Saudi Arabia Industrial Hydraulic Cylinders Market Size, Share, Trends and Forecast by Function, Specification, Bore Size, End Use Industry, and Region, 2026-2034

Saudi Arabia Industrial Hydraulic Cylinders Market Summary:

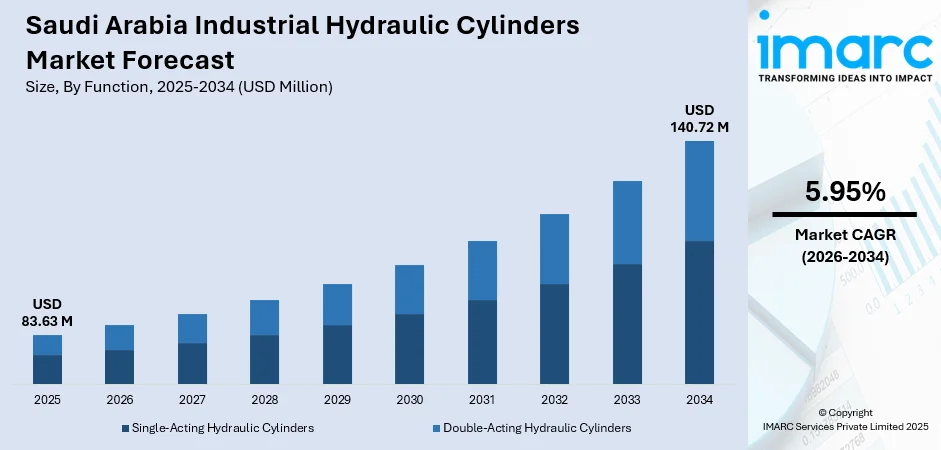

The Saudi Arabia industrial hydraulic cylinders market size was valued at USD 83.63 Million in 2025 and is projected to reach USD 140.72 Million by 2034, growing at a compound annual growth rate of 5.95% from 2026-2034.

The Saudi Arabia industrial hydraulic cylinders market is experiencing substantial expansion driven by the Kingdom's ambitious economic diversification initiatives under Vision 2030. The market growth is primarily fueled by accelerating infrastructure development, increasing adoption of industrial automation across manufacturing sectors, and the ongoing modernization of oil and gas facilities. The escalating demand for high-performance hydraulic systems in construction equipment, mining machinery, and heavy industrial applications continues to strengthen the Saudi Arabia industrial hydraulic cylinders market share.

Key Takeaways and Insights:

- By Function: Double-acting hydraulic cylinders dominate the market with a share of 75% in 2025, owing to their superior operational versatility and ability to generate force in both extension and retraction strokes, making them indispensable for precision-demanding industrial applications.

- By Specification: Welded cylinders lead the market with a share of 60% in 2025, driven by their compact design, extended bearing lengths, and exceptional durability under high-pressure conditions prevalent in construction and oil and gas applications.

- By Bore Size: The 50-150 mm segment represents the largest segment with a market share of 60% in 2025, reflecting the widespread demand for medium-capacity cylinders suitable for diverse industrial equipment and machinery requirements.

