Saudi Arabia Industrial Mixers and Agitators Market Size, Share, Trends and Forecast by Type, Application, and Region, 2026-2034

Saudi Arabia Industrial Mixers and Agitators Market Summary:

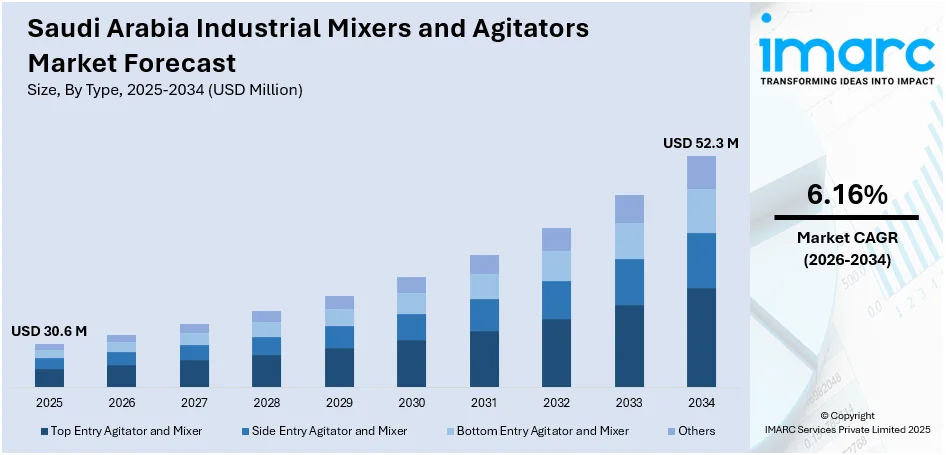

The Saudi Arabia industrial mixers and agitators market size was valued at USD 30.6 Million in 2025 and is projected to reach USD 52.3 Million by 2034, growing at a compound annual growth rate of 6.16% from 2026-2034.

The Saudi Arabia industrial mixers and agitators market is gaining strong momentum as the Kingdom accelerates industrial diversification under Vision 2030 and expands manufacturing capacity across petrochemicals, water treatment, food processing, and mining sectors. Increasing adoption of advanced automation technologies, rising investments in mega-industrial projects, and the growing demand for precision mixing solutions across end-use industries are reinforcing long-term demand and contributing to the Saudi Arabia industrial mixers and agitators market share.

Key Takeaways and Insights:

- By Type: Top entry agitator and mixer represent the largest segment with a market share of 36% in 2025, driven by its versatility in handling high-viscosity chemical and petrochemical processes across large-scale industrial applications in the Kingdom.

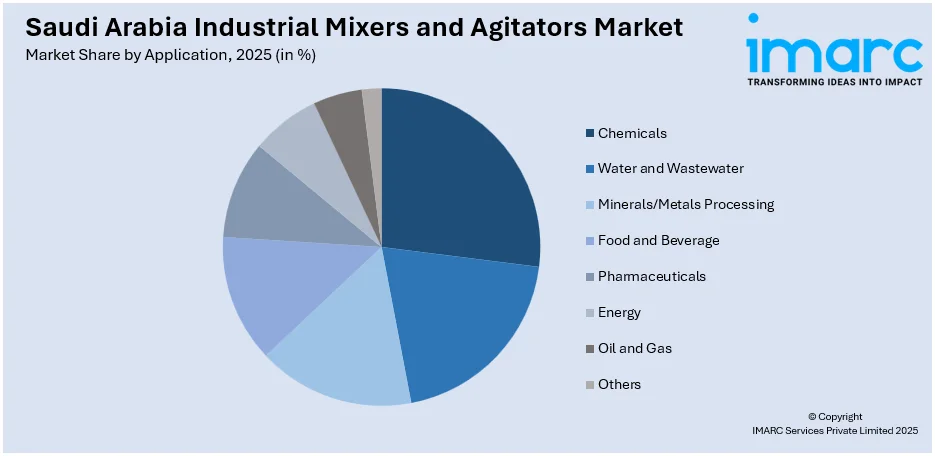

- By Application: Chemicals lead the market with a share of 20% in 2025, supported by Saudi Arabia’s expanding petrochemical production capacity and growing downstream processing requirements.

- By Region: Northern and Central Region dominate the market with a share of 30% in 2025, benefiting from the concentration of industrial cities, petrochemical hubs, and advanced manufacturing facilities in Riyadh and Jubail.

- Key Players: The Saudi Arabia industrial mixers and agitators market features a competitive landscape with established international equipment manufacturers competing alongside regional distributors, focusing on technology innovation, energy efficiency, and customized mixing solutions to capture the growing industrial demand.

