Saudi Arabia Industrial Robotics Market Size, Share, Trends and Forecast by Type, Function, End Use Industry, and Region, 2026-2034

Saudi Arabia Industrial Robotics Market Overview:

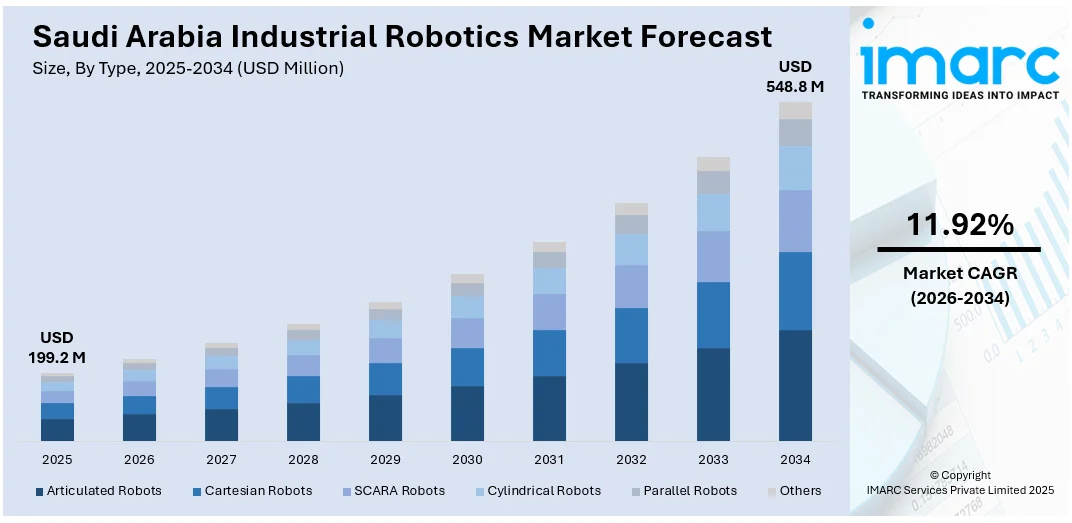

The Saudi Arabia industrial robotics market size reached USD 199.2 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 548.8 Million by 2034, exhibiting a growth rate (CAGR) of 11.92% during 2026-2034. The growing automation across manufacturing, rising demand for precision and efficiency, supportive government initiatives under Vision 2030, increasing adoption in automotive and electronics sectors, and advancements in artificial intelligence and machine learning integration are key drivers fueling the growth of the industrial robotics market in Saudi Arabia.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 199.2 Million |

| Market Forecast in 2034 | USD 548.8 Million |

| Market Growth Rate 2026-2034 | 11.92% |

Saudi Arabia Industrial Robotics Market Trends:

Integration of Robotics in the Automotive and Metal Industries

The automotive and metal fabrication sectors in Saudi Arabia are experiencing a notable shift toward automation, driven by the increasing adoption of industrial robotics to improve productivity, accuracy, and workplace safety. This development aligns with the Kingdom’s broader goal under Vision 2030 to establish itself as a regional automotive manufacturing hub, targeting an annual production capacity of 300,000 vehicles by the end of the decade. Investments in automation technologies are rising as manufacturers seek to streamline operations and reduce dependence on manual labor, which is facilitating the Saudi Arabia industrial robotics market growth. Industrial robots are now widely integrated into high-precision processes such as arc and spot welding, material handling, painting, and complex assembly tasks. These systems contribute to greater production consistency, minimize downtime, and support scalable output to meet growing domestic and export demand. The growing demand for locally produced vehicles and metal products has driven manufacturers to scale up production, making robotics indispensable. The market development is reinforced by strategic collaborations between robotics suppliers and local manufacturing firms to transfer technology and build in-house capabilities, thereby reducing reliance on imported skilled labor and increasing domestic industrial output.

To get more information on this market Request Sample

Saudi Arabia’s Push for Smart Manufacturing

Saudi Arabia is actively embracing advanced and smart manufacturing frameworks that integrate industrial robotics with technologies, data analytics, and cloud-based control systems, which is positively impacting Saudi Arabia industrial robotics market outlook. This evolution is reshaping the market, creating strong growth prospects across key sectors such as automotive, petrochemicals, and electronics manufacturing. The shift is closely aligned with the government’s long-term economic diversification agenda under Vision 2030, which places strong emphasis on reducing oil dependency and building a robust, technology-driven industrial base. Notably, the Advanced Manufacturing Hub Strategy outlines over 800 investment opportunities worth approximately USD 273 Billion. These initiatives are strategically designed to scale up the use of automation, robotics, and Industry 4.0 technologies across Saudi Arabia’s manufacturing landscape. By embedding robotics into digitally connected and automated production lines, Saudi manufacturers are improving operational efficiency, minimizing downtime, and enhancing quality control. This is not only strengthening the competitiveness of local industries but also positioning Saudi Arabia as a regional hub for advanced industrial technology and smart factory solutions. As a result, the demand for industrial robots and intelligent automation systems is expected to see sustained growth in the coming years, which further augments Saudi Arabia industrial robotics market share.