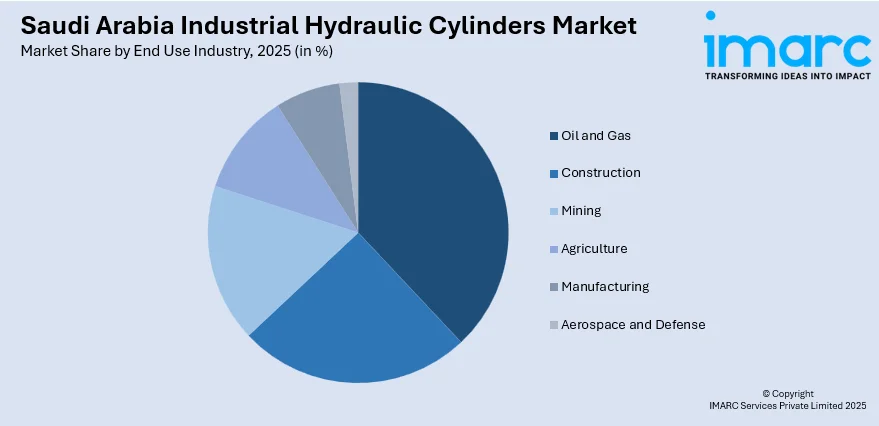

- By End Use Industry: Oil and gas holds the largest share at 30% in 2025, attributed to ongoing upstream exploration activities, offshore field expansions, and extensive modernization of hydrocarbon processing infrastructure.

- Key Players: The Saudi Arabia industrial hydraulic cylinders market features a moderately competitive landscape with established multinational corporations alongside regional manufacturers, driving innovation through technological advancements and strategic partnerships aligned with local content requirements.

To get more information on this market Request Sample

The Saudi Arabia industrial hydraulic cylinders market is witnessing transformative growth supported by the Kingdom's strategic investments exceeding SAR 12 trillion planned through 2030. The construction sector recorded significant contract awards totaling SAR 185 billion in the first half of 2024, representing a 47% increase compared to the previous year. Major infrastructure initiatives including NEOM, Qiddiya, and the Red Sea Project are creating substantial demand for hydraulic-powered construction equipment. The establishment of local manufacturing facilities, such as Emerson's 140,000 square foot innovation hub at King Salman Energy Park inaugurated in October 2024, demonstrates the industry's commitment to reducing import dependency while fostering domestic talent development and technological advancement.

Saudi Arabia Industrial Hydraulic Cylinders Market Trends:

Integration of Smart Sensing and IoT Technologies

The Saudi Arabia industrial hydraulic cylinders market is experiencing a significant shift toward intelligent hydraulic systems incorporating embedded sensors and connectivity features. Modern hydraulic cylinders now integrate real-time monitoring capabilities for pressure, temperature, and loading conditions, enabling predictive maintenance and enhanced operational efficiency. The Kingdom's National Industrial Strategy, emphasizing automation across 4,000 factories, is accelerating demand for IoT-enabled hydraulic solutions that reduce downtime and optimize performance in mission-critical applications spanning oil and gas, construction, and manufacturing sectors.

Localization of Manufacturing and Supply Chains

A prominent trend shaping the Saudi Arabia industrial hydraulic cylinders market is the strategic push toward domestic manufacturing capabilities aligned with Vision 2030 objectives. Global technology leaders are establishing production facilities within the Kingdom to reduce import dependency and develop local supply chains. This localization drive creates opportunities for knowledge transfer, technology advancement, and sustainable practices while strengthening the domestic hydraulic equipment ecosystem. Collaborations between international manufacturers and Saudi partners are enabling the production of precision-engineered cylinders meeting demanding industrial specifications. For instance, in May 2025, Adnan Sayed, Managing Director of Precision Engineering Group, discussed with The Energy Year the company’s efforts to enhance local manufacturing capabilities and technological innovation, as well as to design equipment that ensures worker safety in high-risk project environments. Precision Engineering Group is a Saudi-based provider of engineering solutions and equipment, serving the oil and gas, petrochemical, water, and industrial sectors.

Emphasis on Energy Efficiency and Sustainable Operations

The growing emphasis on energy-efficient hydraulic systems represents a notable trend influencing the Saudi Arabia industrial hydraulic cylinders market. Manufacturers are developing cylinders incorporating advanced sealing technologies, optimized internal geometries, and premium materials that minimize energy losses and extend operational lifespan. The Kingdom's commitment to renewable energy integration and reduced carbon emissions is driving demand for hydraulic equipment featuring sustainable design principles, including infrastructure powered by solar energy and environmentally conscious manufacturing processes.

