Saudi Arabia Intravenous Solution Market Size, Share, Trends and Forecast by Type, Nutrients, and Region, 2026-2034

Saudi Arabia Intravenous Solution Market Overview:

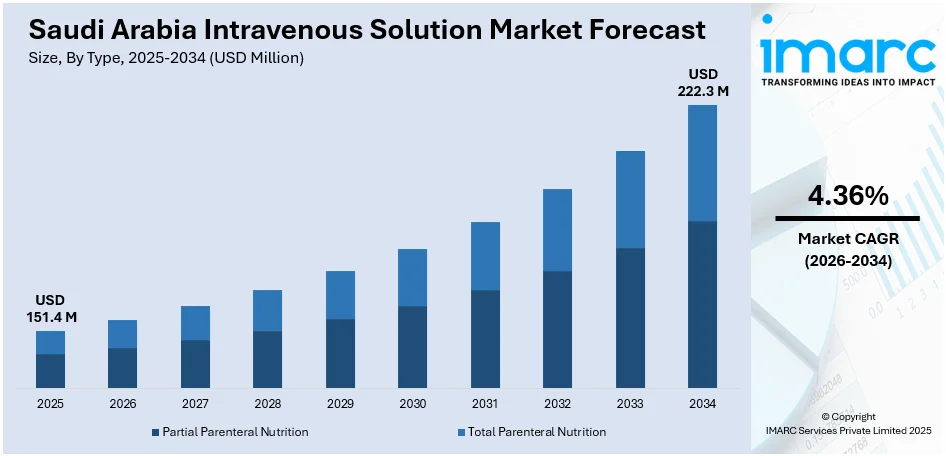

The Saudi Arabia intravenous solution market size reached USD 151.4 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 222.3 Million by 2034, exhibiting a growth rate (CAGR) of 4.36% during 2026-2034. The Saudi Arabia intravenous solution market is being driven by the rising prevalence of chronic diseases, rapidly expanding healthcare infrastructure, government initiatives under Vision 2030 to boost local pharmaceutical manufacturing, escalating demand for advanced medical treatments, growing medical tourism, and heightened investments from international healthcare companies establishing local production facilities.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 151.4 Million |

| Market Forecast in 2034 | USD 222.3 Million |

| Market Growth Rate 2026-2034 | 4.36% |

Saudi Arabia Intravenous Solution Market Trends:

Increasing Incidences of Chronic Diseases

One of the main drivers of the Saudi Arabian intravenous (IV) solution market is the surge in incidence of chronic diseases, including diabetes, cardiovascular diseases, and kidney failure. These diseases tend to necessitate long-term treatment, including IV therapy for hydration, nutrition, and drug administration. Diabetes and other chronic diseases are fast growing in Saudi Arabia as a result of lifestyle factors, such as poor diets and physical inactivity. These conditions frequently lead to complications that need constant intravenous treatment, such as insulin therapy, fluid resuscitation, or parenteral nutrition. Moreover, as the healthcare system in Saudi Arabia keeps getting better, growing numbers of patients are being diagnosed with chronic diseases, which translates to an upsurge in need for IV solutions. Medical practitioners frequently depend on IV therapy to effectively manage the symptoms and course of these diseases. This higher life expectancy is also responsible for the necessity for ongoing treatment and long-term management of these ailments, which necessitates a demand for IV fluids.

To get more information on this market Request Sample

Expanding Healthcare Infrastructure and Medical Tourism

Another major driver in the IV solution market across the region is Saudi Arabia's developing healthcare infrastructure as well as an emphasis on enhancing medical tourism. Saudi Arabia has been spending enormous amounts of capital on healthcare efforts to make Saudi Arabia a regionally leading country in medical service. The build-out of hospitals, clinics, and specialized care facilities throughout Saudi Arabia has caused demand for medical supplies, like IV solutions, to rise. Additionally, the government's Vision 2030 program highlights the growth of medical tourism to attract foreign patients for high-end healthcare treatments. With Saudi Arabia's healthcare industry becoming more advanced and technologically driven, demand for IV solutions increases among both domestic and foreign patients. The flow of medical tourists for elective surgeries, organ transplantation, and critical care is driving the market for IV therapies. Numerous procedures need IV fluids for medication, post-operative recovery, and patient hydration. Such an expansion, together with better healthcare services, is closely attributed to the propelling demand for IV solutions in Saudi Arabia.

