Saudi Arabia Lactic Acid Market Size, Share, Trends and Forecast by Raw Material, Form, Application, and Region, 2026-2034

Saudi Arabia Lactic Acid Market Overview:

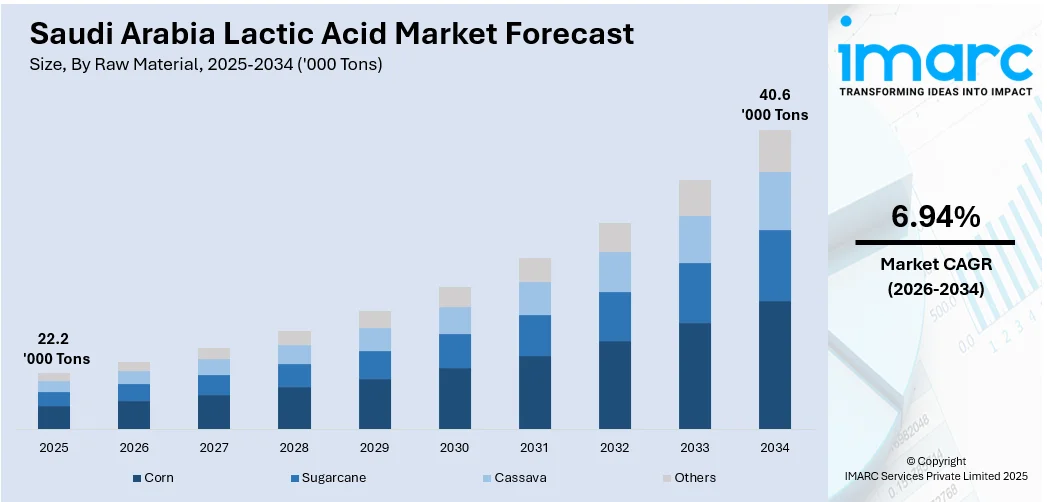

The Saudi Arabia lactic acid market size reached 22.2 Thousand Tons in 2025. Looking forward, IMARC Group expects the market to reach 40.6 Thousand Tons by 2034, exhibiting a growth rate (CAGR) of 6.94% during 2026-2034. Increasing demand for biodegradable plastics, growth in the food and beverage industry, rising consumer awareness of sustainable products, and the expansion of personal care applications are some of the factors propelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | 22.2 Thousand Tons |

| Market Forecast in 2034 | 40.6 Thousand Tons |

| Market Growth Rate 2026-2034 | 6.94% |

Saudi Arabia Lactic Acid Market Trends:

Growing Demand for Raw Materials in Lactic Acid Production

The demand for raw materials in the lactic acid market is increasing as industries across food, pharmaceuticals, and biodegradable plastics continue to expand. A significant portion of lactic acid production relies on imported raw materials such as raw cane sugar, which is essential for fermentation processes. This growing reliance on international sources for key feedstocks highlights the importance of securing consistent supply chains to meet the rising demand for lactic acid. As production capabilities increase in response to market needs, securing stable and diverse raw material imports is becoming more crucial for sustaining growth and meeting the evolving demands of various industries in the market. For example, in 2023, Saudi Arabia imported approximately 703,752 metric tons of raw cane sugar, totaling around USD 1.01 Billion. Additionally, the Kingdom imported fresh or dried sugar cane from Turkey, amounting to USD 716,510 in 2023.

To get more information on this market Request Sample

Growth in Lactic Acid Consumption and Imports

Lactic acid consumption has been on the rise, fueled by expanding applications across various industries. To keep up with this increasing demand, imports have grown significantly, reflecting a shift towards relying more on external suppliers. The demand for lactic acid has outpaced local production capabilities, leading to a growing dependence on global markets to fill the gap. This shift highlights the challenges of maintaining supply levels through domestic production alone, pushing businesses to source more from international markets. As consumption continues to grow, the trend of rising imports is expected to persist, underlining the need for a robust and diversified global supply chain to meet the demands of local industries. For instance, in the 2023/2024 marketing year, total consumption was estimated at around 3.6 million metric tons. To meet this demand, imports totaled approximately 1.38 million metric tons in the first half of the 2022/2023 marketing year (July–December 2022), marking a 37% increase from the same period the previous year.

Saudi Arabia Lactic Acid Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on raw material, form, and application.

