Saudi Arabia Industrial Pumps Market Size, Share, Trends and Forecast by Product, Distribution Channel, Application, and Region, 2026-2034

Saudi Arabia Industrial Pumps Market Overview:

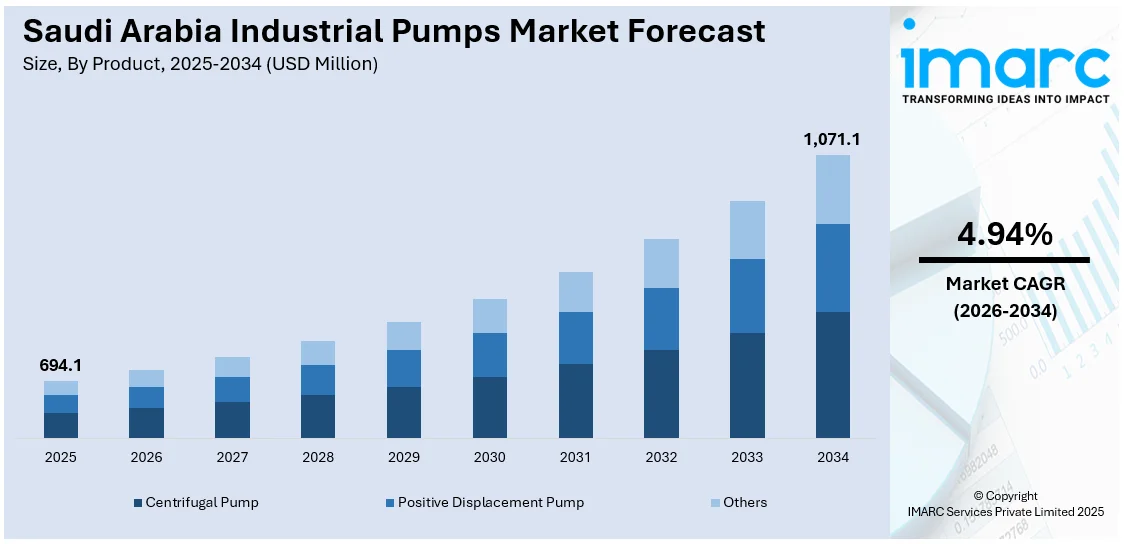

The Saudi Arabia industrial pumps market size reached USD 694.1 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,071.1 Million by 2034, exhibiting a growth rate (CAGR) of 4.94% during 2026-2034. The market is driven by rising demand in oil and gas, water treatment, and power generation sectors. Government initiatives such as Vision 2030 and the National Water Strategy promote infrastructure development, escalating pump demand. Energy-efficient and IoT-enabled pumps are gaining traction due to sustainability goals and operational cost savings. Urbanization and industrialization are further expanding the Saudi industrial pumps market share, supported by foreign investments and technological advancements.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 694.1 Million |

| Market Forecast in 2034 | USD 1,071.1 Million |

| Market Growth Rate 2026-2034 | 4.94% |

Saudi Arabia Industrial Pumps Market Trends:

Increasing Demand for Energy-Efficient Industrial Pumps

The market is witnessing a growing demand for energy-efficient pumping solutions, driven by rising energy costs and sustainability initiatives. In 2023, the total energy consumption in Saudi Arabia stayed constant at 280 Mtoe, with per capita consumption at 7.5 toe and electricity at 9.2 MWh, reflecting high energy intensity in industrial processes. While production of crude oil fell by 9% to 542 Mt, the country remains committed to absolute energy independence and has set its sights on having a 50% renewable share in its power generation by 2030. All these advances, as well as plans to cut CO₂ emissions by 278 MtCO₂eq, indicate shifting energy policies that are affecting the need for efficient industrial pump systems in various sectors across Saudi Arabia. Industries such as oil and gas, water treatment, and power generation are prioritizing pumps with advanced technologies, such as variable frequency drives (VFDs) and smart monitoring systems, to reduce energy consumption. Government regulations, including Vision 2030’s focus on environmental sustainability, are further accelerating this shift. Manufacturers are responding by introducing high-efficiency centrifugal and positive displacement pumps that comply with international energy standards. Additionally, the adoption of IoT-enabled pumps for predictive maintenance is helping industries optimize performance and minimize downtime. As Saudi Arabia continues to diversify its economy and invest in infrastructure, the demand for energy-efficient industrial pumps is expected to rise, creating opportunities for both local and international suppliers.

