Saudi Arabia LED Bulb Market Size, Share, Trends and Forecast by Application and Region, 2026-2034

Saudi Arabia LED Bulb Market Overview:

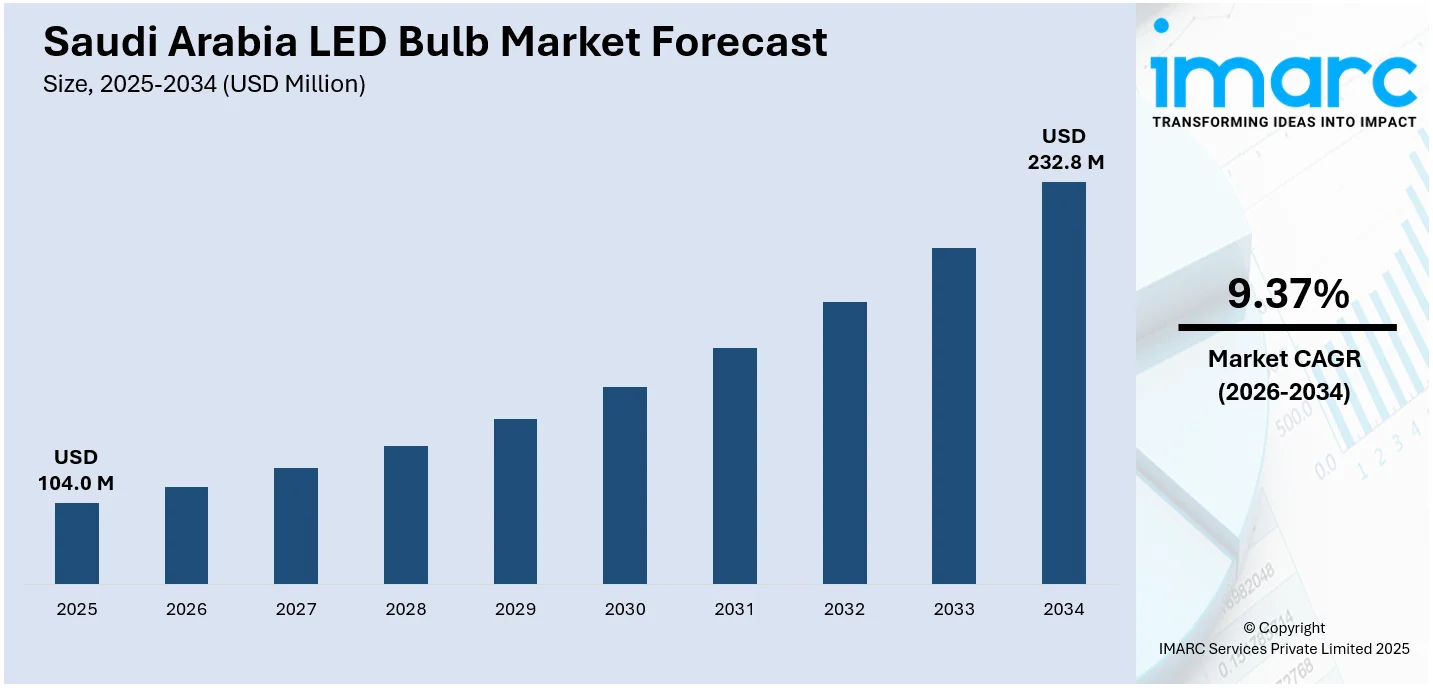

The Saudi Arabia LED bulb market size reached USD 104.0 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 232.8 Million by 2034, exhibiting a growth rate (CAGR) of 9.37% during 2026-2034. The market is driven by national energy efficiency mandates and subsidies supporting LED upgrades in residential, commercial, and municipal infrastructure. Consumer preference for smart lighting, digital control, and aesthetic customization is encouraging widespread adoption, thereby fueling the market. Modernization of aging buildings and growing demand for safety-centric, low-maintenance lighting solutions across older demographics are further augmenting the Saudi Arabia LED bulb market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 104.0 Million |

| Market Forecast in 2034 | USD 232.8 Million |

| Market Growth Rate 2026-2034 | 9.37% |

Saudi Arabia LED Bulb Market Trends:

Energy Diversification Policies and Mandatory Efficiency Regulations

Saudi Arabia's Vision 2030 framework is transforming its energy landscape, with LED lighting positioned as a central solution to reduce electricity consumption and enhance efficiency. The Saudi Energy Efficiency Center (SEEC) and the Saudi Standards, Metrology and Quality Organization (SASO) have introduced stringent regulations to phase out inefficient lighting products and mandate minimum energy performance standards for bulbs sold in the Kingdom. Government-led retrofitting programs for public buildings, mosques, and street lighting projects are prioritizing LED adoption for both cost and energy savings. On June 2, 2024, Saudi Arabia announced its plan to become the first G20 country to replace all street lights with energy-saving LED bulbs, according to Tarshid’s Technical Services Director at the Global Project Management Forum 2024. The national project, aligned with Vision 2030 goals, is expected to achieve energy savings of 70–75% while supporting the Kingdom’s target of 50% renewable electricity by 2030 and net-zero emissions by 2060. These efforts are coordinated with the Ministry of Energy and regional municipalities to accelerate the national transition. Regulatory controls also include labeling systems and import restrictions on non-compliant products, creating a favorable competitive landscape for certified LED suppliers. Furthermore, large-scale infrastructure projects such as The Red Sea Project, NEOM, and Qiddiya are integrating smart, efficient lighting systems to meet sustainability goals. As energy-intensive sectors and high residential consumption drive electricity demand, LEDs serve as a strategic response. These policy-backed actions are catalyzing procurement cycles and incentivizing replacement purchases in both commercial and domestic markets, underpinning long-term Saudi Arabia LED bulb market growth across both developed and developing regions of the Kingdom.

To get more information on this market Request Sample

Commercial Construction Boom and Hospitality Sector Modernization

The ongoing expansion of Saudi Arabia's commercial and hospitality infrastructure is increasing demand for advanced lighting systems that combine aesthetics, efficiency, and longevity. New hotels, shopping malls, entertainment venues, and mixed-use developments are being equipped with programmable LED lighting to meet both energy efficiency regulations and design standards. Investors in luxury properties and tourism-driven infrastructure, particularly in Riyadh, Jeddah, and emerging giga-project zones, are seeking smart lighting systems that enhance ambiance and reduce operational costs. Large commercial developments are adopting daylight harvesting and LED dimming technologies integrated with building automation systems. Moreover, retail franchises and international hotel chains entering the market are retrofitting existing properties with LED fixtures to comply with global energy efficiency benchmarks. In industrial zones and logistics parks, where facilities operate continuously, the low maintenance and long lifespan of LED bulbs provide cost-effective lighting solutions. Supporting these trends, recent technological advancements are reinforcing the Kingdom’s shift toward high-performance lighting. On March 18, 2025, researchers from KAUST, in collaboration with King Abdulaziz City for Science and Technology (KACST), unveiled a nanoplastic material called nanoPE designed to improve LED cooling and extend operational life. By enabling over 80% of infrared heat to escape while reflecting visible light back to the ground, nanoPE enhances thermal radiation emission and reduces energy loss in LED streetlights, where up to 75% of input energy is typically wasted as heat. The technology supports Saudi Arabia’s sustainability goals by reducing carbon emissions and boosting LED durability, particularly in large-scale infrastructure and outdoor applications.

Saudi Arabia LED Bulb Market Segmentation:

