Saudi Arabia Industrial Boiler Market Size, Share, Trends and Forecast by Fuel, Application, and Region, 2026-2034

Saudi Arabia Industrial Boiler Market Summary:

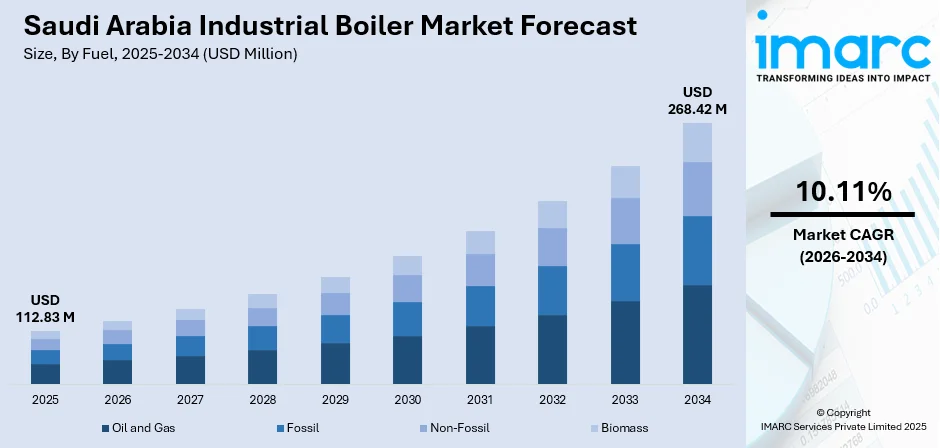

The Saudi Arabia industrial boiler market size was valued at USD 112.83 Million in 2025 and is projected to reach USD 268.42 Million by 2034, growing at a compound annual growth rate of 10.11% from 2026-2034.

The Saudi Arabia industrial boiler market is experiencing robust expansion driven by the Kingdom's Vision 2030 economic diversification agenda, which is catalyzing substantial investments in manufacturing, petrochemicals, and infrastructure development. The increasing demand for process steam across chemicals, food processing, and power generation sectors is creating sustained requirements for high-capacity industrial boilers. Government initiatives promoting energy efficiency standards and sustainable industrial practices are further reshaping the Saudi Arabia industrial boiler market share.

Key Takeaways and Insights:

- By Fuel: Oil and Gas dominates the market with a share of 55% in 2025, attributed to Saudi Arabia's abundant hydrocarbon resources, competitive extraction costs, and the widespread adoption of gas-fired boilers across petrochemical facilities, power plants, and industrial complexes that rely on domestically sourced natural gas for cost-effective steam generation.

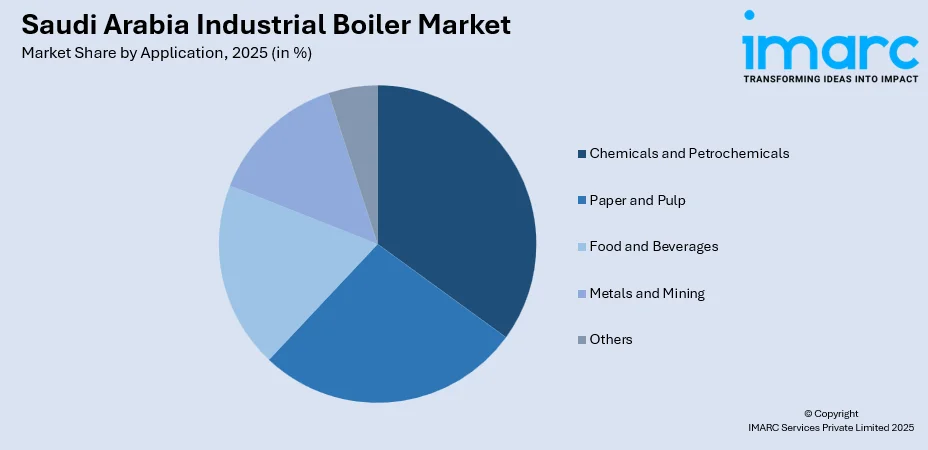

- By Application: Chemicals and Petrochemicals leads the market with a share of 30% in 2025, driven by the Kingdom's position as a global petrochemical production hub, extensive refinery operations requiring high-pressure steam systems, and ongoing capacity expansion projects at industrial cities including Jubail and Yanbu that necessitate substantial boiler installations.

