Saudi Arabia Immunity Boosting Food Products Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2026-2034

Saudi Arabia Immunity Boosting Food Products Market Summary:

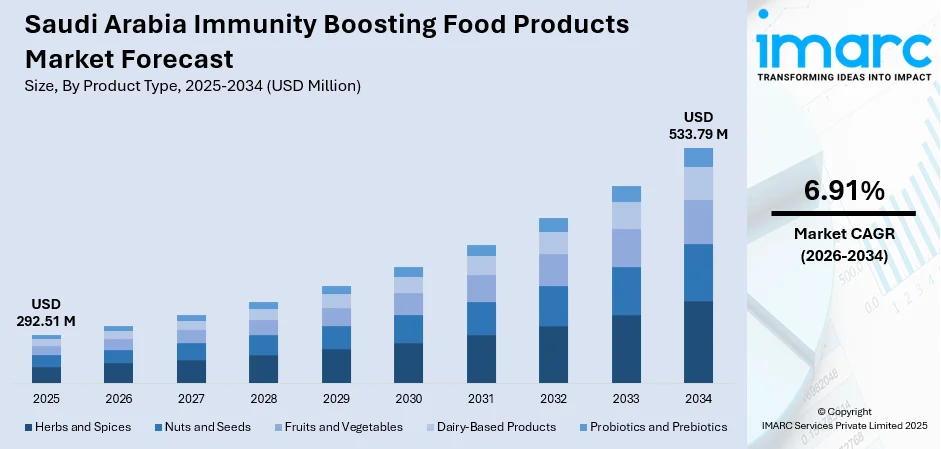

The Saudi Arabia immunity boosting food products market size was valued at USD 292.51 Million in 2025 and is projected to reach USD 533.79 Million by 2034, growing at a compound annual growth rate of 6.91% from 2026-2034.

The Saudi Arabian market for immunity-boosting food products is seeing robust growth, propelled by heightened consumer awareness of health and an increasing emphasis on preventive healthcare. The rising prevalence of lifestyle-related disorders, changing dietary habits, and government initiatives under Saudi Vision 2030 are encouraging consumers to incorporate immunity-enhancing foods into their daily routines. The expanding retail infrastructure, coupled with digital transformation in the food sector, is making these products more accessible across urban and rural areas, thereby strengthening the Saudi Arabia immunity boosting food products market share.

Key Takeaways and Insights:

- By Product Type: Fruits and Vegetables dominate the market with a share of 25% in 2025, driven by growing consumer preference for natural, nutrient-rich foods that provide essential vitamins and antioxidants for immune system support.

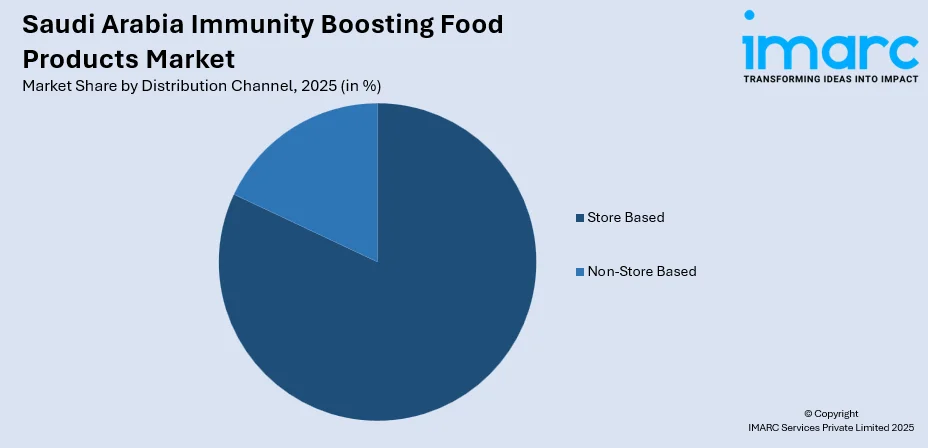

- By Distribution Channel: Store Based leads the market with a share of 82% in 2025, attributed to the strong presence of supermarkets, hypermarkets, and pharmacies that offer trusted access to health-focused food products.

- Key Players: The Saudi Arabia immunity boosting food products market exhibits moderate competitive intensity, with both regional and international companies vying for market share through product innovation, quality assurance, and expanded distribution networks.

To get more information on this market Request Sample

The market is undergoing a notable shift as consumers place greater emphasis on health and wellness in their purchasing choices. Growing awareness of gut health, nutrient deficiencies, and the link between nutrition and immunity is influencing consumer behavior. Government initiatives to improve healthcare, along with public campaigns promoting balanced diets, are creating a supportive environment for market growth. In response, food manufacturers are launching fortified products, functional snacks, and nutrient-enriched beverages focused on immune support and overall well-being. For instance, in December 2024, Saudi Arabia introduced Milaf Cola, the world’s first soft drink made from dates. Created by Thurath Al-Madina, this beverage offers a healthier alternative to conventional sodas, using locally sourced dates to provide natural sweetness along with nutritional advantages. The company intends to broaden its range of date-based drinks, highlighting Saudi Arabia’s dedication to promoting health, sustainability, and economic diversification.

