Saudi Arabia K-12 Education Market Size, Share, Trends and Forecast by Application, Institution, Delivery Mode, and Region, 2026-2034

Saudi Arabia K-12 Education Market Overview:

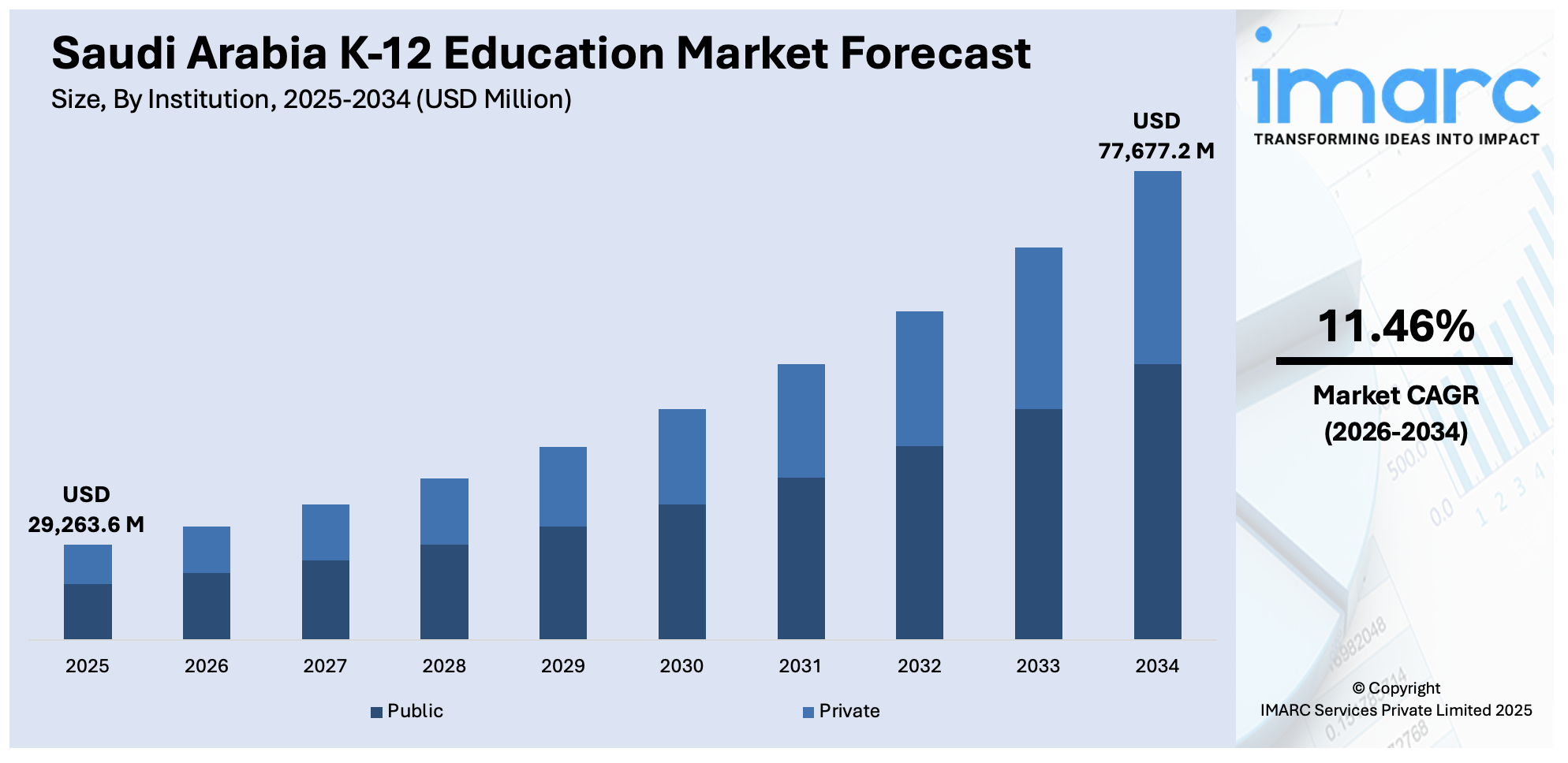

The Saudi Arabia K-12 education market size reached USD 29,263.6 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 77,677.2 Million by 2034, exhibiting a growth rate (CAGR) of 11.46% during 2026-2034. The market is fueled by expanding government investment in education infrastructure and teacher development, which are boosting the standard of education throughout the nation. Growing middle class is also focusing more on quality education, which has expanded demand for both private and public schooling. Progress in technology with digital tools and online educational platforms being integrated, further widen access and enhance learning outcomes leading to the expansion and growth of the Saudi Arabia K-12 education market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 29,263.6 Million |

