Saudi Arabia Industrial Battery Market Size, Share, Trends and Forecast by Type, Application, and Region, 2026-2034

Saudi Arabia Industrial Battery Market Overview:

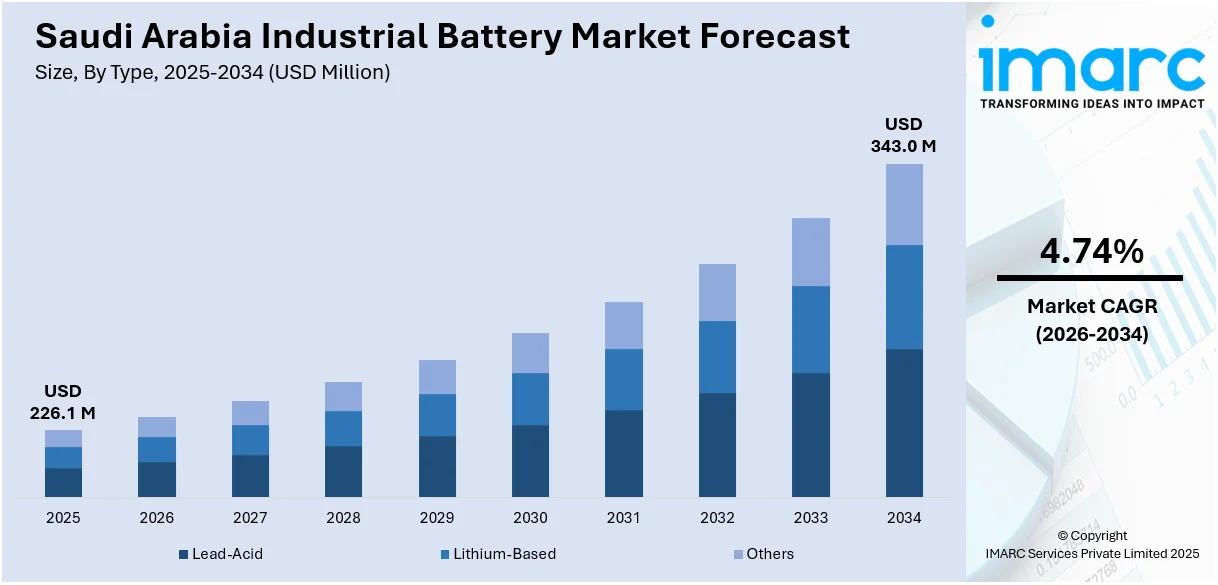

The Saudi Arabia industrial battery market size reached USD 226.1 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 343.0 Million by 2034, exhibiting a growth rate (CAGR) of 4.74% during 2026-2034. At present, the broadening of data centers is driving the demand for reliable, high-capacity energy storage systems. Batteries utilized in data centers aid in providing rapid response times, extended life spans, and elevated energy density, rendering performance and quality crucial. Besides this, rising oil and gas exploration activities are contributing to the expansion of the Saudi Arabia industrial battery market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 226.1 Million |

| Market Forecast in 2034 | USD 343.0 Million |

| Market Growth Rate 2026-2034 | 4.74% |

Saudi Arabia Industrial Battery Market Trends:

Expansion of data centers

The expansion of data centers is positively influencing the market in Saudi Arabia. In May 2025, Qualcomm Technologies, Inc., a leading company in connected intelligent computing, and HUMAIN, established a strategic partnership aimed at developing next-generation artificial intelligence (AI) data centers, infrastructure, and cloud-to-edge services in the Kingdom of Saudi Arabia. As more businesses and government agencies are shifting towards digital infrastructure, the need for data centers is growing rapidly. These facilities require uninterrupted power to ensure the continuous operation of servers, cooling systems, and information technology (IT) equipment. Industrial batteries play a critical role in providing backup power during outages, voltage drops, and grid instability, helping prevent data loss and service interruptions. With Saudi Arabia investing heavily in digital transformation and smart technologies under Vision 2030, both public and private sectors are building new data centers to support cloud services, big data, and AI applications. This expansion is creating the need for advanced battery systems that are durable, efficient, and capable of supporting large-scale operations. Batteries employed in data centers must offer quick response times, long life cycles, and high energy density, making quality and performance essential.

To get more information on this market Request Sample

Growing applications in oil and gas industry

Rising utilization in the oil and gas industry are impelling the Saudi Arabia industrial battery market growth. As per the ITA, Saudi Arabia held around 17% of the globe's confirmed oil reserves and was one of the largest net petroleum exporters, as of January 2024. In oil and gas operations, continuous power supply is critical for safety systems, control equipment, communication networks, and monitoring devices. Industrial batteries provide essential backup power during outages, preventing disruptions that could lead to costly downtime or hazardous situations. As Saudi Arabia is expanding its oil and gas exploration, production, and refining activities, the demand for batteries that can perform well in harsh environments is growing. These batteries must withstand extreme temperatures, vibrations, and corrosive conditions typical of oil and gas sites. Furthermore, with the industry adopting more automated and remote systems, the need for energy storage solutions that ensure uninterrupted operation is increasing. Industrial batteries also support portable equipment and emergency power units used in drilling rigs, pipelines, and offshore platforms.

