Saudi Arabia Industrial Robotics Software Market Size, Share, Trends and Forecast by Type of Software, Deployment Model, Functionality, Application, End User Industry, and Region, 2026-2034

Saudi Arabia Industrial Robotics Software Market Overview:

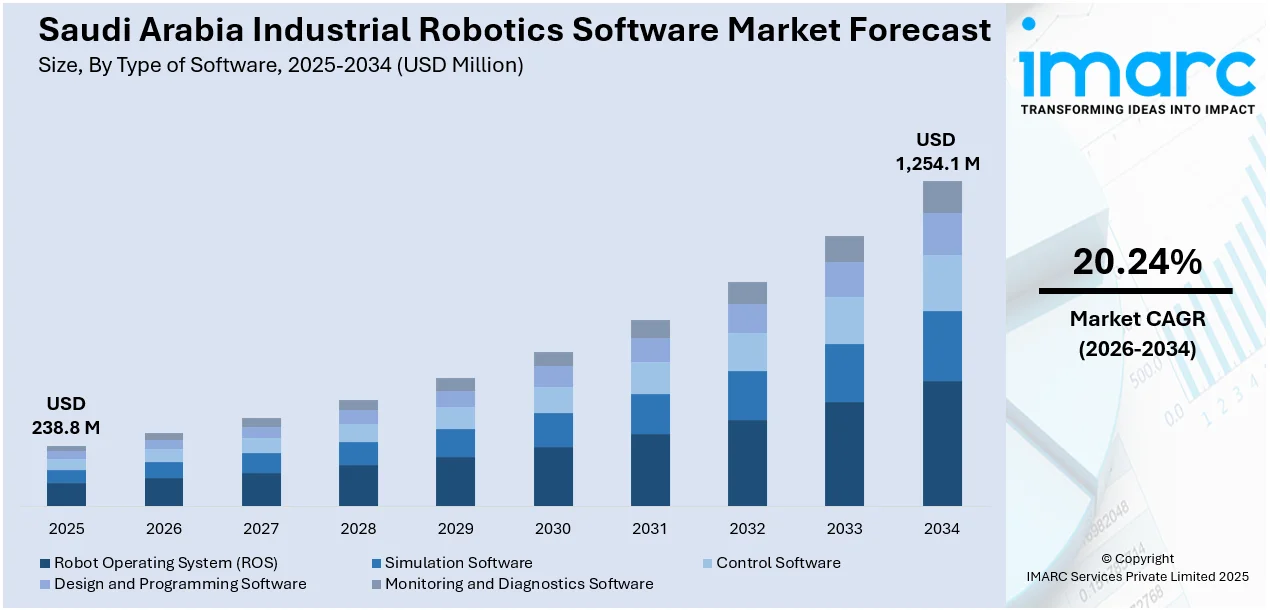

The Saudi Arabia industrial robotics software market size reached USD 238.8 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,254.1 Million by 2034, exhibiting a growth rate (CAGR) of 20.24% during 2026-2034. The market is driven by technological innovations in robotics and AI adoption. Additionally, the government push for smart manufacturing is continuously supporting the market growth. Additionally, the growing need for automation solutions in manufacturing, Industry 4.0 initiatives, and government aids are fueling product adoption. Mass need for automation and implementation of favorable government policies are also contributing significantly to the Saudi Arabia industrial robotics software market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 238.8 Million |

|

Market Forecast in 2034

|

USD 1,254.1 Million |

| Market Growth Rate 2026-2034 | 20.24% |

Saudi Arabia Industrial Robotics Software Market Trends:

Technological Advancements in Robotics and AI Integration

The speedy growth in robotics and artificial intelligence (AI) is playing a key role in the market development. Robotics and AI are now enabling the automation of complex tasks that were previously labor-intensive and error-prone. AI-driven systems are now capable of learning and adapting to new tasks, leading to improved efficiency, precision, and flexibility. Also, advanced software platforms now provide real-time analytics of data, predictive maintenance, and autonomous decision-making, significantly enhancing performance operations. Consequently, Saudi Arabia has been integrating the latest technologies into its industrial processes, with robotics systems based on AI transforming various industries including manufacturing, logistics, and healthcare. Aramex unveiled its cutting-edge robotic sorting center at Jeddah Islamic Port in Saudi Arabia on January 21, 2025, incorporating a sophisticated automated sorting system of 120 robot-guided vehicles with the capability to sort 4,000 shipments an hour. This launch is a critical milestone in the digital transformation journey of the company, supporting Saudi Arabia's Vision 2030 by enhancing the efficiency of logistics using robotics, AI, and automation. This quick uptake of AI technologies into industrial systems is also driving Saudi Arabia industrial robotics software market growth and development, as companies increasingly seek for software that can smoothly integrate with hardware and optimize robotic performance.

