Saudi Arabia Insulin Pumps Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2026-2034

Saudi Arabia Insulin Pumps Market Overview:

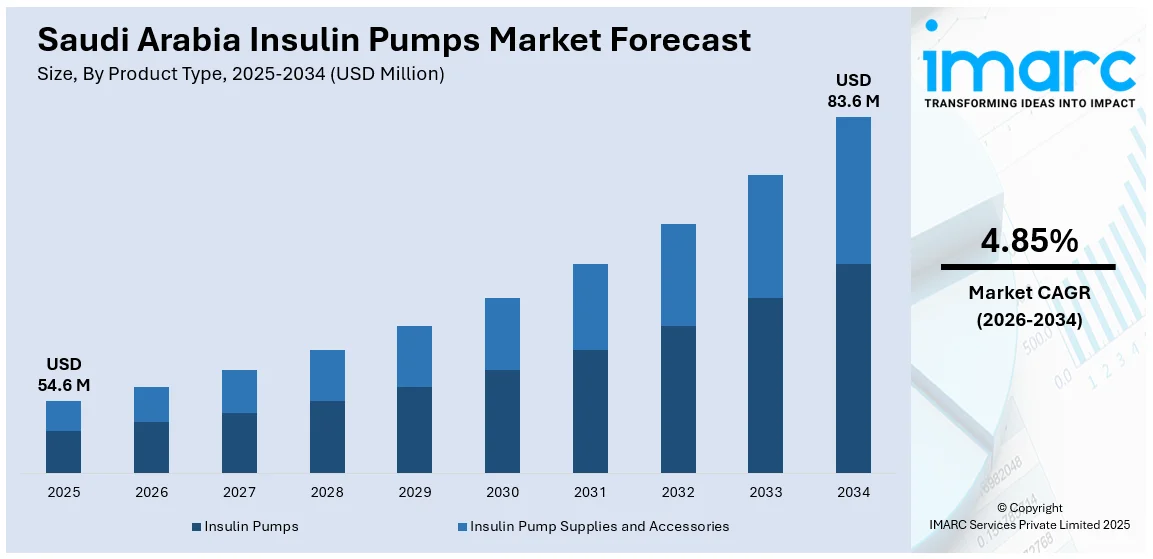

The Saudi Arabia insulin pumps market size reached USD 54.6 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 83.6 Million by 2034, exhibiting a growth rate (CAGR) of 4.85% during 2026-2034. The rising diabetes prevalence, government healthcare initiatives and expanded reimbursement schemes under Vision 2030, continuous technological innovation in CGM-integrated and AI-enabled pump systems and expanding digital health infrastructure that enhances patient self-care and remote monitoring adoption are among the key factors bolstering the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 54.6 Million |

| Market Forecast in 2034 | USD 83.6 Million |

| Market Growth Rate 2026-2034 | 4.85% |

Saudi Arabia Insulin Pumps Market Trends:

Surging Diabetes Prevalence and Vision 2030

Saudi Arabia ranks among the world’s highest when it comes to adult diabetes prevalence, with 23.1% of adults, approximately 5.34 million people, living with diabetes in 2024, creating a large addressable patient base for insulin-delivery devices. Under Vision 2030, the government has pledged over USD 65 billion to modernize healthcare infrastructure, expand e-health services, and establish 21 regional health clusters, improving access to advanced diabetes technologies across urban and rural areas. These strategic initiatives include public–private partnerships for subsidized device procurement and large-scale awareness campaigns, which lower out-of-pocket costs and drive adoption of insulin pumps over multiple daily injections. As newly diagnosed patients enter care pathways enhanced by digital registries and specialist clinics, the conversion rate to pump therapy rises, thereby fueling sustained market growth.

To get more information on this market Request Sample

Technological Innovation and the Advent of Closed-Loop Systems

Innovation in automated insulin delivery is rapidly reshaping the Saudi market as manufacturers embed continuous glucose monitoring (CGM), AI-driven dosing algorithms, and smartphone connectivity into next-generation pumps. These hybrid closed-loop systems adjust basal insulin rates in real time, reducing hypoglycemia events and increasing time in range by approximately 10%, which has driven a sharp uptick in clinical adoption. In confluence with this, the surging patients’ and providers’ preference for integrated solutions over standalone pens or syringes is acting as another significant growth-inducing factor boosting the demand for insulin pumps. Concurrently, telehealth platforms that sync pump and CGM data enable remote titration, virtual coaching, and automated alerts, thereby extending specialist support into home and workplace settings. This convergence of digital health and closed-loop technology is cementing pumps’ role as the cornerstone of modern diabetes care.

