Saudi Arabia Hybrid Electric Vehicle Market Size, Share, Trends and Forecast by Propulsion Type, Configuration Type, Vehicle Type, Power Source, and Region, 2026-2034

Saudi Arabia Hybrid Electric Vehicle Market Size and Share:

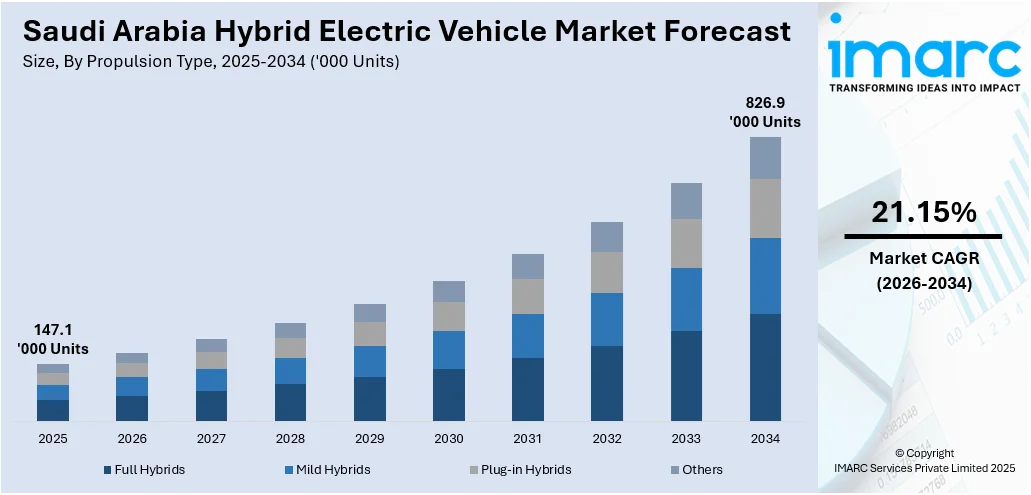

The Saudi Arabia hybrid electric vehicle market size reached 147.1 Thousand Units in 2025. Looking forward, IMARC Group expects the market to reach 826.9 Thousand Units by 2034, exhibiting a growth rate (CAGR) of 21.15% during 2026-2034. The market is advancing through a combination of Vision 2030-driven policies, infrastructure development, and ongoing improvements in hybrid technology that boost performance, efficiency, and affordability, creating a favorable environment for user adoption and strengthening the position of Saudi Arabia in clean mobility.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | 147.1 Thousand Units |

| Market Forecast in 2034 | 826.9 Thousand Units |

| Market Growth Rate 2026-2034 | 21.15% |

Saudi Arabia Hybrid Electric Vehicle Market Trends:

Government Policy and Vision 2030

Saudi Arabia's increasing focus on sustainability is at the forefront of propelling the hybrid electric vehicle (HEV) industry. Through Vision 2030, Saudi Arabia is striving to reduce its dependence on fossil fuels and create economic diversification through promoting the use of green technology. The government is introducing a mix of incentives in the form of tax relief, subsidies, and favorable regulations to promote the adoption of hybrid and electric vehicles (EVs). These policy interventions are complemented by simultaneous investments in supporting infrastructure, softening entry barriers for individuals and manufacturers into the HEV segment. For example, in 2025, E-FILL, the premier EV charging network in Saudi Arabia, announced the roll-out of fast-charging stations in strategic locations throughout the Kingdom. The new stations, equipped with DC fast chargers, are in major cities such as Riyadh, Jeddah, and the Eastern Province, facilitating the adoption of electric mobility. The move is in line with Saudi Arabia's Vision 2030 to achieve lower carbon emissions and support sustainable energy. With such a strong public and private sector alignment, the market is increasingly conducive for HEVs. The combined effect of policy support and infrastructure development is assisting in boosting both user confidence and industry participation, making HEVs a viable and attractive option in the transportation scenario.

To get more information on this market, Request Sample

Technological Advances

The ongoing innovation in hybrid powertrain technology, with newer systems offering increased efficiency, performance, and cost-effectiveness, is supporting the market's growth. Advances in battery technology, particularly in terms of lifespan, charge time, and energy density, are creating cars that are not just more fuel-efficient but also more suited to the driving conditions of the region. Upgrades to energy management systems and the use of smart controls are enhancing hybrids' responsiveness and dependability, overall user experience. These new technologies are helping change user perceptions so that hybrids are now seen as a sustainable and sensible option. Emphasizing this focus on advanced innovation, in 2024, Saudi electric vehicle manufacturer Ceer entered into a strategic partnership with Croatia's Rimac Technology to jointly develop high-performance electric drive systems. This tie-up marks an important step in building local expertise while tapping global knowledge in the field of electric mobility. These innovations in next-generation powertrain development consolidate the ambitions of Saudi Arabia to go beyond being just a user in the HEV market but also signals its intent to become a center of automotive innovation. As these developments continue, they are building on robust fundamentals for long-term market growth and technological leadership.