| Market Forecast in 2034 | USD 77,677.2 Million |

| Market Growth Rate 2026-2034 | 11.46% |

Saudi Arabia K-12 Education Market Trends:

Incorporation of Technology into Education

Saudi Arabia's K-12 education system is experiencing a major overhaul with the inclusion of technology in classrooms. The government has made massive investments in digital infrastructure, making it easier for schools to adopt learning management systems (LMS), interactive content, and adaptive learning platforms. This technology enables customized learning experiences, which address the varying needs of students. In addition, the incorporation of artificial intelligence (AI) in learning facilitates instant feedback and tracking of progress, promoting increased student participation and results. The dedication of the government to digital education is revealed through projects such as the Mustaqbalhum application, offering real-time performance statistics for more than 22,000 schools to parents. These technologies are enhancing the quality of education while exposing students to a future where digital proficiency is an imperative, which further contributes to the Saudi Arabia K-12 education market growth.

To get more information on this market Request Sample

Increase in Private and International Schools

There is a growing demand for private and international schools in Saudi Arabia's K-12 education sector, fueled by a rising middle class and a growing population of expatriates. Parents are looking for high-quality schooling with variety in the curricula, including American, British, and International Baccalaureate (IB) curricula. In Jeddah, over 70 international schools satisfy this demand, offering education compatible with international standards. The Vision 2030 program by the government has also spurred on private sector investment through public-private partnership (PPP) initiatives, including the development of new schools in major urban areas. The expansion is improving the education sector while also promoting a competitive climate that inspires teaching and learning quality improvements.

Focus on Quality and Accountability

Saudi Arabia is heavily focusing on accountability and quality in its K-12 education system. The Ministry of Education has implemented performance benchmarks for schools and universities so that educational achievements are on par with international standards. Accreditation procedures are being made more stringent, and it is leading to more transparency and motivating schools to implement best practices. The government is also investing on teacher development and retention initiatives in order to improve the quality of teaching. These initiatives are meant to transform the ministry's role from a provider into a regulator so that every student gets high-quality education.

Saudi Arabia K-12 Education Growth Drivers:

Implementing Government Education Reforms under Vision 2030

The government of Saudi Arabia is earnestly implementing far-reaching education reforms as part of its Vision 2030 program, which is revolutionizing the K-12 education system. The strategic plan is intended to transform the national education system by enhancing the quality of the curriculum, expanding access to education, and encouraging private sector involvement. The government is always aligning the school curriculum with international norms, including the inclusion of contemporary subjects like science, technology, engineering, and mathematics (STEM), and increasing the application of digital tools in schools. By embedding futuristic education technologies and updating teacher training curricula, the government is promoting an environment that is student-centered. Furthermore, bilingual education, especially English language study, is increasingly being focused on in order to equip learners with international academic and professional competitiveness. As these policy changes gain traction, they are driving the increased need for high-quality private and international schools, hence growth in the K-12 education market in Saudi Arabia.

Embedding Digital Learning and EdTech Solutions

The convergence of digital learning aids and educational technology (EdTech) solutions is dramatically reshaping the K-12 education scene in Saudi Arabia. Schools are embracing digital platforms to drive student engagement, individualize learning experiences, and optimize administrative tasks. The digital transformation is being encouraged by national efforts like the Tatweer Education Technology Program, which encourages the use of smart classrooms, e-learning content, and interactive content. To meet increasing digital literacy demands, public as well as private schools are making investments in infrastructure such as high-speed internet, tablets, and learning management systems (LMS). The continued drive for digitalization is encouraging a more technological and responsive education system, thus attracting high-tech families and investors, and positively impacting the overall growth of Saudi Arabia's K-12 education industry.