Market Outlook 2026-2034:

The Saudi Arabia industrial hydraulic cylinders market outlook remains highly positive, supported by sustained infrastructure investment and industrial modernization initiatives. Continued expansion of mega-projects, accelerating mining sector development with planned investments exceeding USD 100 billion, and the ongoing transformation of manufacturing capabilities through Fourth Industrial Revolution technologies will collectively drive robust market expansion. The market generated a revenue of USD 83.63 Million in 2025 and is projected to reach a revenue of USD 140.72 Million by 2034, growing at a compound annual growth rate of 5.95% from 2026-2034.

Saudi Arabia Industrial Hydraulic Cylinders Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Function | Double-Acting Hydraulic Cylinders | 75% |

| Specification | Welded Cylinders | 60% |

| Bore Size | 50-150 mm | 60% |

| End Use Industry | Oil and Gas | 30% |

Function Insights:

- Single-Acting Hydraulic Cylinders

- Double-Acting Hydraulic Cylinders

The Double-acting hydraulic cylinders dominates the Saudi Arabia industrial hydraulic cylinders market with a share of 75% in 2025.

Double-acting hydraulic cylinders are extensively utilized across Saudi Arabia's industrial landscape due to their capability to generate force in both extension and retraction strokes. These cylinders are essential components in precision-driven applications, including robotics, automated manufacturing systems, and heavy-duty construction equipment operating across the Kingdom's mega-projects.

The increasing incorporation of sensors and electronic feedback mechanisms enabling real-time monitoring, load balancing, and adaptive force control continues to bolster the adoption of double-acting cylinders. As Saudi industries prioritize operational efficiency, automation, and predictive maintenance investments, double-acting cylinders have become central components in intelligent hydraulic systems supporting the Kingdom's industrial transformation objectives.

Specification Insights:

- Tie-Rod Cylinders

- Welded Cylinders

- Telescopic Cylinders

The welded cylinders leads the Saudi Arabia industrial hydraulic cylinders market with a share of 60% in 2025.

Welded hydraulic cylinders are widely favored in mobile and heavy-duty equipment applications throughout Saudi Arabia due to their compact design, extended internal bearing lengths, and superior ability to withstand high-pressure and demanding duty cycles. The construction sector's accelerated growth with contract awards reaching SAR 185 billion in the first half of 2024 has significantly boosted demand for these robust cylinders.

The Kingdom's extensive infrastructure development initiatives including NEOM, Qiddiya, and various transport projects, rely heavily on earthmoving equipment and heavy machinery incorporating welded hydraulic cylinders. Their durability and reliability under harsh operating conditions prevalent in Saudi Arabia's construction and mining environments make them the preferred specification for industrial applications requiring consistent performance.

Bore Size Insights:

- <50 mm

- 50-150 mm

- >150 mm

The 50-150 mm bore size accounts for the highest share at 60% of the total Saudi Arabia industrial hydraulic cylinders market in 2025.

Medium bore size hydraulic cylinders ranging from 50 to 150 mm represent the most versatile category serving diverse industrial applications across Saudi Arabia's growing economy. These cylinders provide optimal balance between force generation capacity and space efficiency, making them suitable for standard construction equipment, manufacturing machinery, and material handling systems.

The widespread adoption of medium bore cylinders reflects the industrial sector's requirement for equipment capable of handling moderate to heavy loads while maintaining operational flexibility. The ongoing expansion of manufacturing facilities, logistics infrastructure, and industrial zones throughout the Kingdom continues driving sustained demand for this bore size category.

End Use Industry Insights:

Access the Comprehensive Market Breakdown Request Sample

- Construction

- Mining

- Agriculture

- Manufacturing

- Oil and Gas

- Aerospace and Defense

The oil and gas exhibits clear dominance with a 30% share of the total Saudi Arabia industrial hydraulic cylinders market in 2025.

Saudi Arabia's oil and gas sector remains a primary driver of hydraulic cylinder demand, supported by continuous investments in upstream exploration, offshore field expansions, and infrastructure modernization. Saudi Aramco's announcement of USD 25 billion in contracts during June 2024 to boost gas production and expand the Master Gas System exemplifies the scale of ongoing hydrocarbon development activities requiring advanced hydraulic equipment.

