Saudi Arabia Iron Ore Market Size, Share, Trends and Forecast by Type, End Use, and Region, 2026-2034

Saudi Arabia Iron Ore Market Overview:

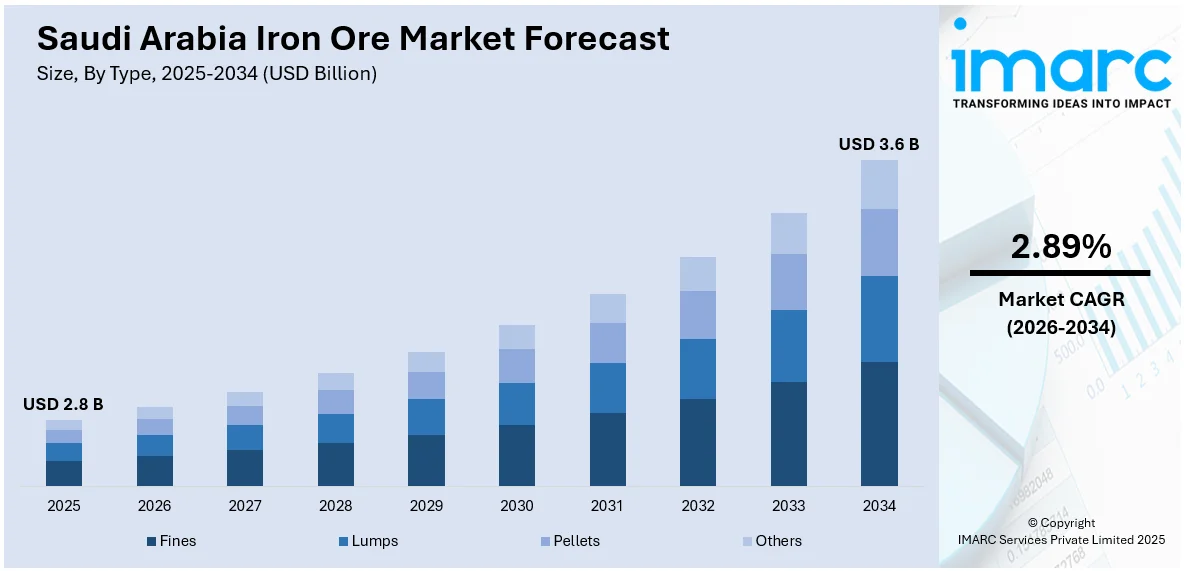

The Saudi Arabia iron ore market size reached USD 2.8 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 3.6 Billion by 2034, exhibiting a growth rate (CAGR) of 2.89% during 2026-2034. The market is propelled by the increasing demand for steel in the construction, manufacturing, and infrastructure industries. In addition to this, the roll-out of government programs like Vision 2030, which is designed to diversify the economy and encourage industrial development, also fuels the demand for iron ore. Apart from that, the increase in domestic mining activities and investments in mining technologies to improve production capacity are expanding the Saudi Arabia iron ore market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 2.8 Billion |

| Market Forecast in 2034 | USD 3.6 Billion |

| Market Growth Rate 2026-2034 | 2.89% |

Saudi Arabia Iron Ore Market Trends:

Expansion of Domestic Mining Operations

The government's initiatives for economic diversification under Vision 2030 has encouraged more investments in the mining industry, with an increasing emphasis on iron ore extraction. For example, on January 15, 2025, Saudi Arabia declared a USD 100 Billion investment program to enhance its mining industry as part of the Vision 2030 economic diversification program. The strategy centers around the extraction of key minerals like lithium, iron, copper, nickel, and rare earth minerals, with USD 20 Billion already in conceptual or under-construction phases. In addition to this, the development of mining zones and infrastructure, including transportation and logistics networks, have been central in enabling growth in production. Furthermore, various local and foreign businesses have joined the market to tap into Saudi Arabia's iron ore deposits, with an emphasis on high-grade ore for steel production. This growth is not only caused by demand within the domestic market but also aims to position the country as a major exporter in the world market. Apart from this, the Kingdom's regulatory framework is evolving to promote private sector involvement, making the mining sector more competitive. In addition, the growing emphasis on sustainability and the use of new mining technologies are likely to enhance efficiency and minimize the environmental footprint of mining operations. This, in turn, is positively impacting the Saudi Arabia iron ore market growth.

