Saudi Arabia Leather Chemicals Market Size, Share, Trends and Forecast by Product, Process, Application, and Region, 2026-2034

Saudi Arabia Leather Chemicals Market Overview:

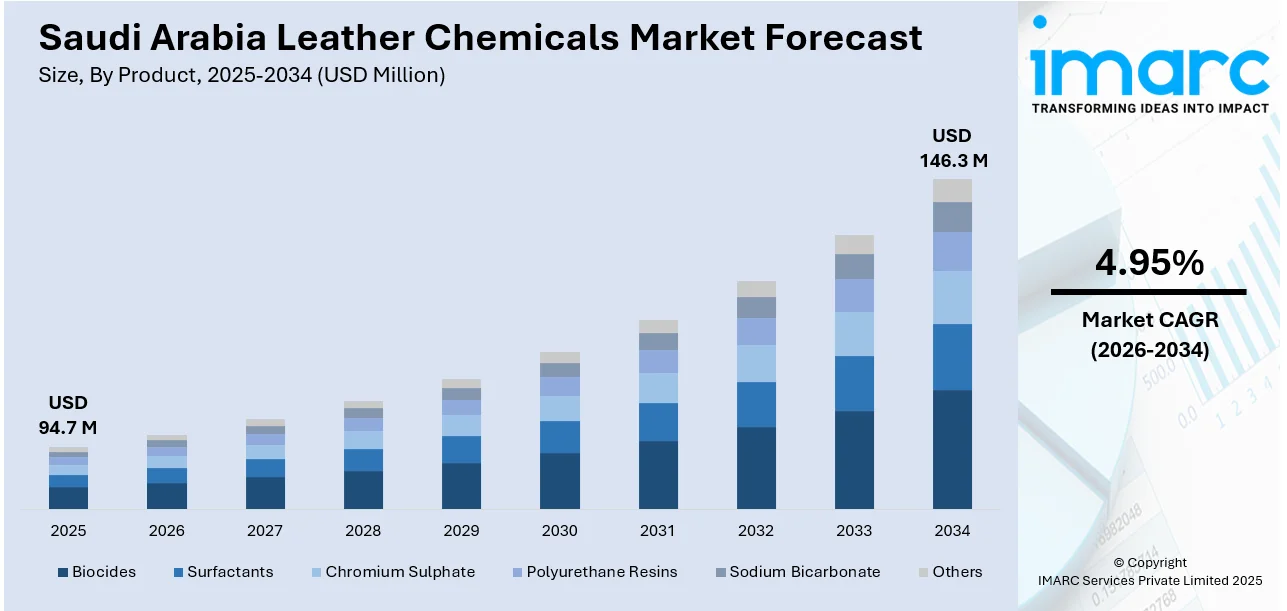

The Saudi Arabia leather chemicals market size reached USD 94.7 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 146.3 Million by 2034, exhibiting a growth rate (CAGR) of 4.95% during 2026-2034. The market is propelled by an increase in demand for premium-quality leather goods in the automotive, fashion, and furniture industries. Rising industrialization and growth of the footwear industry in the region, further supported by an unprecedented increase in disposable income and consumers' desire for luxury products, also spur the growth of the market. Also, government policies supporting the manufacturing industry, as well as technological improvements for sustainable leather manufacturing, are key factors expanding the Saudi Arabia leather chemicals market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 94.7 Million |

| Market Forecast in 2034 | USD 146.3 Million |

| Market Growth Rate 2026-2034 | 4.95% |

Saudi Arabia Leather Chemicals Market Trends:

Growth in the Footwear and Fashion Industry

The rapid expansion of the footwear and fashion industry in Saudi Arabia is a prominent trend influencing the demand for leather chemicals. As consumer spending patterns move in favor of high-end, premium leather products, demand for specialized leather chemicals to improve product appearance, feel, and longevity is growing. As per the 2023 Household Income and Consumption Expenditure Statistics, Saudi Arabia's average monthly disposable income was SAR 11,839 (about USD 3,197). Saudi residents had an average income of SAR 18,056 (about USD 4,875.12) compared to the average income of SAR 5,428 (about USD 1,465.56) by non-Saudi residents. This indicates the vast purchasing power in the country, especially among Saudi residents, which makes up the huge market potential for premium as well as mid-range leather products. The expanding consumer base is also supported by the transformation of the country's retail industry, as global fashion companies continue to make inroads into the Saudi market. Leather chemicals employed in the processes of tanning, dyeing, and finishing play a crucial role in developing the desired properties of luxury leather, including smoothness, richness of color, and durability. As the footwear and fashion segments continue to thrive, the demand for high-quality leather chemicals will further escalate, making it a significant driver of Saudi Arabia leather chemicals market growth.

