Saudi Arabia Hydropower Equipment Market Size, Share, Trends and Forecast by Type, Application, and Region, 2026-2034

Saudi Arabia Hydropower Equipment Market Overview:

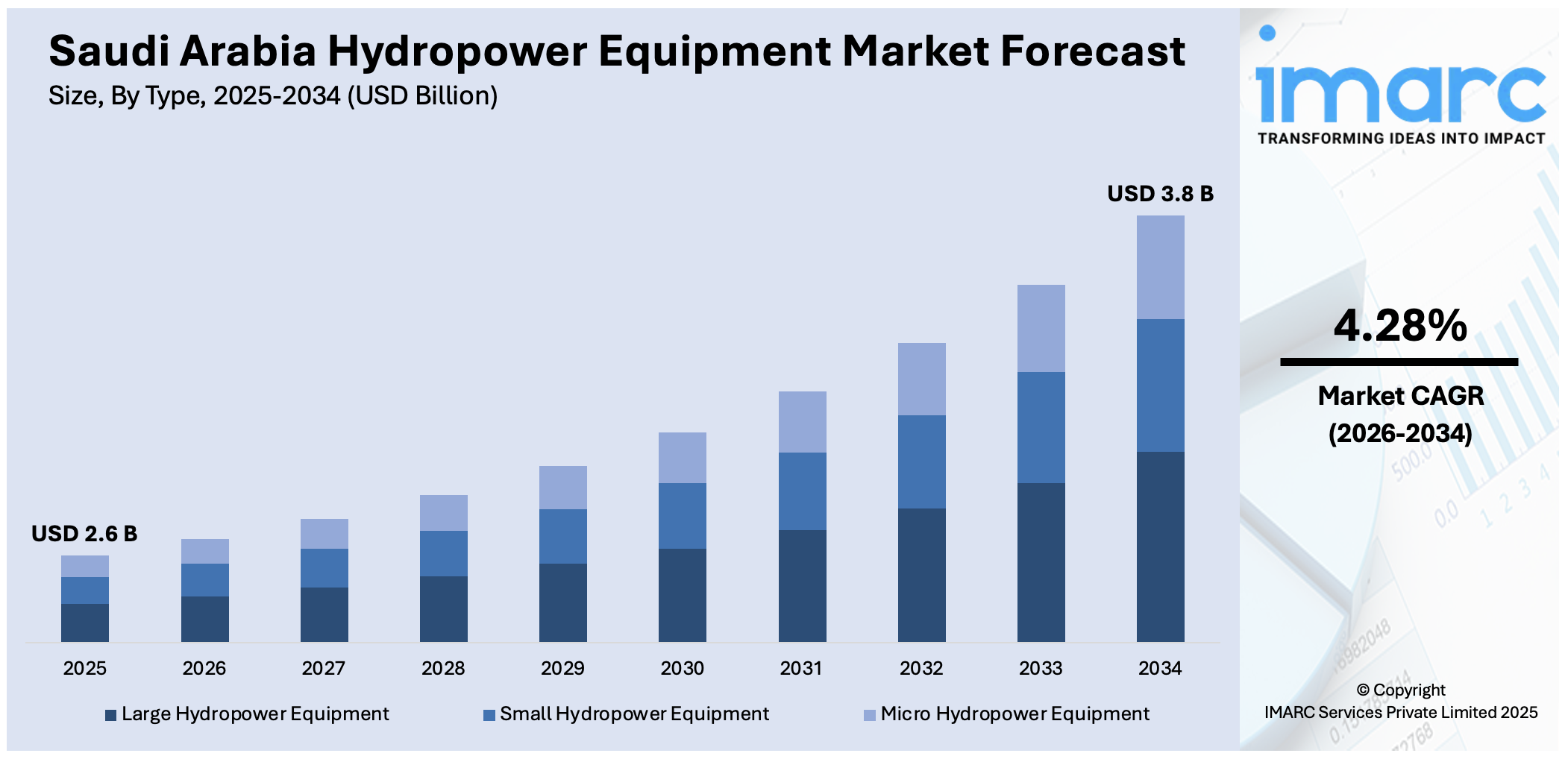

The Saudi Arabia hydropower equipment market size reached USD 2.6 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 3.8 Billion by 2034, exhibiting a growth rate (CAGR) of 4.28% during 2026-2034. Growing energy demand, government investments in renewable energy, and environmental goals are some of the factors contributing to Saudi Arabia hydropower equipment market share. The push for sustainable energy sources, coupled with the country's Vision 2030 plan, fosters increased adoption of hydropower and infrastructure development.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 2.6 Billion |

