Saudi Arabia Industrial Conveyor Systems Market Size, Share, Trends and Forecast by Type, Load Capacity, Operation Type, End Use Industry, and Region, 2026-2034

Saudi Arabia Industrial Conveyor Systems Market Summary:

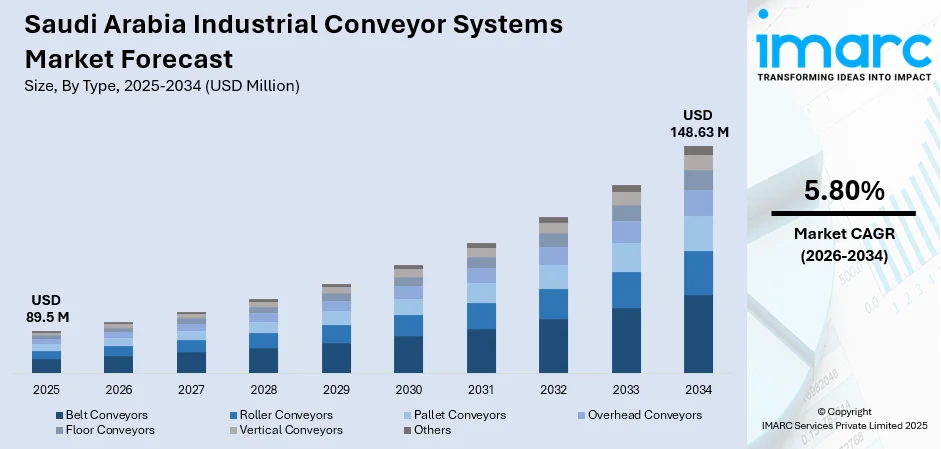

The Saudi Arabia industrial conveyor systems market size was valued at USD 89.5 Million in 2025 and is projected to reach USD 148.63 Million by 2034, growing at a compound annual growth rate of 5.80% from 2026-2034.

The Saudi Arabia industrial conveyor systems market is experiencing robust growth, driven by accelerating industrialization, expanding logistics infrastructure, and government investments under Vision 2030. The Kingdom's strategic push to diversify its economy beyond oil has catalyzed significant demand for automated material handling solutions across the manufacturing, warehousing, and distribution sectors. Rising e-commerce activities, coupled with the development of mega-projects and industrial cities, are fueling the adoption of advanced conveyor technologies that enhance operational efficiency, reduce labor dependency, and support seamless supply chain operations.

Key Takeaways and Insights:

-

By Type: Belt conveyors dominate the market with a share of 41% in 2025, owing to their versatility in handling diverse materials, cost-effectiveness for continuous transport operations, and widespread applications across the mining, manufacturing, and logistics sectors requiring reliable bulk material movement solutions.

-

By Load Capacity: Light-duty conveyors lead the market with a share of 43% in 2025, driven by expanding e-commerce fulfillment centers, pharmaceutical packaging operations, and food processing facilities that require efficient handling of smaller packages and lightweight materials across distribution networks.

-

By Operation Type: Automated conveyors represent the largest segment with a market share of 52% in 2025, reflecting the Kingdom's aggressive adoption of Industry 4.0 technologies, smart manufacturing initiatives, and the growing need for precision-driven, labor-saving material handling systems in modern industrial facilities.

-

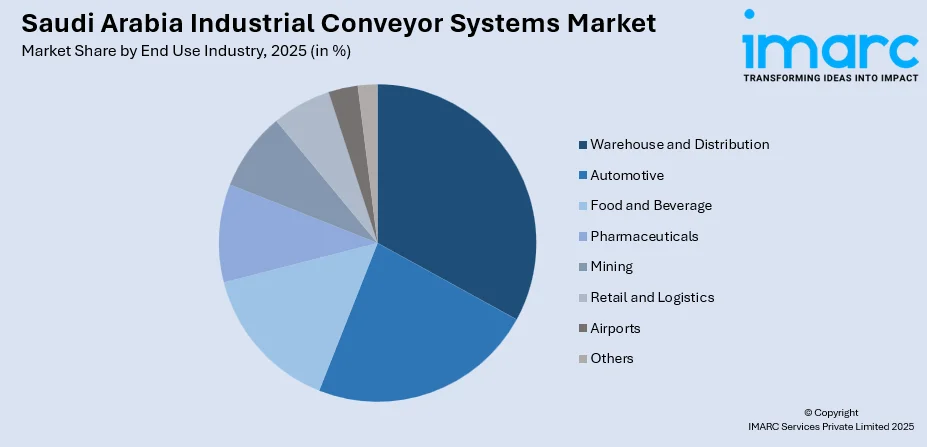

By End Use Industry: Warehouse and distribution exhibit a clear dominance with a 28% share in 2025, propelled by the explosive growth of e-commerce platforms, government-backed logistics zone developments, and the strategic positioning of Saudi Arabia as a regional distribution hub connecting Asia, Europe, and Africa.

