Saudi Arabia Laboratory Automation Market Size, Share, Trends and Forecast by Type, Equipment and Software Type, End User, and Region, 2026-2034

Saudi Arabia Laboratory Automation Market Overview:

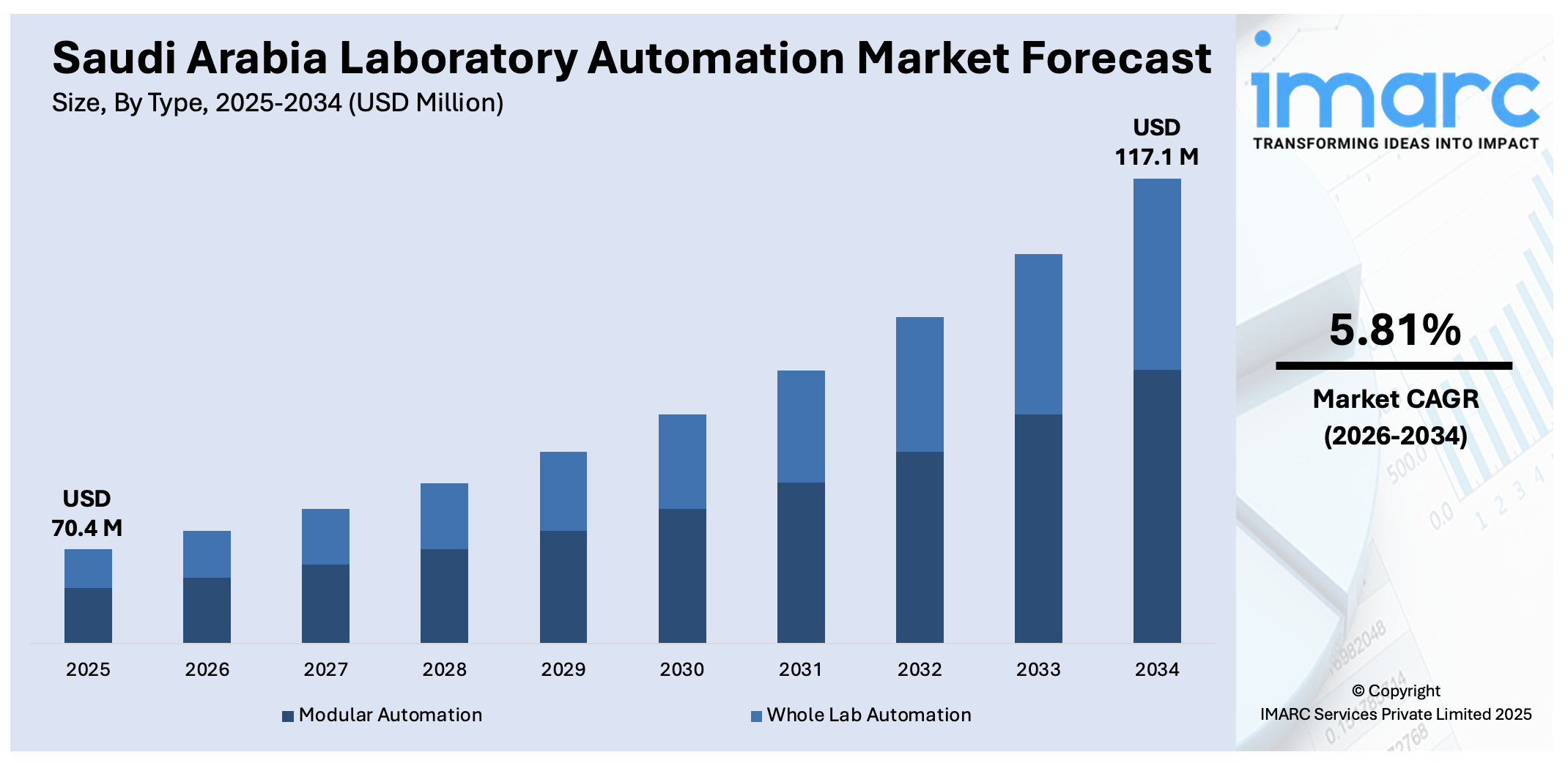

The Saudi Arabia laboratory automation market size reached USD 70.4 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 117.1 Million by 2034, exhibiting a growth rate (CAGR) of 5.81% during 2026-2034. Rising demand for high-throughput diagnostics, increasing investments in healthcare infrastructure, growing focus on reducing human error, and government initiatives supporting digital transformation in laboratories are some of the factors contributing to the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 70.4 Million |

| Market Forecast in 2034 | USD 117.1 Million |

| Market Growth Rate 2026-2034 | 5.81% |

Saudi Arabia Laboratory Automation Market Trends:

AI-Driven Automation for Operational Efficiency

The development of AI-powered solutions is changing operations in Saudi Arabia. Key sectors benefit from increased productivity and improved operations thanks to AI-driven automation. These innovative technologies are intended to streamline processes, eliminate manual labor, and boost production. As firms adopt such technology, they become better suited to manage complicated tasks, allowing for speedier decision-making and more agile workflow. This transition has a particular impact on businesses that demand accuracy and rapid reactions, such as manufacturing, logistics, and energy. Companies in Saudi Arabia are set to achieve more operational resilience and scalability by leveraging AI, enabling them for future development and innovation. These factors are intensifying the laboratory automation market growth. For example, in February 2025, stc unveiled AI-powered agentic solutions at LEAP 2025, in partnership with Shaffra. This collaboration aims to enhance operational efficiency and streamline workflows across key industries in Saudi Arabia through AI-driven automation.

To get more information on this market Request Sample

Innovation in Industrial Automation

Based on the laboratory automation market outlook, the integration of edge computing and artificial intelligence (AI) is influencing Saudi Arabia's industrial automation environment. The implementation of powerful AI-driven apps and edge data centers enables real-time data processing and operational intelligence. This breakthrough is helping to improve safety monitoring and decision-making processes, resulting in increased efficiency throughout industrial activities. The combination of low-latency AI capabilities with adaptive cloud infrastructure improves resilience and automation, making industrial systems more responsive and efficient. These advancements are opening the way for more sophisticated, automated processes, providing a competitive advantage in industries such as energy and manufacturing. For instance, in February 2025, Aramco, Microsoft, and Armada unveiled the world's first industrial distributed cloud in Saudi Arabia, combining edge computing and AI to drive operations. The deployment comprises Armada's Galleon edge data centers, Microsoft's Azure adaptive cloud, and AI-based applications for real-time processing and decision-making of data. The partnership provides low-latency AI applications, automated safety monitoring, and operational intelligence, enhancing efficiency and resilience in Aramco's industrial facilities.

Saudi Arabia Laboratory Automation Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type, equipment and software type, and end user.

Type Insights:

- Modular Automation

- Whole Lab Automation

The report has provided a detailed breakup and analysis of the market based on the type. This includes modular automation and whole lab automation.

Equipment and Software Type Insights:

- Automated Clinical Laboratory Systems

- Workstations

- LIMS (Laboratory Information Management Systems)

- Sample Transport Systems

- Specimen Handling Systems

- Storage Retrieval Systems

- Automated Drug Discovery Laboratory Systems

- Plate Readers

- Automated Liquid Handling Systems

- LIMS (Laboratory Information Management Systems)

- Robotic Systems

- Storage Retrieval Systems

- Dissolution Testing Systems

As per the laboratory automation market forecast, a detailed breakup and analysis of the market based on the equipment and software type have also been provided in the report. This includes automated clinical laboratory systems (workstations, LIMS (laboratory information management systems), sample transport systems, specimen handling systems, and storage retrieval systems) and automated drug discovery laboratory systems (plate readers, automated liquid handling systems, LIMS (laboratory information management systems), robotic systems, storage retrieval systems, and dissolution testing systems).