Saudi Arabia Immunity Boosting Food Products Market Trends:

Rising Consumer Health Consciousness

Health awareness is increasing significantly among Saudi consumers, with a majority actively seeking healthier lifestyle choices and food options. This shift is driven by rising concerns about chronic diseases, obesity, and lifestyle-related disorders. The Saudi Arabia health and wellness market size reached USD 38,747.7 Million in 2025. Looking forward, the market is expected to reach USD 85,661.6 Million by 2034, exhibiting a growth rate (CAGR) of 9.22% during 2026-2034. Consumers are increasingly turning to immunity-boosting foods rich in vitamins, minerals, and antioxidants as part of preventive healthcare routines. Public health campaigns and educational initiatives are reinforcing the importance of balanced nutrition in maintaining immune health and overall well-being.

Growing Demand for Probiotics and Functional Foods

The demand for probiotics and prebiotics is gaining momentum as consumers become more aware of the gut health connection to immunity. Fermented superfoods, fortified dairy products, and probiotic-enriched beverages are increasingly popular among health-conscious consumers. For instance, in February 2025, Indiana-based Liberation Labs raised $50.5 million from investors to establish precision fermentation facilities in Richmond and Saudi Arabia. The Saudi Arabia expansion is highlighted by the participation of the state-owned NEOM Investment Fund, which contributed a portion of the $31.5 million in new capital, alongside Galloway Limited, Meach Cove Capital, and existing backers including Agronomics, New Agrarian Capital, and Siddhi Capital. The remaining $19 million was sourced from insider bridge notes issued last year. The functional food market is expanding rapidly, with consumers willing to pay premium prices for products that offer health benefits beyond basic nutrition. Manufacturers are innovating with plant-based options and Halal-certified supplements to meet local dietary preferences.

Digital Transformation and E-commerce Expansion

The e-commerce sector is experiencing rapid growth, transforming how consumers access immunity-boosting food products. The Saudi Arabia E-commerce market size reached USD 222.9 Billion in 2024. The market is projected to reach USD 708.7 Billion by 2033, exhibiting a growth rate (CAGR) of 12.8% during 2025-2033, which is supporting the market growth. Online grocery platforms are making health-focused products more accessible to consumers across the country, including remote areas. The widespread adoption of digital payments, high internet penetration rates, and growing comfort with online shopping are driving this transformation. Food delivery applications and online health stores are expanding their product ranges to include functional foods and nutritional supplements.

Market Outlook 2026-2034:

The Saudi Arabian market for immunity-boosting food products is set for steady growth over the forecast period, underpinned by positive demographic trends and shifting consumer habits. Growing emphasis on preventive healthcare, higher disposable incomes, and the development of retail networks are expected to continually stimulate demand for these health-focused products. Government initiatives promoting health awareness and sustainable food production under Vision 2030 will create additional growth opportunities. Innovation in product formulations, convenient packaging, and personalized nutrition solutions will shape market evolution. The market generated a revenue of USD 292.51 Million in 2025 and is projected to reach a revenue of USD 533.79 Million by 2034, growing at a compound annual growth rate of 6.91% from 2026-2034.

Saudi Arabia Immunity Boosting Food Products Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Fruits and Vegetables | 25% |

| Distribution Channel | Store Based | 82% |

Product Type Insights:

- Herbs and Spices

- Nuts and Seeds

- Fruits and Vegetables

- Dairy-Based Products

- Probiotics and Prebiotics

The fruits and vegetables segment dominates with a market share of 25% of the total Saudi Arabia immunity boosting food products market in 2025.

The fruits and vegetables segment holds the leading position in the market due to growing consumer awareness about natural, nutrient-dense foods that support immune function. Fresh fruits and vegetables are abundant in vital vitamins, minerals, and antioxidants, which are scientifically acknowledged for their ability to enhance and support the immune system. Government initiatives promoting local agricultural production and food security are enhancing the availability of fresh produce. The Saudi Vision 2030 framework includes targets for increased vegetable self-sufficiency, with subsidies supporting greenhouse construction and modern farming techniques.