To get more information on this market Request Sample

Government Support and Industry 4.0 Initiatives

Government initiatives and strategic Saudi Arabian plans towards Industry 4.0 are one of the major drivers for the Saudi Arabia market. The government has been actively promoting the use of sophisticated technologies, including robotics and automation, across all industries to enhance competitiveness and productivity. By offering subsidies, tax relief, and research grants, Saudi Arabia is creating a conducive environment for industrial robotics development and adoption. The government's efforts to promote smart manufacturing, digitalization, and minimizing labor expenses are driving the development of automation solutions in the country at a faster pace. With a growing push toward diversification from oil dependency, robotics is playing a critical role in advancing the industrial sector. Moreover, the strategic implementation of Industry 4.0 technologies like IoT and data analytics is further driving the adoption of industrial robotics software across various sectors. UBTECH introduced its newest humanoid robots and AI solutions at LEAP 2025 in Saudi Arabia on February 10, 2025, such as the Walker S1, Panda Robot Youyou, and the high-tech Una robot. The Walker S1 industrial humanoid robot capable of multi-tasks, showed how it could handle parcels and sort them, first showcasing itself in the Middle East. This highlights UBTECH's significant contribution to the industrial robotics software market, showcasing its expertise in deploying humanoid robots in various sectors such as industrial manufacturing, commercial services, and household applications.

Saudi Arabia Industrial Robotics Software Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type of software, deployment model, functionality, application, and end user industry.

Type of Software Insights:

- Robot Operating System (ROS)

- Simulation Software

- Control Software

- Design and Programming Software

- Monitoring and Diagnostics Software

The report has provided a detailed breakup and analysis of the market based on the type of software. This includes Robot Operating System (ROS), simulation software, control software, design and programming software, and monitoring and diagnostics software.

Deployment Model Insights:

- On-Premises Solutions

- Cloud-Based Solutions

- Hybrid Solutions

The report has provided a detailed breakup and analysis of the market based on the deployment model. This includes on-premises solutions, cloud-based solutions, and hybrid solutions.

Functionality Insights:

- Robot Programming and Development

- Path Planning and Navigation

- Collaborative Robots (Cobots) Software

- Machine Learning and AI Integration

- Safety and Compliance Features

The report has provided a detailed breakup and analysis of the market based on the functionality. This includes robot programming and development, path planning and navigation, collaborative robots (cobots) software, machine learning and AI integration, and safety and compliance features.