The sector's extensive use of hydraulic cylinders spans drilling operations, well completion equipment, pipeline construction, and refinery maintenance activities. Modernization of existing oilfields utilizing advanced techniques and technologies, combined with the development of major projects including the Jafurah gas field and Marjan offshore expansion, continues to generate substantial demand for reliable, high-performance hydraulic cylinders capable of operating under demanding conditions.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The Northern and Central Region sees strong demand for hydraulic cylinders due to ongoing urban development and infrastructure projects. The modernization of manufacturing plants and growth in material handling and general industry require reliable hydraulic systems for lifting, pushing, and transporting heavy loads. The focus on industrial efficiency and advanced machinery continues to support the steady adoption of durable hydraulic solutions.

In the Western Region, extensive infrastructure and real-estate projects drive the need for heavy machinery like cranes, excavators, and material-handling equipment, all reliant on hydraulic cylinders. Expanding mining, construction, and logistics activities further boost the demand for high-performance and long-lasting hydraulic systems capable of handling rigorous operational requirements.

The Eastern Region, as a hub for oil, gas, and petrochemical industries, demands robust hydraulic cylinders for operations such as drilling, pipeline handling, and heavy-lifting machinery. Industrial modernization and automation in manufacturing and processing facilities also increase the need for advanced cylinders that deliver precision, reliability, and high load-handling capabilities.

The Southern Region is experiencing growth in industrialization, infrastructure development, and expansion of manufacturing and logistics facilities. Hydraulic cylinders are increasingly needed for efficient material handling, agricultural mechanization, and heavy-duty construction machinery, supporting the region’s development and industrial activities.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Industrial Hydraulic Cylinders Market Growing?

Accelerating Infrastructure Development Under Vision 2030

The Saudi Arabia industrial hydraulic cylinders market growth is fundamentally driven by the Kingdom's unprecedented infrastructure development agenda outlined in Vision 2030. The construction sector has witnessed remarkable expansion, with contract awards rising significantly compared to the previous year. The Saudi Arabia construction market size was valued at USD 101.4 Billion in 2025. Looking forward, the market is expected to reach USD 138.4 Billion by 2034, exhibiting a CAGR of 3.52% from 2026-2034. A substantial pipeline exceeding USD 1.5 trillion in unawarded projects awaits development, with total construction investment planned at USD 2.1 trillion over the next eight years. Mega-projects, including NEOM's USD 500 billion smart city development, Qiddiya entertainment destination, and extensive transportation infrastructure, require vast quantities of heavy construction equipment incorporating hydraulic cylinders for lifting, excavation, material handling, and earthmoving operations. This transformative infrastructure agenda ensures sustained demand for high-performance hydraulic solutions across the Kingdom.

Expansion of Oil and Gas Sector Operations

Saudi Arabia's oil and gas industry remains a cornerstone of hydraulic cylinder demand, with ongoing expansion and modernization activities driving market growth. Major projects aimed at boosting gas production and expanding key gas infrastructure are progressing steadily. Large-scale shale gas developments and offshore field expansions continue to advance, requiring extensive hydraulic equipment for drilling, construction, and production operations. This sustained investment in hydrocarbon development ensures strong and consistent demand for industrial hydraulic cylinders.

Mining Sector Transformation and Investment

The Kingdom's strategic emphasis on mining as a key pillar of its national economy is creating significant opportunities for the Saudi Arabia industrial hydraulic cylinders market. Exploration and development activities are accelerating, with numerous projects advancing through engineering and construction stages. Mining operations rely heavily on machinery such as excavators, loaders, and drilling equipment, all of which utilize hydraulic cylinders for material extraction and handling. This mining sector resurgence, aligned with Vision 2030 objectives, positions the market for sustained expansion.

Market Restraints:

What Challenges the Saudi Arabia Industrial Hydraulic Cylinders Market is Facing?