To get more information on this market Request Sample

The Saudi Arabia industrial mixers and agitators market is progressing steadily as the Kingdom experiences a major industrial shift under Vision 2030’s economic diversification agenda and large-scale infrastructure development. Expanding petrochemical complexes, advanced water treatment facilities, and the growing food manufacturing clusters are catalyzing the demand for high performance mixing and agitation systems across a wide range of processing industries. This momentum is reinforced by continued downstream investment, including the 2025 approval of feedstock allocations for two major new petrochemical complexes in Jubail, highlighting the Kingdom’s commitment to strengthening its chemical value chain. Furthermore, government initiatives promoting smart manufacturing adoption, automation integration, and localized industrial equipment production are supporting the market growth. Stricter environmental compliance requirements and advancements in energy efficient mixing technologies are reshaping procurement priorities, creating strong opportunities for equipment suppliers, engineering firms, and service providers across the industrial ecosystem.

Saudi Arabia Industrial Mixers and Agitators Market Trends:

Vision 2030 Industrial Diversification

Saudi Arabia’s industrial landscape is expanding rapidly as the Kingdom advances economic diversification beyond hydrocarbons. The National Industrial Strategy is supporting the development of specialized manufacturing clusters across petrochemicals, automotive, food processing, and mining industries. This acceleration in industrial capacity is reflected in the scale of existing infrastructure, as by the end of 2024 Saudi Arabia had more than 12,000 operational factories across 40 industrial cities, with ambitious plans to increase this number to 36,000 factories by 2035. Such large-scale industrialization is generating sustained demand for industrial mixers and agitators across a wide range of processing and production applications.

Water and Wastewater Infrastructure Expansion

Significant investments in water treatment infrastructure are supporting the growth of Saudi Arabia’s industrial mixers and agitators market. The Kingdom’s commitment to wastewater treatment and reuse, aligned with national sustainability priorities, is catalyzing the demand for advanced processing equipment. This progress is reflected in 2025, when ACCIONA and its partners Tawzea and Tamasuk achieved commercial operation of three major sewage treatment plants in Madinah-3, Buraydah-2, and Tabuk-2. Together, these facilities will treat 440,000 m³ of wastewater daily. Such large-scale projects require reliable mixing and agitation systems for chemical dosing, flocculation, and biological treatment processes.

Infrastructure Development and Construction Materials Production

Large scale infrastructure development and construction activity in Saudi Arabia are driving the need for industrial mixers and agitators used in cement, concrete additives, coatings, and other construction materials. Agitation systems are essential for maintaining formulation consistency and material stability during high volume production. This demand is reinforced by the expansion of industrial zones supporting construction related manufacturing, including the 2025 launch of new industrial projects in Dammam’s First and Second Industrial Zones. These initiatives feature multi storey factory complexes and ready built industrial units to attract investment under Vision 2030. As megaprojects advance, there is a rise in the demand for heavy duty mixing systems suited to abrasive materials and continuous operations.

How Vision 2030 is Transforming the Saudi Arabia Industrial Mixers and Agitators Market:

Saudi Vision 2030 is significantly influencing the industrial mixers and agitators market by promoting economic diversification, industrial localization, and advancement in manufacturing capabilities. Substantial investments across chemicals, petrochemicals, water treatment, mining, food processing, and pharmaceutical sectors are generating sustained demand for high efficiency mixing solutions. Initiatives under the National Industrial Development and Logistics Program encourage domestic manufacturing, strategic partnerships, and technology transfer, thereby reducing reliance on imports. The development of mega projects, industrial zones, and economic cities is expanding process driven industries that require precise mixing and process control. In addition, sustainability objectives emphasizing energy efficiency and resource optimization are supporting the adoption of advanced, performance-oriented mixer and agitator technologies across the Kingdom.

Market Outlook 2026-2034:

The Saudi Arabia industrial mixers and agitators market is positioned for sustained growth, driven by Vision 2030’s ambitious industrialization agenda and the rising demand across petrochemical, water treatment, and food processing sectors. Increasing localization of advanced manufacturing capabilities, coupled with increasing environmental compliance requirements, are expected to drive higher revenue streams and foster a more competitive, technologically advanced industrial mixing landscape. The market generated a revenue of USD 30.6 Million in 2025 and is projected to reach a revenue of USD 52.3 Million by 2034, growing at a compound annual growth rate of 6.16% from 2026-2034.