-

By Region: Northern and Central Region comprises the largest region with 50% share in 2025, due to the concentration of industrial zones, logistics hubs, and manufacturing facilities around Riyadh, supported by strong infrastructure, government investments, and rising automation adoption across warehouses, factories, and distribution centers.

-

Key Players: Key players drive the Saudi Arabia industrial conveyor systems market by expanding product portfolios, investing in automation technologies, and strengthening partnerships with local distributors. Their focus on customized solutions, after-sales services, and integration of Internet of Things (IoT)-enabled monitoring systems enhances operational efficiency and market penetration.

To get more information on this market Request Sample

The Saudi Arabia industrial conveyor systems market is witnessing substantial expansion, as the Kingdom accelerates its industrial transformation under Vision 2030. Government initiatives are positioning logistics as a critical pillar of economic diversification, attracting substantial investments in automated material handling infrastructure. The Saudi Authority for Industrial Cities and Technology Zones, referred to as MODON, broadened its overall logistics area in industrial cities throughout the Kingdom to more than 4.8 Million square meters, as of June 2024, creating significant demand for conveyor installations across industrial parks. Rising adoption of smart warehouse solutions, integration of artificial intelligence (AI) in manufacturing processes, and the establishment of specialized logistics zones are reshaping the competitive landscape. The government's commitment to developing world-class infrastructure, coupled with increasing foreign direct investments (FDIs) and partnerships with global automation providers, continues to strengthen the foundation for sustained market growth.

Saudi Arabia Industrial Conveyor Systems Market Trends:

Integration of IoT and Smart Monitoring Technologies

Integration of IoT and smart monitoring technologies is driving the Saudi Arabia industrial conveyor systems market by enabling real-time performance tracking, predictive maintenance, and improved operational efficiency. As per IMARC Group, the Saudi Arabia IoT market size reached USD 9,490.7 Million in 2024. Sensors and connected control systems help operators monitor belt speed, load conditions, and equipment health, reducing unplanned downtime. Industrial operators increasingly adopt smart conveyors to lower maintenance costs and extend equipment lifespan. These technologies also support automation and data-driven decision-making, aligning with Vision 2030 goals for digitalized manufacturing and smarter industrial operations across logistics, mining, and production facilities.

Rising Demand for Modular and Flexible Conveyor Configurations

Manufacturing and logistics operators across the Kingdom are increasingly adopting modular conveyor systems that offer scalability and adaptability to changing operational requirements. These flexible configurations enable rapid reconfiguration of production lines and distribution layouts without significant capital expenditure. The trend reflects the dynamic nature of Saudi Arabia's industrial landscape, where businesses require agile material handling solutions capable of accommodating seasonal demand fluctuations and evolving product portfolios while maintaining operational efficiency.

Expansion of Automated Sortation and Cross-Belt Systems

The proliferation of e-commerce and rapid fulfillment requirements is driving widespread adoption of advanced sortation conveyors and cross-belt systems across Saudi warehouses. These high-speed sorting solutions enable precise routing of packages based on destination codes, significantly reducing processing times. At the Saudi Warehousing & Logistics Expo in September 2024, Savoye was set to showcase advanced warehouse automation technologies, including goods-to-person robotics systems, packing machines, and conveyors, addressing fulfillment challenges across the retail and pharmaceutical sectors.

How Vision 2030 is Transforming the Saudi Arabia Industrial Conveyor Systems Market:

Vision 2030 is transforming the Saudi Arabia industrial conveyor systems market by accelerating industrial diversification, automation, and large-scale infrastructure development. The program’s focus on expanding manufacturing, logistics, mining, and food processing industries is increasing demand for efficient material handling and automated conveyor solutions. Development of industrial zones, economic cities, and logistics hubs is encouraging factories and warehouses to adopt conveyor systems to improve throughput, reduce labor dependency, and enhance operational efficiency. Vision 2030’s emphasis on localization and productivity is also driving investments in advanced conveyor technologies integrated with sensors, robotics, and digital control systems. Growth in mining and mineral processing activities further supports demand for heavy-duty conveyor systems. Additionally, expansion of ports, airports, and distribution centers strengthens the need for conveyor solutions in cargo handling and sorting operations.