Growing Demand for International Curricula and Multilingual Education

There is an increase in the need for international curricula and multilingual education in the Saudi market, driven by ambitions of both expatriate communities and local parents seeking education that is globally competitive. Institutions providing international programs like the International Baccalaureate (IB), British (IGCSE), and American curricula are experiencing more enrollments, especially in major cities. Parents are putting a high value on fluency in English and other foreign languages alongside Arabic to support their children's future educational and professional opportunities. This demand is also being supplemented by education reforms stimulating global content integration and cross-cultural skills. In addition, international schools are increasingly serving Saudi nationals, following eased regulations that before restricted their access. The presence of varied curricular options is facilitating families to choose programs that are in tune with international university entrance and hiring standards. Subsequently, the demand for internationally accepted educational models is gradually increasing enrollment in international schools and fueling additional investment within this sector.

Saudi Arabia K-12 Education Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on application, institution, and delivery mode.

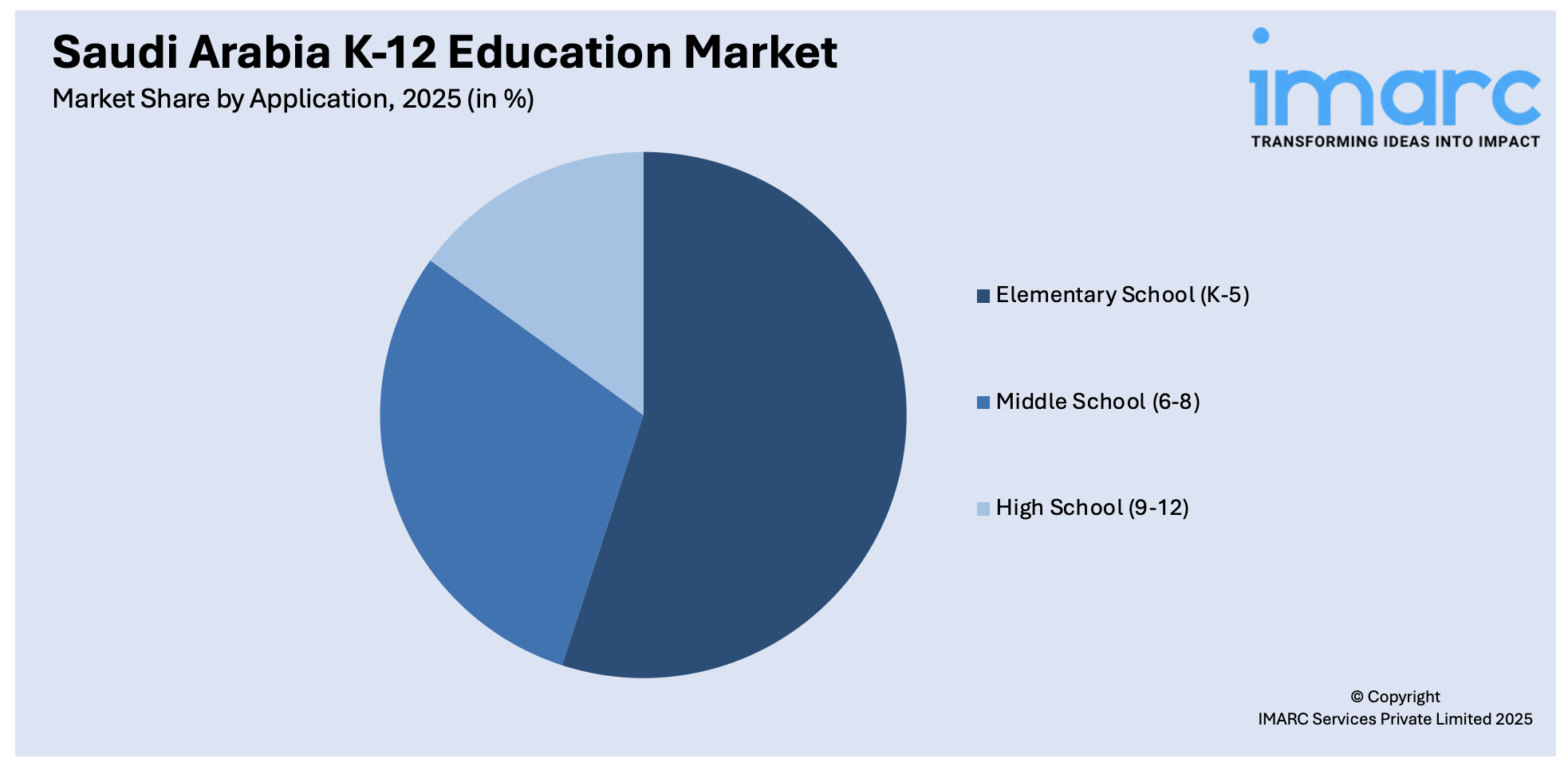

Application Insights:

Access the comprehensive market breakdown Request Sample

- Elementary School (K-5)

- Middle School (6-8)

- High School (9-12)

The report has provided a detailed breakup and analysis of the market based on the application. This includes elementary school (K-5), middle school (6-8), and high school (9-12).

Institution Insights:

- Public

- Private

A detailed breakup and analysis of the market based on the institution has also been provided in the report. This includes public and private.

Delivery Mode Insights:

- Online

- Offline

A detailed breakup and analysis of the market based on the delivery mode has also been provided in the report. This includes online and offline.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia K-12 Education Market News:

- June 2025: iSchool, a top K-12 platform for artificial intelligence and coding education in the MENA region, has revealed its purchase of SEEDS, the EdTech branch of the Egyptian-Saudi software company Algoriza. The decision represents a crucial advancement in iSchool’s strategy for regional expansion, especially in Saudi Arabia’s swiftly changing education sector. Through this acquisition, iSchool secures access to SEEDS' existing operations, academic partnerships, and expanding student network throughout Saudi regions.

- May 2025: GEMS Education Group revealed its growth into Bahrain and Saudi Arabia through a strategic alliance formed by its educational consultancy division, First School Management (FSM), with Spark Education Platform (SEP), a rapidly expanding school operator in Saudi Arabia. This partnership marks a significant advancement in FSM’s goal to leverage GEMS Education’s 66 years of experience in providing exceptional educational results to approximately half a million students globally who have completed their education at its institutions. Established in the UAE in 1959, GEMS Education ranks as one of the largest private K-12 education providers globally, operating schools across nine nations.

- May 2025: First School Management (FSM), the educational advisory project of GEMS Education, has entered into its initial intellectual property agreement with Spark Education Platform (SEP) to introduce the GEMS brand in chosen schools in Saudi Arabia and Bahrain. SEP is among the quickest expanding K-12 regional school operators. The portfolio includes four schools that can accommodate more than 10,000 students, aiming to expand to over 20 schools with 20,000 enrolled students across KSA and the GCC within the next five years.

- May 2025: Maarif Education, a major education provider in Saudi Arabia with more than 50 years of experience in K-12 education, has achieved the full acquisition of Ibn Khaldoun Education Company (IKEC). This strategic initiative signifies one of the most significant investments in the education sector within the Kingdom, expanding Maarif's scale by almost 60%. IKEC runs four schools in Riyadh that provide both national and international educational programs, accommodating around 13,000 students. This inclusion has increased Maarif’s overall student population to around 36,000 students.

- January 2025: Spark Education Platform (SEP), a rapidly expanding K-12 provider in Saudi Arabia, owned by the Saudi Education Fund (SEF) under EFG Hermes’s management, announced that it has finalized agreements to take over a majority interest in Qimam El Hayat International School located in Riyadh. This strategic action strengthens SEP's stance in the Saudi education sector, enhancing its recently disclosed purchase of 4 schools in the Kingdom.

Saudi Arabia K-12 Education Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Elementary School (K-5), Middle School (6-8), High School (9-12) |

| Institutions Covered | Public, Private |

| Delivery Modes Covered | Online, Offline |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia K-12 education market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia K-12 education market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia K-12 education industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The K-12 education market in Saudi Arabia was valued at USD 29,263.6 Million in 2025.

The Saudi Arabia K-12 education market is projected to exhibit a CAGR of 11.46% during 2026-2034, reaching a value of USD 77,677.2 Million by 2034.

Key factors driving the Saudi Arabia K-12 education market include government-led reforms under Vision 2030, rising demand for international curricula, increased private sector investment, growing school-age population, rapid digital transformation through EdTech integration, and continuous improvement in teacher training and professional development programs.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)