Saudi Arabia Ice Cream Market Report by Flavor (Vanilla, Chocolate, Fruit, and Others), Category (Impulse Ice Cream, Take-Home Ice Cream, Artisanal Ice Cream), Product (Cup, Stick, Cone, Brick, Tub, and Others), Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Ice Cream Parlors, Online Stores, and Others), and Region 2026-2034

Market Overview:

Saudi Arabia ice cream market size reached USD 810.6 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,066.9 Million by 2034, exhibiting a growth rate (CAGR) of 3.10% during 2026-2034. The expansion of international and local ice cream brands, high income level of individuals, and rising collaborations between ice cream manufacturers and popular food and beverage (F&B) brands represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 810.6 Million |

|

Market Forecast in 2034

|

USD 1,066.9 Million |

| Market Growth Rate 2026-2034 | 3.10% |

Ice cream is prepared using cream, milk, sugar, and flavorings. It is churned while freezing to incorporate air, resulting in a smooth and creamy texture. It is sweetened with sugar and stored and served at a freezing temperature to maintain its solid form. It is available in a wide range of flavors, ranging from classic vanilla and chocolate to exotic options like mango or cookie dough. It can be customized with various toppings and served in various forms, such as cones, cups, or as part of sundaes. It provides relief from heat and is a refreshing dessert option. It often serves as a social treat, bringing people together for celebrations and gatherings. It is widely used as an ingredient in creating other desserts, such as cakes or milkshakes. Besides this, as it is enjoyed by people of all ages, the demand for ice cream is increasing across Saudi Arabia.

Saudi Arabia Ice Cream Market Trends:

Changing Consumer Preferences

In Saudi Arabia, consumer preferences are rapidly evolving, creating new opportunities for the ice cream industry. The younger generation is progressively looking for distinctive tastes and inventive dishes, moving away from conventional favorites. The 2024 Saudi Family Statistics Report from the General Authority for Statistics (GASTAT) indicated that roughly 71 percent of the population is below the age of 35, with an average age of 26.6 years and a median age of 23.5. This youthful demographic is creating a need for a variety of luxurious dessert selections, featuring premium ingredients and health-oriented options. With the growing consciousness about healthier lifestyles, there is a rise in the demand for low-fat, dairy-free, and sugar-free ice creams, serving consumers who wish to indulge while considering their health. The contemporary retail environment is further facilitating this change by improving access to numerous ice cream brands and types, promoting experimentation and creativity within the market.

Expansion of Retail Channels

The Saudi Arabian ice cream market growth is significantly influenced by the expansion of retail channels as they increase product accessibility and consumer reach across the Kingdom. Supermarkets, convenience shops, and specialized ice cream shops are growing in number, especially in city regions, enhancing ice cream accessibility for shoppers. According to the IMARC Group, the retail market size in Saudi Arabia was estimated at USD 282.2 Billion in 2024, highlighting the substantial growth opportunities in the industry. This accessibility is leading to increased consumption levels. Moreover, the increasing popularity of online food delivery services is opening new avenues for ice cream brands to connect with a wider audience, providing convenience and prompt delivery options. Specialized stores centered on frozen desserts, like exclusive ice cream shops, are improving consumer experiences by developing engaging atmospheres. These establishments frequently highlight premium and handcrafted ice cream, appealing to affluent clients in search of top-notch, distinct offerings. Retailers are leveraging this trend by providing unique packaging and tailored services to stand out in a competitive market.

Rise of Collaborations and Brand Partnerships

Collaborations between ice cream brands and various industries or famous products are emerging as an effective marketing tactic in Saudi Arabia. By teaming up with well-known chocolate or candy brands and developing ice cream adaptations of famous drinks, these partnerships generate excitement and draw in fresh customers. For instance, ice cream companies are progressively introducing co-branded flavors alongside international snack or drink firms, such as merging ice cream with coffee brands, chocolate makers, or well-known cookie items. These collaborations aim to leverage the existing user base of these brands, enhancing the appeal of ice cream products to a wider audience. Moreover, collaborations with local chefs or celebrities are enabling ice cream brands to attract attention and build trust in the market, generating distinctive products that entice consumers interested in sampling exclusive, limited-edition items. These partnerships are crucial in fostering innovation and maintaining the market's novelty and excitement.

