Saudi Arabia Industrial Hoses Market Size, Share, Trends and Forecast by Material Type, Application, and Region, 2026-2034

Saudi Arabia Industrial Hoses Market Overview:

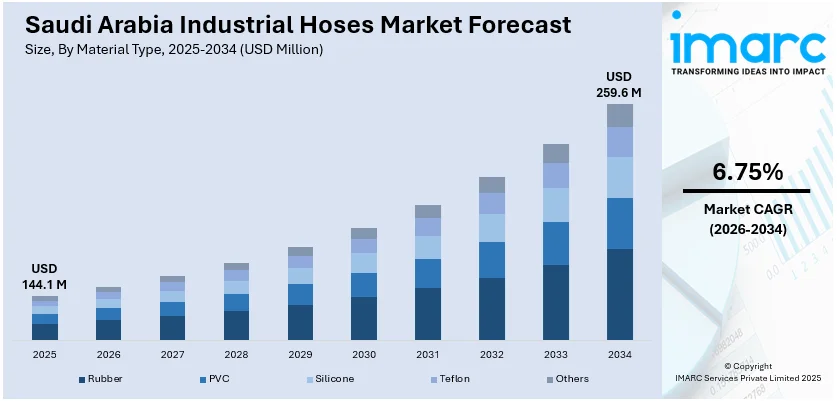

The Saudi Arabia industrial hoses market size reached USD 144.1 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 259.6 Million by 2034, exhibiting a growth rate (CAGR) of 6.75% during 2026-2034. At present, the Saudi industrial sector is witnessing ongoing growth through the continuous diversification process under the Vision 2030 program. Moreover, construction and infrastructure improvements are rising fast on the back of government investments in new cities, transportation networks, and industrial complexes. Apart from this, the growing emphasis on environmental sustainability and safety standards is expanding the Saudi Arabia industrial hoses market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 144.1 Million |

| Market Forecast in 2034 | USD 259.6 Million |

| Market Growth Rate 2026-2034 | 6.75% |

Saudi Arabia Industrial Hoses Market Trends:

Rapid Industrial Development and Diversification

The Saudi industrial sector is witnessing ongoing growth through the continuous diversification process under the Vision 2030 program. With industries like oil and gas, petrochemicals, manufacturing, and construction improving their operations, the need for industrial hoses is consistently rising. Expansion in these industries is fueling the demand for superior equipment, including industrial hoses, to facilitate proper operational processes. Firms are now investing in more reliable and efficient hose systems to cater to the growing needs of fluid and gas transfers. In addition to this, the diversification of the economy from oil dependence is promoting new industrial establishments, all of which demand industrial hoses for a range of applications, from high-pressure to chemical-resistant use. The development of industrial infrastructure and technological uptake is, hence, a primary driver of the increasing demand for industrial hoses. On January 11, 2025, KSA government bodies declared a SAR10 billion (£2.19 billion) investment in the Standard Incentives Programme to promote and support the industrial sector.

To get more information on this market Request Sample

Increased Investments in Infrastructure Development

Saudi Arabia is constantly focused on developing its infrastructure under its ambitious development initiatives. The construction and infrastructure improvements are rising fast on the back of government investments in new cities, transportation networks, and industrial complexes. This ongoing infrastructure development is creating a consistent demand for industrial hoses used in several applications, such as water supply and drainage and chemical processing. The constant construction processes, particularly in the commercial and residential sectors, are demanding long-lasting hoses that can endure extreme pressure and temperature. Also, the installation of utilities and energy infrastructure, such as the construction of renewable energy plants, is playing an important role in increasing demand for industrial specialty hoses. Moreover, companies are now emphasizing producing hoses of international quality standards, thereby propelling the Saudi Arabia industrial hoses market growth. The IMARC Group predicts that the Saudi Arabia construction market size is projected to increase to USD 135.6 Billion by 2033.

Growing Emphasis on Environmental Sustainability and Safety Standards

Saudi Arabia is increasingly improving its safety and environmental regulations to comply with international sustainability targets. Businesses are regularly embracing mechanisms to reduce the environmental footprint, such as the use of hoses that meet stricter standards for the handling of dangerous substances. The continued move towards environmental sustainability is driving the need for hoses that are made from sustainable and long-lasting materials, able to withstand extreme operating conditions without increasing the risk of spills and contamination. Moreover, industries are placing greater emphasis on safety measures, hence opening a market for hoses that not only satisfy safety requirements but also improve the efficacy of industrial processes. The demand for hoses in the oil and gas industry, for instance, is rising as organizations strive to reduce environmental and safety hazards involved in fluid transfer operations. Thus, the ongoing adoption of tighter safety and environmental regulations is driving the demand for industrial hoses with high performance in Saudi Arabia.

Saudi Arabia Industrial Hoses Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on material type and application.

Material Type Insights:

- Rubber

- PVC

- Silicone

- Teflon

- Others

The report has provided a detailed breakup and analysis of the market based on the material type. This includes rubber, PVC, silicone, teflon, and others.

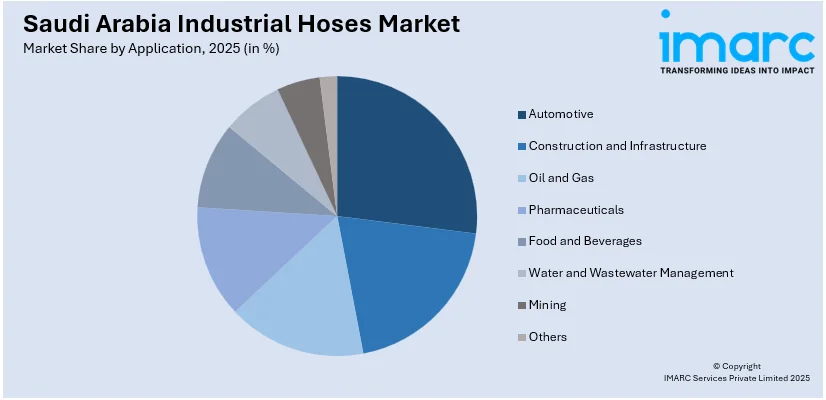

Application Insights:

Access the comprehensive market breakdown Request Sample

- Automotive

- Construction and Infrastructure

- Oil and Gas

- Pharmaceuticals

- Food and Beverages

- Water and Wastewater Management

- Mining

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes automotive, construction and infrastructure, oil and gas, pharmaceuticals, food and beverages, water and wastewater management, mining, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Industrial Hoses Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Material Types Covered | Rubber, PVC, Silicone, Teflon, Others |

| Applications Covered | Automotive, Construction and Infrastructure, Oil and Gas, Pharmaceuticals, Food and Beverages, Water and Wastewater Management, Mining, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia industrial hoses market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia industrial hoses market on the basis of material type?

- What is the breakup of the Saudi Arabia industrial hoses market on the basis of application?

- What is the breakup of the Saudi Arabia industrial hoses market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia industrial hoses market?

- What are the key driving factors and challenges in the Saudi Arabia industrial hoses market?

- What is the structure of the Saudi Arabia industrial hoses market and who are the key players?

- What is the degree of competition in the Saudi Arabia industrial hoses market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia industrial hoses market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia industrial hoses market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia industrial hoses industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)