Saudi Arabia Industrial Sand Market Size, Share, Trends and Forecast by Product Type, Grade, Application, End Use, and Region, 2026-2034

Saudi Arabia Industrial Sand Market Summary:

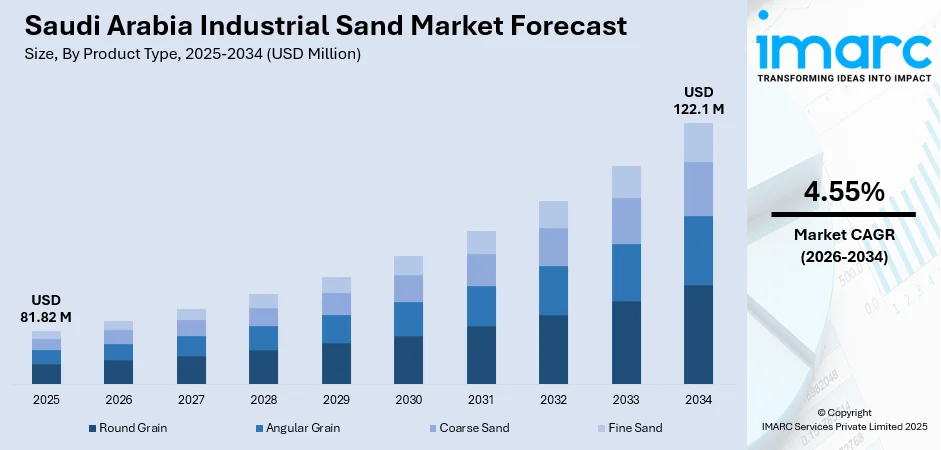

The Saudi Arabia industrial sand market size was valued at USD 81.82 Million in 2025 and is projected to reach USD 122.1 Million by 2034, growing at a compound annual growth rate of 4.55% from 2026-2034.

The Saudi Arabia industrial sand market is experiencing robust growth as the Kingdom accelerates its infrastructure development agenda under Vision 2030 and expands renewable energy generation capacity. Increasing investments in mega-construction projects, rising domestic glass and ceramics manufacturing, and escalating demand from hydraulic fracturing operations in unconventional gas fields are reinforcing industrial supply chains. Advancements in mining technologies, quality control systems, and sustainable extraction practices are enhancing production efficiency and positioning Saudi Arabia as a regional hub for high-purity silica sand processing, thereby augmenting the Saudi Arabia industrial sand market share.

Key Takeaways and Insights:

- By Product Type: Round grain dominates the market with a share of 32% in 2025, attributed to its superior flowability, consistent particle distribution, and widespread application across glass manufacturing and foundry casting processes.

- By Grade: Industrial grade leads the market with a share of 68% in 2025, driven by its cost-effectiveness and versatility across construction, concrete production, and general manufacturing applications requiring standardized silica specifications.

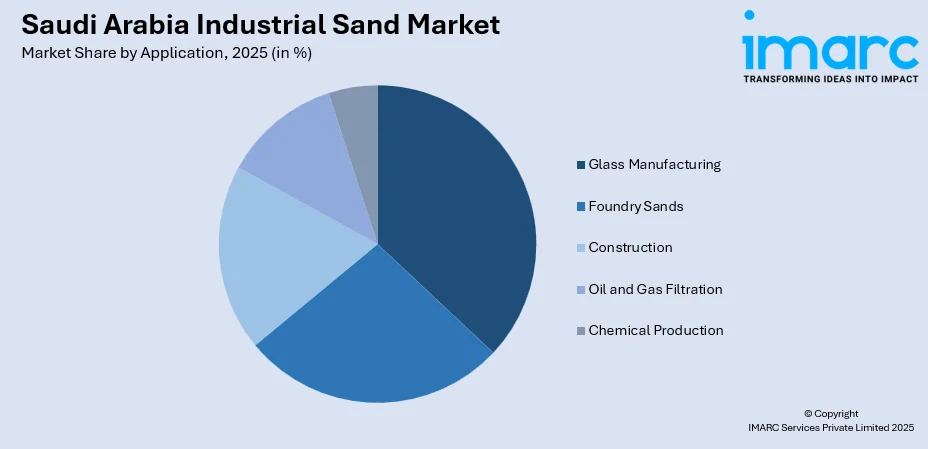

- By Application: Glass manufacturing represents the largest segment with a market share of 30% in 2025, owing to expanding domestic float glass production, architectural glazing demand from mega-projects, and rising container glass requirements.