Consumer preferences are shifting toward healthier dietary patterns that incorporate more fruits and vegetables as foundational elements of immune support. The expansion of controlled-environment agriculture, including hydroponic and vertical farming facilities, is improving year-round availability of fresh produce despite challenging climate conditions. Vision 2030 aims to increase the agriculture sector’s share of the Kingdom’s GDP while strengthening its contribution to the diversification of the non-oil economy. The initiative targets a twofold growth in agricultural production by 2030 compared to the sector’s early performance under the Vision. Significantly, Saudi Arabia’s agricultural GDP reached around SAR 114 billion in 2024, setting a new record and exceeding earlier projections. Retailers are responding to demand by expanding their fresh produce sections and offering organic options. The integration of fruits and vegetables into functional food products and fortified beverages is creating additional growth opportunities within this segment.

Distribution Channel Insights:

Access the Comprehensive Market Breakdown Request Sample

- Store Based

- Non-Store Based

The store based segment leads the market with a share of 82% of the total Saudi Arabia immunity boosting food products market in 2025.

Store-based retail maintains dominance in the distribution of immunity-boosting food products, driven by the strong presence of supermarkets, hypermarkets, and pharmacies across Saudi Arabia. Consumers continue to prefer physical stores for purchasing health-related food products due to the ability to inspect product quality, seek expert advice, and compare options directly. Leading retail chains are enhancing their health and wellness offerings by allocating increased shelf space to functional foods, fortified products, and nutritional supplements designed to promote immune support.

The retail infrastructure in urban centers such as Riyadh, Jeddah, and Dammam continues to expand, with new store openings planned by major chains. Pharmacies and drugstores represent an important distribution channel due to the trust consumers place in these outlets for health-related purchases. Modern retail formats are adapting to health-conscious consumer preferences by improving product assortment, offering premium organic options, and providing educational resources about immunity-boosting foods. The personalized shopping experience and immediate product availability continue to support the store-based channel's market leadership.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The Northern and Central regions of Saudi Arabia, including Riyadh, are witnessing strong demand for immunity-boosting food products due to rising urbanization, higher disposable incomes, and increased health awareness. The government’s healthcare initiatives under Vision 2030 and campaigns promoting balanced nutrition encourage consumption of fortified foods and functional beverages. Supermarkets, e-commerce platforms, and retail chains are expanding product availability, while consumer preference for plant-based and nutrient-enriched products fuels market growth.

In the Western region, including cities like Jeddah and Mecca, demand for immunity-focused foods is driven by a combination of religious tourism, urban population density, and a growing health-conscious consumer base. Retailers are introducing fortified snacks, functional drinks, and probiotic-enriched products to meet evolving dietary preferences. Awareness of gut health, micronutrient intake, and immunity enhancement is rising, supported by social media campaigns and public health initiatives targeting lifestyle-related nutrition improvements.

The Eastern region, with its industrial hubs and expatriate population, shows growing interest in immunity-boosting foods. The combination of corporate wellness programs, higher disposable income, and a diverse demographic drives adoption of fortified foods, functional beverages, and nutraceuticals. Consumers are increasingly aware of nutrition’s role in immunity, prompting manufacturers to innovate with Halal-certified, plant-based, and micronutrient-enriched options tailored to regional dietary habits and lifestyle needs.

In the Southern region, including Abha and Najran, rising health awareness and government-supported nutrition campaigns are influencing the consumption of immunity-enhancing foods. The region’s younger population and expanding retail infrastructure, including supermarkets and convenience stores, create opportunities for functional foods and fortified beverages. Manufacturers are introducing products tailored to local tastes, combining traditional ingredients with modern formulations to promote gut health, nutrient intake, and overall immune support.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Immunity Boosting Food Products Market Growing?

Increasing Health Awareness and Preventive Healthcare Focus

Health awareness is rising significantly among Saudi consumers, driven by growing concerns about chronic diseases, obesity, and lifestyle-related health conditions. The population is increasingly prioritizing preventive healthcare and seeking natural solutions to maintain immune health. Government-led health campaigns under Saudi Vision 2030 are educating consumers about the importance of balanced nutrition and the role of immunity-boosting foods in disease prevention. The prevalence of micronutrient deficiencies, particularly vitamin D, is prompting consumers to incorporate fortified foods and supplements into their diets. This shift toward proactive health management is creating sustained demand for products that support immune function and overall wellness.

Expansion of Retail Infrastructure and Modern Trade Channels

The retail sector in Saudi Arabia is experiencing robust growth, with supermarkets, hypermarkets, and specialty health stores expanding their presence across urban and suburban areas. The Saudi Arabia retail market size was valued at USD 293.6 Billion in 2025. Looking forward, the market is expected to reach USD 411.7 Billion by 2034, exhibiting a CAGR of 3.83% during 2026-2034. Major retail chains are investing in store openings, with emphasis on health and wellness product categories. This expansion improves consumer access to immunity boosting food products and creates visibility for new product offerings. Pharmacies and drugstores are strengthening their nutritional product sections, providing trusted channels for health-conscious consumers. The modernization of retail formats and improvement in supply chain infrastructure ensure product freshness and availability across the country.