- Key Players: The Saudi Arabia industrial boiler market exhibits a moderately competitive landscape characterized by the presence of established international manufacturers alongside regional suppliers. Market participants are focusing on technological innovations including smart monitoring systems, energy-efficient designs, and after-sales service networks to strengthen their competitive positioning.

To get more information on this market Request Sample

The Saudi Arabia industrial boiler market is witnessing transformative growth underpinned by unprecedented industrial expansion and infrastructure modernization initiatives. The National Industrial Development and Logistics Program continues to drive manufacturing investments, with industrial facilities increasing by sixty percent since Vision 2030's launch. The Kingdom's petrochemical sector, contributing substantially to non-oil exports, remains the primary demand generator for industrial steam systems. In April 2024, Saudi Aramco awarded engineering, procurement, and construction contracts worth USD 7.7 billion for a major expansion of its Fadhili Gas Plant in the Eastern Province, reflecting the magnitude of ongoing industrial investments requiring boiler infrastructure. The desalination sector's expansion, energy efficiency mandates under the Saudi Energy Efficiency Program, and growing food manufacturing investments are creating diversified demand streams across the market.

Saudi Arabia Industrial Boiler Market Trends:

Integration of Smart Technologies and Predictive Maintenance Systems

Saudi Arabia’s industrial boiler market is increasingly adopting AI and IoT-enabled monitoring solutions. Smart boilers with real-time performance analytics and predictive maintenance are gaining popularity across industrial facilities, helping operators optimize combustion, minimize unplanned downtime, and improve operational efficiency. In June 2025, Saudi Aramco said that integrating digital technologies across the Kingdom’s industrial base including AI, IoT and automation that could boost industrial productivity by 15 to 25 percent. Recent launches of advanced IoT-integrated boilers reflect the market’s focus on energy-efficient and technology-driven operations.

Transition Toward Cleaner and Alternative Fuel Sources

Environmental sustainability initiatives and government incentives are driving a shift toward cleaner boiler technologies in the Kingdom. Adoption of biomass and hydrogen-powered systems is gaining momentum, particularly in industrial zones focused on reducing carbon emissions. In 2024, ACWA Power confirmed continued development of the NEOM Green Hydrogen Project, one of the world’s largest green hydrogen initiatives, underscoring the national push toward hydrogen based industrial infrastructure. Regulatory support is encouraging manufacturers to develop fuel-flexible boilers capable of operating on multiple energy sources, accelerating the transition to greener industrial operations.

Rising Demand from Food and Beverage Manufacturing Expansion

Saudi Arabia’s focus on food security and local manufacturing is boosting boiler demand in the food and beverage sector. The development of large-scale food manufacturing clusters is creating a need for reliable steam generation infrastructure. The launch of the Jeddah Food Cluster covering 11 million square meters and backed by an investment of about USD 5.3 billion demonstrates the scale of new food processing capacity coming online in the Kingdom. Major international brands are establishing facilities in the Kingdom, reflecting the sector’s growth and the increasing requirement for efficient and robust industrial boiler solutions.

Market Outlook 2026-2034:

The Saudi Arabia industrial boiler market outlook remains positive, underpinned by strong government support for industrial diversification and infrastructure development. Strategic initiatives aimed at expanding manufacturing capacity are fueling consistent demand for steam generation solutions. Growth in petrochemical facilities, water desalination plants, and large-scale manufacturing hubs across key industrial cities is expected to sustain market momentum. Increasing focus on energy efficiency, technology integration, and cleaner fuel adoption further reinforces the market’s long-term expansion potential, making it an attractive sector for equipment providers and investors. The market generated a revenue of USD 112.83 Million in 2025 and is projected to reach a revenue of USD 268.42 Million by 2034, growing at a compound annual growth rate of 10.11% from 2026-2034.

Saudi Arabia Industrial Boiler Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Fuel | Oil and Gas | 55% |

| Application | Chemicals and Petrochemicals | 30% |

Fuel Insights:

- Oil and Gas

- Fossil

- Non-Fossil

- Biomass

The oil and gas dominate with a market share of 55% of the total Saudi Arabia industrial boiler market in 2025.