Raw Material Insights:

- Corn

- Sugarcane

- Cassava

- Others

The report has provided a detailed breakup and analysis of the market based on the raw material. This includes corn, sugarcane, cassava, and others.

Form Insights:

- Liquid

- Solid

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes liquid and solid.

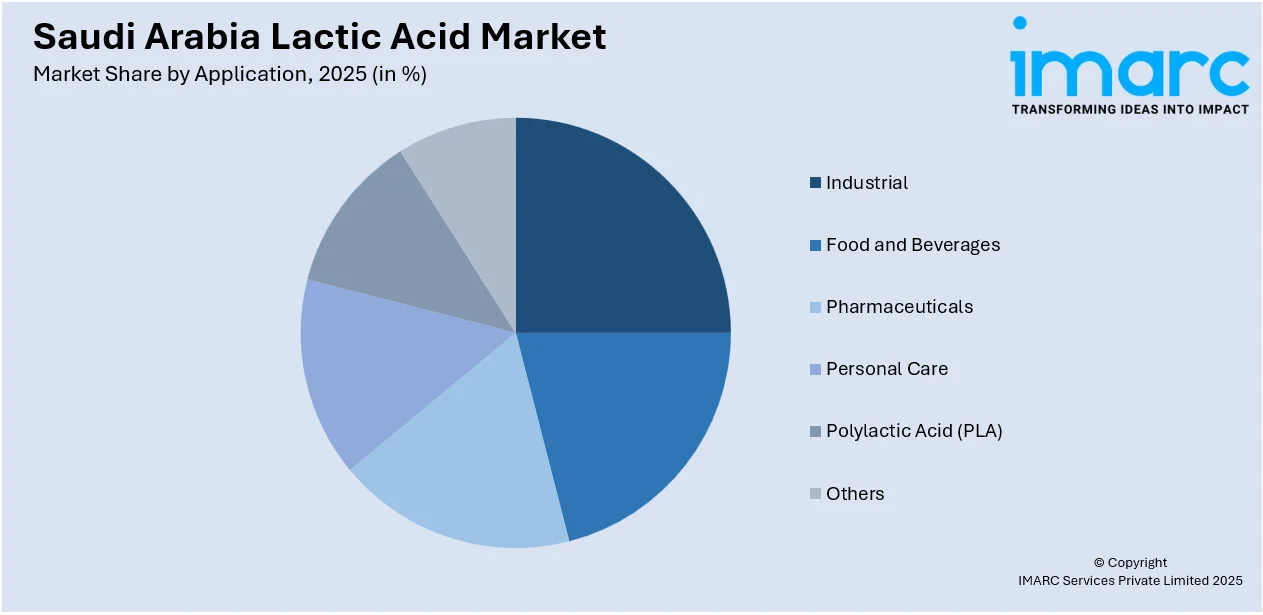

Application Insights:

Access the comprehensive market breakdown Request Sample

- Industrial

- Food and Beverages

- Pharmaceuticals

- Personal Care

- Polylactic Acid (PLA)

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes industrial, food and beverages, pharmaceuticals, personal care, polylactic acid (PLA), and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Lactic Acid Market News:

- In July 2024, Evofem Biosciences partnered with Pharma 1 Drug Store LLC to grant exclusive commercialization rights for Phexxi (lactic acid, citric acid, potassium bitartrate) in the Middle East, including Saudi Arabia. Pharma 1 plans to file for regulatory approval in the UAE, aiming to launch this hormone-free contraceptive gel upon approval.

Saudi Arabia Lactic Acid Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Thousand Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Raw Materials Covered | Corn, Sugarcane, Cassava, Others |

| Forms Covered | Liquid and Solid |

| Applications Covered | Industrial, Food and Beverages, Pharmaceuticals, Personal Care, Polylactic Acid (PLA), Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia lactic acid market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia lactic acid market on the basis of raw material?

- What is the breakup of the Saudi Arabia lactic acid market on the basis of form?

- What is the breakup of the Saudi Arabia lactic acid market on the basis of application?

- What are the various stages in the value chain of the Saudi Arabia lactic acid market?

- What are the key driving factors and challenges in the Saudi Arabia lactic acid market?

- What is the structure of the Saudi Arabia lactic acid market and who are the key players?

- What is the degree of competition in the Saudi Arabia lactic acid market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia lactic acid market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia lactic acid market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia lactic acid industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)