Saudi Arabia Intravenous Solution Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on type and nutrients.

Type Insights:

- Partial Parenteral Nutrition

- Total Parenteral Nutrition

The report has provided a detailed breakup and analysis of the market based on the type. This includes partial parenteral nutrition and total parenteral nutrition.

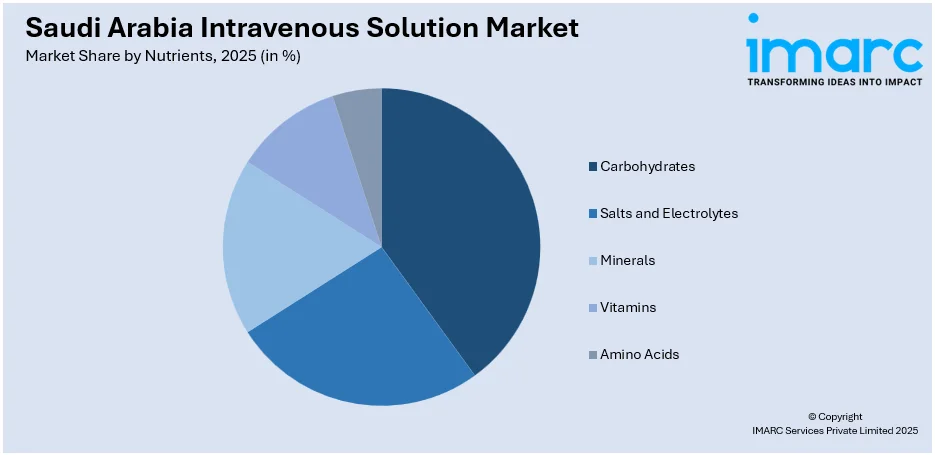

Nutrients Insights:

Access the comprehensive market breakdown Request Sample

- Carbohydrates

- Salts and Electrolytes

- Minerals

- Vitamins

- Amino Acids

A detailed breakup and analysis of the market based on the nutrients have also been provided in the report. This includes carbohydrates, salts and electrolytes, minerals, vitamins, and amino acids.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Intravenous Solution Market News:

- January 2025: Akkad Holdings announced plans to invest USD 200 million in an intravenous (IV) fluid manufacturing facility in Saudi Arabia's King Abdullah Economic City. This move aims to address global IV fluid shortages and establish a local production hub for the U.S. market. The establishment of this facility is expected to bolster Saudi Arabia's healthcare infrastructure by increasing local production capacity for IV solutions.

- October 2024: IV ONE, a dedicated intravenous therapy center, launched in Riyadh to enhance infusion care for patients with chronic illnesses, autoimmune disorders, and nutrient deficiencies. Backed by TVM Capital Healthcare, IV ONE offers outpatient IV solutions through specialized staff and integrated health systems, aiming to improve treatment adherence and clinical outcomes while aligning with the Kingdom’s Vision 2030 healthcare goals.

Saudi Arabia Intravenous Solution Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Partial Parenteral Nutrition, Total Parenteral Nutrition |

| Nutrients Covered | Carbohydrates, Salts and Electrolytes, Minerals, Vitamins, Amino Acids |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia intravenous solution market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia intravenous solution market on the basis of type?

- What is the breakup of the Saudi Arabia intravenous solution market on the basis of nutrients?

- What is the breakup of the Saudi Arabia intravenous solution market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia intravenous solution market?

- What are the key driving factors and challenges in the Saudi Arabia intravenous solution market?

- What is the structure of the Saudi Arabia intravenous solution market and who are the key players?

- What is the degree of competition in the Saudi Arabia intravenous solution market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia intravenous solution market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia intravenous solution market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia intravenous solution industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)