Saudi Arabia Industrial Air Compressors Market Size, Share, Trends and Forecast by Product, Lubrication, Operation, Capacity, End User, and Region, 2026-2034

Saudi Arabia Industrial Air Compressors Market Overview:

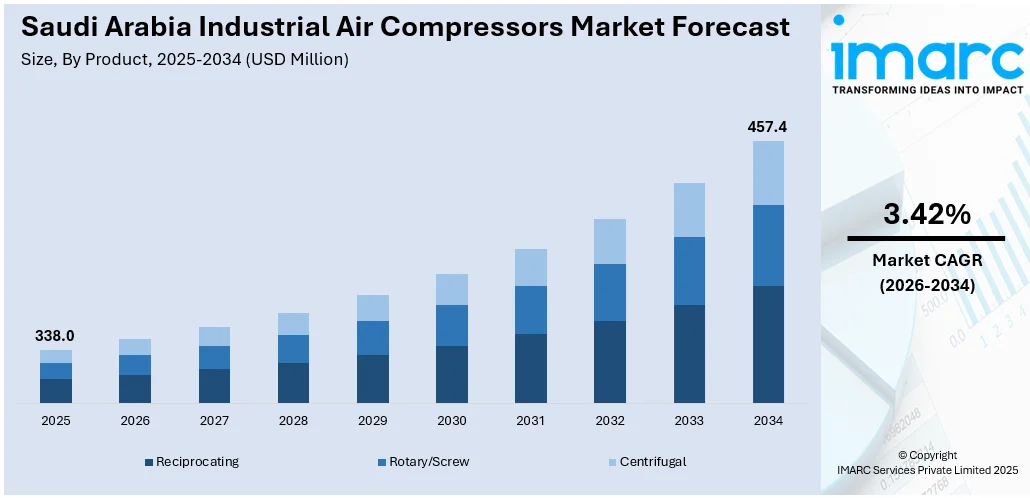

The Saudi Arabia industrial air compressors market size reached USD 338.0 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 457.4 Million by 2034, exhibiting a growth rate (CAGR) of 3.42% during 2026-2034. The market is witnessing significant growth, supported by strong demand from sectors such as oil and gas, manufacturing, construction, and chemicals. Investments in industrial automation, energy efficiency, and infrastructure projects are accelerating adoption. The focus on low-maintenance, high-performance compressors is also influencing purchasing decisions, contributing to the rising Saudi Arabia industrial air compressors market share across diverse applications.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 338.0 Million |

| Market Forecast in 2034 | USD 457.4 Million |

| Market Growth Rate 2026-2034 | 3.42% |

Saudi Arabia Industrial Air Compressors Market Trends:

Rising Demand from Oil & Gas Sector

The oil and gas sector remains a key contributor to the demand for industrial air compressors in Saudi Arabia. According to the data published by CEIC, Saudi Arabia's oil consumption reached 4,051.907 thousand barrels per day in December 2023, up from 3,854.152 thousand barrels per day in December 2022. With the Kingdom being one of the world’s leading oil producers, air compressors are essential in multiple stages of the value chain from upstream drilling and extraction to midstream processing and downstream refining. These operations require robust, high-capacity compressors capable of withstanding harsh environments and continuous use. Applications include pneumatic drilling tools, gas compression, enhanced oil recovery systems, and instrumentation air supply in refineries. The expansion of upstream activities and new refinery projects under Vision 2030 further strengthen the need for reliable compressed air systems. Additionally, efforts to improve operational efficiency and reduce equipment downtime are leading oil companies to invest in advanced, energy-efficient compressors, reinforcing their role in supporting productivity and safety across the hydrocarbon sector.

To get more information on this market Request Sample

Growing Shift Toward Energy-Efficient Models

In Saudi Arabia, industrial sectors are increasingly shifting toward energy-efficient air compressor technologies to meet rising energy cost concerns and sustainability targets. For instance, in February 2025, Galadari Energy Solutions launched Atlas Copco's B-Air, the world's first battery-powered air compressor. Emission-free and capable of operating for up to eight hours on a charge, it targets sectors like construction and oil, with plans to expand into Saudi Arabia and other Gulf markets by 2025. Variable Speed Drive (VSD) compressors are at the forefront of this transition, offering dynamic control over motor speed based on real-time air demand. This reduces energy waste, lowers operating costs, and extends equipment life key advantages in energy-intensive industries such as manufacturing, oil and gas, and chemicals. As companies pursue operational efficiency and environmental compliance under Vision 2030, VSD compressors are gaining traction as a preferred choice. Government initiatives promoting energy optimization and industrial modernization are also encouraging this shift. Additionally, international manufacturers are entering the market with advanced, energy-saving compressor models tailored to local climate and load conditions. This widespread adoption is a significant contributor to Saudi Arabia industrial air compressors market growth across various end-use segments.

Saudi Arabia Industrial Air Compressors Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product, lubrication, operation, capacity, and end user.