Market Outlook 2026-2034:

The Saudi Arabia industrial conveyor systems market is poised for continued expansion, as the Kingdom advances its ambitious infrastructure development agenda and industrial diversification objectives. Mega-projects, including NEOM, Red Sea Global, and Qiddiya, are generating substantial demand for sophisticated material handling solutions. The market generated a revenue of USD 89.5 Million in 2025 and is projected to reach a revenue of USD 148.63 Million by 2034, growing at a compound annual growth rate of 5.80% from 2026-2034. The government's commitment to establishing logistics zones incorporating advanced automation from inception, combined with the growing localization of manufacturing capabilities, will continue to drive investments in conveyor infrastructure across the industrial and commercial sectors.

Saudi Arabia Industrial Conveyor Systems Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Belt Conveyors | 41% |

| Load Capacity | Light-Duty Conveyors | 43% |

| Operation Type | Automated Conveyors | 52% |

| End Use Industry | Warehouse and Distribution | 28% |

| Region | Northern and Central Region | 50% |

Type Insights:

- Belt Conveyors

- Roller Conveyors

- Pallet Conveyors

- Overhead Conveyors

- Floor Conveyors

- Vertical Conveyors

- Others

Belt conveyors dominate with a market share of 41% of the total Saudi Arabia industrial conveyor systems market in 2025.

Belt conveyors maintain their dominant position in the Saudi Arabia industrial conveyor systems market due to their exceptional versatility, reliability, and cost-effectiveness across diverse industrial applications. These systems efficiently handle bulk materials in mining operations, packaged goods in distribution centers, and components in manufacturing assembly lines.

The widespread adoption of belt conveyors reflects their adaptability to Saudi Arabia's harsh environmental conditions, including high ambient temperatures and dusty operating environments. Manufacturers are incorporating advanced features, such as heat-resistant materials, dust-suppression systems, and energy-efficient drives, to meet the demanding requirements of local industries. The ongoing expansion of industrial cities and logistics parks continues to drive installations of customized belt conveyor solutions designed for specific material handling applications. In November 2025, H.E. Saleh bin Nasser Al-Jasser, the Minister of Transport and Logistic Services, launched the Agility Logistics Park in Jeddah, a private-sector investment of SAR 611 Million by Agility Logistics Parks (ALP). Built on a 576,760 sqm property with over 338,000 sqm of constructed space, the top-tier logistics facility consists of six Grade-A warehouses, created and built to meet the highest global standards.

Load Capacity Insights:

- Light-Duty Conveyors

- Medium-Duty Conveyors

- Heavy-Duty Conveyors

Light-duty conveyors lead with a share of 43% of the total Saudi Arabia industrial conveyor systems market in 2025.

Light-duty conveyors have emerged as the preferred choice across Saudi Arabia's rapidly expanding e-commerce fulfillment centers, pharmaceutical distribution facilities, and food processing operations. These systems excel in handling packages, cartons, and lightweight materials with precision and speed, meeting the growing demand for efficient last-mile logistics.

The proliferation of micro-fulfillment centers in urban areas, combined with the expansion of retail and grocery distribution networks, continues to fuel demand for light-duty conveyor installations. As per IMARC Group, the Saudi Arabia retail market size was valued at USD 293.6 Billion in 2025. Light-duty conveyors offer lower initial investment costs, reduced energy consumption, and easier integration with automated sorting technologies compared to heavier alternatives. Operators benefit from modular configurations that enable rapid deployment and seamless scalability as business volumes expand.

Operation Type Insights:

- Automated Conveyors

- Semi-Automated Conveyors

- Manual Conveyors

Automated conveyors exhibit a clear dominance with a 52% share of the total Saudi Arabia industrial conveyor systems market in 2025.

Automated conveyor systems are experiencing unprecedented adoption across Saudi Arabia as industries embrace smart manufacturing and Industry 4.0 principles. These systems integrate seamlessly with robotic picking stations, warehouse management software, and real-time tracking technologies to deliver precision-driven material handling operations. In February 2024, Alat and SoftBank Group announced a strategic partnership to establish a next-generation industrial automation business with investment up to USD 150 Million, building an automated manufacturing hub in Riyadh.

The shift towards automated conveyors addresses critical workforce challenges while significantly improving operational efficiency, accuracy, and throughput across manufacturing and logistics facilities. These systems enable continuous operations with minimal human intervention, reducing labor costs and eliminating errors associated with manual handling processes. The integration of AI and machine learning (ML) capabilities further enhances system performance through predictive maintenance and dynamic route optimization.

End Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- Automotive

- Food and Beverage

- Warehouse and Distribution

- Pharmaceuticals

- Mining

- Retail and Logistics

- Airports

- Others

Warehouse and distribution represent the leading segment with a 28% share of the total Saudi Arabia industrial conveyor systems market in 2025.

The warehouse and distribution industry commands the largest share of conveyor system installations, as Saudi Arabia positions itself as a global logistics hub. The explosive growth of e-commerce platforms and regional operators has created unprecedented demand for high-speed sorting and fulfillment solutions. Sales from e-commerce utilizing Mada cards in Saudi Arabia reached SR197.42 Billion (USD 52.64 Billion) in 2024, reflecting a year-on-year increase of 25.82%, based on information from the Kingdom’s central bank.

Government initiatives supporting logistics infrastructure development, including the establishment of logistics zones and special economic zones in Riyadh, Jeddah, and King Abdullah Economic City, are accelerating conveyor investments. Distribution centers are increasingly deploying multi-level conveyor networks with cross-belt sorters and sliding shoe systems to achieve rapid throughput. The integration of conveyors with automated storage and retrieval systems creates seamless material flow from receiving through shipping operations.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and Central Region prevails the market with a share of 50% of the total Saudi Arabia industrial conveyor systems market in 2025.

The Northern and Central Region leads the Saudi Arabia industrial conveyor systems market due to the concentration of large-scale manufacturing, logistics, and food processing facilities around Riyadh and adjacent industrial cities. These regions host major industrial zones, warehouses, and distribution centers that rely on conveyor systems to handle high material volumes efficiently. Rapid expansion of e-commerce fulfillment centers and cold storage facilities further drives demand for automated conveyor solutions to improve throughput, accuracy, and operational efficiency across supply chains.

Additionally, the Northern and Central Region benefits from extensive government-backed industrial development initiatives and superior infrastructure connectivity. Proximity to major highways, dry ports, and rail networks supports large logistics hubs that require advanced conveyor systems for sorting, packaging, and material handling. Growth in mining equipment assembly, construction materials manufacturing, and consumer goods production strengthens adoption of heavy-duty and customized conveyor solutions, reinforcing the region’s leadership in Saudi Arabia industrial conveyor systems market.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Industrial Conveyor Systems Market Growing?

Expansion of Manufacturing and Industrial Diversification

Saudi Arabia’s industrial conveyor systems market is strongly driven by rapid expansion of manufacturing under Vision 2030. The Kingdom is actively diversifying beyond oil by developing automotive assembly, food and beverage (F&B) processing, pharmaceuticals, construction materials, and metal fabrication industries. New factories and industrial clusters require efficient material handling solutions to manage high-volume production, reduce manual labor, and improve throughput. Conveyor systems enable streamlined movement of raw materials, semi-finished goods, and finished products across production lines. As manufacturers focus on productivity, consistency, and workplace safety, automated conveyors are increasingly preferred over manual handling. Localization initiatives and industrial licensing reforms are also encouraging private sector investments in medium and large manufacturing units. These facilities demand customized conveyor solutions tailored to different loads, layouts, and environmental conditions. Overall, sustained industrial growth, factory automation, and emphasis on operational efficiency continue to generate long-term demand for industrial conveyor systems across Saudi Arabia’s manufacturing landscape.

Growth of Logistics, Warehousing, and E-commerce Infrastructure

Rapid growth of logistics, warehousing, and e-commerce infrastructure is a major driver of the Saudi Arabia industrial conveyor systems market. The Kingdom’s strategic location as a regional trade hub is encouraging development of large logistics parks, fulfillment centers, and distribution warehouses. Rising online retail activities are increasing the need for fast, accurate, and automated order handling. Conveyor systems play a critical role in sorting, packaging, and transporting goods within warehouses, improving speed and reducing error rates. Investments in cold storage facilities for food and pharmaceuticals further boost demand for specialized conveyor solutions. Government-backed logistics initiatives and privatization of transport services are accelerating warehouse automation. Companies are adopting conveyor-based material handling to manage higher parcel volumes and meet shorter delivery timelines. As logistics operations scale up to serve domestic and international markets, conveyor systems remain essential infrastructure, propelling consistent market growth.