To get more information on this market Request Sample

Rising Demand for Sustainable and Eco-friendly Leather Production

One of the major trends in the market is the growing demand for sustainable and eco-friendly leather production. As per industry reports, more than 90% of leather goods have been treated with chromium-based tanning chemicals, most notably basic chromium sulfate, as they are cheap and effective. However, research has identified substantial environmental and health hazards posed by these chemicals. A study of 105 samples of leather reported extremely high concentrations of total chromium (32–45,800 mg/kg) and CrVI (0.5–64.3 mg/kg), with 82% of samples violating the European Union's limit of 3 mg/kg for CrVI. This has triggered a change in the market, with producers tending more towards safer substitutes for chromium-based chemicals. Saudi Arabian manufacturers are looking to embrace more environmentally friendly chemical formulations, such as plant tannins, biodegradable dyes, and waterborne coatings. These chemicals not only minimize the emission of toxic pollutants but also assist in compliance with stringent environmental regulations enforced by both local and international markets. This trend is also driven by the increasing consciousness of consumers about the ecological impact of their purchases, which has pressed brands and manufacturers towards adopting eco-friendly practices. Additionally, environmentally friendly leather chemicals also endorse the circular economy, in which recycling and reuse of leather material are encouraged. This demand for greener alternatives is expected to lead to significant growth in the market for sustainable leather chemicals.

Saudi Arabia Leather Chemicals Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product, process, and application.

Product Insights:

- Biocides

- Surfactants

- Chromium Sulphate

- Polyurethane Resins

- Sodium Bicarbonate

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes biocides, surfactants, chromium sulphate, polyurethane resins, sodium bicarbonate, and others.

Process Insights:

- Tanning and Dyeing

- Beamhouse Chemicals

- Finishing Chemicals

A detailed breakup and analysis of the market based on the process have also been provided in the report. This includes tanning and dyeing, beamhouse chemicals, and finishing chemicals.

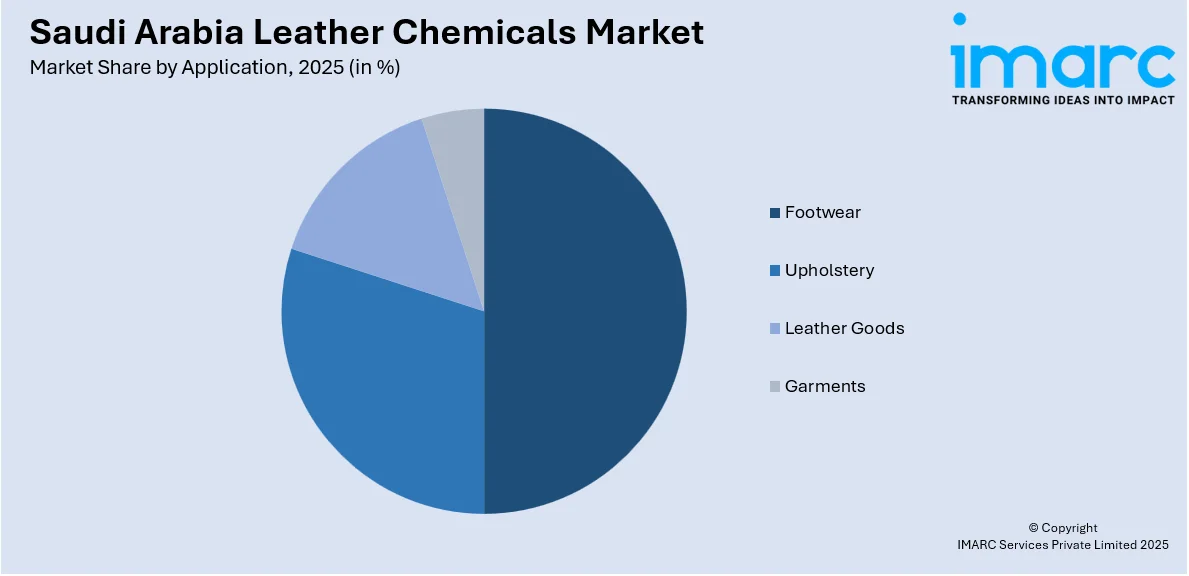

Application Insights:

Access the comprehensive market breakdown Request Sample

- Footwear

- Upholstery

- Leather Goods

- Garments

The report has provided a detailed breakup and analysis of the market based on the application. This includes footwear, upholstery, leather goods, and garments.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Leather Chemicals Market News:

- On January 20, 2024, Lamees Alfadhel, a product designer from Saudi Arabia, introduced "Qitmeer," a groundbreaking machine that transforms damaged and discarded dates into vegan leather sheets. Qitmeer offers an innovative solution to environmental issues by converting agricultural waste into sustainable materials. This project supports Saudi Arabia's Vision 2030, fostering eco-friendly production and contributing to the country's growing creative economy.

Saudi Arabia Leather Chemicals Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Biocides, Surfactants, Chromium Sulphate, Polyurethane Resins, Sodium Bicarbonate, Others |

| Processes Covered | Tanning and Dyeing, Beamhouse Chemicals, Finishing Chemicals |

| Applications Covered | Footwear, Upholstery, Leather Goods, Garments |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia leather chemicals market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia leather chemicals market on the basis of product?

- What is the breakup of the Saudi Arabia leather chemicals market on the basis of process?

- What is the breakup of the Saudi Arabia leather chemicals market on the basis of application?

- What is the breakup of the Saudi Arabia leather chemicals market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia leather chemicals market?

- What are the key driving factors and challenges in the Saudi Arabia leather chemicals market?

- What is the structure of the Saudi Arabia leather chemicals market and who are the key players?

- What is the degree of competition in the Saudi Arabia leather chemicals market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia leather chemicals market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia leather chemicals market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia leather chemicals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)