Saudi Arabia Industrial Dehumidifiers Market Size, Share, Trends and Forecast by Type, Installation, End User, and Region, 2026-2034

Saudi Arabia Industrial Dehumidifiers Market Overview:

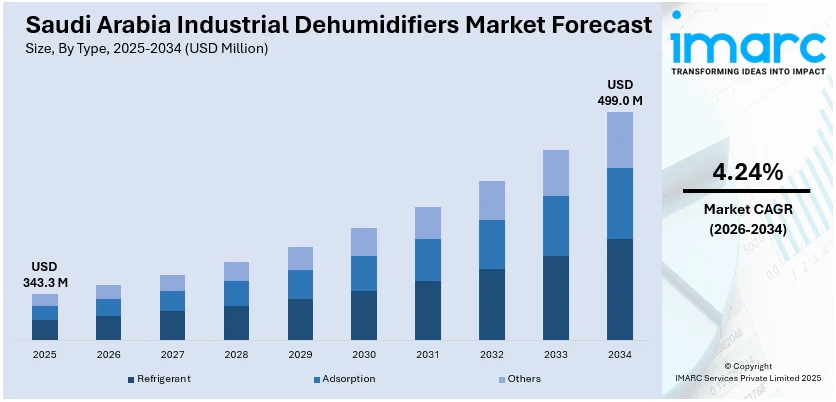

The Saudi Arabia industrial dehumidifiers market size reached USD 343.3 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 499.0 Million by 2034, exhibiting a growth rate (CAGR) of 4.24% during 2026-2034. The market is witnessing significant growth due to rising demand in sectors like food processing, pharmaceuticals, and logistics, where humidity control is essential. The country’s expanding industrial base, harsh climate conditions, and focus on infrastructure development are also driving adoption. Energy-efficient and smart dehumidifier systems are further gaining preference across facilities, thereby positively contributing to the Saudi Arabia industrial dehumidifiers market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 343.3 Million |

| Market Forecast in 2034 | USD 499.0 Million |

| Market Growth Rate 2026-2034 | 4.24% |

Saudi Arabia Industrial Dehumidifiers Market Trends:

Rising Adoption in Logistics and Warehousing

The logistics and warehousing sector in Saudi Arabia is experiencing rapid expansion, driven by the growth of e-commerce, cold chain logistics, and industrial trade. According to the data published by the International Trade Administration (ITA), Saudi Arabia's e-commerce is poised for growth, with 33.6 million users expected by 2024, a 42% increase from 2019. Online sales represented 6% of total retail in 2020, with a 50% rise in average user spending over three years, supported by a 97% smartphone penetration rate. As more goods are stored and moved through distribution hubs, maintaining controlled environmental conditions has become a critical requirement. Humidity-sensitive products like electronics, pharmaceuticals, and perishable foods require consistent dehumidification to prevent spoilage, corrosion, and quality degradation. Industrial dehumidifiers help maintain optimal humidity levels, ensuring product integrity and regulatory compliance. In cold storage applications, these systems prevent ice buildup, enhance energy efficiency, and prolong equipment life. The Kingdom’s strategic investments in logistics infrastructure, including free zones and smart warehouses under Vision 2030, are further encouraging the adoption of advanced dehumidification technologies. As warehousing operations scale up, humidity control solutions are becoming standard components, directly supporting the growth of the Saudi Arabia industrial dehumidifiers market.

To get more information on this market Request Sample

Growing Focus on Energy Efficiency

Energy efficiency has become a key purchasing criterion in the Saudi Arabia industrial dehumidifier market, as industries seek to manage operating expenses and meet sustainability targets. Due to the significant energy expenses linked to HVAC systems in the area's extreme climate, companies are increasingly adopting dehumidifiers that aim to lower power consumption while maintaining effectiveness. Features like variable-speed compressors, sophisticated moisture sensors, and automated controls contribute to reduced energy use, particularly in large-scale industries such as food storage, pharmaceuticals, and manufacturing. Regulatory emphasis on sustainable industrial practices and growing awareness of environmental impact are also encouraging the shift toward greener technologies. Equipment suppliers are responding with innovative models that offer long-term savings and reliability. This push toward efficiency is not only helping industries optimize operations but also playing a vital role in driving Saudi Arabia industrial dehumidifier market growth across sectors prioritizing cost-effective and eco-friendly solutions.