Saudi Arabia Ice Cream Market Growth Drivers:

Product Innovations and Experiences

The ice cream sector in Saudi Arabia is progressively influenced by creative consumer experiences, as brands introduce unique flavors, interactive store concepts, and customizable offerings to attract a younger, trend-conscious audience. Ice cream companies are expanding past conventional products and exploring innovative methods to connect with consumers, such as providing interactive experiences in stores or via mobile applications. Certain ice cream parlors now offer personalized options, allowing patrons to select their ingredients or witness the ice cream being prepared before their eyes with liquid nitrogen for an engaging display. Pop-up events and ice cream festivals are also becoming popular, enabling brands to present new flavors and innovative ideas. These advancements not only attract individuals seeking novelty but also establish ice cream shops as lifestyle hubs. Emphasizing experiential marketing fosters brand loyalty and encourages word-of-mouth referrals, which assists in market expansion and boosts consumer engagement.

Increased Focus on Local and Sustainable Sourcing

Sustainability is emerging as a crucial trend in Saudi Arabia, as consumers are becoming aware about the environmental effects of their buying choices. This change is influencing the ice cream industry, as numerous brands emphasize local ingredient sourcing and implement environment-friendly practices in their operations. By utilizing local ingredients, ice cream makers are minimizing their carbon emissions, supporting local farming, and offering consumers fresher, more sustainable goods. Furthermore, packaging is gaining importance for various ice cream brands, with a growing demand for recyclable, biodegradable, or reusable options. Consumers are attracted to brands that emphasize sustainability and ethical sourcing, benefiting the environment while aligning with increasing consumer demands for transparency and responsible manufacturing practices. The shift toward sustainability influenced the Saudi Arabia ice cream market size 2024, with more brands presenting themselves as eco-friendly options.

Growth of Tourism and Hospitality Sector

The growth of the tourism and hospitality sector in Saudi Arabia is another key driver for the ice cream market. With the country's Vision 2030 initiative aiming to boost tourism, there is an increase in both domestic and international visitors, contributing to higher demand for food and beverages, including ice cream. In December 2024, the UN Tourism stated that Saudi Arabia secured the third position worldwide in the growth rate of international tourist arrivals, achieving a 61% rise in the initial eight to nine months of 2024 compared to the same timeframe in 2019. With the increasing number of people visiting to major cities like Riyadh, Jeddah, and Mecca, the demand for varied culinary experiences is growing. Hotels, resorts, and tourist destinations are providing high-end ice cream selections to accommodate global visitors. Additionally, various tourist-focused spots are incorporating local tastes or fusion ideas, bringing a creative touch to classic ice cream. This advancement in the hospitality industry not only boosts the visibility of ice cream brands but also creates new opportunities for vendors to broaden their presence in tourist-dense regions.

Saudi Arabia Ice Cream Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on flavor, category, product, and distribution channel.

Flavor Insights:

To get more information on this market, Request Sample

- Vanilla

- Chocolate

- Fruit

- Others

The report has provided a detailed breakup and analysis of the market based on the flavor. This includes vanilla, chocolate, fruit, and others.

Category Insights:

- Impulse Ice Cream

- Take-Home Ice Cream

- Artisanal Ice Cream

A detailed breakup and analysis of the market based on the category have also been provided in the report. This includes impulse ice cream, take-home ice cream, and artisanal ice cream.

Product Insights:

- Cup

- Stick

- Cone

- Brick

- Tub

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes cup, stick, cone, brick, tub, and others.

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Ice Cream Parlors

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, ice cream parlors, online stores, and others.

