maintain market position against these competing technologies offering differentiated performance characteristics.

Competitive Landscape:

The Saudi Arabia hot melt adhesive market features a competitive landscape, comprising global adhesive manufacturers and regional producers serving diverse industrial segments. Market participants differentiate through product innovations, technical support services, and supply chain reliability ensuring consistent product availability. Companies increasingly invest in local manufacturing capabilities, responding to government localization incentives while developing sustainable formulations aligned with evolving environmental requirements. Strategic partnerships with end-user industries enable customized solution development addressing specific application challenges. Distribution network strength and technical service capabilities represent critical competitive factors as customers seek suppliers offering comprehensive support beyond product supply. The market rewards manufacturers demonstrating application expertise across packaging, construction, and assembly segments through enhanced market positioning and customer loyalty.

Saudi Arabia Hot Melt Adhesive Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Ethylene-Vinyl Acetate (EVA), Polyurethane, Rubber, Polyolefin, Polyamide, MPO, Non-Wood Based, Others |

| Applications Covered | Packaging, Assembly, Woodworking, Automotive, Non-Wovens, Bookbinding, Tape and Labels, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia hot melt adhesive market size was valued at USD 77.9 Million in 2025.

The Saudi Arabia hot melt adhesive market is expected to grow at a compound annual growth rate of 4.33% from 2026-2034 to reach USD 114.1 Million by 2034.

Ethylene-vinyl acetate (EVA) dominated the market with a share of 40%, driven by its cost-effectiveness, versatility across multiple substrates, and excellent performance in high-speed packaging applications throughout industrial manufacturing operations.

Key factors driving the Saudi Arabia hot melt adhesive market include expanding packaging industry driven by e-commerce growth, robust construction sector development under Vision 2030 initiatives, and industrial diversification programs promoting local manufacturing capabilities.

Major challenges include raw material price volatility affecting production economics, performance limitations under extreme temperature conditions, competition from alternative adhesive technologies, supply chain dependencies on imported resins, and evolving environmental regulations requiring formulation adjustments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)