- By End Use: Construction holds the largest share at 34% in 2025, reflecting substantial infrastructure investments under Vision 2030, including smart cities, transportation networks, and industrial developments across the Kingdom.

- By Region: Eastern region dominates the market with a share of 36% in 2025, driven by strong demand from oil and gas operations, extensive petrochemical and glass manufacturing activities, ongoing industrial infrastructure development, and the region’s proximity to high-quality silica sand reserves and major export ports.

- Key Players: The Saudi Arabia industrial sand market exhibits moderate competitive intensity, with established regional producers expanding processing capacities, investing in quality testing facilities, and forming strategic partnerships to strengthen supply chains and capture emerging opportunities.

To get more information on this market Request Sample

The Saudi Arabia industrial sand market is advancing as government initiatives drive infrastructure modernization, manufacturing localization, and energy sector diversification. Growing emphasis on sustainable building materials, expanding glass production facilities, and increasing unconventional gas extraction activities are reinforcing demand for high-quality silica sand. In August 2025, ACWA Power commenced commercial operations at three solar facilities in Saudi Arabia, including the Al Kahfah, Al-Rass 2, and SAAD 2 projects, with a combined capacity of 2.79 GW. These developments underscore the accelerating renewable energy transition requiring high-purity silica for photovoltaic glass manufacturing. Strategic investments in processing technologies, beneficiation units, and quality management systems are enabling manufacturers to meet evolving industry specifications and support the Kingdom's industrial self-sufficiency objectives.

Saudi Arabia Industrial Sand Market Trends:

Expansion of Renewable Energy Infrastructure

The Kingdom's accelerating transition toward clean energy generation is creating sustained demand for high-purity industrial sand essential for photovoltaic glass manufacturing and concentrated solar power applications. Solar installations require silica with exceptional clarity, thermal stability, and chemical purity to ensure optimal energy conversion efficiency and equipment longevity. Saudi Arabia's Renewable Energy Project Development Office has established plans to develop 58.7 GW of renewable capacity by 2030, with solar power representing the dominant generation source. This ambitious target is driving investments in domestic silica processing capabilities to support the expanding solar infrastructure and strengthen Saudi Arabia industrial sand market growth.

Growing Emphasis on Manufacturing Localization

The Kingdom's strategic focus on reducing import dependency and establishing vertically integrated industrial supply chains is reshaping the industrial sand sector. Government initiatives under the National Industrial Development and Logistics Program are encouraging domestic production of glass, ceramics, and construction materials, thereby catalyzing demand for locally processed silica. In November 2023, Zoujaj Glass received board approval to establish a sixth production line for glass containers at its Riyadh facility, projected to increase annual capacity by approximately 25,000 metric tons. Such capacity expansions reflect the broader industry trend toward manufacturing self-sufficiency and localized raw material sourcing.

Advancement of Quality Control Technologies

The industrial sand sector is witnessing increased adoption of automated screening systems, real-time monitoring equipment, and advanced beneficiation technologies to ensure consistent product specifications. Manufacturers are investing in sophisticated testing laboratories and quality management certifications to meet stringent requirements from the glass, foundry, and construction industries. The integration of artificial intelligence in processing operations enables precise particle size distribution, impurity detection, and production optimization. These technological advancements are enhancing supply reliability, reducing waste, and supporting Saudi Arabia's positioning as a quality-assured supplier in regional and international markets.

How Vision 2030 is Transforming the Saudi Arabia Industrial Sand Market:

Saudi Arabia’s Vision 2030 is significantly reshaping the industrial sand market by boosting demand and expanding domestic supply chains. Large-scale infrastructure and mega-projects, like NEOM and urban development initiatives, are increasing the need for high-quality industrial sand in concrete, glass, and specialty materials for construction and manufacturing. This growth is supported by investments in processing technologies, regulatory standards, and sustainable extraction practices that improve sand quality and environmental compliance. Additionally, expanding downstream sectors such as automotive, chemicals, and renewable energy under Vision 2030 further drives industrial sand consumption and market expansion. The result is a more competitive, diversified industrial sand sector aligned with broader economic transformation goals.