The oil and gas segment leads Saudi Arabia’s industrial boiler market, driven by the Kingdom’s abundant natural gas reserves and well-established extraction infrastructure. Gas-fired boilers are the preferred choice for steam generation across major petrochemical complexes, refineries, and power plants in industrial hubs such as Jubail and Yanbu. Competitive fuel costs and reliable gas supply make these systems economically attractive, supporting their continued dominance in industrial applications. In 2024, Saudi Aramco increased proven gas reserves at the Jafurah gas field by 15 trillion standard cubic feet of raw gas, strengthening long‑term domestic fuel supply for gas‑fired boilers.

Ongoing investments in unconventional gas exploration and the recovery of associated gas from oil production are further strengthening domestic fuel availability. These initiatives ensure sustained operational efficiency for gas-fired boilers, reinforcing their central role in Saudi Arabia’s industrial energy landscape.

Application Insights:

Access the Comprehensive Market Breakdown Request Sample

- Chemicals and Petrochemicals

- Paper and Pulp

- Food and Beverages

- Metals and Mining

- Others

The chemicals and petrochemicals lead with a share of 30% of the total Saudi Arabia industrial boiler market in 2025.

Saudi Arabia’s chemicals and petrochemicals industry is a key pillar of the Kingdom’s economic diversification strategy, driving strong demand for industrial boilers. Major industrial hubs in Jubail and Yanbu host integrated petrochemical facilities that rely on high-capacity steam generation for processes such as cracking, distillation, and chemical synthesis. The sector’s continued expansion underscores the critical role of reliable boiler systems in supporting operational efficiency and production growth. In April 2025, Saudi Aramco, Sinopec and Yasref signed a venture framework agreement to expand the petrochemical complex at Yanbu, adding a mixed‑feed steam cracker facility and aromatics complex to boost output.

Ongoing capacity development projects are further boosting boiler demand in this segment. Recent collaborations and large-scale petrochemical complex developments highlight the need for extensive steam generation infrastructure, reflecting the sector’s dynamic growth and sustained energy requirements.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Anchored by Riyadh, the Northern and Central Region serves as the Kingdom’s manufacturing and administrative hub. Specialized zones like Sudair Industrial and Business City attract investments in pharmaceuticals, food processing, and light manufacturing, all of which rely on reliable steam generation infrastructure to support operational efficiency.

The Western Region, including Jeddah and Makkah, functions as a strategic trade gateway and food manufacturing center. It hosts one of the Kingdom’s largest food production clusters and industrial zones like Yanbu, where petrochemical and refining operations drive demand for industrial boiler installations.

The Eastern Region is the leading center for industrial boilers, housing Jubail and Dammam industrial complexes. This area supports major refinery, petrochemical, gas processing, and desalination operations, making it the largest demand hub for high-capacity steam generation systems in the Kingdom.

The Southern Region, featuring Jazan Industrial City, focuses on heavy industries, energy-intensive manufacturing, and agricultural processing. Its strategic location supports exports to Africa while accommodating mining, metals processing, and other industrial activities that rely heavily on steam generation infrastructure.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Industrial Boiler Market Growing?

Vision 2030 Economic Diversification and Industrial Expansion

Saudi Arabia’s Vision 2030 agenda is reshaping the industrial landscape and steadily increasing the need for industrial boilers. The National Industrial Strategy is driving the creation of new manufacturing facilities across sectors such as logistics, automotive, aviation, and food processing—each dependent on robust steam generation systems. As evidence of this transformation, in 2024 the Saudi Authority for Industrial Cities and Technology Zones (MODON) issued 1,346 new industrial licenses, attracting over SAR 50 billion in investments. Rapid growth in industrial zones across Riyadh, the Eastern Province, and the Makkah region reflects this momentum. Massive government investments in industrial infrastructure, specialized clusters, and port development continue to strengthen long-term demand for advanced boiler technologies.

Petrochemical Sector Capacity Expansion and Downstream Integration

Expansion of Saudi Arabia’s petrochemical sector remains a major driver of industrial boiler demand. The Kingdom is shifting from basic chemical production to more sophisticated downstream products, prompting significant investments in integrated complexes and advanced processing facilities. New petrochemical developments in Jubail, along with major projects undertaken by leading industry players, require extensive high-capacity steam generation systems. Government approvals for new feedstock allocations and upcoming multi-product complexes further highlight the sector’s growth trajectory and the essential role of reliable boiler infrastructure in supporting expanded processing capabilities.