Growing Environmental Awareness and Concerns

Increasing awareness among the Saudi public regarding environmental concerns, including the detrimental effects of automobile emissions, is rising. The public is becoming aware about the need to mitigate air pollution and carbon footprints. With tightening global environmental standards, demand for environment friendly solutions, such as hybrid cars, is growing. Customers are turning to HEVs, which provide less fuel usage and emissions than traditional internal combustion engine (ICE) vehicles. This trend is being led by the young generation, who are more eco-conscious and seeking cleaner modes of transportation. As sustainability efforts and awareness campaigns build momentum, consumer demand for electric and hybrid vehicles continues to build, driving automakers to add more models to the Saudi market. The shift towards cleaner technologies is also fueling the adoption of HEVs. In 2025, While participating in a panel discussion at the Qatar Economic Forum in Doha, Minister of Industry and Mineral Resources Bandar Alkhorayef remarked that Saudi Arabia’s drive for EV production highlights the Kingdom’s dedication to developing a contemporary and sustainable economy. His remarks arise as Saudi Arabia increases initiatives to establish itself as a regional center for car production, especially in electric vehicles. Supported by the Public Investment Fund, the Kingdom has put money into projects like the US company Lucid Motors, which is constructing a manufacturing plant in King Abdullah Economic City. In line with its extensive diversification efforts, Saudi Arabia plans to manufacture more than 300,000 vehicles each year by 2030.

Saudi Arabia Hybrid Electric Vehicle Market Growth Drivers:

EV Infrastructure Development

Electric vehicle (EV) infrastructure in Saudi Arabia is expanding at a rapid rate, and this is a significant driver of the HEV market. The nation is heavily investing in charging points to enable hybrid and electric cars in prominent cities and highways. Private and public sector partnerships are in progress to increase the EV infrastructure to allow consumers to easily switch to HEVs. Charging spots are being strategically located in prime areas like malls, fuel stations, and residential zones, diminishing the fear of sparse charging access. Moreover, the government is also driving collaborations with international EV charging companies to introduce innovative charging technologies into Saudi Arabia. The increased availability of charging stations is motivating increasing numbers of consumers to look toward buying hybrid cars, as the presence of charging infrastructure will directly impact the convenience and feasibility of having an HEV. This factor is playing a key role in driving the growth of the market.

Economic Diversification and Vision 2030

Vision 2030, Saudi Arabia's economic diversification plan, is pushing the country towards increasing economic diversification, aiming to decrease its reliance on oil and encouraging sustainability in all sectors. The hybrid electric vehicle market is directly influenced by this plan, with large investments being made in green technologies and infrastructure development. Vision 2030 stresses the need to transition to cleaner energy, and hybrid vehicles are viewed as part of the process. The state is promoting the use of energy-efficient vehicles as part of its general goal of sustainability, and this has necessitated a growing number of HEVs on the roads. By this vision, Saudi Arabia is becoming a world leader in the transition to clean energy technologies, which is giving an environment-friendly drive to the hybrid vehicle market growth. This is also creating an ecosystem involving the manufacturing, research, and innovation of hybrid vehicles.

Rising Fuel Prices and Economic Incentives

Escalating fuel costs are compelling Saudi consumers to turn to different transportation options, stimulating the demand for hybrid electric vehicles. Saudi Arabia once boasted some of the lowest gasoline prices in the world, but recent economic measures have witnessed fuel prices rising gradually. This is prompting consumers to look at cars with improved fuel efficiency, including hybrids that combine the use of an electric motor and an internal combustion engine. HEVs enable drivers to save on their fuel intake a great deal, particularly when driving through city centers where stop-and-go traffic is experienced. The economic benefits of lower road tax rates and hybrid car maintenance as well are also adding to their popularity. With fuel prices remaining volatile, consumers are increasingly seeking economical, fuel-efficient substitutes for conventional gasoline-fueled vehicles, driving the HEV market.

Saudi Arabia Hybrid Electric Vehicle Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on propulsion type, configuration type, vehicle type, and power source.

Propulsion Type Insights:

- Full Hybrids

- Mild Hybrids

- Plug-in Hybrids

- Others

The report has provided a detailed breakup and analysis of the market based on the propulsion type. This includes full hybrids, mild hybrids, plug-in hybrids, and others.