Saudi Arabia Industrial Robotics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type, function, and end use industry.

Type Insights:

- Articulated Robots

- Cartesian Robots

- SCARA Robots

- Cylindrical Robots

- Parallel Robots

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes articulated robots, cartesian robots, SCARA robots, cylindrical robots, parallel robots, and others.

Function Insights:

- Soldering and Welding

- Materials Handling

- Assembling and Disassembling

- Painting and Dispensing

- Milling, Cutting and Processing

- Others

A detailed breakup and analysis of the market based on the function have also been provided in the report. This includes soldering and welding, materials handling, assembling and disassembling, painting and dispensing, milling, cutting and processing, and others.

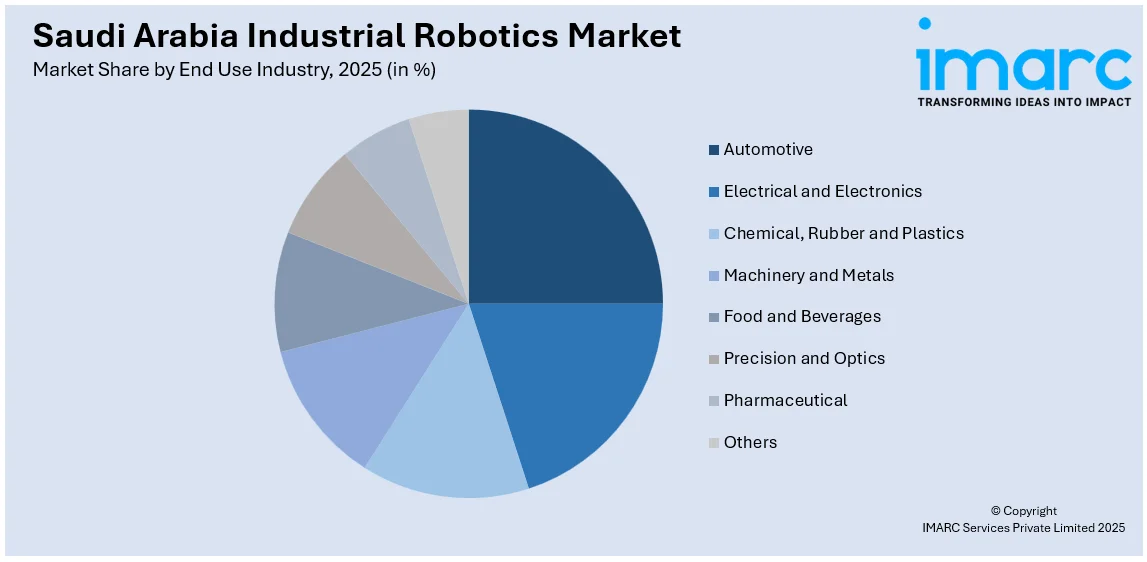

End Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- Automotive

- Electrical and Electronics

- Chemical, Rubber and Plastics

- Machinery and Metals

- Food and Beverages

- Precision and Optics

- Pharmaceutical

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes automotive, electrical and electronics, chemical, rubber and plastics, machinery and metals, food and beverages, precision and optics, pharmaceutical, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Industrial Robotics Market News:

- On February 20, 2024, Alat, a Public Investment Fund (PIF) company, and SoftBank Group announced a strategic partnership to establish a next-generation industrial automation business in Saudi Arabia. The joint venture will invest up to USD 150 Million to build a fully automated manufacturing and engineering hub in Riyadh. This initiative aims to produce advanced industrial robots, supporting the Kingdom's Vision 2030 goals for economic diversification and sustainable industrial development.

- On February 13, 2025, Alat CEO Amit Midha announced that Saudi Arabia plans to commence exports of industrial robots by the end of May 2025. These robots, developed through a joint venture with SoftBank, are designed to outperform human labor in manufacturing tasks and are expected to be cost-effective, potentially reshaping global production processes.

Saudi Arabia Industrial Robotics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Articulated Robots, Cartesian Robots, SCARA Robots, Cylindrical Robots, Parallel Robots, Others |

| Functions Covered | Soldering and Welding, Materials Handling, Assembling and Disassembling, Painting and Dispensing, Milling, Cutting and Processing, Others |

| End Use Industries Covered | Automotive, Electrical and Electronics, Chemical, Rubber and Plastics, Machinery and Metals, Food and Beverages, Precision and Optics, Pharmaceutical, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia industrial robotics market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia industrial robotics market on the basis of type?

- What is the breakup of the Saudi Arabia industrial robotics market on the basis of function?

- What is the breakup of the Saudi Arabia industrial robotics market on the basis of end use industry?

- What is the breakup of the Saudi Arabia industrial robotics market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia industrial robotics market?

- What are the key driving factors and challenges in the Saudi Arabia industrial robotics market?

- What is the structure of the Saudi Arabia industrial robotics market and who are the key players?

- What is the degree of competition in the Saudi Arabia industrial robotics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia industrial robotics market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia industrial robotics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia industrial robotics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)