Desalination and Water Infrastructure Development

Saudi Arabia’s reliance on desalination as a primary water source continues to generate strong demand for industrial boilers, especially in thermal desalination plants. The national strategy emphasizes expanding water production capacity and modernizing existing facilities, supported by continuous investment from global financing institutions. In 2025, Saudi Water Authority (SWA) secured USD 300 million financing to rebuild and upgrade aging multi‑stage flash (MSF) desalination facilities such as Jubail 1 Desalination Plant and Khobar 2 Desalination Plant, extending their operational life by at least 20 years while improving capacity and efficiency. While membrane-based technologies are increasingly adopted, thermal processes such as multi-stage flash and multi-effect distillation remain crucial and depend heavily on steam generation. Integrated power-and-water plants further reinforce the importance of industrial boilers, as combined heat and power systems optimize energy use across electricity generation and desalination operations.

Market Restraints:

What Challenges the Saudi Arabia Industrial Boiler Market is Facing?

High Capital Investment Requirements for Advanced Systems

The substantial upfront costs associated with modern industrial boiler systems present adoption barriers for medium-sized enterprises. Advanced boilers incorporating smart monitoring, energy recovery systems, and emissions control technologies command premium pricing that extends payback periods and strains capital budgets.

Volatile Fuel Prices Impacting Operational Economics

Fluctuations in energy prices create uncertainty for industrial boiler operators planning fuel procurement strategies. While domestic gas pricing offers relative stability, international market dynamics and regional production adjustments periodically influence fuel availability and cost structures affecting boiler operational economics.

Skilled Workforce Availability for Specialized Operations

The Kingdom faces challenges in maintaining adequate skilled personnel for operating and maintaining sophisticated industrial boiler systems. Complex modern equipment requires specialized technical expertise for optimal performance, creating workforce development imperatives as industrial expansion accelerates across multiple sectors.

Competitive Landscape:

The Saudi Arabia industrial boiler market exhibits a moderately consolidated competitive structure featuring established international equipment manufacturers, regional specialists, and emerging domestic suppliers. Market participants compete on technological capabilities, energy efficiency ratings, after-sales service networks, and pricing strategies. International manufacturers leverage advanced engineering expertise and global supply chains to serve major petrochemical and industrial projects, while regional players focus on localized service capabilities and customer relationships. The market is witnessing increased emphasis on digitalization, with vendors integrating smart monitoring solutions and predictive maintenance capabilities to differentiate offerings. Strategic partnerships between international manufacturers and local distributors are strengthening market coverage across industrial cities and emerging manufacturing zones.

Recent Developments:

- In May 2025, Xinli Boiler participated in the Middle East Poultry Expo 2025 in Riyadh, showcasing high-efficiency gas, biomass, and waste-heat-recovery boilers. The company’s engagement highlights rising boiler demand in agro-processing and poultry operations requiring reliable thermal systems. The move reflects diversification beyond heavy industry into food and agriculture.

- In March 2024, B&W announced contracts totaling US$ 24 million to design and supply three industrial boilers (and associated equipment) for petrochemical facilities in the Middle East and Central Asia.

Saudi Arabia Industrial Boiler Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fuels Covered | Oil and Gas, Fossil, Non-Fossil, Biomass |

| Applications Covered | Chemicals and Petrochemicals, Paper and Pulp, Food and Beverages, Metals and Mining, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia industrial boiler market size was valued at USD 112.83 Million in 2025.

The Saudi Arabia industrial boiler market is expected to grow at a compound annual growth rate of 10.11% from 2026-2034 to reach USD 268.42 Million by 2034.

The oil and gas segment dominated with 55% market share, driven by Saudi Arabia's abundant hydrocarbon resources, competitive extraction costs, and extensive natural gas infrastructure supporting industrial steam generation requirements across petrochemical and manufacturing facilities.

Key factors driving the Saudi Arabia industrial boiler market include Vision 2030 economic diversification initiatives, petrochemical sector capacity expansion, desalination infrastructure development, growing food manufacturing investments, and government mandates promoting energy efficiency standards across industrial operations.

Major challenges include high capital investment requirements for advanced boiler systems, volatile fuel price dynamics affecting operational economics, skilled workforce availability constraints, regulatory compliance complexities, and the need for continuous maintenance and technological upgrades to meet evolving efficiency standards.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)