Product Insights:

- Reciprocating

- Rotary/Screw

- Centrifugal

The report has provided a detailed breakup and analysis of the market based on the product. This includes reciprocating, rotary/screw, and centrifugal.

Lubrication Insights:

- Oil-Free

- Oil-Filled

A detailed breakup and analysis of the market based on the lubrication have also been provided in the report. This includes oil-free and oil-filled.

Operation Insights:

- ICE

- Electric

A detailed breakup and analysis of the market based on the operation have also been provided in the report. This includes ICE and electric.

Capacity Insights:

- Up to 100 kW

- 101-200 kW

- 201-300 kW

- 301-500 kW

- 501 kW and Above

A detailed breakup and analysis of the market based on the capacity have also been provided in the report. This includes up to 100 kW, 101-200 kW, 201-300 kW, 301-500 kW, and 501 kW and above.

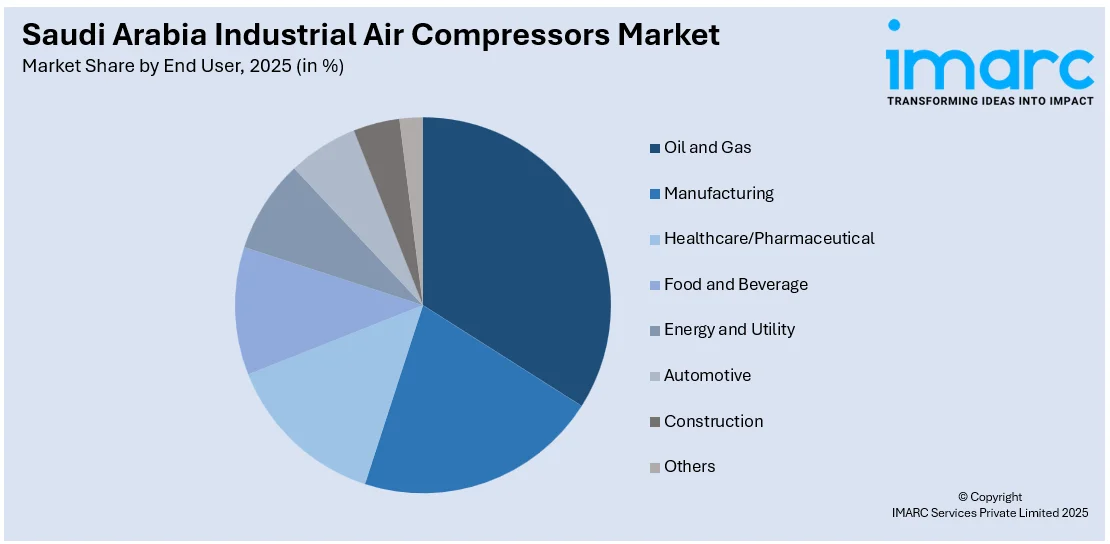

End User Insights:

Access the comprehensive market breakdown Request Sample

- Oil and Gas

- Manufacturing

- Healthcare/Pharmaceutical

- Food and Beverage

- Energy and Utility

- Automotive

- Construction

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes oil and gas, manufacturing, healthcare/pharmaceutical, food and beverage, energy and utility, automotive, construction, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Industrial Air Compressors Market News:

- In December 2023, Cummins Arabia announced its partnership with Sullivan Palatek Asia to distribute Diesel Driven Portable Air Compressors in the UAE. This alliance strengthens Cummins' position in the market and enhances offerings in Saudi Arabia, providing integrated support and innovative products tailored for the region's demanding industrial sectors.

Saudi Arabia Industrial Air Compressors Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Reciprocating, Rotary/Screw, Centrifugal |

| Lubrications Covered | Oil-Free, Oil-Filled |

| Operations Covered | ICE, Electric |

| Capacities Covered | Up to 100 kW, 101-200 kW, 201-300 kW, 301-500 kW, 501 kW and Above |

| End Users Covered | Oil and Gas, Manufacturing, Healthcare/Pharmaceutical, Food and Beverage, Energy and Utility, Automotive, Construction, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia industrial air compressors market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia industrial air compressors market on the basis of product?

- What is the breakup of the Saudi Arabia industrial air compressors market on the basis of lubrication?

- What is the breakup of the Saudi Arabia industrial air compressors market on the basis of operation?

- What is the breakup of the Saudi Arabia industrial air compressors market on the basis of capacity?

- What is the breakup of the Saudi Arabia industrial air compressors market on the basis of end user?

- What is the breakup of the Saudi Arabia industrial air compressors market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia industrial air compressors market?

- What are the key driving factors and challenges in the Saudi Arabia industrial air compressors market?

- What is the structure of the Saudi Arabia industrial air compressors market and who are the key players?

- What is the degree of competition in the Saudi Arabia industrial air compressors market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia industrial air compressors market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia industrial air compressors market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia industrial air compressors industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)