Saudi Arabia Industrial Smart Sensors Market Size, Share, Trends and Forecast by Type, End User, and Region, 2026-2034

Saudi Arabia Industrial Smart Sensors Market Overview:

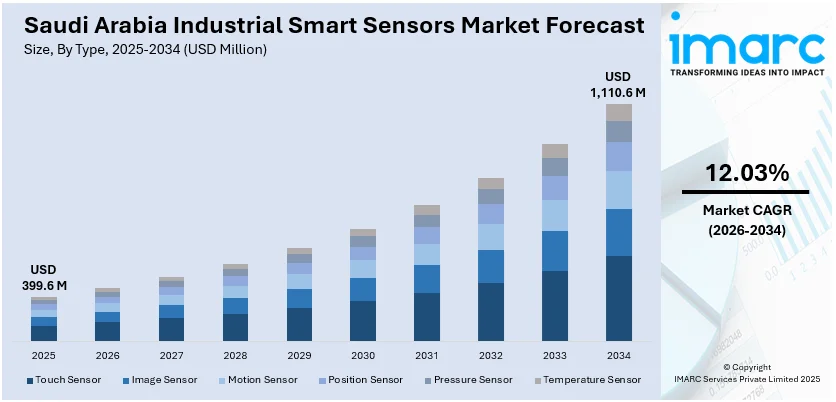

The Saudi Arabia industrial smart sensors market size reached USD 399.6 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,110.6 Million by 2034, exhibiting a growth rate (CAGR) of 12.03% during 2026-2034. Increasing automation in manufacturing, growing adoption of IIoT technologies, government initiatives under Vision 2030, demand for real-time data monitoring, rising investments in oil and gas modernization, and emphasis on energy efficiency and predictive maintenance are some of the factors contributing to Saudi Arabia industrial smart sensors market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 399.6 Million |

| Market Forecast in 2034 | USD 1,110.6 Million |

| Market Growth Rate 2026-2034 | 12.03% |

Saudi Arabia Industrial Smart Sensors Market Trends:

Rising Use of Smart Sensors in Environmental Monitoring

Industrial applications in Saudi Arabia are witnessing greater use of smart sensing technologies for real-time environmental oversight. Deployments in coastal and port zones are integrating intelligent sensors capable of detecting water quality changes instantly, helping monitor salinity, temperature, oxygen levels, and chemical presence. These systems support rapid response to pollution risks, particularly in high-traffic maritime areas. As sensor networks expand nationwide, they are becoming essential tools for environmental compliance and operational safety. Their adoption reflects a broader shift toward automation and data-driven decision-making in managing industrial impacts on marine ecosystems. This growing integration of smart sensing into infrastructure aligns with the country’s strategic goals for sustainability and industrial modernization under Vision 2030. These factors are intensifying the Saudi Arabia industrial smart sensors market growth. For example, in May 2025, Saudi Arabia’s National Center for Environmental Compliance deployed the first smart buoy in the Arabian Gulf at Jubail Port, equipped with smart sensors for real-time monitoring of water quality. As part of a 35-buoy national rollout, these sensor-equipped systems support rapid detection of pollutants, enhancing environmental oversight in industrial port areas and reinforcing the role of intelligent sensing in managing marine impacts linked to port and maritime activity.

To get more information on this market Request Sample

Expansion of 3D Sensing in Industrial Automation

Saudi Arabia is advancing the use of high-precision 3D sensing technologies to support its shift toward smart manufacturing. Solid-state LiDAR systems with beam-steering capabilities are enabling accurate object detection and real-time spatial awareness in complex industrial environments. These compact and durable solutions are increasingly integrated into industrial smart sensors for tasks such as equipment monitoring, process control, and safety automation. Their ability to deliver reliable, high-resolution data without moving parts enhances system efficiency and reduces maintenance needs. As the Kingdom focuses on modernizing infrastructure and optimizing industrial processes, such sensing technologies are becoming integral to automation strategies. This reflects a broader push for intelligent systems that combine sensing, data processing, and connectivity to meet Vision 2030 objectives. For instance, in February 2025, e-Photonics introduced LiDAR-based 3D sensing solutions powered by Lumotive’s beam-steering technology, offering precise, solid-state sensing for industrial applications. These systems enhance real-time object detection and environmental mapping, aligning with Saudi Arabia’s push for smart manufacturing and automation. Their compact, high-performance design supports integration into industrial smart sensors, contributing to Vision 2030 goals in infrastructure and process optimization.

Saudi Arabia Industrial Smart Sensors Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type and end user.

Type Insights:

- Touch Sensor

- Image Sensor

- Motion Sensor

- Position Sensor

- Pressure Sensor

- Temperature Sensor

The report has provided a detailed breakup and analysis of the market based on the type. This includes touch sensor, image sensor, motion sensor, position sensor, pressure sensor, and temperature sensor.

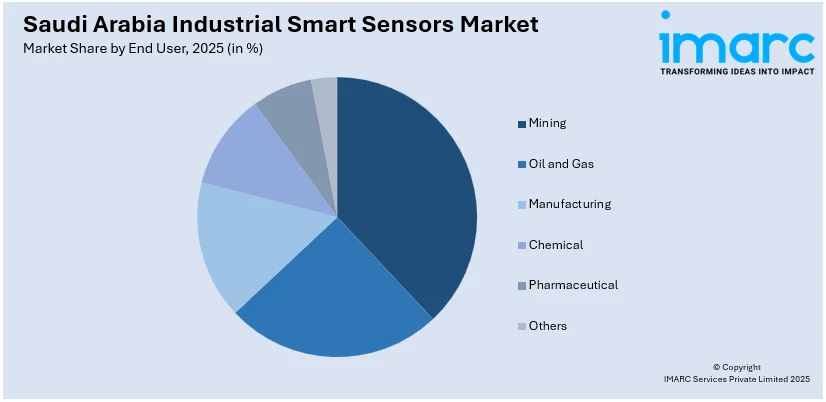

End User Insights:

Access the comprehensive market breakdown Request Sample

- Mining

- Oil and Gas

- Manufacturing

- Chemical

- Pharmaceutical

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes mining, oil and gas, manufacturing, chemical, pharmaceutical, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Industrial Smart Sensors Market News:

- In March 2025, Qualcomm, Aramco, and RDIA launched an AI-focused startup accelerator in Saudi Arabia to advance digital innovation across sectors. This initiative supports the development of AI technologies that can enhance industrial automation, including smart sensor applications in manufacturing and energy. By nurturing local startups, the program aims to accelerate the adoption of intelligent sensing solutions aligned with Vision 2030’s push for smart industry and advanced digital infrastructure.

Saudi Arabia Industrial Smart Sensors Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Touch Sensor, Image Sensor, Motion Sensor, Position Sensor, Pressure Sensor, Temperature Sensor |

| End Users Covered | Mining, Oil and Gas, Manufacturing, Chemical, Pharmaceutical, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia industrial smart sensors market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia industrial smart sensors market on the basis of type?

- What is the breakup of the Saudi Arabia industrial smart sensors market on the basis of end user?

- What is the breakup of the Saudi Arabia industrial smart sensors market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia industrial smart sensors market?

- What are the key driving factors and challenges in the Saudi Arabia industrial smart sensors market?

- What is the structure of the Saudi Arabia industrial smart sensors market and who are the key players?

- What is the degree of competition in the Saudi Arabia industrial smart sensors market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia industrial smart sensors market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia industrial smart sensors market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia industrial smart sensors industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)