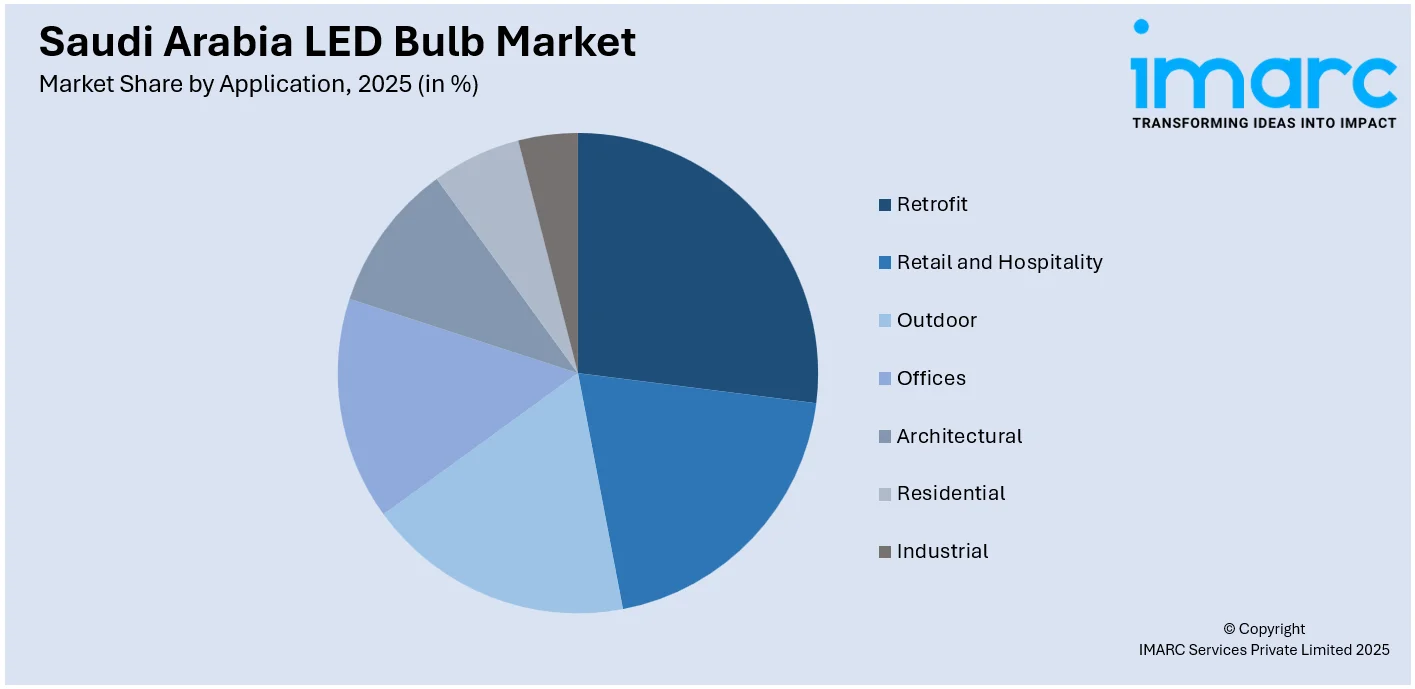

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on application.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Retrofit

- Retail and Hospitality

- Outdoor

- Offices

- Architectural

- Residential

- Industrial

The report has provided a detailed breakup and analysis of the market based on the application. This includes retrofit, retail and hospitality, outdoor, offices, architectural, residential, and industrial.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all major regional markets. This includes Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia LED Bulb Market News:

- On March 11, 2025, Asheil Lighting secured land in Shaqraa Industrial City to build a 6,800m² advanced manufacturing facility integrating LED technologies, precision engineering, and localized production. The facility is part of a joint venture with Versatile International and Haneco Lighting aimed at reducing import dependence (currently over 40%) from China, while enhancing supply chain resilience and job creation for Saudi talent. This move aligns with Saudi Vision 2030 and is expected to significantly support Saudi Arabia LED bulb market expansion by addressing demand from giga-projects and major infrastructure developments.

Saudi Arabia LED Bulb Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Retrofit, Retail and Hospitality, Outdoor, Offices, Architectural, Residential, Industrial |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia LED bulb market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia LED bulb market on the basis of application?

- What is the breakup of the Saudi Arabia LED bulb market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia LED bulb market?

- What are the key driving factors and challenges in the Saudi Arabia LED bulb market?

- What is the structure of the Saudi Arabia LED bulb market and who are the key players?

- What is the degree of competition in the Saudi Arabia LED bulb market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia LED bulb market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia LED bulb market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia LED bulb industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)