Market Outlook 2026-2034:

The Saudi Arabia industrial sand market offers strong growth potential supported by ongoing construction activity, rising manufacturing capacity, and increasing investments across the energy sector. Policy measures focused on economic diversification, domestic industrial development, and sustainability are fostering an enabling environment for long-term expansion. Large-scale renewable and conventional energy developments underway nationwide highlight persistent infrastructure spending, reinforcing demand fundamentals and supporting steady consumption of industrial sand across multiple applications throughout the projected outlook period and downstream manufacturing value chains over coming years. The market generated a revenue of USD 81.82 Million in 2025 and is projected to reach a revenue of USD 122.1 Million by 2034, growing at a compound annual growth rate of 4.55% from 2026-2034.

Saudi Arabia Industrial Sand Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Round Grain |

32% |

|

Grade |

Industrial Grade |

68% |

|

Application |

Glass Manufacturing |

30% |

|

End Use |

Construction |

34% |

|

Region |

Eastern Region |

36% |

Product Type Insights:

- Round Grain

- Angular Grain

- Coarse Sand

- Fine Sand

The round grain segment dominates with a market share of 32% of the total Saudi Arabia industrial sand market in 2025.

Round grain industrial sand maintains market leadership owing to its superior physical characteristics that enhance performance across multiple industrial applications. The spherical particle morphology enables improved flowability during glass melting processes, uniform mold filling in foundry operations, and optimal packing density in filtration applications. Glass manufacturers particularly value round grain silica for producing clear, defect-free products with consistent thermal properties. In August 2024, Gulf Guard, a subsidiary of the National Company for Glass Industries, approved a study to establish a float and insulating glass plant at an estimated investment of SAR 806.2 million in the Royal Jubail Industrial Commission, highlighting the expanding demand for premium-quality round grain silica.

The segment benefits from established processing infrastructure and quality assurance protocols that ensure consistent particle size distribution and chemical purity. Domestic producers have invested in advanced washing, drying, and classification equipment to meet specifications required by glass and foundry industries. The growing emphasis on architectural glazing for mega-construction projects and the expansion of container glass production are reinforcing demand for high-quality round grain sand across the Kingdom.

Grade Insights:

- Industrial Grade

- Specialty Grade

- High Purity Grade

The industrial grade segment leads with a share of 68% of the total Saudi Arabia industrial sand market in 2025.

Industrial grade silica sand commands the dominant market position through its widespread application across construction, concrete production, and general manufacturing sectors requiring cost-effective raw materials. This grade offers suitable silica content and physical properties for applications where ultra-high purity specifications are not essential, enabling competitive pricing while meeting functional requirements. The ongoing expansion of infrastructure projects under Vision 2030 generates substantial demand for industrial grade sand in concrete manufacturing, asphalt production, and land reclamation activities. The Saudi Arabia construction market size was valued at USD 101.4 Billion in 2025. Looking forward, the market is expected to reach USD 138.4 Billion by 2034, exhibiting a CAGR of 3.52% from 2026-2034.

The segment benefits from abundant domestic reserves and established extraction operations across the Kingdom. Producers have expanded processing capacities to meet growing requirements from construction contractors and building material manufacturers. The government's emphasis on utilizing local resources and reducing imported construction materials further strengthens demand for domestically produced industrial grade sand.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Glass Manufacturing

- Foundry Sands

- Construction

- Oil and Gas Filtration

- Chemical Production

The glass manufacturing segment holds the largest market share at 30% of the total Saudi Arabia industrial sand market in 2025.

Glass manufacturing represents the leading application segment driven by expanding domestic production capacity for flat glass, container glass, and specialty glass products. The sector requires high-purity silica sand with specific chemical compositions, particle size distributions, and minimal impurity levels to ensure product clarity, strength, and thermal resistance. Saudi manufacturers have invested substantially in modern furnaces and production lines to meet growing demand from construction, automotive, and packaging industries. The Saudi Arabia glass manufacturing market size reached USD 1.2 Billion in 2025. Looking forward, the market is expected to reach USD 1.9 Billion by 2034, exhibiting a growth rate (CAGR) of 5.37% during 2026-2034, reflecting the sector's significant contribution to industrial sand consumption.