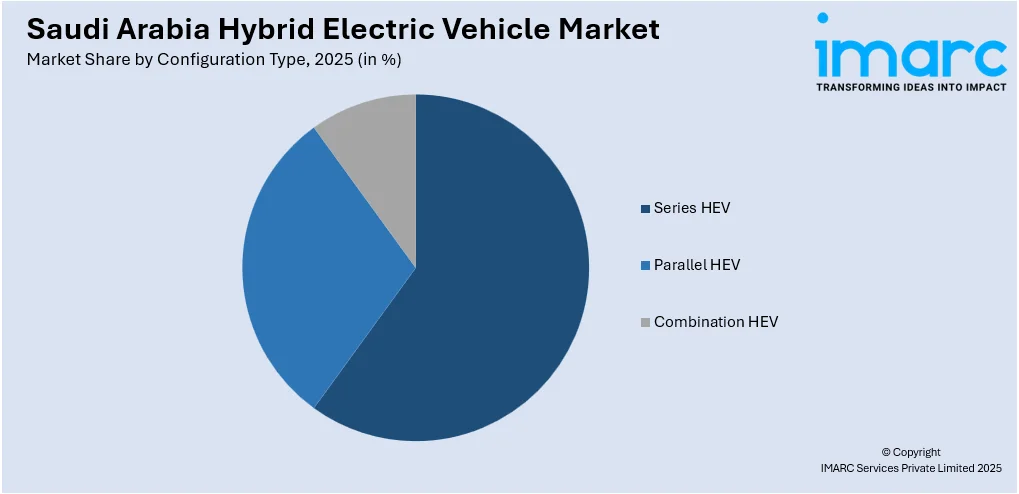

Configuration Type Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Series HEV

- Parallel HEV

- Combination HEV

A detailed breakup and analysis of the market based on the configuration type have also been provided in the report. This includes series HEV, parallel HEV, and combination HEV.

Vehicle Type Insights:

- Passenger Cars

- Commercial Vehicles

- Two-Wheelers

- Others

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes passenger cars, commercial vehicles, two-wheelers, and others.

Power Source Insights:

- Stored Electricity

- On Board Electric Generator

A detailed breakup and analysis of the market based on the power source have also been provided in the report. This includes stored electricity and on board electric generator.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Hybrid Electric Vehicle Market News:

- In September 2025, Al-Futtaim BYD KSA held its first Super Hybrid Tech Day at the BYD Showroom and Discovery Centre in Saudi Arabia. The event provided media, influencers, customers, and sub-dealers an exclusive chance to experience BYD's advanced hybrid innovations for the first time in the Kingdom. The Super Hybrid Tech Day showcased BYD's groundbreaking Dual Mode technology. This internally created plug-in hybrid system merges the ease of fuel refilling with the effectiveness of electric driving.

- In August 2025, Al Ghurair Mobility has signed a deal with China’s Dongfeng Motor Corporation to introduce the premium car brands MHero and Voyah in Saudi Arabia, representing a significant step in its regional growth. As per a recent press statement, the collaboration will bring forth innovative new energy and hybrid vehicles designed for the Kingdom, in line with Saudi Arabia’s Vision 2030 objectives of sustainable transport and economic diversification. Supported by Al Ghurair’s service network, the brands guarantee a blend of performance, innovation, and luxury.

- In August 2025, During the 2025 Chengdu International Auto Show, Smart captured attention by unveiling its innovative EHD Super Hybrid technology. With this launch, the brand stepped into what it terms the smart 2.0 era, merging fully electric cars with plug-in hybrid versions. This twofold approach enables Smart, the German-Chinese brand, to cater to a broader spectrum of customers globally while strengthening its foothold in essential markets. The announcement accompanied the brand's formal entry into Saudi Arabia via a strategic alliance with Juffali Automotive Company, signifying a major achievement for Smart in the area.

- In April 2025, Tesla electric vehicle firm, owned by billionaire Elon Musk, launched its inaugural showroom in the oil-rich nation of Saudi Arabia, where hybrid cars remain relatively rare.

- In May 2024, BYD opened its first showroom in Saudi Arabia in Riyadh's Al Ghader district, showcasing both battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs) like the Qin Plus and Song Plus. The showroom, built with Al-Futtaim Electric Mobility Company, also featured models such as the Han EV, Atto 3, and Seal EV. BYD aimed to expand its presence in Saudi Arabia with more stores and a local new energy ecosystem.

- In February 2024, Al-Futtaim Electric Mobility Company launched BYD, the world's top-selling brand of New Energy Vehicles (NEV), in Saudi Arabia. This move marked a significant step towards sustainable transportation, aligning with Saudi Vision 2030. The event was celebrated across major cities and introduced electric and hybrid vehicles, including the BYD HAN, ATTO 3, and SEAL, to Saudi Arabia.

Saudi Arabia Hybrid Electric Vehicle Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Thousand Units |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Propulsion Types Covered | Full Hybrids, Mild Hybrids, Plug-in Hybrids, Others |

| Configuration Types Covered | Series HEV, Parallel HEV, Combination HEV |

| Vehicle Types Covered | Passenger Cars, Commercial Vehicles, Two-Wheelers, Others |

| Power Sources Covered | Stored Electricity, On Board Electric Generator |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia hybrid electric vehicle market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia hybrid electric vehicle market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia hybrid electric vehicle industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The hybrid electric vehicle market in Saudi Arabia reached 147.1 Thousand Units in 2025.

The Saudi Arabia hybrid electric vehicle market is projected to exhibit a CAGR of 21.15% during 2026-2034, reaching a volume of 826.9 Thousand Units by 2034.

Key factors driving the Saudi Arabia hybrid electric vehicle market include government incentives and policy support, rising environmental awareness, advancements in hybrid technology, development of EV infrastructure, economic diversification under Vision 2030, and increasing fuel prices, which encourage consumers to opt for more fuel-efficient and eco-friendly transportation options.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)