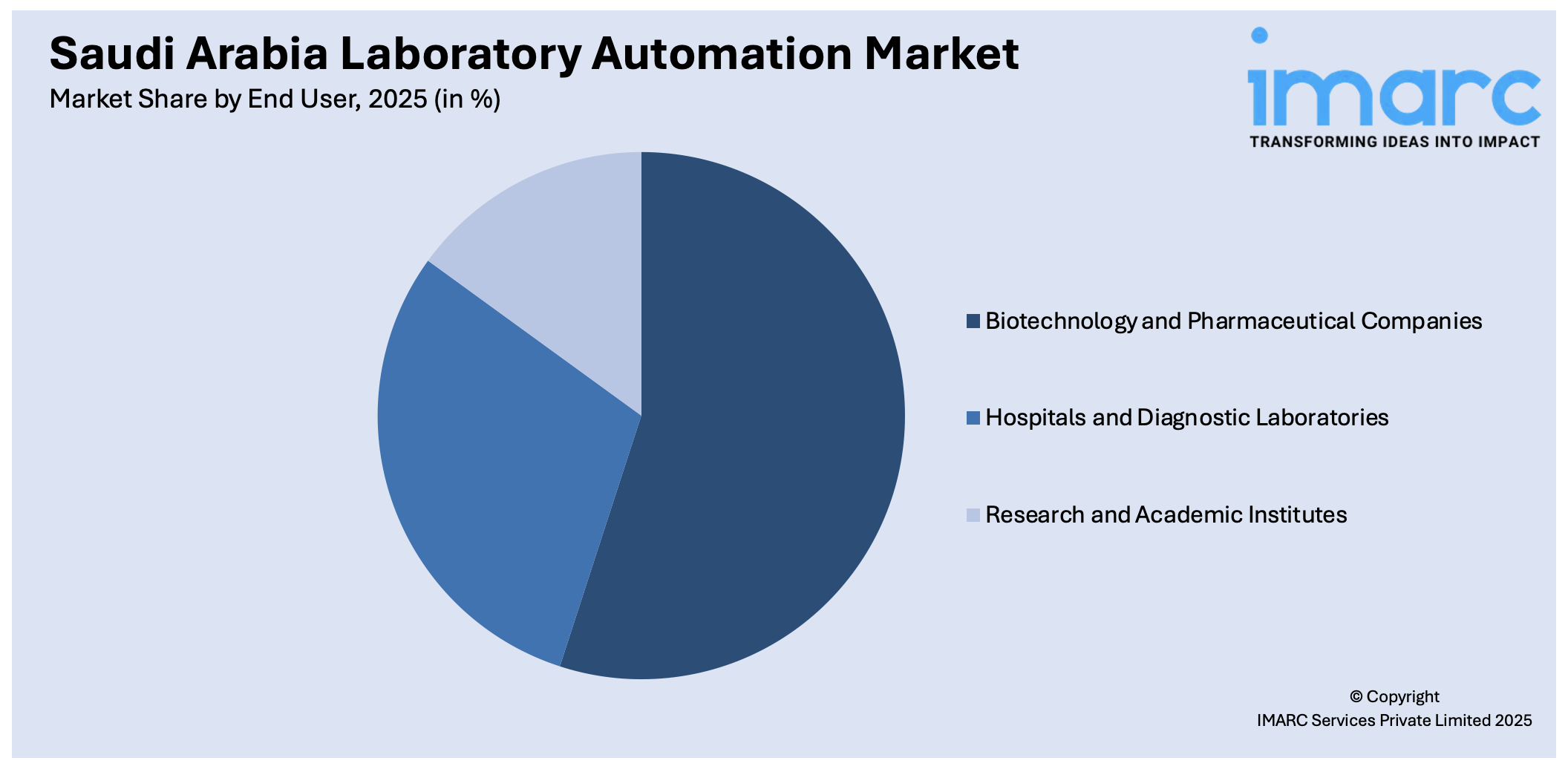

End User Insights:

Access the comprehensive market breakdown Request Sample

- Biotechnology and Pharmaceutical Companies

- Hospitals and Diagnostic Laboratories

- Research and Academic Institutes

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes biotechnology and pharmaceutical companies, hospitals and diagnostic laboratories, and research and academic institutes.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Laboratory Automation Market News:

- In March 2025, the Ministry of Industry and Mineral Resources announced Saudi Arabia's participation in Hannover Messe 2025, showcasing advancements in manufacturing, automation, and industrial technology, including laboratory automation innovations.

- In February 2025, the Medlab Middle East Congress introduced a Lab Automation conference track, featuring global experts discussing automation, robotics, and AI's impact on laboratory operations. The event highlighted advancements in laboratory workflows and diagnostic accuracy.

Saudi Arabia Laboratory Automation Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Modular Automation, Whole Lab Automation |

| Equipment and Software Types Covered |

|

| End Users Covered | Biotechnology and Pharmaceutical Companies, Hospitals and Diagnostic Laboratories, Research and Academic Institutes |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia laboratory automation market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia laboratory automation market on the basis of type?

- What is the breakup of the Saudi Arabia laboratory automation market on the basis of equipment and software type?

- What is the breakup of the Saudi Arabia laboratory automation market on the basis of end user?

- What is the breakup of the Saudi Arabia laboratory automation market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia laboratory automation market?

- What are the key driving factors and challenges in the Saudi Arabia laboratory automation market?

- What is the structure of the Saudi Arabia laboratory automation market and who are the key players?

- What is the degree of competition in the Saudi Arabia laboratory automation market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia laboratory automation market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia laboratory automation market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia laboratory automation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)