Saudi Arabia Industrial IoT Market Size, Share, Trends and Forecast by Component, End-User, and Region, 2026-2034

Saudi Arabia Industrial IoT Market Overview:

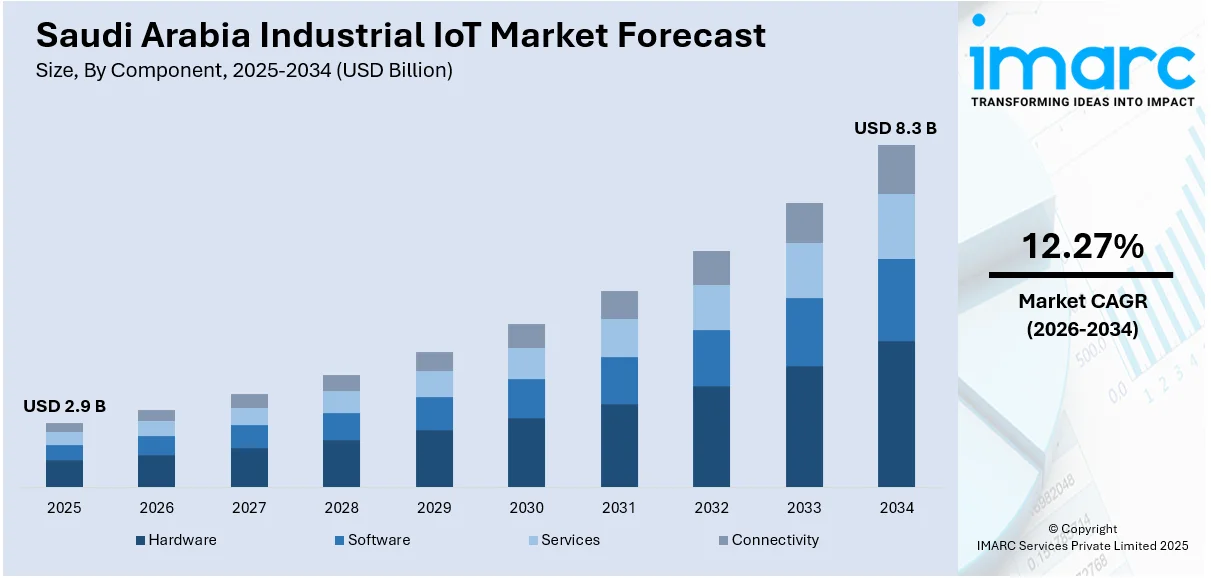

The Saudi Arabia industrial IoT market size reached USD 2.9 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 8.3 Billion by 2034, exhibiting a growth rate (CAGR) of 12.27% during 2026-2034. Regulatory initiatives, alongside significant investments in digital infrastructure like 5G and cloud computing, are driving industrial IoT adoption by providing a secure, scalable environment while fostering industrial modernization, operational efficiency, and alignment with Vision 2030 goals through advanced connectivity and technology partnerships.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 2.9 Billion |

| Market Forecast in 2034 | USD 8.3 Billion |

| Market Growth Rate 2026-2034 | 12.27% |

Saudi Arabia Industrial IoT Market Trends:

Government Regulations and Support for Digital Transformation

Regulatory measures and policy structures in Saudi Arabia are significantly contributing to the promotion of industrial Internet of Things (IIoT) implementation in different sectors. The governing authority is introducing various initiatives focused on facilitating the digital transformation of industrial sectors, promoting IIoT adoption through financial incentives, and establishing clear standards for data security, operational safety, and environmental impact. Regulatory agencies are making certain that IIoT solutions comply with national safety and security regulations, establishing a strong and secure groundwork for companies to adopt these technologies. In accordance with this, the governing body is also making significant investments in public sector programs to promote the advancement and implementation of cutting-edge technologies. This integrated regulatory and financial backing creates an atmosphere in which companies can confidently implement IIoT solutions, assured that they correspond with Saudi Arabia's strategic objectives. A prime example of this governmental commitment is the agreement signed in 2025 by Saudi Arabia's Ministry of Industry and Mineral Resources with Deutsche Messe and Riyadh Exhibitions Company to launch the Industrial Transformation Exhibition. Set for December 2025, this event will showcase advancements in automation, smart manufacturing, and industry 4.0 technologies, underscoring the dedication to strengthening Saudi Arabia’s industrial capabilities. The exhibition also aims to attract global manufacturers and technology providers, further promoting Saudi Arabia as a hub for industrial innovation and positioning IIoT at the core of its future industrial landscape.