| Market Forecast in 2034 | USD 3.8 Billion |

| Market Growth Rate 2026-2034 | 4.28% |

Saudi Arabia Hydropower Equipment Market Trends:

Growing Investment in Renewable Energy Infrastructure

Saudi Arabia is increasingly prioritizing the construction of renewable energy infrastructure, with major investments in cutting-edge transmission systems to enable the connection and integration of renewable energy resources. Gigantic projects are coming up that include the installation of high-capacity HVDC systems, with the objective of transmitting power from renewable sources like hydropower efficiently. Such efforts fall in line with the nation's overall sustainability visions under Vision 2030. As the grid is upgraded to support renewable energy, the need for specialized equipment for hydropower, such as conversion and transmission technology, is likely to increase. This realignment is a demonstration of the nation's drive toward realizing energy security while lessening the use of fossil fuels, thus presenting new business opportunities in the hydropower equipment sector. These factors are intensifying the Saudi Arabia hydropower equipment market growth. For example, in May 2023, Hitachi Energy signed agreements with ENOWA and Saudi Electricity Company to design and develop the first phase of the NEOM region’s transmission system. The agreements include supplying three HVDC systems with a total power capacity of 9 GW. This collaboration supports Saudi Arabia’s Vision 2030, aiming to integrate renewable energy sources and enhance sustainable grid infrastructure in the country, fostering the growth of the hydropower equipment market.

To get more information on this market Request Sample

Localizing Renewable Energy Technology Production

Saudi Arabia is increasingly focusing on developing local expertise and manufacturing capabilities for renewable energy technologies, including hydropower equipment. The country’s emphasis on Vision 2030 is driving a shift toward local production and assembly of critical energy infrastructure components, such as HVDC converter stations and power transformers. By establishing local manufacturing plants and creating partnerships with global energy firms, Saudi Arabia aims to reduce reliance on imports and stimulate its economy. The push for local production is further supported by the country's abundant renewable resources, such as solar and wind, which will complement hydropower projects. Through collaborations with domestic service providers, the transfer of knowledge and skills is expected to bolster the local workforce and promote sustainable energy practices. Moreover, the development of local competencies is seen as essential for building long-term energy security, ensuring the country can effectively maintain and upgrade its energy infrastructure. As a result, the hydropower equipment market will benefit from an increased demand for domestically produced equipment, accelerating the growth of local manufacturing in the renewable energy sector.

Saudi Arabia Hydropower Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type and application.

Type Insights:

- Large Hydropower Equipment

- Small Hydropower Equipment

- Micro Hydropower Equipment

The report has provided a detailed breakup and analysis of the market based on the type. This includes large hydropower equipment, small hydropower equipment, and micro hydropower equipment.