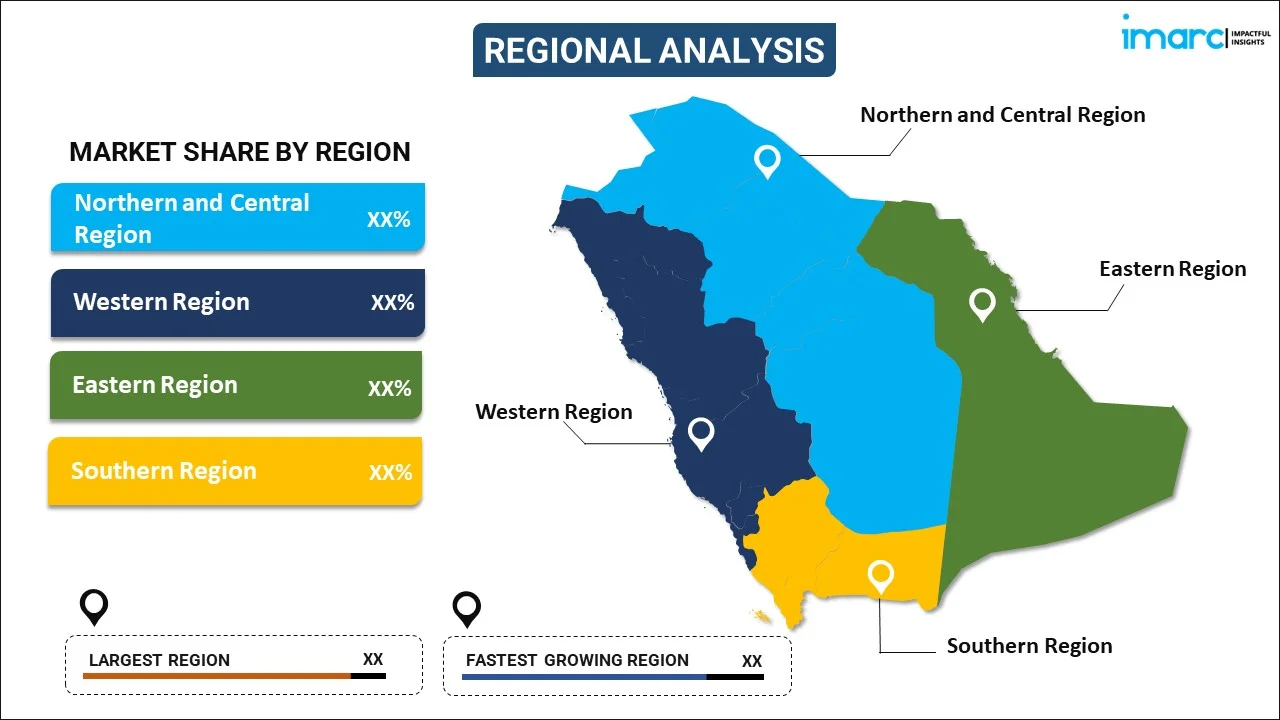

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latest News and Developments:

- In July 2025, Milky Ice Cream launched new flagship cafes in Sharjah, UAE and Riyadh, Saudi Arabia as part of its Middle East expansion. The brand offers handcrafted ice cream, gourmet desserts, and drinks made with natural ingredients.

- In May 2025, Saudia Dairy & Foodstuff Company (SADAFCO), the market leader in long-life (UHT) milk, tomato paste and ice cream, announced a strategic partnership with SAP and NTT DATA-IGSA to drive its digital transformation and sustainability goals. The collaboration will implement SAP’s intelligent ERP system to enhance operations, customer experience, and ESG performance.

- In April 2025, Egypt’s popular Dara’s Ice Cream opened its first Jeddah outlet at La Paz Plaza, following success in Cairo and Riyadh. Known for fresh, small-batch gelato made with natural ingredients, it offers crowd-favorites like Honeycomb and Belgian Chocolate. The parlor combines nostalgic vibes with rich flavors, quickly becoming a local sensation.

- In February 2025, Ola Kayal announced the upcoming launch of Nabati Eatery in Jeddah’s Al Rawdah district, offering a fully plant-based, gluten-free, and organic dining experience. The menu will include innovative dishes and vegan ice cream made with cashew and coconut milk. The eatery emphasizes sustainability, local sourcing, and clean eating.

- In August 2024, Shin-Line Group (Kazakhstan) and Al-alameya Group (Saudi Arabia) signed an agreement to build an ice cream factory in Saudi Arabia. The project was backed by regional authorities and aimed to boost Shin-Line’s export potential. The first batch of locally produced ice cream was expected to hit stores in 2025.

- In August 2024, Creative Eats Studio, led by Saudi chef Eman Fallatah, launched a line of gourmet ice cream sandwiches inspired by nostalgic childhood treats. The three handcrafted flavors included The Original, Tout Ya Chocolatah, and La Togla, made with premium ingredients. The initiative supported local hiring, women's empowerment, and farm-to-fork values.

Saudi Arabia Ice Cream Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Flavors Covered | Vanilla, Chocolate, Fruit, Others |

| Categories Covered | Impulse Ice Cream, Take-Home Ice Cream, Artisanal Ice Cream |

| Products Covered | Cup, Stick, Cone, Brick, Tub, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Ice Cream Parlors, Online Stores, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia ice cream market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia ice cream market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia ice cream industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The ice cream market in Saudi Arabia was valued at USD 810.6 Million in 2025.

The Saudi Arabia ice cream market is projected to exhibit a CAGR of 3.10% during 2026-2034, reaching a value of USD 1,066.9 Million by 2034.

The Saudi Arabia ice cream market growth is driven by changing consumer preferences, increased demand for premium and innovative flavors, and rising interest in health-conscious options. Additionally, the expanding retail network and growing popularity of quick-service restaurants are increasing the availability and consumption of ice cream products.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)