Saudi Arabia Industrial Battery Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type and application.

Type Insights:

- Lead-Acid

- Lithium-Based

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes lead-acid, lithium-based, and others.

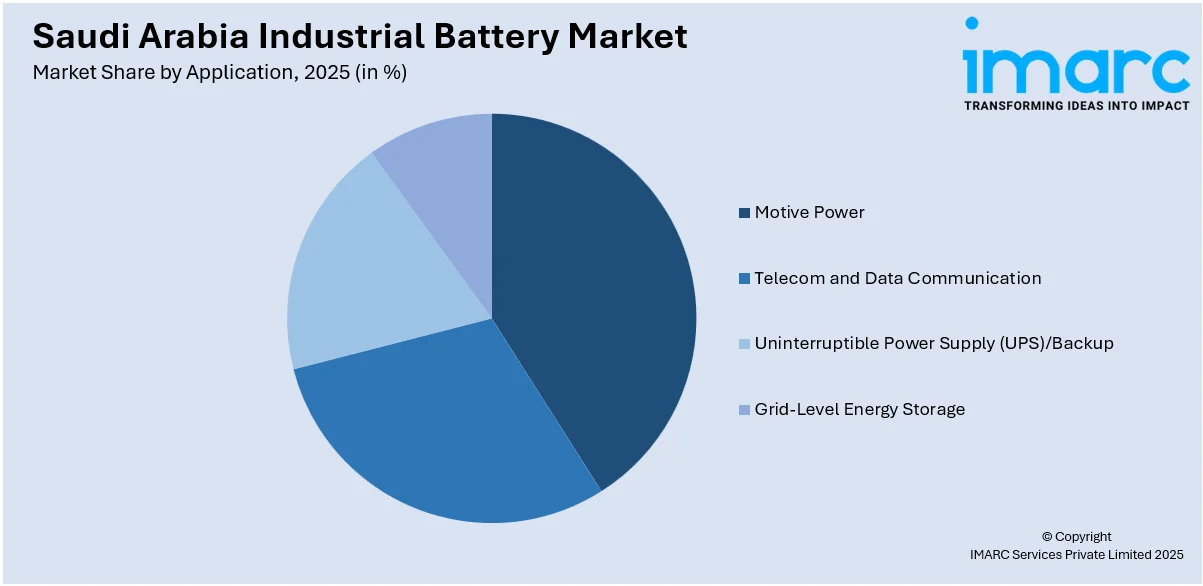

Application Insights:

Access the comprehensive market breakdown Request Sample

- Motive Power

- Telecom and Data Communication

- Uninterruptible Power Supply (UPS)/Backup

- Grid-Level Energy Storage

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes motive power, telecom and data communication, uninterruptible power supply (UPS)/backup, and grid-level energy storage.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Industrial Battery Market News:

- In January 2025, Aramco and Ma’aden collaborated to create a joint venture focused on lithium mining in Saudi Arabia, a move that significantly influenced the Kingdom’s chemical industry. The new initiative was set to tackle the rising demand for lithium, an essential element in manufacturing batteries for electric vehicles (EVs), particularly as Saudi Arabia intensified its efforts to satisfy the surging local need for EVs and renewable energy initiatives. By producing lithium domestically, the kingdom could emerge as an important participant in the international chemical supply chain, generating fresh possibilities for downstream industries.

- In January 2025, researchers at King Abdullah University of Science and Technology in Saudi Arabia developed an innovative technology that could position the Kingdom as a top lithium producer. Extracting lithium from brine could significantly increase worldwide lithium supplies by hundreds of billions of Tons. KAUST created a lithium-extraction method that might enhance Saudi Arabia’s battery sector.

Saudi Arabia Industrial Battery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Lead-Acid, Lithium-Based, Others |

| Applications Covered | Motive Power, Telecom and Data Communication, Uninterruptible Power Supply (UPS)/Backup, Grid-Level Energy Storage |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia industrial battery market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia industrial battery market on the basis of type?

- What is the breakup of the Saudi Arabia industrial battery market on the basis of application?

- What is the breakup of the Saudi Arabia industrial battery market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia industrial battery market?

- What are the key driving factors and challenges in the Saudi Arabia industrial battery market?

- What is the structure of the Saudi Arabia industrial battery market and who are the key players?

- What is the degree of competition in the Saudi Arabia industrial battery market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia industrial battery market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia industrial battery market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia industrial battery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)