Shortage of Skilled Technical Workforce

The Saudi Arabia industrial hydraulic cylinders market faces significant challenges from the scarcity of skilled professionals required for equipment installation, maintenance, and repair operations. The construction industry alone is projected to face a deficit of 663,000 skilled workers by 2030, potentially leading to project delays and increased operational costs. This talent shortage necessitates continued reliance on expatriate workers, creating sustainability challenges for the broader industrial equipment sector.

Dependency on Imported Components and Technology

Despite ongoing localization initiatives, Saudi Arabia continues importing the majority of its hydraulic equipment components and advanced machinery from international suppliers. This dependency exposes the market to supply chain vulnerabilities, currency fluctuations, and shipping cost variations. High import costs including shipping, customs duties, and taxes can strain local end-users' budgets while limiting market accessibility for smaller enterprises.

Rising Construction and Operational Costs

Construction costs in Saudi Arabia increased between 3.4% and 4.2% in 2024, driven by high demand for skilled labor, building materials, and specialized services required by giga-projects. The Red Sea crisis has disrupted maritime supply chains, leading to increased building material costs throughout the region. These rising costs impact equipment procurement budgets and may moderate demand growth in certain market segments.

Competitive Landscape:

The Saudi Arabia industrial hydraulic cylinders market exhibits a moderately competitive structure characterized by the presence of established multinational corporations alongside emerging regional manufacturers. International technology leaders leverage their extensive experience, global supply chains, and advanced engineering capabilities to maintain market leadership positions. Simultaneously, the market witnesses growing participation from local manufacturers benefiting from government initiatives promoting domestic production and local content requirements. Strategic partnerships between global hydraulic equipment providers and Saudi enterprises are becoming increasingly common, facilitating technology transfer and localized production aligned with Vision 2030 objectives. Competition focuses on product reliability, technological innovation, after-sales service capabilities, and alignment with the Kingdom's industrial localization goals.

Recent Developments:

- October 2024: Emerson inaugurated a new 140,000 square foot manufacturing and innovation hub at King Salman Energy Park in Saudi Arabia. The facility brings together an extensive automation technology portfolio, including control systems, valves, and instrumentation, while supporting Saudi Vision 2030 objectives of promoting local manufacturing, reducing import dependency, and developing local talent through sustainable energy-efficient infrastructure.

- July 2024: Eaton partnered with Jebel Ali Free Zone Authority (JAFZA) to establish a new 500,000 square foot facility in Dubai, integrating manufacturing, R&D, and commercial operations. The facility focuses on advanced and sustainable technologies, enhancing Eaton's regional capacity for hydraulics including hydraulic cylinders and fluid power solutions, with construction scheduled to conclude by 2026 and the creation of approximately 700 jobs.

Saudi Arabia Industrial Hydraulic Cylinders Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Functions Covered | Single-Acting Hydraulic Cylinders, Double-Acting Hydraulic Cylinders |

| Specifications Covered | Tie-Rod Cylinders, Welded Cylinders, Telescopic Cylinders |

| Bore Sizes Covered | <50 mm, 50–150 mm, 150 mm |

| End User Industries Covered | Construction, Mining, Agriculture, Manufacturing, Oil and Gas, Aerospace and Defense |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia industrial hydraulic cylinders market size was valued at USD 83.63 Million in 2025.

The Saudi Arabia industrial hydraulic cylinders market is expected to grow at a compound annual growth rate of 5.95% from 2026-2034 to reach USD 140.72 Million by 2034.

Double-acting hydraulic cylinders dominated the market with a 75% share in 2025, attributed to their versatility in providing force during both extension and retraction strokes, essential for precision industrial applications.

Key factors driving the Saudi Arabia industrial hydraulic cylinders market include accelerating infrastructure development under Vision 2030, expansion of oil and gas sector operations, growing mining sector investments, increasing industrial automation adoption, and establishment of local manufacturing capabilities.

Major challenges include a shortage of skilled technical workforce for installation and maintenance, dependency on imported components and technology, rising construction and operational costs, supply chain vulnerabilities, and the need for continuous technological upgrades to meet evolving industrial requirements.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)