Saudi Arabia Induction Cooktop Market Size, Share, Trends and Forecast by Product, Application, Distribution Channel, and Region, 2026-2034

Saudi Arabia Induction Cooktop Market Overview:

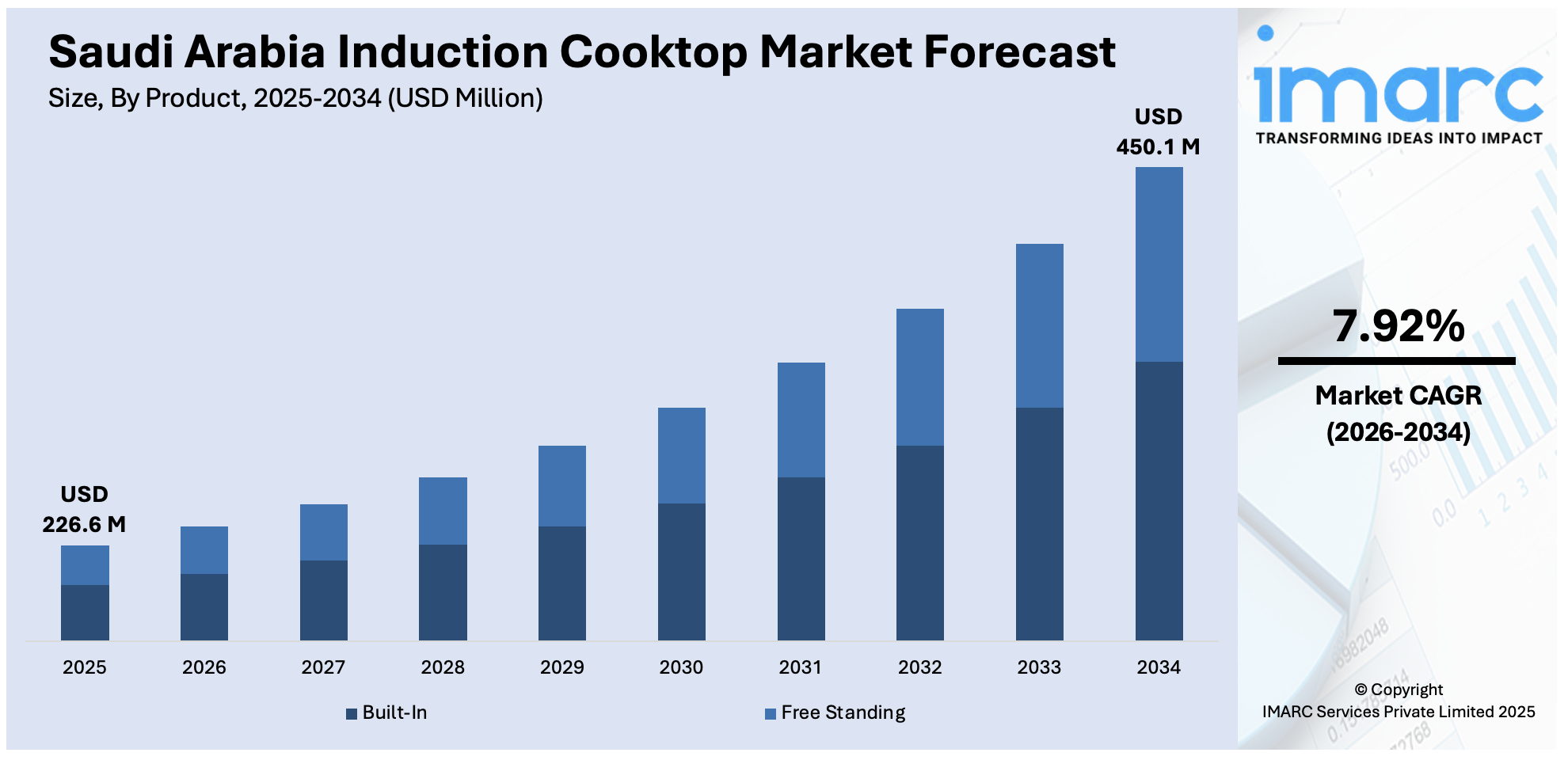

The Saudi Arabia induction cooktop market size reached USD 226.6 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 450.1 Million by 2034, exhibiting a growth rate (CAGR) of 7.92% during 2026-2034. The market is witnessing a steady growth due to rising demand for energy-efficient, safe, and modern kitchen appliances. Urban households are increasingly adopting induction cooktops due to their speed, precision, and ease of maintenance. Growing awareness about electricity savings and cleaner cooking methods is significantly shaping consumer purchasing habits, while competitive pricing and broader retail availability are further boosting the Saudi Arabia induction cooktop market share across both residential and commercial segments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 226.6 Million |

