Saudi Arabia Implantable Medical Devices Market Size, Share, Trends and Forecast by Product Type, Material, End-User, and Region, 2026-2034

Saudi Arabia Implantable Medical Devices Market Overview:

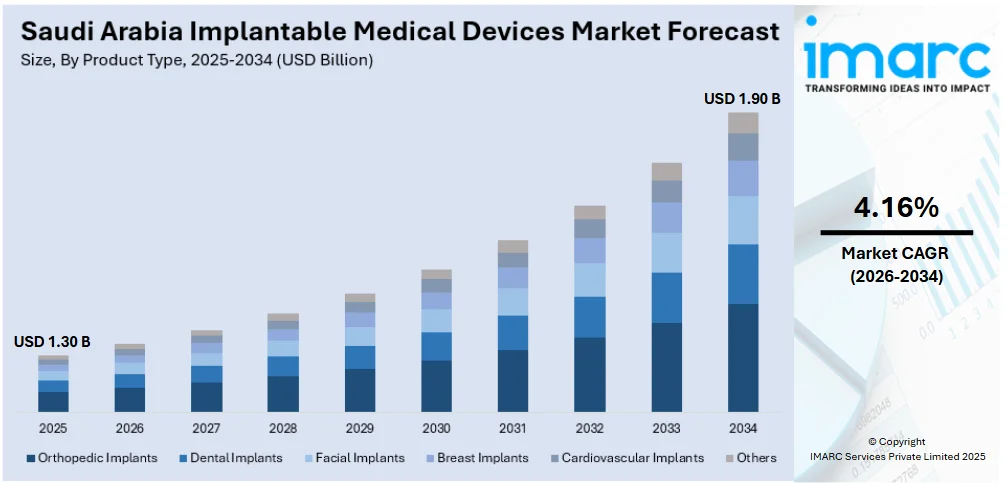

The Saudi Arabia implantable medical devices market size reached USD 1.30 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 1.90 Billion by 2034, exhibiting a growth rate (CAGR) of 4.16% during 2026-2034. The market is driven by rising chronic disease prevalence, aging population, technological advancements, and government healthcare initiatives. These factors collectively boost demand for innovative, minimally invasive implants that enhance treatment outcomes and support the Kingdom’s healthcare modernization goals.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1.30 Billion |

| Market Forecast in 2034 | USD 1.90 Billion |

| Market Growth Rate 2026-2034 | 4.16% |

Saudi Arabia Implantable Medical Devices Market Trends:

Aging Population and Associated Health Concerns

Saudi Arabia is witnessing a demographic shift with a growing elderly population. Aging is linked to increased health conditions like osteoporosis, arthritis, and cardiovascular issues, which often require implantable devices such as joint replacements, spinal implants, and cardiac pacemakers. This trend places significant pressure on the healthcare system to provide age-specific solutions, driving the Saudi Arabia implantable medical devices market growth. The need for implantable medical devices becomes essential because they deliver extended relief and better mobility for geriatric patients. The rising life expectancy creates an increased necessity for sustainable and high-quality healthcare interventions within the healthcare system. The increasing number of elderly people represents a prime force that boosts Saudi Arabia's healthcare market demand for implantable medical devices.

To get more information on this market Request Sample

Technological Advancements in Medical Devices

Rapid technological innovation in implantable medical devices is revolutionizing healthcare in Saudi Arabia. Developments such as bioresorbable stents, smart pacemakers, and minimally invasive implants are improving treatment efficacy and patient safety. The improvements in medical technology result in patients spending less time in hospitals, and they need shorter recovery periods with fewer medical complications. Healthcare professionals are more inclined to adopt these technologies due to their reliability and enhanced outcomes, which is fueling the Saudi Arabia implantable medical devices market share. Additionally, increased integration of digital health solutions like wireless monitoring supports patient tracking and post-operative care. As hospitals modernize and upgrade their infrastructure, demand for next-generation implantable devices grows, making technological innovation a major driver of market expansion in Saudi Arabia.