Saudi Arabia Industrial Mixers and Agitators Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Top Entry Agitator and Mixer |

36% |

|

Application |

Chemicals |

20% |

|

Region |

Northern and Central Region |

30% |

Type Insights:

- Top Entry Agitator and Mixer

- Side Entry Agitator and Mixer

- Bottom Entry Agitator and Mixer

- Others

Top entry agitator and mixer dominate with a market share of 36% of the total Saudi Arabia industrial mixers and agitators market in 2025.

Top entry agitator and mixer hold the biggest market share due to their versatility across large volume tanks and reactors. These systems are widely used in chemicals, petrochemicals, water treatment, and food processing facilities where high capacity and continuous mixing are required. Their ability to handle varying viscosities, temperatures, and process conditions supports broad industrial adoption. Ease of installation on large vessels, strong mixing efficiency, and compatibility with existing tank designs make top entry configurations a preferred choice for many industrial operators.

Operational reliability and maintenance advantages further strengthen the position of top entry agitator and mixer. These units allow easier access for inspection, servicing, and component replacement without major vessel modification. Their suitability for high torque applications and long operating cycles supports use in critical production processes. Manufacturers and plant operators value proven performance, standardized designs, and availability of spare parts. High utilization across major process industries and alignment with large scale industrial projects under national development programs reinforce the dominance in the market.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Chemicals

- Water and Wastewater

- Minerals/Metals Processing

- Food and Beverage

- Pharmaceuticals

- Energy

- Oil and Gas

- Others

Chemicals lead with a market share of 20% of the total Saudi Arabia industrial mixers and agitators market in 2025.

Chemicals represent the largest segment, driven by the scale and complexity of chemical processing activities across the Kingdom. Mixing and agitation are critical for reactions, dispersion, suspension, and temperature control in chemical production. Strong presence of petrochemicals, specialty chemicals, fertilizers, and industrial chemicals drives the continuous demand for high performance mixing equipment. Large production volumes, strict process control requirements, and safety considerations require reliable agitators capable of operating under high pressure and corrosive environments, supporting sustained equipment investment within chemical manufacturing facilities nationwide.

Expansion of downstream chemical industries under national industrial diversification programs further reinforces this dominance. New plants and capacity upgrades require customized mixing systems for reactors, storage tanks, and blending operations to ensure consistent formulations and compliance with strict quality standards. This momentum is supported by the 2025 second phase of the standardized industrial incentives program, which offered direct grants of up to SR50 million to strengthen factories producing critical imported goods. Such initiatives expand chemical clusters, driving the demand for efficient agitation technologies and equipment upgrades.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and Central Region exhibit a clear dominance with a 30% share of the total Saudi Arabia industrial mixers and agitators market in 2025.

Northern and Central Region lead the market attributed to the concentration of manufacturing activity, industrial clusters, and large-scale processing facilities. The region hosts a high share of chemical, petrochemical, food processing, water treatment, and construction material plants that require continuous mixing operations. Proximity to major demand centers and industrial cities supports steady equipment installation and replacement demand. This dominance is reinforced by ongoing regional development investments, including the 2025 launch of 48 major projects worth SR4.4 billion in the Tabuk region, targeting environment, water, and agriculture sectors. A key initiative, the SR550 million Tabuk 2 Water Treatment Plant, will treat 90,000 cubic meters of water per day, strengthening the demand for advanced agitation systems.

The region also benefits from superior infrastructure, logistics connectivity, and access to skilled technical services. Presence of industrial service providers, equipment distributors, and maintenance contractors enables faster deployment and lifecycle support for mixing systems. Centralized decision-making hubs and headquarters of major industrial firms influence procurement volumes and technology choices. Industrial parks and economic zones promote adoption of modern processing equipment aligned with efficiency and quality requirements. Ongoing investments under Vision 2030 in industrial expansion, localization, and capacity upgrades further strengthen the demand for reliable mixers and agitators across production facilities in this region.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Industrial Mixers and Agitators Market Growing?

Pharmaceutical and Healthcare Manufacturing Growth

The growing emphasis on local pharmaceutical production and healthcare supply chain development in Saudi Arabia is catalyzing the demand for precision industrial mixers and agitators. Pharmaceutical manufacturing requires highly controlled mixing processes to ensure product purity, dosage accuracy, and compliance with stringent regulatory standards. This expansion is supported by rising domestic investment in biotechnology and advanced medical production facilities. The momentum is reflected in 2025, when Lifera, a PIF-backed company, and Jamjoom Pharma announced a strategic joint venture in Riyadh to develop and produce vaccines, biologics, and biosimilars locally. Such initiatives increase the need for contamination free, high performance mixing solutions, positioning healthcare manufacturing as a major factor bolstering the market growth.

