Saudi Arabia Interventional Cardiology Devices Market Size, Share, Trends and Forecast by Product, End User, and Region, 2026-2034

Saudi Arabia Interventional Cardiology Devices Market Overview:

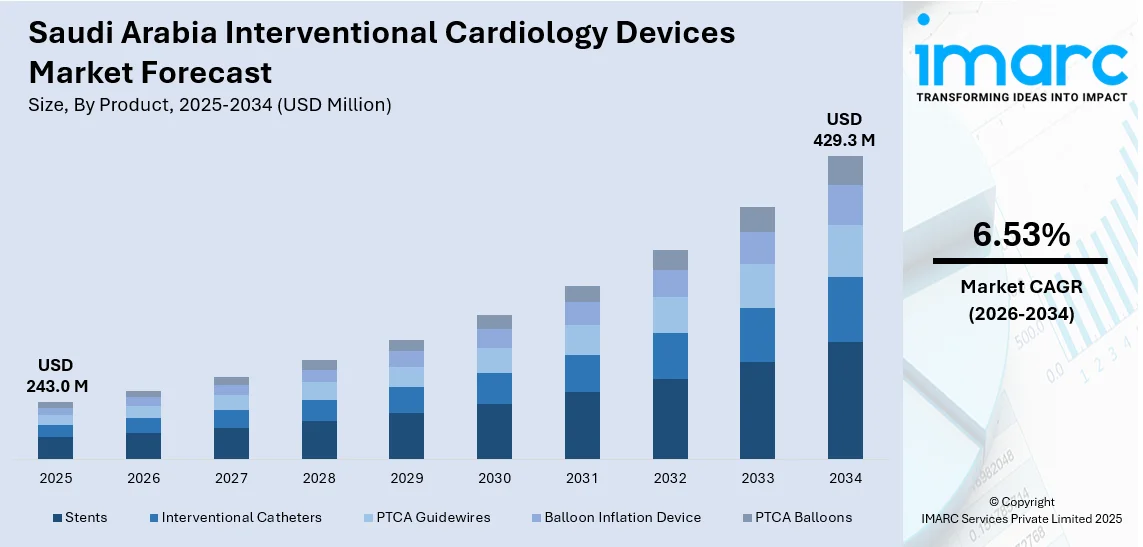

The Saudi Arabia interventional cardiology devices market size reached USD 243.0 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 429.3 Million by 2034, exhibiting a growth rate (CAGR) of 6.53% during 2026-2034. Rising cardiovascular disease prevalence, increased healthcare investments, widespread adoption of minimally invasive procedures, a growing aging population, an expanding private healthcare sector, and improved access to advanced medical technologies due to government initiatives contribute to Saudi Arabia interventional cardiology devices market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 243.0 Million |

| Market Forecast in 2034 | USD 429.3 Million |

| Market Growth Rate 2026-2034 | 6.53% |

Saudi Arabia Interventional Cardiology Devices Market Trends:

Advancements in Clinical Expertise and Technology Adoption

Saudi Arabia is bolstering its interventional cardiology industry by emphasizing practitioner skill development and the use of new technology. Workshops and expert-led discussions on new approaches and technology advancements are helping to drive this transition. There is a larger movement within the country to improve clinical capabilities and promote the use of precision equipment and minimally invasive techniques. Efforts to improve healthcare infrastructure and foster continuous learning are increasing demand for specialist goods and next-generation solutions that deal with complicated cardiovascular conditions. This continued professional and technical development is assisting Saudi Arabia in becoming as a regionally competitive hub for advanced cardiac care. These factors are intensifying the Saudi Arabia interventional cardiology devices market growth. For example, in March 2024, the Saudi Arabian Cardiac Interventional Society hosted SACIS Studio 2024, featuring workshops and discussions on the latest advancements in interventional cardiology. The event aimed to enhance the skills of practitioners and promote the adoption of innovative technologies in the field.

To get more information on this market Request Sample

Rising Burden of Cardiovascular Disease Driving Innovation

The rising prevalence of cardiovascular illness in Saudi Arabia is driving the interventional cardiology sector toward more innovation and device adoption. With heart disease still the leading cause of death and a sizable proportion of the population at risk, there is a growing emphasis on early detection, sophisticated therapies, and preventative care strategies. High cholesterol, obesity, diabetes, smoking, and sedentary lifestyles are driving increased demand for minimally invasive treatments, drug eluting stents, and next-generation cardiac support devices. Healthcare professionals are increasingly concentrating on improving skills and extending access to current treatment choices to meet the changing requirements of a population facing a serious heart health crisis. This setting is opening up chances for specialist interventional cardiology technology around the country. For instance, as of 2023, cardiovascular disease (CVD) remains the leading cause of death in Saudi Arabia, accounting for approximately 45% of all mortalities, primarily due to atherosclerosis and heart attacks. More than 30% of the Saudi population is at risk of heart disease, with major contributing factors including high cholesterol, obesity, smoking, diabetes, and lack of physical activity.

