Saudi Arabia Inflight Catering Market Size, Share, Trends and Forecast by Food Type, Flight Service Type, Aircraft Seating Class, and Region, 2026-2034

Saudi Arabia Inflight Catering Market Overview:

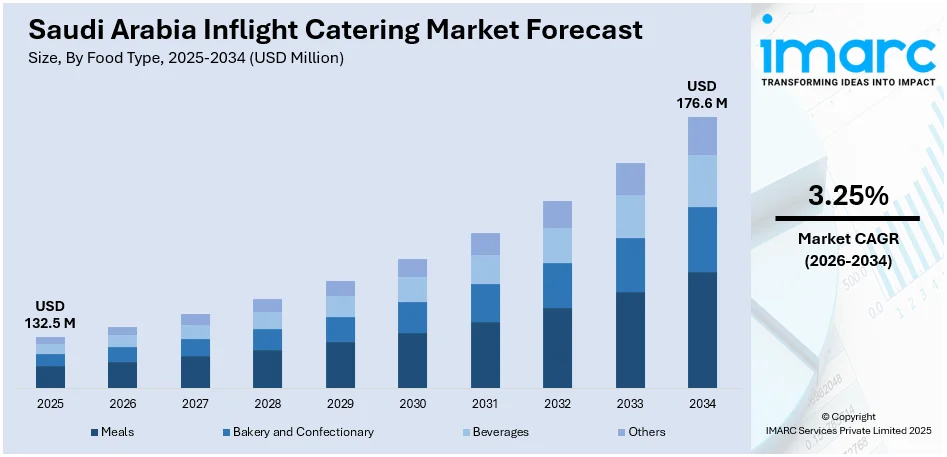

The Saudi Arabia inflight catering market size reached USD 132.5 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 176.6 Million by 2034, exhibiting a growth rate (CAGR) of 3.25% during 2026-2034. The market is being driven by the rapid progress of religious tourism, expansion of full-service airlines, rising demand for premium onboard dining experiences, strategic aviation investments under Vision 2030, and partnerships with global catering firms to enhance service quality and operational capacity across domestic and international routes.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 132.5 Million |

| Market Forecast in 2034 | USD 176.6 Million |

| Market Growth Rate 2026-2034 | 3.25% |

Saudi Arabia Inflight Catering Market Trends:

Booming Religious Tourism – Pilgrimage Traffic to Mecca and Medina

One of the key market drivers is the regular and massive inflow of religious tourists. The Kingdom receives millions of Muslim pilgrims each year for Hajj and Umrah, with volumes during religious periods especially increasing dramatically. In 2024 alone, the Saudi government logged more than 1.83 million Hajj pilgrims and much more for year-round Umrah. This massive traffic directly propels demand for air travel, particularly from nations with high Muslim populations like Indonesia, Pakistan, India, Egypt, and Malaysia. Air carriers serving this spiritual market frequently collaborate with inflight catering companies to provide Halal-compliant meals with precise dietary preferences customized to religious norms, which are not only compulsory but also culturally important. It is also for large volumes since it tends to be long-haul flights with repeated meal services. Inflight caterers have to also synchronize their schedules with airlines to suit the stringent timelines of chartered pilgrimage flights that experience peak times over brief duration windows, causing seasonally strong but high-peak demand patterns.

To get more information on this market Request Sample

Expansion of Full-Service Airlines and Premium Air Travel Segment

Another important driver is the expanding domestic aviation industry, specifically the progress of full-service airlines and high-end travel services. For example, national carrier Saudia, formerly known as Saudi Arabian Airlines, and the recently announced Riyadh Air are investing heavily in improving fleet quality, introducing international routes, and improving passenger experience. These moves are directly connected to escalating demand for premium inflight catering services. In contrast to the religious tourism market, where volume and dietary adherence are the focus, the premium air travel segment is fueled by differentiation, innovation, and exclusivity in onboard cuisine. Full-service carriers are now competing on the quality of their in-flight meals, employing gourmet chefs, providing regionally inspired multi-course meals, and incorporating technologies such as pre-order meal customization for business and first-class passengers. Corporate travelers, diplomats, and high-paying passengers—particularly those on long-haul flights to Europe, Asia, or North America—entertain expectations of restaurant-grade fare. Consequently, Saudi Arabian inflight catering operators are expanding in-flight production facilities, recruiting qualified culinary professionals, and implementing upmarket food handling and preparation technology.