To get more information on this market Request Sample

Rising Steel Demand in Construction and Infrastructure

The demand for iron ore in Saudi Arabia is closely tied to the burgeoning steel industry, driven largely by the rapid growth in construction and infrastructure development. As per industry reports, Saudi Arabia's real estate market saw robust growth in 2024 due to Vision 2030 projects and massive investments worth SR 4.9 Trillion (approximately USD 1.3 Trillion) in infrastructure, resulting in the construction of more than one million residential properties and commercial space expansion. Large giga-projects like NEOM, Qiddiya, and the Red Sea Project, led by the Public Investment Fund, are reshaping city living and tourism. This is cementing the Kingdom's vision for innovation and sustainability. Along with this, the expansion in buildings leads to a need for a higher supply of steel, which subsequently increases the demand for iron ore. In addition, the government's emphasis on developing its manufacturing sector and minimizing its import reliance has resulted in more attention towards domestic sources of materials, such as iron ore. As steel is a fundamental input in building, demand for iron ore will continue to be robust in the foreseeable future.

Saudi Arabia Iron Ore Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type and end use.

Type Insights:

- Fines

- Lumps

- Pellets

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes fines, lumps, pellets, and others.

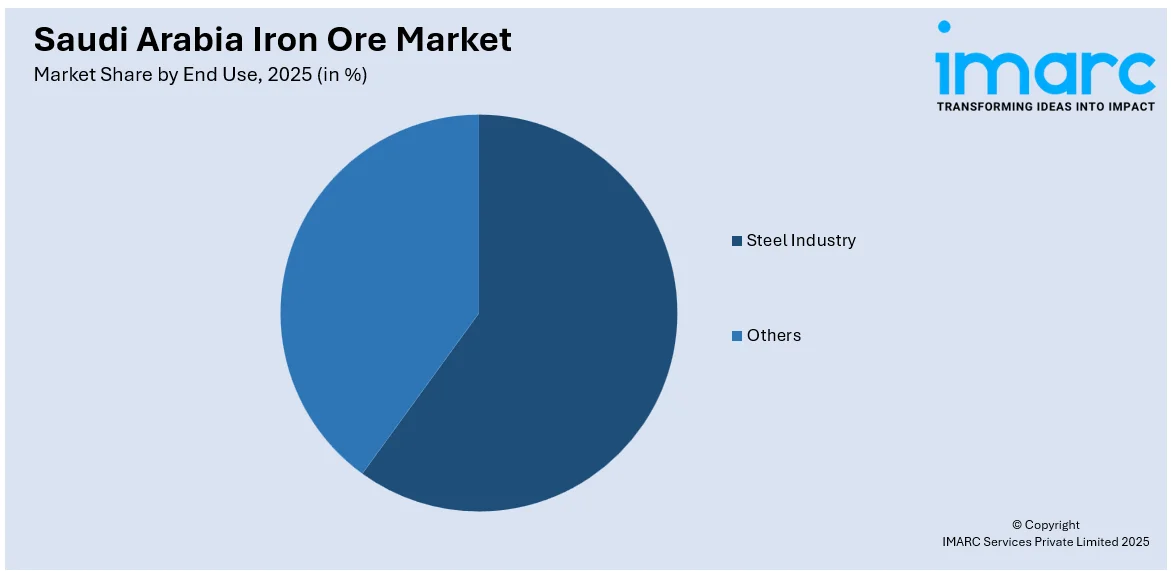

End Use Insights:

Access the comprehensive market breakdown Request Sample

- Steel Industry

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes steel industry and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern & Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Iron Ore Market News:

- On January 11, 2024, the Royal Commission for Jubail and Yanbu signed an agreement a with Brazilian mining company Vale. The partnership aims to develop an iron ore briquettes project in Saudi Arabia. This initiative, announced during the Future Minerals Forum, is a strategic component of Vale's efforts to decarbonize the steel manufacturing industry and aligns with Saudi Arabia's Vision 2030 objectives. The project will be situated in Ras Al-Khair Industrial City, emphasizing technological innovation and sustainable industrial development in the region.

Saudi Arabia Iron Ore Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Fines, Lumps, Pellets, Others |

| End Uses Covered | Steel Industry, Others |

| Regions Covered | Northern & Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia iron ore market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia iron ore market on the basis of type?

- What is the breakup of the Saudi Arabia iron ore market on the basis of end use?

- What is the breakup of the Saudi Arabia iron ore market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia iron ore market?

- What are the key driving factors and challenges in the Saudi Arabia iron ore market?

- What is the structure of the Saudi Arabia iron ore market and who are the key players?

- What is the degree of competition in the Saudi Arabia iron ore market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia iron ore market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia iron ore market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia iron ore industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)