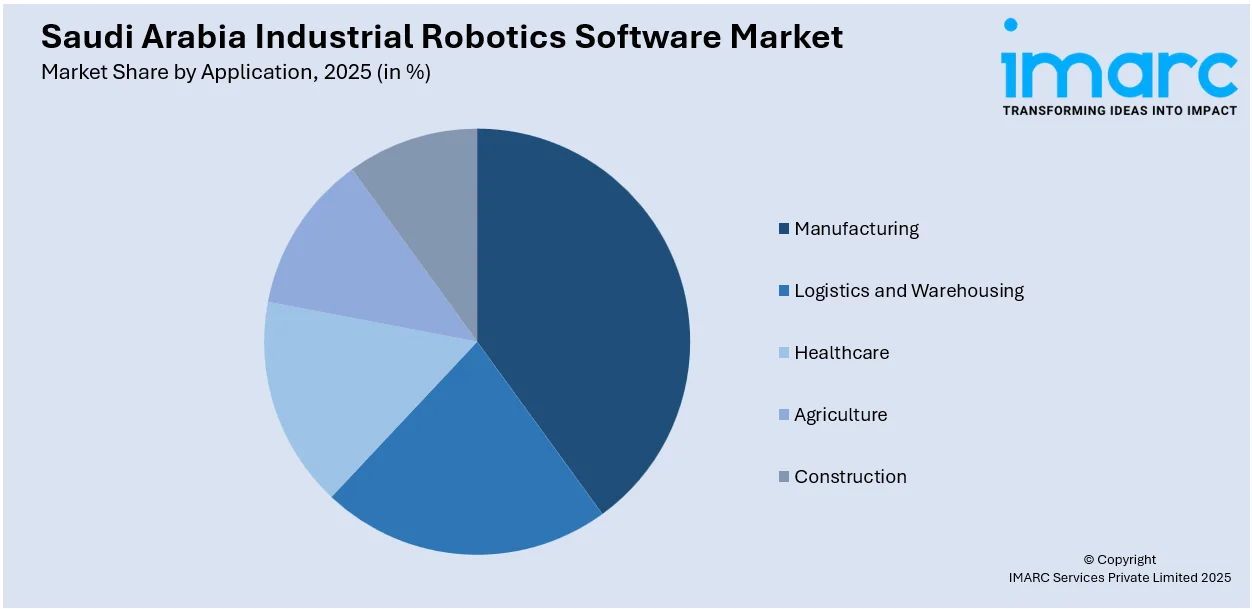

Application Insights:

Access the comprehensive market breakdown Request Sample

- Manufacturing

- Logistics and Warehousing

- Healthcare

- Agriculture

- Construction

The report has provided a detailed breakup and analysis of the market based on the application. This includes manufacturing, logistics and warehousing, healthcare, agriculture, and construction.

End User Industry Insights:

- Aerospace and Defense

- Automotive

- Electronics

- Food and Beverage

- Pharmaceuticals

The report has provided a detailed breakup and analysis of the market based on the end user industry. This includes aerospace and defense, automotive, electronics, food and beverage, and pharmaceuticals.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has provided a comprehensive analysis of all major regional markets, including Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Industrial Robotics Software Market News:

- On May 7, 2025, it was announced that NEOM has partnered with GMT Robotics to introduce advanced robotic systems in construction, aimed at accelerating capital project delivery and revolutionizing the sector in Saudi Arabia. The agreement highlights the integration of robotics in construction, specifically focusing on rebar cage assembly and handling systems, which can reduce onsite workforce requirements by up to 90% through offsite prefabrication.

- On March 9, 2025, the King Abdullah University of Science and Technology (KAUST) announced the development of a robotic system designed to automate date palm harvesting, marking a significant step in agricultural innovation in Saudi Arabia. Led by Assistant Professor Shinkyu Park, the system utilizes AI-powered robotics to improve efficiency in key farming tasks such as harvesting, pollination, and tree maintenance, promising increased yield and enhanced quality of dates.

Saudi Arabia Industrial Robotics Software Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Type of Softwares Covered | Robot Operating System (ROS), Simulation Software, Control Software, Design and Programming Software, Monitoring and Diagnostics Software |

| Deployment Models Covered | On-Premises Solutions, Cloud-Based Solutions, Hybrid Solutions |

| Functionalities Covered | Robot Programming and Development, Path Planning and Navigation, Collaborative Robots (Cobots) Software, Machine Learning and AI Integration, Safety and Compliance Features |

| Applications Covered | Manufacturing, Logistics and Warehousing, Healthcare, Agriculture, Construction |

| End User Industries Covered | Aerospace and Defense, Automotive, Electronics, Food and Beverage, Pharmaceuticals |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia industrial robotics software market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia industrial robotics software market on the basis of type of software?

- What is the breakup of the Saudi Arabia industrial robotics software market on the basis of deployment model?

- What is the breakup of the Saudi Arabia industrial robotics software market on the basis of functionality?

- What is the breakup of the Saudi Arabia industrial robotics software market on the basis of application?

- What is the breakup of the Saudi Arabia industrial robotics software market on the basis of end user industry?

- What is the breakup of the Saudi Arabia industrial robotics software market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia industrial robotics software market?

- What are the key driving factors and challenges in the Saudi Arabia industrial robotics software?

- What is the structure of the Saudi Arabia industrial robotics software market and who are the key players?

- What is the degree of competition in the Saudi Arabia industrial robotics software market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia industrial robotics software market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia industrial robotics software market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia industrial robotics software industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)