The glass industry benefits from government initiatives promoting manufacturing localization and import substitution. In December 2025, Gulf Guard approved a SAR 1.0 billion glass manufacturing project in Jubail, including float glass and coater glass production lines scheduled for commissioning between 2027 and 2028. Such investments underscore the expanding glass production capacity that will sustain silica sand demand throughout the forecast period.

End Use Insights:

- Construction

- Automotive

- Glass and Ceramics

- Oil and Gas

- Electronics

The construction segment exhibits clear dominance with a 34% share of the total Saudi Arabia industrial sand market in 2025.

The construction sector maintains the largest end use share driven by massive infrastructure investments under the Vision 2030 economic diversification program. Industrial sand serves as a critical raw material in concrete production, asphalt manufacturing, mortar preparation, and various building applications requiring durable, high-quality aggregates. Mega-projects including NEOM, the Red Sea Project, Qiddiya, and Diriyah are generating unprecedented demand for construction materials across the Kingdom. The International Trade Administration reported Saudi Arabia's construction sector was valued at USD 70.33 billion in 2024 and is projected to grow to USD 91.36 billion by 2029.

The segment benefits from strategic government initiatives allocating over SAR 12 trillion in planned investments by 2030 for urban development, transportation infrastructure, and industrial facilities. In December 2024, Saudi Arabia's Ministry of Industry and Mineral Resources launched competitive bidding for 22 gravel and sand quarry sites in the Eastern Province and Tabuk region to ensure stable domestic supply of essential construction materials. These measures demonstrate the Kingdom's commitment to developing mining infrastructure that supports sustained construction activity.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The Eastern region holds the largest regional market share at 36% of the total Saudi Arabia industrial sand market in 2025.

The Eastern region dominates the industrial sand market through its strategic location encompassing major industrial cities, petrochemical complexes, and proximity to significant mineral deposits. The region hosts concentrated oil and gas operations that consume substantial quantities of silica sand for hydraulic fracturing and well completion activities. Jubail Industrial City, one of the world's largest industrial complexes, accommodates numerous glass, ceramics, and chemical manufacturers requiring consistent silica sand supplies. The presence of established mining operations, processing facilities, and transportation infrastructure enables efficient production and distribution across the region.

The Eastern Region benefits from significant investment in unconventional gas development, particularly the Jafurah shale gas field, which is regarded as one of the Kingdom’s most strategically important energy resources supporting long-term industrial and infrastructure growth. In June 2024, Aramco awarded USD 25 billion in contracts to expand unconventional gas production, targeting a 60% increase in Saudi Arabia's gas output by 2030. These developments are intensifying demand for high-quality frac sand in hydraulic fracturing operations, reinforcing the Eastern Region's market leadership position.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Industrial Sand Market Growing?

Expansion of Vision 2030 Infrastructure Projects

The Kingdom's comprehensive economic transformation program is generating unprecedented demand for construction materials, including industrial sand required for concrete, asphalt, and building applications. Vision 2030 encompasses over USD 1.3 trillion in mega-projects targeting smart city development, transportation networks, tourism infrastructure, and industrial facilities. NEOM alone represents a USD 500 billion investment establishing an advanced technology and sustainable living hub requiring massive construction material inputs. The Riyadh Metro, King Salman International Airport, and Diriyah Project exemplify transformative infrastructure initiatives consuming substantial silica sand volumes. Strong government commitments under Vision 2030 are ensuring sustained construction activity across Saudi Arabia, providing long-term support for industrial development and consistently driving demand for industrial sand throughout the Kingdom.

Rising Domestic Glass and Ceramics Manufacturing

The strategic emphasis on manufacturing localization is driving the expansion of glass production facilities that depend on high-purity silica sand as the primary raw material. Producers of float glass depend on steady supplies of silica to manufacture architectural glazing materials for large-scale construction projects, whereas manufacturers of container glass cater to the rising packaging needs of the food, beverage, and pharmaceutical sectors. Ceramic tile production, prioritized under the Kingdom's import substitution initiatives, consumes processed sand in substantial volumes. In February 2025, Obeikan Glass Company signed a memorandum of understanding with Isoclima to utilize specialized glass manufacturing expertise for automotive applications, demonstrating expanding product diversification.