To get more information on this market Request Sample

Advancements in Connectivity and Digital Infrastructure

The swift advancement of digital infrastructure in Saudi Arabia, featuring extensive rollout of high-speed internet, 5G networks, and cloud computing, is bolstering the market growth. These innovations enable immediate data transfer, distance monitoring, and smooth incorporation of IIoT devices within industrial settings, thus improving operational efficiency and scalability. With decreased latency and enhanced reliability, the range of IIoT applications broadens, encompassing sectors like asset tracking, predictive maintenance, and intelligent automation. Investments from both the government and private sector are reinforcing the information technology (IT) infrastructure, fostering a setting that promotes the interoperability and scalability needed for IIoT systems. The growth of industrial data centers and edge computing abilities speed up data processing and enhance data security, which is vital for industrial functions. In 2025, Nokia and Zain KSA announced a partnership to deploy the region's first 4G/5G Femtocell solution in Saudi Arabia and the MEA region. The collaboration will enhance indoor connectivity for Zain KSA's enterprise clients by ensuring reliable 4G and 5G network coverage. The initiative is in line with Saudi Vision 2030, which highlights digital transformation as a fundamental aspect of economic expansion, thereby facilitating the smooth integration of IIoT technologies across multiple sectors and propelling industrial modernization.

Saudi Arabia Industrial IoT Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on component and end-user.

Component Insights:

- Hardware

- Software

- Services

- Connectivity

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware, software, services, and connectivity.

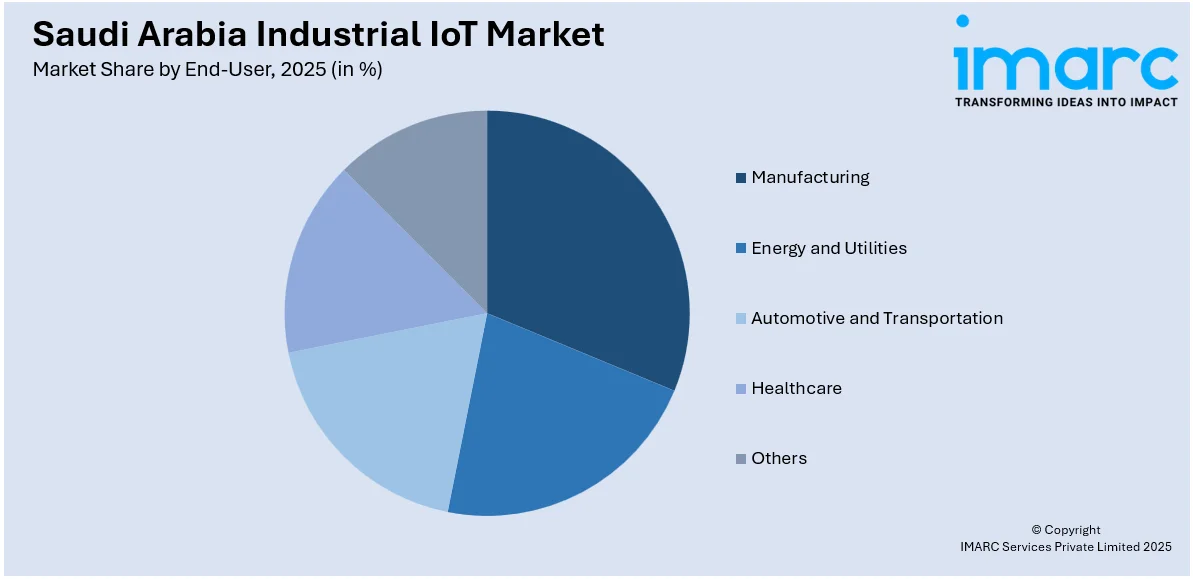

End-User Insights:

Access the comprehensive market breakdown Request Sample

- Manufacturing

- Energy and Utilities

- Automotive and Transportation

- Healthcare

- Others

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes manufacturing, energy and utilities, automotive and transportation, healthcare, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Industrial IoT Market News:

- In September 2024, Qualcomm Technologies and Alat announced a strategic collaboration to enhance AI and Industrial IoT solutions in Saudi Arabia. The partnership focused on developing AI-powered smart devices and IoT modules, including an AI inference accelerator card. This initiative aimed to establish Saudi Arabia as a global leader in digital transformation and innovation.

- In May 2024, Aramco and Qualcomm signed a memorandum of understanding (MoU) to advance the development of industrial 4G, 5G, and non-terrestrial networks (NTN) in Saudi Arabia. The collaboration focused on using 450MHz cellular technology to enhance industrial IoT capabilities. The initiative aimed to connect millions of intelligent edge devices through advanced cellular technology, AI, and high-performance computing.

Saudi Arabia Industrial IoT Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Hardware, Software, Services, Connectivity |

| End-Users Covered | Manufacturing, Energy and Utilities, Automotive and Transportation, Healthcare, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia industrial IoT market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia industrial IoT market on the basis of component?

- What is the breakup of the Saudi Arabia industrial IoT market on the basis of end-user?

- What is the breakup of the Saudi Arabia industrial IoT market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia industrial IoT market?

- What are the key driving factors and challenges in the Saudi Arabia industrial IoT market?

- What is the structure of the Saudi Arabia industrial IoT market and who are the key players?

- What is the degree of competition in the Saudi Arabia industrial IoT market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia industrial IoT market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia industrial IoT market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia industrial IoT industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)