Government Support and Vision 2030 Initiatives

The Saudi government's Vision 2030 framework includes comprehensive initiatives to improve public health and promote sustainable food production. Policies supporting local agriculture, organic farming, and food security are creating favorable conditions for the immunity boosting food products market. Regulatory frameworks implemented by the Saudi Food and Drug Authority ensure product safety and quality, building consumer confidence. For instance, the Saudi Food and Drug Authority (SFDA) officially rolled out the third phase of its food services on the “Ghad” unified electronic system, effective May 25, 2025. This step reflects the SFDA’s ongoing efforts to modernize digital infrastructure and streamline processes, aiming to enhance efficiency and provide a better experience for stakeholders within the food sector. Health awareness campaigns and educational initiatives are encouraging citizens to adopt healthier dietary habits. Investment in agricultural technology, including greenhouse farming and hydroponics, is enhancing domestic production capacity for fresh produce and functional food ingredients.

Market Restraints:

What Challenges the Saudi Arabia Immunity Boosting Food Products Market is Facing?

Limited Consumer Knowledge and Awareness Gaps

Despite growing health consciousness, significant knowledge gaps remain among consumers regarding specific immunity-boosting ingredients and their benefits. Many consumers lack understanding of the differences between probiotics, prebiotics, and other functional ingredients, limiting informed purchasing decisions. This awareness gap hinders market penetration for specialized products and requires sustained educational efforts from manufacturers and health authorities.

Regulatory Complexity and Approval Processes

The regulatory landscape for health-focused food products involves stringent guidelines for product approvals, health claims, and labeling requirements. The Saudi Food and Drug Authority maintains rigorous standards that can extend product approval timelines and increase compliance costs for manufacturers. These regulatory requirements, while ensuring product safety, may pose challenges for new market entrants and limit the pace of product innovation.

High Competition and Market Fragmentation

The market is characterized by intense competition among local, regional, and international brands offering similar product categories. Market fragmentation makes differentiation challenging, with multiple brands competing for consumer attention through comparable product offerings and health claims. Price competition may pressure profit margins and limit resources available for product development and marketing investments.

Competitive Landscape:

The Saudi Arabia immunity boosting food products market features a moderately competitive environment with participation from both established multinational corporations and regional players. Companies compete through product innovation, quality assurance, distribution expansion, and brand building. Leading participants focus on developing localized products that meet Halal requirements and regional taste preferences. Strategic partnerships between international brands and local distributors enhance market penetration. Investment in manufacturing facilities within Saudi Arabia is increasing as companies seek to strengthen supply chains and support local production goals. Digital marketing, influencer partnerships, and health education campaigns are key strategies employed to build consumer awareness and brand loyalty.

Recent Developments:

- March 2025: iPRO officially launched its healthy hydration products in Saudi Arabia through a strategic partnership with Al Rabie. The collaboration aims to promote health-conscious beverage options in the Kingdom, featuring unique formulations with natural ingredients and vitamins, now available at over 21,000 sales points nationwide.

- January 2025: Zinereo Pharma collaborated with Experts Pharma Care in Saudi Arabia to conduct targeted medical training sessions centered on the importance of probiotics in promoting women's health. The training program engaged key opinion leaders and healthcare practitioners to enhance understanding of probiotic solutions.

- July 2024: Agthia Group PJSC inaugurated a new protein manufacturing facility in Jeddah, representing an investment of AED 90 million. The facility spans 9,000 square meters with annual production capacity exceeding 9,000 tons, strengthening local production capabilities and supporting self-sufficiency goals.

Saudi Arabia Immunity Boosting Food Products Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Herbs and Spices, Nuts and Seeds, Fruits and Vegetables, Dairy-Based Products, Probiotics and Prebiotics |

| Distribution Channels Covered | Store Based, Non-Store Based |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia immunity boosting food products market size was valued at USD 292.51 Million in 2025.

The Saudi Arabia immunity boosting food products market is expected to grow at a compound annual growth rate of 6.91% from 2026-2034 to reach USD 533.79 Million by 2034.

Fruits and vegetables held the largest share with 25% of the market in 2025, driven by consumer preference for natural, nutrient-rich foods that provide essential vitamins and antioxidants for immune support.

Key factors driving the Saudi Arabia immunity boosting food products market include increasing health awareness, rising prevalence of lifestyle diseases, government initiatives under Vision 2030, expanding retail infrastructure, and growing consumer preference for preventive healthcare solutions.

Major challenges include limited consumer knowledge about specific immunity-boosting ingredients, regulatory complexity in product approvals, high competition and market fragmentation, supply chain constraints for imported ingredients, and the need for sustained consumer education initiatives.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)