Government Initiatives and Healthcare Investments

Under Saudi Vision 2030, the government is heavily investing in healthcare infrastructure, digital transformation, and localization of medical manufacturing. These efforts include expanding public and private healthcare facilities, encouraging medical tourism, and streamlining regulatory frameworks. As part of these initiatives, there’s increased emphasis on the adoption of advanced medical technologies, including implantable devices. Strategic collaborations with global medical device companies further enhance local availability and innovation, which is creating a positive impact on the Saudi Arabia implantable medical devices market outlook. Government support in research funding and partnerships also accelerates market growth. These combined actions are creating a conducive environment for the implantable medical devices market to thrive, positioning it as a key segment in the nation’s healthcare advancement strategy.

Saudi Arabia Implantable Medical Devices Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on product type, material, and end-user.

Product Type Insights:

- Orthopedic Implants

- Dental Implants

- Facial Implants

- Breast Implants

- Cardiovascular Implants

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes orthopedic implants, dental implants, facial implants, breast implants, cardiovascular implants, and others.

Material Insights:

- Polymers

- Metals

- Ceramics

- Biologics

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes polymers, metals, ceramics, and biologics.

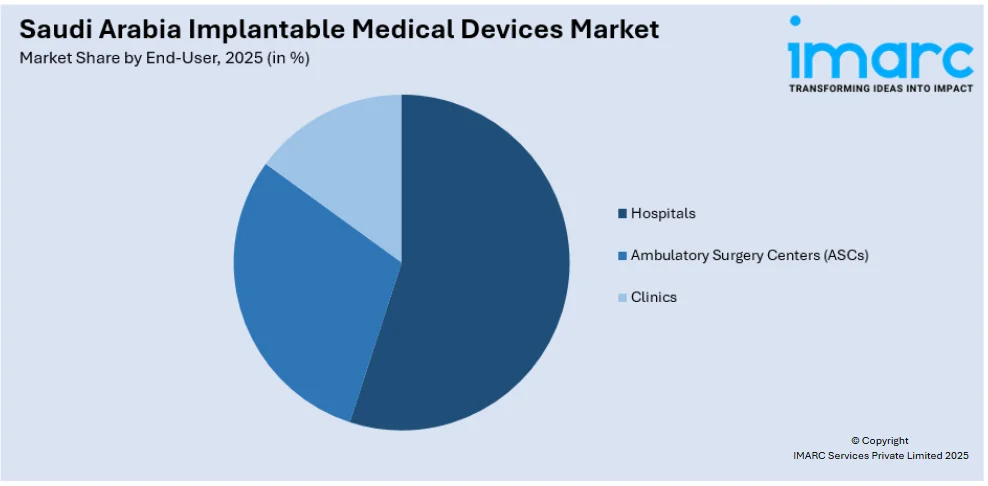

End-User Insights:

Access the comprehensive market breakdown Request Sample

- Hospitals

- Ambulatory Surgery Centers (ASCs)

- Clinics

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospitals, ambulatory surgery centers (ASCs), and clinics.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include the Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Implantable Medical Devices Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Orthopedic Implants, Dental Implants, Facial Implants, Breast Implants, Cardiovascular Implants, Others |

| Materials Covered | Polymers, Metals, Ceramics, Biologics |

| End-Users Covered | Hospitals, Ambulatory Surgery Centers (ASCs), Clinics |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia implantable medical devices market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia implantable medical devices market on the basis of product type?

- What is the breakup of the Saudi Arabia implantable medical devices market on the basis of material?

- What is the breakup of the Saudi Arabia implantable medical devices market on the basis of end-user?

- What is the breakup of the Saudi Arabia implantable medical devices market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia implantable medical devices market?

- What are the key driving factors and challenges in the Saudi Arabia implantable medical devices market?

- What is the structure of the Saudi Arabia implantable medical devices market and who are the key players?

- What is the degree of competition in the Saudi Arabia implantable medical devices market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia implantable medical devices market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia implantable medical devices market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia implantable medical devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)