Saudi Arabia Hydroponics Market Size, Share, Trends and Forecast by Type, Crop Type, Equipment, and Region, 2026-2034

Saudi Arabia Hydroponics Market Overview:

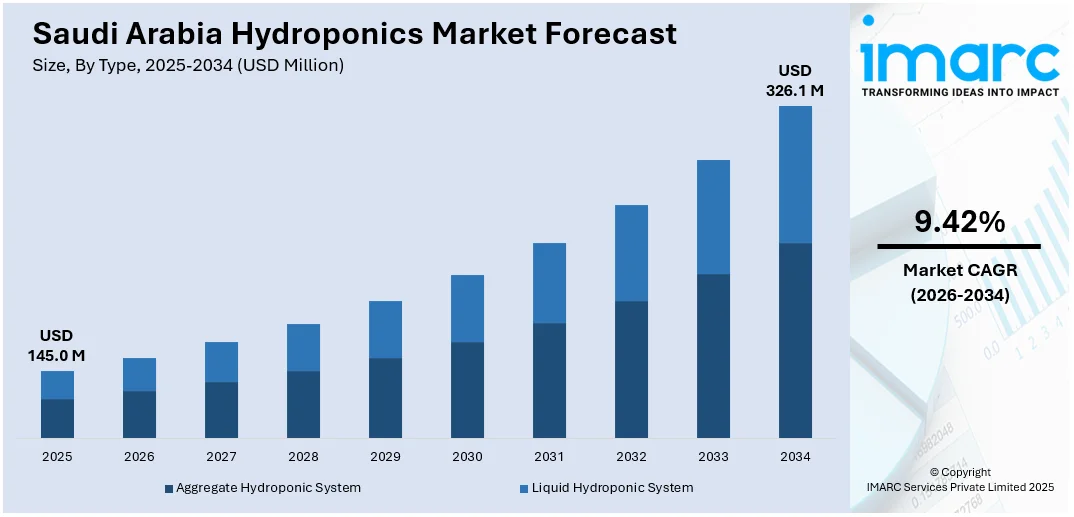

The Saudi Arabia hydroponics market size reached USD 145.0 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 326.1 Million by 2034, exhibiting a growth rate (CAGR) of 9.42% during 2026-2034. The increasing demand for sustainable farming, implementation of government initiatives supporting food security, rising awareness about pesticide-free produce, adoption of advanced agri-tech, expanding urban farming trends, and the need to reduce dependency on food imports are some of the factors contributing to significant market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 145.0 Million |

| Market Forecast in 2034 | USD 326.1 Million |

| Market Growth Rate 2026-2034 | 9.42% |

Saudi Arabia Hydroponics Market Trends:

Expansion of Controlled Environment Agriculture (CEA)

Controlled Environment Agriculture (CEA) is gaining prominence in Saudi Arabia due to its compatibility with the country's arid climate and limited arable land, which is propelling Saudi Arabia's hydroponics market growth. According to industry report, the nation experiences extreme climatic conditions, with average annual rainfall at just 59 mm and summer temperatures reaching up to 55 °C. Over 90% of the country is covered in desert terrain, and it lacks any natural lakes or rivers, making traditional agriculture highly critical. In this context, hydroponics, which is an integral element of CEA offers a viable alternative by enabling food cultivation with significantly lower water consumption and without the need for fertile soil. These systems are particularly well-suited to Saudi Arabia's resource-constrained environment, offering consistent and scalable crop production regardless of outdoor weather conditions. The growing relevance of hydroponics is further underscored by national programs such as the Saudi Green Initiative and Vision 2030, which prioritize advanced agricultural practices to strengthen food security, promote sustainability, and reduce reliance on imported produce. This convergence of climate-driven necessity and strategic policy support is accelerating the development of the hydroponics market across the Kingdom. In addition to this, private sector players and agritech startups are collaborating with research institutions to develop localized hydroponic systems tailored to desert conditions. These efforts reflect a broader trend of embedding hydroponics within CEA frameworks to create scalable, resilient agricultural infrastructure in Saudi Arabia.

To get more information on this market Request Sample

Integration of Digital Agriculture Technologies

The growing adoption of advanced agricultural technologies and digital solutions within hydroponic systems is enhancing efficiency, precision, and sustainability, which is also creating a positive Saudi Arabia hydroponics market outlook. This technological shift is driven by national priorities, as outlined in Vision 2030, which includes a comprehensive USD 10 Billion strategy to strengthen global food supply chains and enhance domestic agricultural output. Within this framework, hydroponics is emerging as a key solution for sustainable food production, particularly in water-scarce and arid environments. Farmers and agritech companies in Saudi Arabia are actively deploying Internet of Things (IoT) devices to monitor nutrient concentrations, pH levels, and temperature in real-time. These smart systems enable highly controlled growing environments, which are essential for optimizing crop yields and minimizing input waste. Data collected from sensors is processed through cloud-based analytics platforms, offering actionable insights that support early detection of plant stress and more responsive farm management. Besides this, the emergence of mobile apps and remote monitoring tools is enabling remote farm management, especially for investors operating multiple sites. These digital solutions are further promoted through public-private partnerships aimed at training farmers and entrepreneurs in smart agriculture. The adoption of such technologies is augmenting Saudi Arabia hydroponics market share, positioning hydroponics as a data-driven, high-yield farming model.