Surging Mining, Cement, and Bulk Material Handling Activities

Expansion of mining, cement, and bulk material handling activities is significantly catalyzing the demand for industrial conveyor systems in Saudi Arabia. Saudi Arabia's Ministry of Industry and Mineral Resources (MIM) revealed that exploration expenditure surged five times in four years, hitting SAR1.05 Billion (USD 280.5 Million) in 2024, up from SAR501 Million in 2023 and SAR205 Million in 2020. The Kingdom’s focus on developing its mineral resources, including phosphate, bauxite, gold, and industrial minerals, requires heavy-duty conveyor solutions for transporting ores and aggregates. Conveyor systems are preferred in mining and quarrying due to their ability to handle continuous loads over long distances with lower operating costs. Similarly, growth in cement and building materials production to support infrastructure and housing projects increases the use of conveyors in crushing, processing, and packaging operations. These industries require robust, abrasion-resistant, and high-capacity conveyor systems. Continuous investments in mining infrastructure and construction materials manufacturing are sustaining demand for durable and customized conveyor technologies. As bulk material handling remains central to Saudi Arabia’s industrial expansion, conveyor systems continue to play a vital operational role.

Market Restraints:

What Challenges the Saudi Arabia Industrial Conveyor Systems Market is Facing?

High Initial Capital Investment Requirements

The substantial upfront costs associated with automated conveyor systems present barriers for small and medium enterprises (SMEs) seeking to modernize operations. Advanced systems incorporating IoT sensors, robotics integration, and sophisticated control software require significant capital outlays that may challenge organizations with limited budgets or uncertain return-on-investment timelines.

Skilled Workforce Shortages for System Operation and Maintenance

The transition towards automated conveyor systems demands specialized technical expertise for installation, programming, and ongoing maintenance that remains scarce in the local labor market in Saudi Arabia. Organizations face challenges recruiting qualified technicians capable of managing sophisticated automation technologies while ensuring minimal operational disruptions during system integration phases.

Harsh Environmental Operating Conditions

Harsh environmental operating conditions affect the Saudi Arabia industrial conveyor systems market by increasing wear, maintenance requirements, and system design complexity. High temperatures, dust, sand, and humidity accelerate component degradation, impacting belts, motors, and bearings. Industrial operators must invest in heat-resistant materials, sealed components, and reinforced structures to ensure reliability. These conditions raise installation and lifecycle costs, extend maintenance cycles, and require specialized engineering solutions, influencing procurement decisions and slowing adoption among cost-sensitive industries.

Competitive Landscape:

The Saudi Arabia industrial conveyor systems market exhibits a competitive structure comprising global automation leaders and regional specialists serving diverse industrial requirements. International players leverage technological expertise and comprehensive product portfolios to address complex material handling challenges across the manufacturing and logistics sectors. Local manufacturers and system integrators compete through customized solutions, competitive pricing, and responsive after-sales support networks. Strategic partnerships between global technology providers and Saudi distributors enable effective market penetration while addressing localization requirements. Companies are differentiating through integrated solutions combining conveyor hardware with warehouse management software, predictive maintenance services, and IoT-enabled monitoring platforms.

Saudi Arabia Industrial Conveyor Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Belt Conveyors, Roller Conveyors, Pallet Conveyors, Overhead Conveyors, Floor Conveyors, Vertical Conveyors, Others |

| Load Capacities Covered | Light-Duty Conveyors, Medium-Duty Conveyors, Heavy-Duty Conveyors |

| Operation Types Covered | Automated Conveyors, Semi-Automated Conveyors, Manual Conveyors |

| End Use Industries Covered | Automotive, Food and Beverage, Warehouse and Distribution, Pharmaceuticals, Mining, Retail and Logistics, Airports, Others |

| Regions Covered | Northern Saudi Arabia, Central Saudi Arabia, Southern Saudi Arabia, and Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia industrial conveyor systems market size was valued at USD 89.5 Million in 2025.

The Saudi Arabia industrial conveyor systems market is expected to grow at a compound annual growth rate of 5.80% from 2026-2034 to reach USD 148.63 Million by 2034.

Belt conveyors dominated the market with a share of 41%, driven by their versatility in handling diverse materials across mining, manufacturing, and logistics applications requiring reliable continuous transport solutions.

Key factors driving the Saudi Arabia industrial conveyor systems market include accelerating e-commerce growth, government investments in logistics infrastructure under Vision 2030, industrial diversification initiatives, expanding manufacturing sector, and rising adoption of automation technologies.

Major challenges include high initial capital investment requirements, skilled workforce shortages for system operation and maintenance, harsh environmental operating conditions, integration complexities with legacy systems, and supply chain constraints for specialized components.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)