To get more information on this market Request Sample

Rapid Expansion of Water and Wastewater Treatment Projects

The increasing investments in water and wastewater treatment infrastructure are also favoring the Saudi Arabia industrial pumps market growth. Saudi Arabia is tackling day-to-day water transmission losses of as much as 40% by introducing the latest leak detection technology. At the same time, the Saline Water Conversion Corporation (SWCC) has committed USD 6.6 billion towards desalination, including the development of five new facilities by 2027. The National Water Company (NWC) allocated USD 20 billion for 1,218 water distribution projects, USD 20.32 billion for 857 wastewater collection projects, and USD 3.29 billion for 86 wastewater treatment plant projects in 2023. These large-scale projects are likely to significantly enhance the market demand for high-performance industrial pumps across the Kingdom's utility networks. Rapid urbanization, population growth, and government initiatives such as the National Water Strategy 2030 are driving the development of desalination plants, sewage treatment facilities, and irrigation networks. Industrial pumps, including submersible, diaphragm, and multistage pumps, are in high demand to support these projects. Additionally, the need for reliable and corrosion-resistant pumps in harsh environments is pushing manufacturers to innovate with durable materials including stainless steel and composites. Public-private partnerships (PPPs) and foreign investments are further expanding the sector, ensuring a steady demand for industrial pumps. With water scarcity being a critical challenge, the expansion of treatment facilities will continue to propel the market.

Saudi Arabia Industrial Pumps Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product, distribution channel, and application.

Product Insights:

- Centrifugal Pump

- Axial Flow Pump

- Radial Flow Pump

- Mixed Flow Pump

- Positive Displacement Pump

- Reciprocating

- Rotary

- Others

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes centrifugal pump (axial flow pump, radial flow pump, and mixed flow pump), positive displacement pump (reciprocating, rotary, and others), and others.

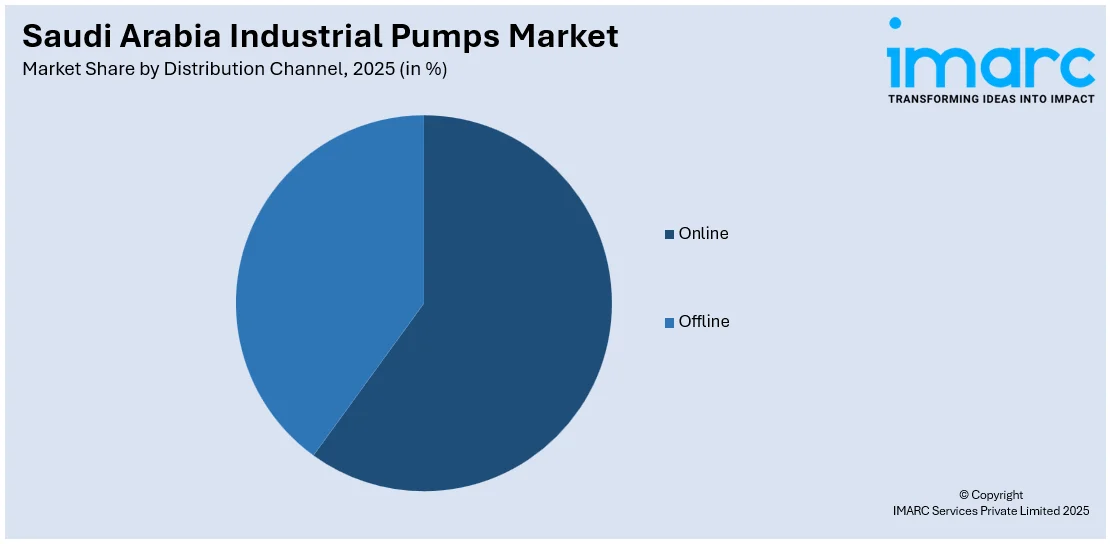

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Online

- Offline

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online and offline.

Application Insights:

- Oil and Gas

- Chemicals

- Construction

- Power Generation

- Water and Wastewater

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes oil and gas, chemicals, construction, power generation, water and wastewater, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Industrial Pumps Market News:

- June 18, 2024: Roto Pumps launched the newest Wear Compensation Stator, a major technological breakthrough in Progressive Cavity Pump that uses color-coded spacers to maximize rotor-stator interference and minimize wear. This solution assures higher volumetric efficiency, less power consumption, and longer pump life, crucial advantages as Saudi Arabia's growing industrial sectors need them. While infrastructure and utility demands escalate, this solution offers significant value for energy-saving and durable pumping systems.

Saudi Arabia Industrial Pumps Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Distribution Channels Covered | Online, Offline |

| Applications Covered | Oil and Gas, Chemicals, Construction, Power Generation, Water and Wastewater, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia industrial pumps market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia industrial pumps market on the basis of product?

- What is the breakup of the Saudi Arabia industrial pumps market on the basis of distribution channel?

- What is the breakup of the Saudi Arabia industrial pumps market on the basis of application?

- What is the breakup of the Saudi Arabia industrial pumps market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia industrial pumps market?

- What are the key driving factors and challenges in the Saudi Arabia industrial pumps market?

- What is the structure of the Saudi Arabia industrial pumps market and who are the key players?

- What is the degree of competition in the Saudi Arabia industrial pumps market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia industrial pumps market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia industrial pumps market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia industrial pumps industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)