| Market Forecast in 2034 | USD 450.1 Million |

| Market Growth Rate 2026-2034 | 7.92% |

Saudi Arabia Induction Cooktop Market Trends:

Rising Focus on Energy Efficiency

In Saudi Arabia, consumers are paying closer attention to energy consumption due to rising electricity bills and broader awareness of sustainable living. Induction cooktops are gaining popularity because they use electromagnetic technology that heats cookware directly, minimizing energy loss and reducing cooking time. This efficiency appeals to households aiming to cut utility costs without sacrificing performance. Compared to traditional gas or electric stoves, induction units offer faster heating and better temperature control, which translates into noticeable energy savings over time. Government-led energy efficiency campaigns and appliance labeling have also helped consumers recognize the long-term cost benefits. As a result, energy efficiency is no longer a bonus feature it's becoming a major driver behind the increasing adoption of induction cooktops in the Saudi market.

To get more information on this market Request Sample

Growing Demand for Modular Kitchen

Urban housing trends in Saudi Arabia are shifting toward compact, modern, and modular kitchens, especially in apartments and newly built homes. These kitchens prioritize clean design, space efficiency, and integrated appliances making induction cooktops a natural fit. Their sleek, flat surfaces complement modern interiors, while built-in models save counter space and add a streamlined look. Homeowners and interior designers are increasingly choosing induction units over gas stoves for both aesthetic and practical reasons. Younger buyers, in particular, prefer the safety features, faster cooking, and ease of cleaning that induction offers. As home layouts continue to evolve with a focus on design and efficiency, induction cooktops are becoming a standard part of the kitchen setup. This shift is playing a significant role in driving Saudi Arabia induction cooktop market growth across urban residential segments.

E-Commerce Growth and Retail Expansion

The expansion of e-commerce in Saudi Arabia has made induction cooktops more accessible to a wider customer base. Online platforms offer detailed product comparisons, user reviews, and discounts, helping buyers make informed choices without visiting physical stores. Major retailers also run frequent promotions, bundle deals, and seasonal sales both online and in-store, encouraging trial and purchase. This ease of access is especially important in smaller cities where physical appliance stores may be limited. Delivery and installation services offered by top e-commerce players further simplify the buying process. As consumer trust in online shopping grows, more people are turning to digital platforms for kitchen appliances. The combined push from retail and e-commerce channels is helping boost market penetration and awareness, especially among tech-savvy and price-conscious consumers across the country.

Saudi Arabia Induction Cooktop Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product, application, and distribution channel.

Product Insights:

- Built-In

- Free Standing

The report has provided a detailed breakup and analysis of the market based on the product. This includes built-in and free standing.

