Saudi Arabia Industrial Pumps and Valves Market Size, Share, Trends and Forecast by Product Type, Position, Driving Force, End Use, and Region, 2025-2033

Saudi Arabia Industrial Pumps and Valves Market Overview:

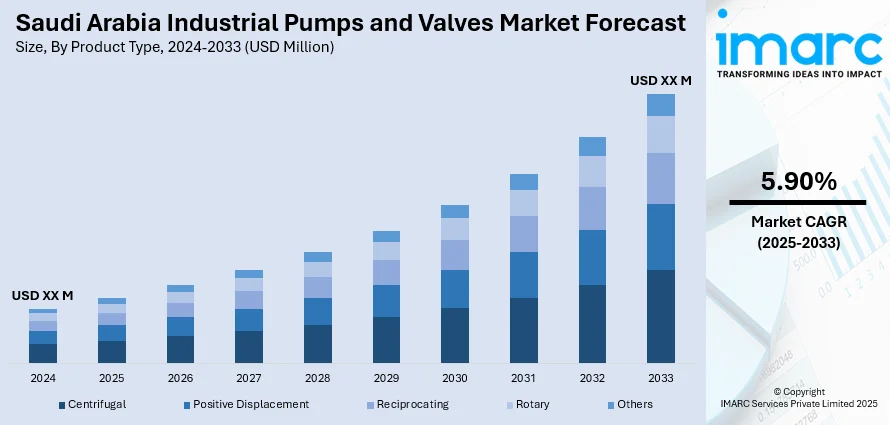

The Saudi Arabia industrial pumps and valves market size is projected to exhibit a growth rate (CAGR) of 5.90% during 2025-2033. The market is expanding due to increased investments in water infrastructure and energy projects. Besides, the push for industrial automation and efficient fluid handling systems continues to support Saudi Arabia industrial pumps and valves market share across the oil and gas and manufacturing sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Growth Rate 2025-2033 | 5.90% |

Saudi Arabia Industrial Pumps and Valves Market Trends:

Increasing Demand for Oil and Gas Projects

Saudi Arabia's industrial valves and pumps market is expanding powerfully pushed by growing demand for oil and gas projects. With the Kingdom's aspirations to be an energy leader in the world, the need for advanced solutions in industrial operations, especially in the oil and gas sector, is on the rise. In September 2024, the American companies had a meeting with the Minister of Industry to address localizing the solution of mining and growing the valves and pumps industry. The program is expected to reduce the country's reliance on imports and enhance innovation in the national industry. The cooperation seeks to improve the energy infrastructure of the Kingdom. It will result in the production of advanced valves and pump systems that are tailored specifically to address the requirements of the oil and gas industry. The demand for effective, reliable, and robust pumping units is likely to drive market development and technological advancements in Saudi Arabia. Through local manufacturing and joint ventures, this program will reduce production costs and enhance the overall quality of available products. With increasing emphasis on energy infrastructure, Saudi Arabia is increasingly becoming a dominant force in the Saudi Arabia industrial pumps and valves market growth and thus guaranteeing long-term sustainability and growth in the industry.

To get more information on this market, Request Sample

Advancement in Technological Capabilities

The Saudi Industrial Pumps and Valves market continues to evolve with the advancement of pump technology, leading to more efficient and powerful solutions. Technological innovations in pumps are crucial for meeting the increasing demands of heavy-duty industries, including oil and gas, construction, and mining. In October 2024, Danfoss Power Solutions expanded its D1P high-power pump portfolio by introducing a 160-cc displacement size. This development brings significant improvements in performance, efficiency, and reliability, particularly for machinery operating in challenging environments. The new 160-cc pump features a robust design with low-friction roller-element cradle bearings and advanced cylinder-block technology, ensuring durability and long-lasting performance under high-pressure conditions. These innovations are expected to enhance Saudi Arabia’s industrial capabilities, particularly in industries that require high power and efficiency. By incorporating advanced features such as electronic displacement control and torque control, these pumps can optimize operational efficiency, reducing downtime and minimizing operational costs. With the increasing demand for specialized pumps in industries like oil and gas, mining, and material handling, this advancement positions Saudi Arabia to become a leader in the industrial pumps and valves market, while supporting its Vision 2030 objectives of industrial self-sufficiency and growth.