Intensification of Unconventional Gas Development

Saudi Arabia's aggressive development of shale gas resources is creating significant demand for high-quality frac sand essential to hydraulic fracturing operations. The Jafurah gas field, positioned as the Middle East's largest shale gas development, contains estimated reserves of 229 trillion cubic feet of gas and 75 billion barrels of condensate. Aramco’s unconventional gas program is designed to significantly reduce reliance on crude oil for power generation, supporting energy diversification and improving fuel efficiency across Saudi Arabia’s energy system. In July 2024, Aramco revealed seven new oil and gas discoveries in the Eastern Province, including the Al-Ladam and Al-Farouk unconventional fields, expanding the nation's hydrocarbon production capabilities and reinforcing frac sand requirements.

Market Restraints:

What Challenges the Saudi Arabia Industrial Sand Market is Facing?

Environmental Regulations and Sustainability Pressures

The industrial sand sector faces increasing scrutiny regarding environmental impacts from extraction operations, including land disturbance, water consumption, and dust emissions. Regulatory frameworks are evolving to mandate sustainable mining practices, rehabilitation requirements, and environmental impact assessments that increase operational complexity and costs. Producers must invest in pollution control equipment, water recycling systems, and land restoration programs to maintain compliance with tightening environmental standards.

Competition from Alternative Materials

The growing adoption of manufactured sand, recycled aggregates, and alternative materials in construction applications poses competitive challenges to natural industrial sand. Technological advancements enable production of engineered substitutes with consistent specifications that appeal to quality-conscious manufacturers. Environmental considerations favoring circular economy approaches and resource efficiency are accelerating interest in alternative materials, potentially constraining natural sand demand growth.

Transportation and Logistics Constraints

The bulk nature of industrial sand creates significant transportation challenges, particularly for deposits located far from major consumption centers. High logistics costs associated with moving heavy materials across vast distances impact delivered prices and competitive positioning. Infrastructure limitations in certain regions constrain efficient distribution, while fuel price volatility introduces cost uncertainty that affects supply chain planning and customer relationships.

Competitive Landscape:

The Saudi Arabia industrial sand market exhibits moderate competitive intensity characterized by established regional producers, specialized processors, and diversified mining companies competing across product grades and end-use applications. Market participants are investing in production capacity expansion, quality certification programs, and processing technology upgrades to strengthen competitive positioning. Strategic partnerships with glass manufacturers, construction contractors, and energy companies enable suppliers to secure long-term offtake agreements and enhance market stability. The government's emphasis on developing the mining sector as a third economic pillar is attracting investment and encouraging operational improvements across the industry value chain.

Recent Developments:

-

April 2025: Iraq's Ministry of Industry and Minerals signed a strategic cooperation agreement with Saudi Arabia's Ajyal Company to establish the largest integrated silica-based industrial complex in Anbar Province. The facility will utilize silica as the core raw material for producing flat glass, ceramic tiles, glass containers, sodium silicate, and other industrial products, signaling expanded regional collaboration in sand-intensive manufacturing.

Saudi Arabia Industrial Sand Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Round Grain, Angular Grain, Coarse Sand, Fine Sand |

| Grades Covered | Industrial Grade, Specialty Grade, High Purity Grade |

| Applications Covered | Glass Manufacturing, Foundry Sands, Construction, Oil and Gas Filtration, Chemical Production |

| End Uses Covered | Construction, Automotive, Glass and Ceramics, Oil and Gas, Electronics |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia industrial sand market size was valued at USD 81.82 Million in 2025.

The Saudi Arabia industrial sand market is expected to grow at a compound annual growth rate of 4.55% from 2026-2034 to reach USD 122.1 Million by 2034.

Round grain, holding the largest revenue share of 32% in 2025, remains pivotal for Saudi Arabia's industrial sand applications, enabling superior performance in glass manufacturing, foundry casting, and filtration processes through its consistent particle morphology and flowability characteristics.

Key factors driving the Saudi Arabia industrial sand market include expanding infrastructure development under Vision 2030, growing domestic glass and ceramics manufacturing, increasing unconventional gas extraction activities, rising renewable energy investments, and government initiatives promoting mining sector development.

Major challenges include evolving environmental regulations requiring sustainable mining practices, competition from manufactured sand and alternative materials, transportation logistics constraints, fluctuating raw material processing costs, and the need for continuous quality improvements to meet evolving industry specifications.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)