Adoption of Automation and Advanced Processing Technologies

Industrial modernization and the adoption of automation are catalyzing the demand for technologically advanced mixers and agitators in Saudi Arabia. Manufacturers are increasingly prioritizing process efficiency, reduced downtime, and consistent output quality. Automated mixing systems with digital monitoring, variable speed controls, and energy efficient designs support higher productivity and better operational control. As industries integrate smart manufacturing practices, there is a rise in the demand for mixing equipment that can be seamlessly incorporated into automated production lines. This technological shift strengthens the market growth by encouraging replacement of older systems with modern solutions.

Rise of Mining and Mineral Processing Activities

Saudi Arabia’s robust mining sector is emerging as a key factor influencing the industrial mixers and agitators market, as increased investment in mineral extraction and downstream processing strengthens demand for specialized mixing systems. Mixing equipment is critical in slurry handling, ore flotation, and chemical treatment operations, where agitators ensure uniform suspension of solids and stable processing conditions. This momentum is reinforced by national initiatives, including the 2026 launch of the third round of the Mining Exploration Enablement Program, designed to accelerate exploration activity and attract stronger local and international investment. As new mining projects progress, there is a rise in the demand for heavy duty mixers capable of handling abrasive, high density materials.

Market Restraints:

What Challenges the Saudi Arabia Industrial Mixers and Agitators Market is Facing?

High Initial Investment Costs for Advanced Mixing Systems

Advanced industrial mixing and agitation systems require substantial capital investment, encompassing equipment procurement, installation, and integration with existing process infrastructure. The high upfront costs are particularly challenging for small and medium-sized enterprises (SMEs) operating in budget-constrained industrial segments, limiting broader adoption of technologically advanced mixing solutions and creating barriers to equipment modernization across smaller manufacturing facilities.

Shortage of Specialized Technical Workforce

The Kingdom faces a shortage of specialized professionals skilled in the installation, operation, and maintenance of advanced mixing and agitation systems. Many high-specification systems require expert knowledge for optimal commissioning and process optimization. Reliance on foreign technical expertise adds costs, creates logistical complexities, and can introduce delays in equipment deployment and troubleshooting, constraining the pace of industrial mixing technology adoption across the sector.

Limited Local Manufacturing and Supply Chain Dependencies

Saudi Arabia’s limited domestic manufacturing capability for advanced industrial mixing equipment creates significant reliance on imported systems and components. This dependency on international supply chains introduces vulnerabilities including extended lead times, currency fluctuation risks, and potential disruptions from global trade dynamics. The absence of a robust local manufacturing base for high-specification agitators restricts rapid equipment procurement and increases overall lifecycle costs.

Competitive Landscape:

The Saudi Arabia industrial mixers and agitators market features a moderately consolidated competitive landscape characterized by the presence of established global equipment manufacturers competing alongside regional distributors and service providers. Market dynamics are shaped by product innovation focused on energy efficiency, corrosion resistance, and smart automation integration suited for the Kingdom’s demanding industrial environments. Competition is driven by technological differentiation, after-sales service capabilities, and the ability to deliver customized mixing solutions tailored to specific process requirements across petrochemical, water treatment, and food processing applications.

Saudi Arabia Industrial Mixers and Agitators Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Top Entry Agitator and Mixer, Side Entry Agitator and Mixer, Bottom Entry Agitator and Mixer, Others |

| Applications Covered | Chemicals, Water and Wastewater, Minerals/Metals Processing, Food and Beverage, Pharmaceuticals, Energy, Oil and Gas, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia industrial mixers and agitators market size was valued at USD 30.6 Million in 2025.

The Saudi Arabia industrial mixers and agitators market is expected to grow at a compound annual growth rate of 6.16% from 2026-2034 to reach USD 52.3 Million by 2034.

Top entry agitator and mixer holds the largest revenue share of 36% in 2025, driven by its versatility in handling diverse chemical and petrochemical processing applications, superior mixing efficiency in large vessels, and compatibility with the Kingdom’s expanding industrial infrastructure.

Key factors driving the Saudi Arabia industrial mixers and agitators market include rapid industrial diversification and expanding manufacturing capacity, reflected in over 12,000 operational factories across 40 industrial cities by end-2024, with plans to scale up to 36,000 factories by 2035, boosting demand across processing sectors.

Major challenges include high initial investment costs for advanced mixing systems, shortage of specialized technical workforce for equipment installation and maintenance, limited local manufacturing capability creating import dependencies, and supply chain vulnerabilities affecting equipment procurement timelines.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)