Saudi Arabia Industrial Pumps and Valves Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on product type, position, driving force, and end use.

Product Type Insights:

- Centrifugal

- Positive Displacement

- Reciprocating

- Rotary

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes centrifugal, positive displacement, reciprocating, rotary, and others.

Position Insights:

- Submersible

- Non-Submersible

The report has provided a detailed breakup and analysis of the market based on the position. This includes submersible and non-submersible.

Driving Force Insights:

- Engine Driven

- Electrical Driven

The report has provided a detailed breakup and analysis of the market based on the driving force. This includes engine driven and electrical driven.

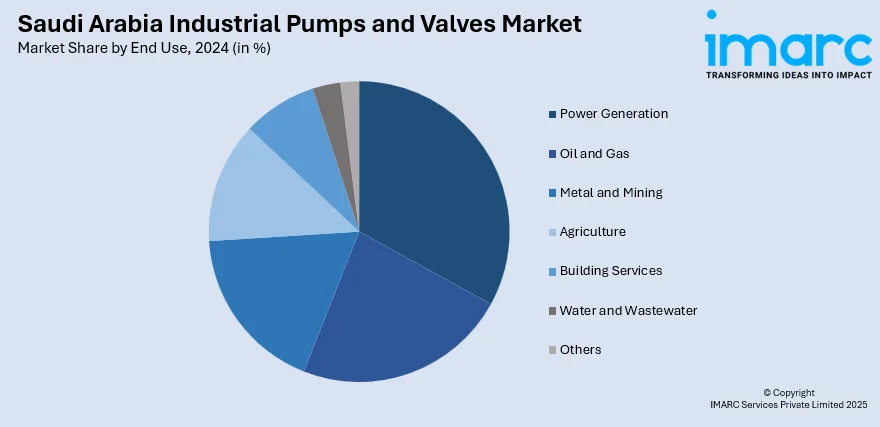

End Use Insights:

- Power Generation

- Oil and Gas

- Metal and Mining

- Agriculture

- Building Services

- Water and Wastewater

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes power generation, oil and gas, metal and mining, agriculture, building services, water and wastewater, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central region, Western region, Eastern region, and Southern region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Industrial Pumps and Valves Market News:

- May 2025: Oliver Valves Group signed an exclusive agency agreement with ATCO, strengthening its presence in Saudi Arabia's industrial market. This partnership is set to enhance the local supply of high-quality valves and pumps, supporting the Kingdom’s energy sector development and industrial growth.

- March 2025: Energy Capital Group (ECG) acquired MT Enterprises, enhancing its industrial services platform in Saudi Arabia. This strategic move boosted ECG's capacity in sectors like oil, gas, petrochemicals, and power. The acquisition positively impacted the industrial pumps and valves market by fostering innovation, expanding service delivery, and advancing technology transfer in alignment with Saudi Vision 2030.

Saudi Arabia Industrial Pumps and Valves Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Centrifugal, Positive Displacement, Reciprocating, Rotary, Others |

| Positions Covered | Submersible, Non-Submersible |

| Driving Forces Covered | Engine Driven, Electrical Driven |

| End Uses Covered | Power Generation, Oil and Gas, Metal and Mining, Agriculture, Building Services, Water and Wastewater, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia industrial pumps and valves market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia industrial pumps and valves market on the basis of product type?

- What is the breakup of the Saudi Arabia industrial pumps and valves market on the basis of position?

- What is the breakup of the Saudi Arabia industrial pumps and valves market on the basis of driving force?

- What is the breakup of the Saudi Arabia industrial pumps and valves market on the basis of end use?

- What is the breakup of the Saudi Arabia industrial pumps and valves market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia industrial pumps and valves market?

- What are the key driving factors and challenges in the Saudi Arabia industrial pumps and valves market?

- What is the structure of the Saudi Arabia industrial pumps and valves market and who are the key players?

- What is the degree of competition in the Saudi Arabia industrial pumps and valves market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia industrial pumps and valves market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia industrial pumps and valves market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia industrial pumps and valves industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)