Saudi Arabia Hydroponics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type, crop type, and equipment.

Type Insights:

- Aggregate Hydroponic System

- Closed System

- Opened System

- Liquid Hydroponic System

The report has provided a detailed breakup and analysis of the market based on the type. This includes aggregate hydroponic system (closed system and opened system) and liquid hydroponic system.

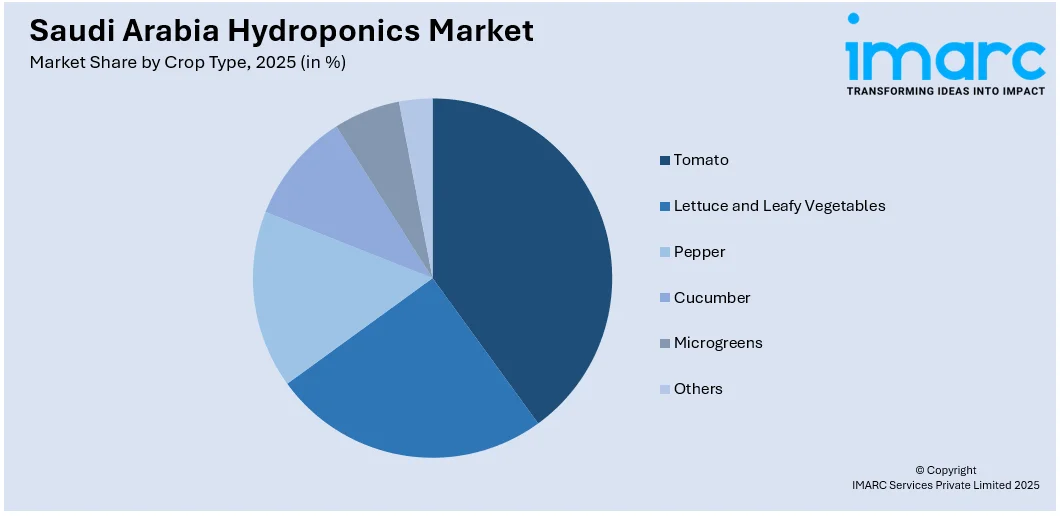

Crop Type Insights:

Access the comprehensive market breakdown Request Sample

- Tomato

- Lettuce and Leafy Vegetables

- Pepper

- Cucumber

- Microgreens

- Others

A detailed breakup and analysis of the market based on the crop type have also been provided in the report. This includes tomato, lettuce and leafy vegetables, pepper, cucumber, microgreens, and others.

Equipment Insights:

- HVAC

- LED Grow Light

- Irrigation Systems

- Material Handling

- Control Systems

- Others

The report has provided a detailed breakup and analysis of the market based on the equipment. This includes HVAC, LED grow light, irrigation systems, material handling, control systems, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Hydroponics Market News:

- On January 22, 2025, Saudi agritech startup Arable announced the successful closure of a USD 2.55 Million seed funding round, with 90% of the investment sourced from foreign investors. Arable specializes in designing hydroponic farming systems tailored to Saudi Arabia's arid climate, enabling facilities to be established four times faster and at significantly reduced costs compared to traditional methods. This initiative is in line with Saudi Arabia's Vision 2030 goals, which include increasing food security, lowering dependency on imports, and establishing the Kingdom as a pioneer in sustainable farming.

Saudi Arabia Hydroponics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Crop Types Covered | Tomato, Lettuce and Leafy Vegetables, Pepper, Cucumber, Microgreens, Others |

| Equipment Covered | HVAC, LED Grow Light, Irrigation Systems, Material Handling, Control Systems, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia hydroponics market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia hydroponics market on the basis of type?

- What is the breakup of the Saudi Arabia hydroponics market on the basis of crop type?

- What is the breakup of the Saudi Arabia hydroponics market on the basis of equipment?

- What is the breakup of the Saudi Arabia hydroponics market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia hydroponics market?

- What are the key driving factors and challenges in the Saudi Arabia hydroponics market?

- What is the structure of the Saudi Arabia hydroponics market and who are the key players?

- What is the degree of competition in the Saudi Arabia hydroponics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia hydroponics market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia hydroponics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia hydroponics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)