Expansion of Food and Pharmaceutical Industries

The food and pharmaceutical industries in Saudi Arabia are expanding rapidly, driven by population growth, rising healthcare needs, and government-led diversification initiatives. Both sectors require stringent humidity control to ensure product safety, stability, and compliance with regulatory standards. In pharmaceutical production, even minor fluctuations in humidity can affect drug efficacy and shelf life, making precise dehumidification essential. Similarly, food processing and storage demand-controlled environments to prevent spoilage, maintain texture, and extend shelf life. With increased investment in cold chains, production facilities, and packaging units, industrial dehumidifiers are becoming integral to operations. The push for localized manufacturing under Vision 2030 has further strengthened infrastructure in these sectors, creating new demand for environmental control systems. As these industries scale, the need for high-performance and energy-efficient dehumidifiers continues to grow, reinforcing the importance of humidity management in quality assurance and operational efficiency.

Saudi Arabia Industrial Dehumidifiers Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type, installation, and end user.

Type Insights:

- Refrigerant

- Adsorption

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes refrigerant, adsorption, and others.

Installation Insights:

- Floor

- Ceiling

A detailed breakup and analysis of the market based on the installation have also been provided in the report. This includes floor and ceiling.

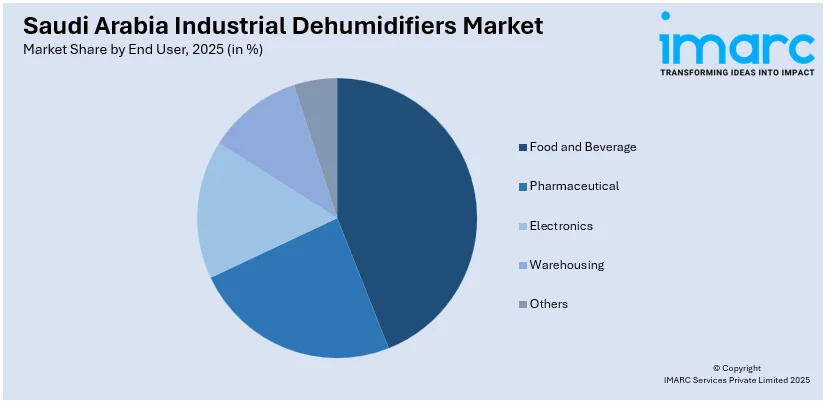

End User Insights:

Access the comprehensive market breakdown Request Sample

- Food and Beverage

- Pharmaceutical

- Electronics

- Warehousing

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes food and beverage, pharmaceutical, electronics, warehousing, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Industrial Dehumidifiers Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Refrigerant, Adsorption, Others |

| Installations Covered | Floor, Ceiling |

| End Users Covered | Food and Beverage, Pharmaceutical, Electronics, Warehousing, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia industrial dehumidifiers market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia industrial dehumidifiers market on the basis of type?

- What is the breakup of the Saudi Arabia industrial dehumidifiers market on the basis of installation?

- What is the breakup of the Saudi Arabia industrial dehumidifiers market on the basis of end user?

- What is the breakup of the Saudi Arabia industrial dehumidifiers market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia industrial dehumidifiers market?

- What are the key driving factors and challenges in the Saudi Arabia industrial dehumidifiers market?

- What is the structure of the Saudi Arabia industrial dehumidifiers market and who are the key players?

- What is the degree of competition in the Saudi Arabia industrial dehumidifiers market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia industrial dehumidifiers market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia industrial dehumidifiers market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia industrial dehumidifiers industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)