Saudi Arabia Interventional Cardiology Devices Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product and end user.

Product Insights:

- Stents

- Drug Eluting Stents

- Bare Metal Stents

- Bio-Absorbable Stents

- Interventional Catheters

- IVUS Catheters

- Guiding Catheters

- Angiography Catheters

- PTCA Guidewires

- Balloon Inflation Device

- PTCA Balloons

- Cutting Balloons

- Scoring Balloons

- Drug Eluting Balloons

- Normal Balloons

The report has provided a detailed breakup and analysis of the market based on the product. This includes stents (drug eluting stents, bare metal stents, and bio-absorbable stents), interventional catheters (IVUS catheters, guiding catheters, and angiography catheters), PTCA guidewires, balloon inflation device, and PTCA balloons (cutting balloons, scoring balloons, drug eluting balloons, and normal balloons).

End User Insights:

Access the comprehensive market breakdown Request Sample

- Hospitals

- Ambulatory Surgical Centers

- Others

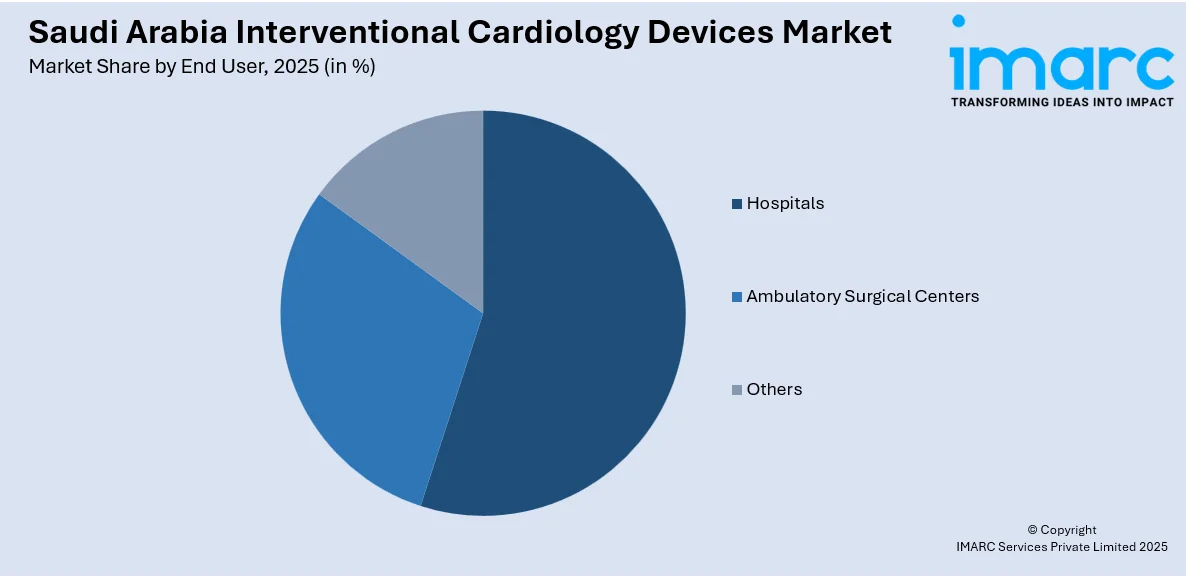

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospitals, ambulatory surgical centers, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Interventional Cardiology Devices Market News:

- In January 2025, Saudi Arabia achieved a milestone in interventional cardiology with King Faisal Specialist Hospital successfully performing a robotic-assisted implantation of Abbott’s HeartMate 3 ventricular assist device. This marks the world’s first fully robotic HeartMate 3 procedure, setting a new benchmark in advanced heart failure treatment.

Saudi Arabia Interventional Cardiology Devices Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| End Users Covered | Hospitals, Ambulatory Surgical Centers, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, and Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia interventional cardiology devices market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia interventional cardiology devices market on the basis of product?

- What is the breakup of the Saudi Arabia interventional cardiology devices market on the basis of end user?

- What is the breakup of the Saudi Arabia interventional cardiology devices market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia interventional cardiology devices market?

- What are the key driving factors and challenges in the Saudi Arabia interventional cardiology devices market?

- What is the structure of the Saudi Arabia interventional cardiology devices market and who are the key players?

- What is the degree of competition in the Saudi Arabia interventional cardiology devices market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia interventional cardiology devices market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia interventional cardiology devices market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia interventional cardiology devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)