Saudi Arabia Insulin Pumps Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Insulin Pumps

- Tethered Pumps

- Disposable/Patch Insulin Pumps

- Insulin Pump Supplies and Accessories

- Infusion Set Insertion Devices

- Insulin Reservoirs/Cartridges

The report has provided a detailed breakup and analysis of the market based on the product type. This includes insulin pumps (tethered pumps and disposable/patch insulin pumps) and insulin pump supplies and accessories (infusion set insertion devices and insulin reservoirs/cartridges).

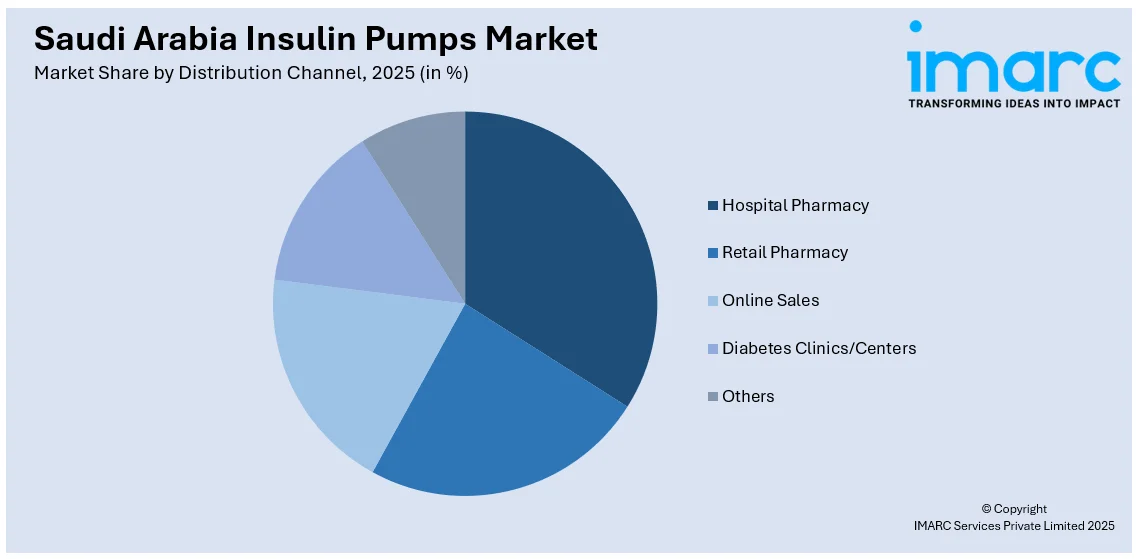

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Hospital Pharmacy

- Retail Pharmacy

- Online Sales

- Diabetes Clinics/Centers

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes hospital pharmacy, retail pharmacy, online sales, diabetes clinics/centers, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Insulin Pumps Market News:

- February 2025: Saudi Arabia launched its first local insulin manufacturing facility in Sudair Industrial City, overseen by Sudair Pharma in partnership with Sanofi and NUPCO. The plant will produce around 15 million insulin pens annually, while empowering national self‑sufficiency and supporting Vision 2030 healthcare goals. This local production can enhance insulin pump adoption by ensuring a more stable, accessible insulin supply for continuous delivery systems.

- February 2023: South Korea’s EOFlow partnered with Gulf Drug to launch its wearable, patch-style insulin pump, the EOPatch, across the UAE and other GCC countries. The device has regulatory approval in Europe, South Korea, Indonesia, and the UAE, and is also reportedly being prepared for launch in Saudi Arabia.

Saudi Arabia Insulin Pumps Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Distribution Channels Covered | Hospital Pharmacy, Retail Pharmacy, Online Sales, Diabetes Clinics/Centers, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia insulin pumps market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia insulin pumps market on the basis of product type?

- What is the breakup of the Saudi Arabia insulin pumps market on the basis of distribution channel?

- What is the breakup of the Saudi Arabia insulin pumps market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia insulin pumps market?

- What are the key driving factors and challenges in the Saudi Arabia insulin pumps market?

- What is the structure of the Saudi Arabia insulin pumps market and who are the key players?

- What is the degree of competition in the Saudi Arabia insulin pumps market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia insulin pumps market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia insulin pumps market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia insulin pumps industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)