Saudi Arabia Inflight Catering Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on food type, flight service type, and aircraft seating class.

Food Type Insights:

- Meals

- Bakery and Confectionary

- Beverages

- Others

The report has provided a detailed breakup and analysis of the market based on the food type. This includes meals, bakery and confectionary, beverages, and others.

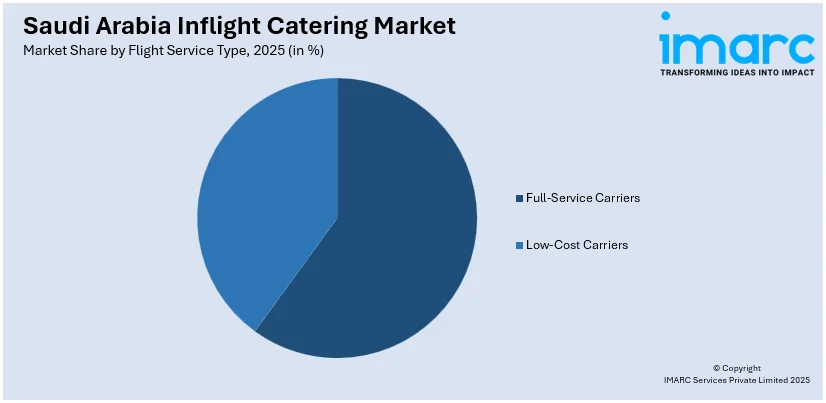

Flight Service Type Insights:

Access the comprehensive market breakdown Request Sample

- Full-Service Carriers

- Low-Cost Carriers

A detailed breakup and analysis of the market based on the flight service type have also been provided in the report. This includes full-service carriers and low-cost carriers.

Aircraft Seating Class Insights:

- Economy Class

- Business Class

- First Class

The report has provided a detailed breakup and analysis of the market based on the aircraft seating class. This includes economy class, business class, and first class.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Inflight Catering Market News:

- April 2025: Saudia expanded its international network by launching direct flights to Bali, Vienna, and Athens, enhancing global connectivity. This is set to positively impact the inflight catering market by increasing meal demand and service volume across long-haul and regional flights.

- January 2025: CATRION Catering Holding Company secured a five-year, SAR 2.3 billion contract with Riyadh Air to provide in-flight meals, beverages, and related services for both domestic and international flights. This partnership aims to deliver world-class culinary experiences, emphasizing Saudi flavors and supporting local suppliers in line with Vision 2030.

Saudi Arabia Inflight Catering Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Food Types Covered | Meals, Bakery and Confectionary, Beverages, Others |

| Flight Service Type Covered | Full-Service Carriers, Low-Cost Carriers |

| Aircraft Seating Classes Covered | Economy Class, Business Class, First Class |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia inflight catering market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia inflight catering market on the basis of food type?

- What is the breakup of the Saudi Arabia inflight catering market on the basis of flight service type?

- What is the breakup of the Saudi Arabia inflight catering market on the basis of aircraft seating class?

- What are the various stages in the value chain of the Saudi Arabia inflight catering market?

- What are the key driving factors and challenges in the Saudi Arabia inflight catering market?

- What is the structure of the Saudi Arabia inflight catering market and who are the key players?

- What is the degree of competition in the Saudi Arabia inflight catering market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia inflight catering market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia inflight catering market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia inflight catering industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)