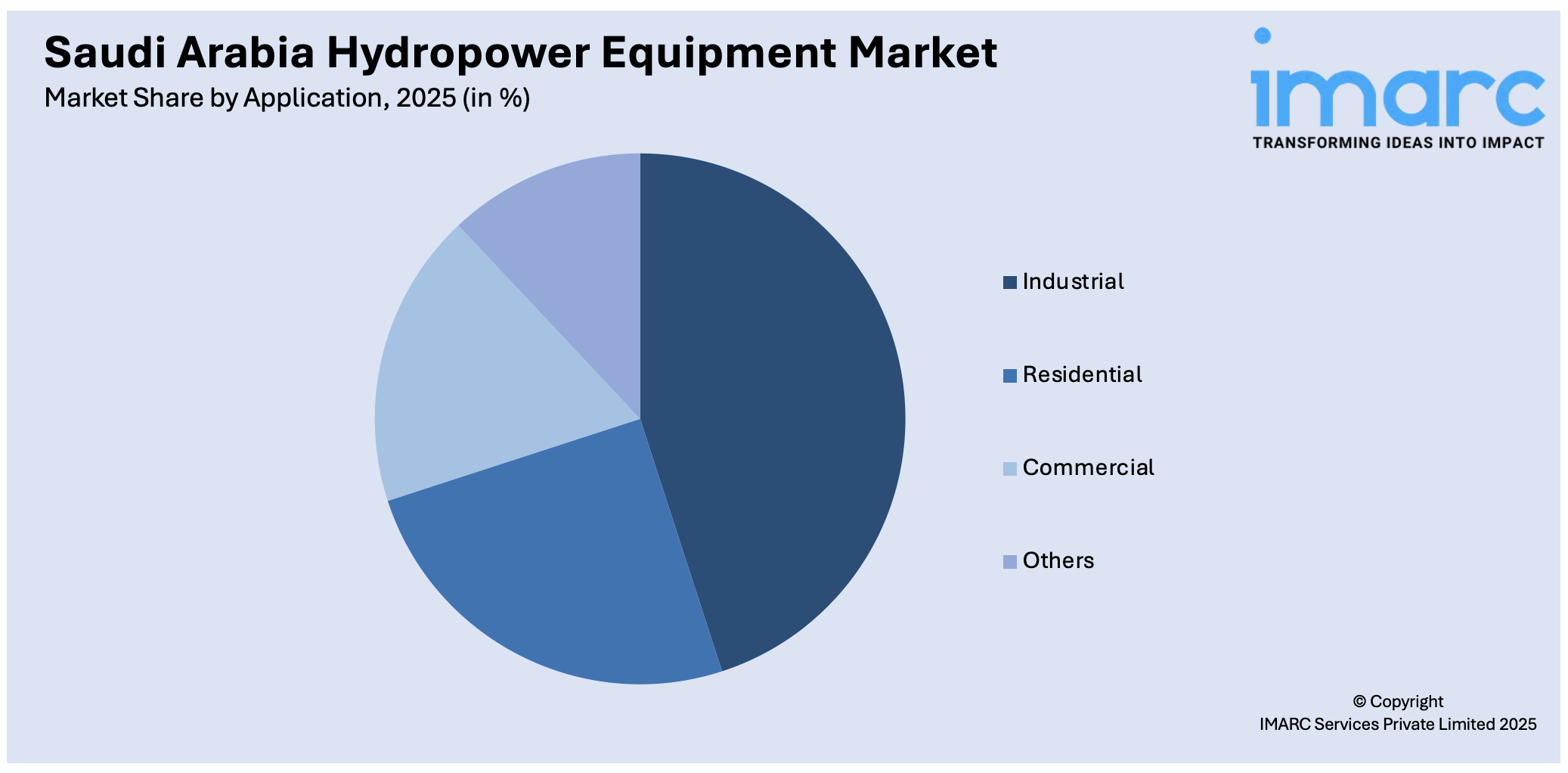

Application Insights:

Access the comprehensive market breakdown Request Sample

- Industrial

- Residential

- Commercial

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes industrial, residential, commercial, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Hydropower Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Large Hydropower Equipment, Small Hydropower Equipment, Micro Hydropower Equipment |

| Applications Covered | Industrial, Residential, Commercial, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia hydropower equipment market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia hydropower equipment market on the basis of type?

- What is the breakup of the Saudi Arabia hydropower equipment market on the basis of application?

- What is the breakup of the Saudi Arabia hydropower equipment market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia hydropower equipment market?

- What are the key driving factors and challenges in the Saudi Arabia hydropower equipment market?

- What is the structure of the Saudi Arabia hydropower equipment market and who are the key players?

- What is the degree of competition in the Saudi Arabia hydropower equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia hydropower equipment market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia hydropower equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia hydropower equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)