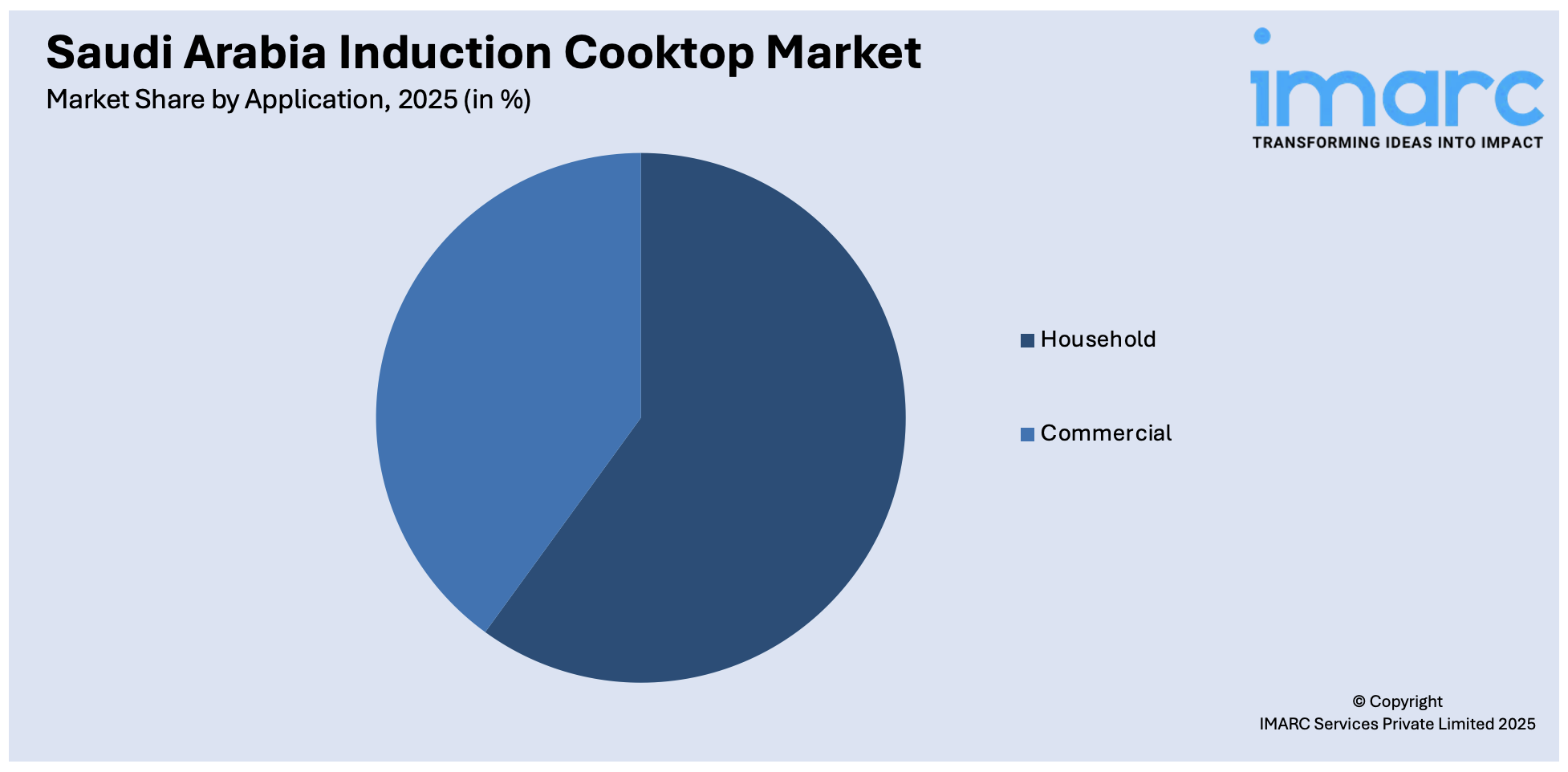

Application Insights:

Access the comprehensive market breakdown Request Sample

- Household

- Commercial

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes household and commercial.

Distribution Channel Insights:

- Hypermarkets and Supermarkets

- Specialty Stores

- Online

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes hypermarkets and supermarkets, specialty stores, and online.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Induction Cooktop Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Built-In, Free Standing |

| Applications Covered | Household, Commercial |

| Distribution Channels Covered | Hypermarkets and Supermarkets, Specialty Stores, Online |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia induction cooktop market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia induction cooktop market on the basis of product?

- What is the breakup of the Saudi Arabia induction cooktop market on the basis of application?

- What is the breakup of the Saudi Arabia induction cooktop market on the basis of distribution channel?

- What is the breakup of the Saudi Arabia induction cooktop market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia induction cooktop market?

- What are the key driving factors and challenges in the Saudi Arabia induction cooktop market?

- What is the structure of the Saudi Arabia induction cooktop market and who are the key players?

- What is the degree of competition in the Saudi Arabia induction cooktop market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia induction cooktop market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia induction cooktop market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia induction cooktop industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)